|

市场调查报告书

商品编码

1684675

产后忧郁症治疗市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Postpartum Depression Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

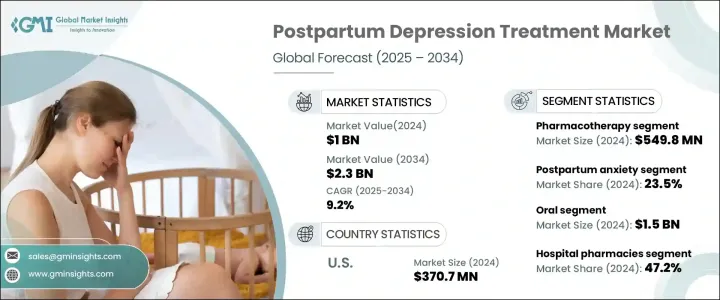

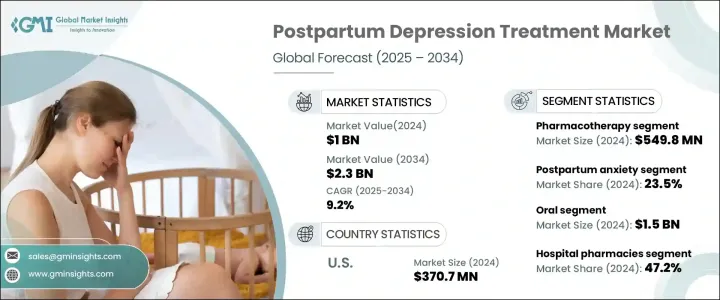

2024 年全球产后忧郁症治疗市场规模达到 10 亿美元,预计 2025 年至 2034 年期间将以 9.2% 的强劲复合年增长率扩张。产后忧郁症影响全球相当一部分新手妈妈,成为人们关注的公共卫生议题。

随着心理健康成为产妇护理的核心组成部分,世界各地的医疗保健系统正在不断发展,优先考虑全面的产后支持。对创新治疗的需求不断增长,以及对早期诊断的日益关注,为该市场的发展创造了肥沃的土壤。政府、医疗保健组织和倡导团体正在齐心协力消除产后忧郁症的耻辱感,使更多女性能够寻求帮助。这些共同努力正在培养一个鼓励创新、研究和投资突破性疗法的市场环境。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 9.2% |

近年来,人们对产后忧郁症认识的转变促进了该市场的快速发展。产后护理期间的常规筛检已成为许多地区的标准做法,使医疗保健提供者能够及早发现和治疗产后忧郁症。公共卫生运动正在强调母亲心理健康的重要性,使女性更容易识别症状并寻求治疗。医疗保健基础设施的改善,加上远距医疗和数位健康解决方案的进步,增加了人们获得医疗服务的机会,特别是对于医疗服务不足的人。随着针对性治疗的需求不断上升,这些发展为持续的市场成长奠定了基础。

产后忧郁症治疗市场根据相关情况进行细分,包括产后焦虑症、产后忧郁症、产后创伤后压力症候群 (PTSD)、产后强迫症 (OCD)、产后恐慌症和产后精神病。其中,产后焦虑占比最大,2024 年为 23.5%。对母亲心理健康的重视,加上医疗保健服务的增强,提高了诊断率和治疗采用率。远距医疗平台的日益普及进一步增强了人们获得医疗服务的机会,确保有需要的人能够及时介入。

在美国,2024 年产后忧郁症治疗市场价值为 3.707 亿美元,预计到 2032 年复合年增长率为 8.9%。美国医疗保健体系拥有完善的基础设施和支持性心理健康政策,在提高医疗可近性方面发挥关键作用。产后忧郁症治疗的保险覆盖范围进一步鼓励了人们的采用,推动了全国市场的持续扩张。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 产后忧郁症盛行率不断上升

- 药物开发的进展

- 人们对女性健康的认识和关注度不断提高

- 产业陷阱与挑战

- 相关副作用导致的安全性问题

- 产后忧郁症药物价格高昂

- 成长动力

- 成长潜力分析

- 未来趋势

- 监管格局

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 产后焦虑

- 产后忧郁症

- 产后创伤后压力症候群 (PTSD)

- 产后强迫症 (OCD)

- 产后恐慌症

- 产后精神病

第六章:市场估计与预测:依治疗方式,2021 – 2034 年

- 主要趋势

- 药物治疗

- 选择性血清素再摄取抑制剂 (SSRI)

