|

市场调查报告书

商品编码

1684687

连网汽车技术市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Connected Vehicle Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

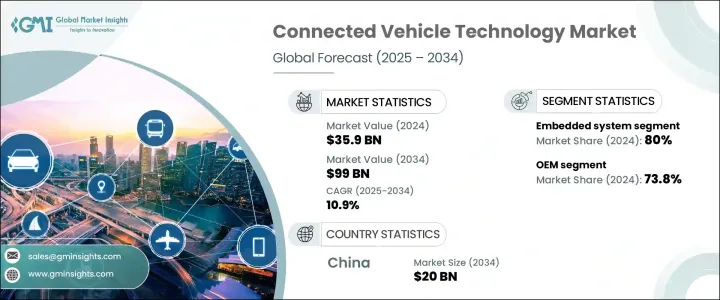

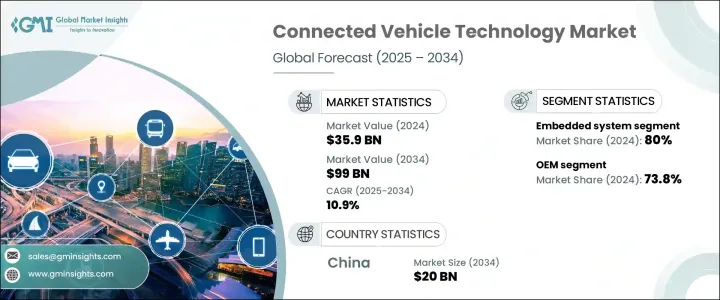

2024 年全球连网汽车技术市场价值为 359 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 10.9%。这一成长主要得益于数位解决方案的快速采用以及对更智慧、更安全、更有效率的交通运输日益增长的需求。这一增长主要得益于政府激励措施,例如车辆安全功能的税收减免和汽车购买补贴,这些措施鼓励消费者和製造商采用尖端汽车技术。连接性已成为现代汽车设计的一个重要方面,汽车製造商专注于将先进的远端资讯处理、资讯娱乐和安全系统整合到他们的车型中。随着技术的不断发展,人工智慧、5G 网路和基于云端的平台的日益广泛使用,正在增强车与一切 (V2X) 通信,改善整体驾驶体验并确保更高的安全标准。

电动和自动驾驶汽车的日益普及也推动了市场扩张,因为这些汽车严重依赖嵌入式系统进行导航、诊断和远端监控。汽车製造商越来越多地与科技公司合作,开发安全、高效能的数位解决方案,以增强连接性并保持网路安全。消费者的期望正在转向车内个人化、无缝的数位体验,这进一步推动製造商的创新。随着无线(OTA)更新的兴起,汽车製造商现在可以在购买后增强车辆功能,使汽车保持最新的软体改进。这一趋势使得连网汽车技术成为一种必需品而非选择,加速了其在全球的普及。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 359亿美元 |

| 预测值 | 990亿美元 |

| 复合年增长率 | 10.9% |

车联网技术市场主要分为V2X通讯和嵌入式系统。嵌入式系统由于在製造过程中直接整合到车辆中,将在 2024 年占据最大份额。这些系统包括远端资讯处理、资讯娱乐和导航解决方案,可改善使用者体验、提高车辆性能并实现即时资料交换。随着自动驾驶的推动,嵌入式系统变得更加重要,支援进阶驾驶辅助系统 (ADAS) 和预测性维护解决方案。汽车製造商正在利用人工智慧驱动的分析来优化效能并提高道路安全,使嵌入式系统成为连网汽车生态系统的支柱。

连网汽车技术主要被两个领域所采用:原始设备製造商(OEM)和售后市场。 2024 年, OEM领域占据了 73.8% 的市场份额,反映了该行业对工厂安装的连接解决方案的高度重视。製造商正在将远端资讯处理和 V2X 通讯功能嵌入到新车辆中,以满足消费者对无缝数位整合日益增长的需求。这种直接整合增强了车辆安全性、优化了性能并提高了驾驶效率,使 OEM 成为市场成长的主要驱动力。随着越来越多的汽车製造商投资于智慧製造和基于云端的平台,原始设备製造商在塑造连网移动未来方面的作用不断扩大。

在积极的营销活动、不断增长的汽车销售以及消费者对高科技汽车功能的强烈需求的推动下,中国联网汽车技术市场预计将在 2034 年创造 200 亿美元的市场规模。该国致力于减少排放和推动智慧交通解决方案的承诺也正在加速其应用。整个亚太地区的市场正在快速扩张,政府和汽车行业领导者积极推动该行业的数位转型。随着消费者对高阶连结功能的兴趣日益增长,北美也经历了类似的发展势头。越来越多的购车者现在优先考虑配备整合数位解决方案的车辆,这使得连网汽车技术成为汽车产业未来的核心组成部分。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 汽车原厂设备製造商

- 技术提供者

- 电信公司

- 平台开发者

- 最终用户

- 供应商概况

- 利润率分析

- 车连网技术用例

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 安全功能的需求不断增加

- 5G 连接的进步

- 人工智慧与机器学习的融合

- 不断增加的政府法规和激励措施

- 产业陷阱与挑战

- 资料隐私和安全问题

- 实施成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按技术,2021-2034 年,

- 主要趋势

- V2X 通信

- 嵌入式系统

第六章:市场估计与预测:依车型,2021-2034,

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

- 电动车 (EV)

第 7 章:市场估计与预测:按应用,2021-2034 年,

- 主要趋势

- 自动驾驶

- 出游即服务 (MaaS)

