|

市场调查报告书

商品编码

1684663

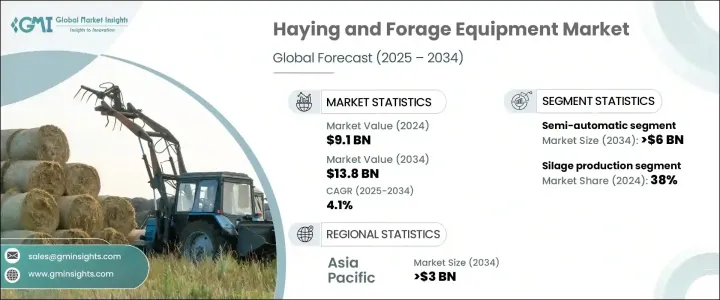

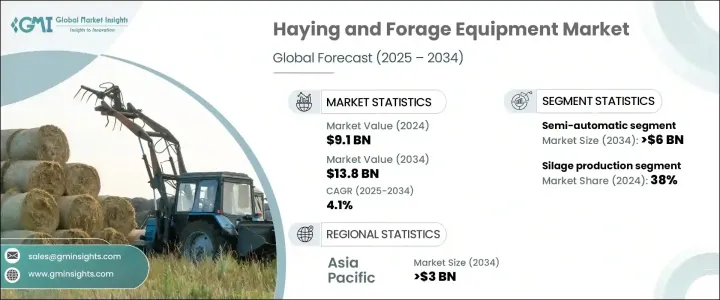

干草和饲料设备市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Haying and Forage Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球干草和饲料设备市场价值为 91 亿美元,将经历显着增长,预计 2025 年至 2034 年期间的复合年增长率为 4.1%。随着全球人口稳步增长,农业部门面临越来越大的提高生产力的压力,特别是乳製品和肉类行业。为了满足这种需求,农民越来越多地采用机械化牧草收割来确保稳定供应高品质的饲料。采用先进的干草和饲料机械有助于降低劳动成本,提高营运效率,并提高干草和青贮饲料的品质。因此,市场可望继续扩张。

除了对牲畜饲料的需求不断增长之外,干草和饲料机械的技术进步在产业转型中发挥着至关重要的作用。智慧农业解决方案和精准农业与干草和饲料设备相结合,提高了整体生产力。这些创新不仅使营运更加高效,而且还允许农民收集资料以改善决策。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 91亿美元 |

| 预测值 | 138亿美元 |

| 复合年增长率 | 4.1% |

市场按操作类型分类,包括手动、半自动和全自动系统。 2024 年,半自动部分占据市场最大份额,达到 40%。预计该领域将大幅成长,到 2034 年将达到 60 亿美元。与手动方法相比,这些机器可节省大量时间和劳力,同时比全自动替代方案更实惠。这使得半自动设备对农民特别有吸引力,特别是在新兴市场,因为经济性和易用性是主要考虑因素。

在应用方面,干草和饲料设备市场分为青贮饲料生产、水果干草製作和作物残留物处理。青贮饲料生产占有最大的份额,到 2024 年将占 38% 的市场份额。青贮饲料生产可以长期储存饲料,这对于维持牲畜生产力至关重要,特别是在生长季节不可预测或放牧面积有限的地区。全球对乳製品和肉类产品的需求不断增长,进一步推动了青贮饲料作为饲料保存的主要方法的应用。

中国将在 2024 年占据全球干草和牧草设备市场的 60% 份额,占据主导地位,预计到 2034 年将达到 30 亿美元。此外,中国致力于透过政府激励措施和机械化项目实现农业部门现代化,这一倡议在先进干草和饲料机械的快速普及中发挥了关键作用,刺激了该地区的显着增长。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 零件供应商

- 技术供应商

- 干草和饲料设备製造商

- 经销商

- 最终用户

- 利润率分析

- 定价分析

- 专利格局

- 成本明细

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对高效率、优质牲畜饲料生产的需求不断增长

- 提高农业机械化和自动化程度

- 干草和饲料机械的技术进步

- 政府对农业现代化的补贴与支持

- 产业陷阱与挑战

- 先进的干草和饲料设备初始成本较高

- 发展中地区对机械化解决方案的认知与采用有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按设备,2021 - 2034 年

- 主要趋势

- 割草机

- 打包机

- 摊草机

- 耙子

- 青贮收割机

- 护髮素

- 包装器

- 其他的

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 干草收割

- 青贮饲料生产

- 农作物残渣处理

第七章:市场估计与预测:按运营,2021 - 2032 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- AGCO