- 血清素去甲肾上腺素再摄取抑制剂 (SNRI)

- 三环抗忧郁剂 (TCA)

- 其他药物疗法

- 荷尔蒙治疗

- 其他治疗

第 7 章:市场估计与预测:按管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 肠外

- 其他给药途径

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Bausch Health Companies

- Biogen

- Cipla

- Eli Lilly and Company

- GSK

- Merck

- Novartis

- Pfizer

- Sage Therapeutics

- Teva Pharmaceutical Industries

The Global Postpartum Depression Treatment Market reached USD 1 billion in 2024 and is anticipated to expand at a robust CAGR of 9.2% between 2025 and 2034. This rapid growth reflects increasing awareness of maternal mental health and the critical need for effective interventions. Postpartum depression, affecting a significant percentage of new mothers globally, has been thrust into the spotlight as a public health concern.

As mental health becomes a central component of maternal care, healthcare systems worldwide are evolving to prioritize comprehensive postpartum support. The rise in demand for innovative treatments, alongside the growing focus on early diagnosis, has created fertile ground for advancements in this market. Governments, healthcare organizations, and advocacy groups are working in tandem to destigmatize postpartum depression, enabling more women to seek help. These collective efforts are fostering a market environment that encourages innovation, research, and investment in groundbreaking therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 9.2% |

In recent years, a paradigm shift in how postpartum depression is perceived has contributed to this market's rapid development. Routine screening during postnatal care has become standard practice in many regions, allowing healthcare providers to identify and address postpartum depression early. Public health campaigns are shedding light on the importance of maternal mental well-being, making it easier for women to recognize symptoms and seek treatment. Improved healthcare infrastructure, coupled with advancements in telemedicine and digital health solutions, has increased access to care, especially for underserved populations. These developments have laid the foundation for sustained market growth as the demand for targeted treatments continues to rise.

The postpartum depression treatment market is segmented based on associated conditions, including postpartum anxiety, postpartum blues, postpartum post-traumatic stress disorder (PTSD), postpartum obsessive-compulsive disorder (OCD), postpartum panic disorder, and postpartum psychosis. Among these, postpartum anxiety accounted for the largest share at 23.5% in 2024. This condition is highly prevalent among new mothers, driving demand for effective treatment options. The emphasis on maternal mental health, coupled with enhanced access to healthcare services, has improved diagnosis rates and treatment adoption. The growing popularity of telehealth platforms has further bolstered access to care, ensuring timely interventions for individuals in need.

In the United States, the postpartum depression treatment market was valued at USD 370.7 million in 2024, with projections indicating an 8.9% CAGR through 2032. Several factors fuel this growth, including the increasing prevalence of postpartum depression, greater public awareness of maternal mental health, and the availability of cutting-edge therapies. The U.S. healthcare system, with its established infrastructure and supportive mental health policies, plays a pivotal role in enhancing accessibility. Insurance coverage for postpartum depression treatments has further encouraged adoption, driving continued market expansion across the country.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of postpartum depression

- 3.2.1.2 Advancements in drug development

- 3.2.1.3 Growing awareness and focus on women's health

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Safety concerns due to associated side effects

- 3.2.2.2 High cost of postpartum depression drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future trends

- 3.5 Regulatory landscape

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Postpartum anxiety

- 5.3 Postpartum blues

- 5.4 Postpartum post-traumatic stress disorder (PTSD)

- 5.5 Postpartum obsessive-compulsive disorder (OCD)

- 5.6 Postpartum panic disorder

- 5.7 Postpartum psychosis

Chapter 6 Market Estimates and Forecast, By Treatment, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pharmacotherapy

- 6.2.1 Selective serotonin reuptake inhibitors (SSRIs)

- 6.2.2 Serotonin norepinephrine reuptake inhibitors (SNRIs)

- 6.2.3 Tricyclic antidepressants (TCA)

- 6.2.4 Other pharmacotherapies

- 6.3 Hormone therapy

- 6.4 Other treatments

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bausch Health Companies

- 10.2 Biogen

- 10.3 Cipla

- 10.4 Eli Lilly and Company

- 10.5 GSK

- 10.6 Merck

- 10.7 Novartis

- 10.8 Pfizer

- 10.9 Sage Therapeutics

- 10.10 Teva Pharmaceutical Industries