- 资讯娱乐

- 车队管理

- 安全和保障

- 车辆诊断与维护

第 8 章:市场估计与预测:依最终用途,2021-2034 年,

- 主要趋势

- OEM

- 售后市场

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aptiv

- Atos

- AWS

- Bosch

- Cisco

- Continental

- Denso

- Ericsson

- Harman (Samsung Electronics)

- IBM

- Infineon Technologies

- Intel

- Microsoft

- Mobileye

- NXP Semiconductors

- Orange

- Qualcomm

- Telenor

- Verizon

- Vodafone

The Global Connected Vehicle Technology Market, valued at USD 35.9 billion in 2024, is set to expand at a CAGR of 10.9% between 2025 and 2034. The growth is driven by the rapid adoption of digital solutions and the increasing demand for smarter, safer, and more efficient transportation. This growth is fueled by government incentives such as tax breaks on vehicle safety features and subsidies for car purchases, which encourage both consumers and manufacturers to embrace cutting-edge automotive technologies. Connectivity has become an essential aspect of modern vehicle design, with automakers focusing on integrating advanced telematics, infotainment, and safety systems into their models. As technology continues to evolve, the growing use of artificial intelligence, 5G networks, and cloud-based platforms is enhancing vehicle-to-everything (V2X) communication, improving overall driving experiences, and ensuring higher safety standards.

The rising popularity of electric and autonomous vehicles is also propelling market expansion, as these vehicles rely heavily on embedded systems for navigation, diagnostics, and remote monitoring. Automakers are increasingly collaborating with technology companies to develop secure, high-performance digital solutions that enhance connectivity while maintaining cybersecurity. Consumer expectations are shifting towards personalized, seamless digital experiences within their vehicles, further pushing manufacturers to innovate. With the rise of over-the-air (OTA) updates, car manufacturers can now enhance vehicle functionality post-purchase, keeping cars up to date with the latest software improvements. This trend is making connected vehicle technology a necessity rather than an option, accelerating its adoption worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.9 Billion |

| Forecast Value | $99 Billion |

| CAGR | 10.9% |

The market for connected vehicle technology is primarily divided into V2X communication and embedded systems. Embedded systems commanded the largest share in 2024 due to their direct integration into vehicles during the manufacturing process. These systems include telematics, infotainment, and navigation solutions that improve user experience, enhance vehicle performance, and enable real-time data exchange. With the push toward autonomous driving, embedded systems are becoming even more critical, supporting advanced driver-assistance systems (ADAS) and predictive maintenance solutions. Automakers are leveraging AI-driven analytics to optimize performance and increase road safety, making embedded systems the backbone of the connected vehicle ecosystem.

Connected vehicle technology is utilized by two major segments: original equipment manufacturers (OEMs) and the aftermarket. In 2024, the OEM segment held a commanding 73.8% market share, reflecting the industry's strong focus on factory-installed connectivity solutions. Manufacturers are embedding telematics and V2X communication capabilities into new vehicles, addressing growing consumer demands for seamless digital integration. This direct integration enhances vehicle safety, optimizes performance, and improves driving efficiency, positioning OEMs as the primary drivers of market growth. As more automakers invest in smart manufacturing and cloud-based platforms, the role of OEMs in shaping the future of connected mobility continues to expand.

China connected vehicle technology market is on track to generate USD 20 billion by 2034, driven by aggressive marketing campaigns, increasing vehicle sales, and a strong consumer appetite for high-tech automotive features. The country's commitment to reducing emissions and advancing smart transportation solutions is also accelerating adoption. The Asia-Pacific region as a whole is witnessing rapid market expansion, with governments and automotive leaders actively promoting digital transformation in the sector. North America is experiencing similar momentum as consumer interest in advanced connectivity features grows. A rising number of car buyers now prioritize vehicles equipped with integrated digital solutions, solidifying connected vehicle technology as a core component of the automotive industry's future.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automotive OEMs

- 3.1.2 Technology providers

- 3.1.3 Telecommunication companies

- 3.1.4 Platform developers

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Use cases of connected vehicle technology

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for safety features

- 3.8.1.2 Advancements in 5G connectivity

- 3.8.1.3 Integration of AI and machine learning

- 3.8.1.4 Growing government regulations and incentives

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Data privacy and security concerns

- 3.8.2.2 High cost of implementation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034, ($Bn)

- 5.1 Key trends

- 5.2 V2X communication

- 5.3 Embedded system

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021-2034, ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 Light Commercial Vehicles (LCVs)

- 6.3.2 Heavy Commercial Vehicles (HCVs)

- 6.4 Electric Vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034, ($Bn)

- 7.1 Key trends

- 7.2 Autonomous driving

- 7.3 Mobility as a Service (MaaS)

- 7.4 Infotainment

- 7.5 Fleet management

- 7.6 Safety and security

- 7.7 Vehicle diagnostics and maintenance

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034, ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Atos

- 10.3 AWS

- 10.4 Bosch

- 10.5 Cisco

- 10.6 Continental

- 10.7 Denso

- 10.8 Ericsson

- 10.9 Harman (Samsung Electronics)

- 10.10 IBM

- 10.11 Infineon Technologies

- 10.12 Intel

- 10.13 Microsoft

- 10.14 Mobileye

- 10.15 NXP Semiconductors

- 10.16 Orange

- 10.17 Qualcomm

- 10.18 Telenor

- 10.19 Verizon

- 10.20 Vodafone