- Challenge Implements

- Claas KGaA

- CNH Industrial

- Deere & Company

- Farm King

- Kongskilde Industries

- Krone

- Kubota

- Kuhn Group

- Lely Industries

- Maschinenfabrik Bernard Krone

- McHale Engineering

- Morra Group

- Pottinger Landtechnik

- Rostselmash

- Sitrex

- Tonutti-Wolagri

- Vermeer

- Vicon

The Global Haying And Forage Equipment Market, valued at USD 9.1 billion in 2024, is set to experience significant growth, projected to expand at a CAGR of 4.1% from 2025 to 2034. This growth is primarily driven by the increasing need for efficient livestock feed production. With the global population steadily rising, there is growing pressure on the agricultural sector to enhance productivity, particularly in the dairy and meat industries. To meet this demand, farmers are increasingly turning to mechanized forage harvesting to secure a consistent supply of high-quality feed. The adoption of advanced haying and forage machinery is helping reduce labor costs, boost operational efficiency, and elevate the quality of hay and silage. As a result, the market is positioned for continued expansion.

In addition to the growing demand for livestock feed, technological advancements in haying and forage machinery are playing a crucial role in transforming the industry. The integration of smart farming solutions and precision agriculture into haying and forage equipment is enhancing overall productivity. These innovations not only enable more efficient operations but also allow farmers to gather data for improved decision-making.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 4.1% |

The market is categorized by operation type, which includes manual, semi-automatic, and fully automatic systems. In 2024, the semi-automatic segment captured the largest share of the market, accounting for 40%. This segment is anticipated to grow significantly, reaching USD 6 billion by 2034. Semi-automatic equipment stands out because it strikes an optimal balance between cost and performance. These machines provide substantial time and labor savings compared to manual methods, while being more affordable than fully automated alternatives. This makes semi-automatic equipment particularly attractive to farmers, especially in emerging markets where affordability and ease of use are key considerations.

When it comes to application, the haying and forage equipment market is segmented into silage production, fruit haymaking, and crop residue processing. Silage production holds the largest share, representing 38% of the market in 2024. This dominance is driven by the vital role silage plays in preserving nutrient-rich feed for livestock. Silage production allows for long-term storage of forage, which is crucial for maintaining livestock productivity, especially in regions with unpredictable growing seasons or limited grazing areas. The increasing global demand for dairy and meat products further fuels the adoption of silage as a key method of feed preservation.

China leads the global haying and forage equipment market with a commanding 60% share in 2024, and it is projected to reach USD 3 billion by 2034. The country's prominence in the market is largely attributed to its vast agricultural industry and large livestock population, both of which drive the demand for efficient forage harvesting equipment. Additionally, China's commitment to modernizing its agricultural sector through government incentives and mechanization programs has played a pivotal role in the rapid adoption of advanced haying and forage machinery, spurring significant growth in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component supplier

- 3.2.2 Technology supplier

- 3.2.3 Haying and forage equipment manufacturers

- 3.2.4 Distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Pricing analysis

- 3.5 Patent Landscape

- 3.6 Cost Breakdown

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for efficient and high-quality livestock feed production

- 3.10.1.2 Increasing mechanization and automation in agriculture

- 3.10.1.3 Technological advancements in haying and forage machinery

- 3.10.1.4 Government subsidies and support for modernizing agricultural practices

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial costs of advanced haying and forage equipment

- 3.10.2.2 Limited awareness and adoption of mechanized solutions in developing regions

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Mowers

- 5.3 Balers

- 5.4 Tedders

- 5.5 Rakes

- 5.6 Forage Harvesters

- 5.7 Conditioners

- 5.8 Wrappers

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Haymaking

- 6.3 Silage production

- 6.4 Crop residue processing

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2032 ($Bn, Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-Automatic

- 7.4 Fully Automatic

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 AGCO

- 9.2 Challenge Implements

- 9.3 Claas KGaA

- 9.4 CNH Industrial

- 9.5 Deere & Company

- 9.6 Farm King

- 9.7 Kongskilde Industries

- 9.8 Krone

- 9.9 Kubota

- 9.10 Kuhn Group

- 9.11 Lely Industries

- 9.12 Maschinenfabrik Bernard Krone

- 9.13 McHale Engineering

- 9.14 Morra Group

- 9.15 Pottinger Landtechnik

- 9.16 Rostselmash

- 9.17 Sitrex

- 9.18 Tonutti-Wolagri

- 9.19 Vermeer

- 9.20 Vicon