|

市场调查报告书

商品编码

1750294

车联网服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Connected Vehicle Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

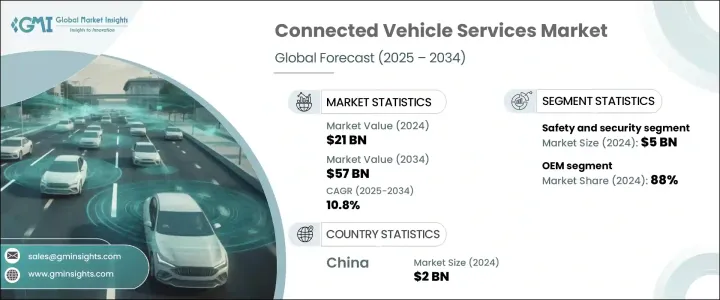

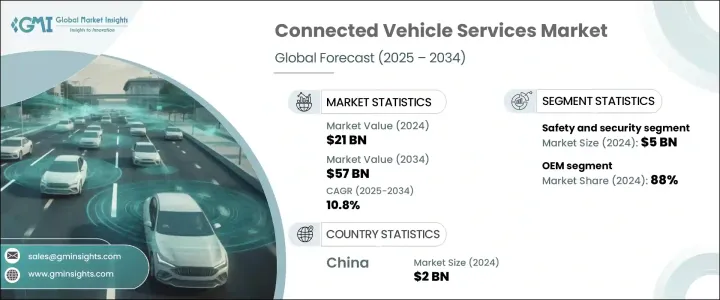

2024 年全球连网汽车服务市场规模达 210 亿美元,预计到 2034 年将以 10.8% 的复合年增长率成长至 570 亿美元。这一增长主要源于从传统汽车向软体定义汽车的快速转变,这极大地重塑了汽车服务的开发、提供和盈利方式。与传统汽车不同,现代汽车围绕着自适应软体平台设计,即使在购买后也能实现即时更新和按需服务。这种动态架构使製造商能够透过无线更新引入远端诊断、驾驶辅助和系统升级等功能,从而提高客户满意度并扩大服务范围。因此,在对更智慧、反应更快、更安全的行动解决方案日益增长的需求的推动下,连网汽车服务已成为汽车发展策略的基本组成部分。

消费者越来越期望他们的车辆能够提供内建的连接功能,以提升驾驶体验,同时确保安全性和便利性。这种需求转变促使汽车製造商将资讯娱乐、安全警报、导航和远端控制等服务直接整合到新车型中。持续更新功能和提供个人化服务的能力正在将汽车转变为数位平台,并鼓励基于订阅的服务模式。製造商现在专注于透过预测性维护警报、使用情况追踪和语音辅助命令来提升用户体验。随着汽车不断融入人工智慧和物联网技术,提供可扩展远端资讯处理和强大云端功能的公司将占据领先地位。此外,围绕资料隐私、网路安全和车辆安全不断演变的全球法规正在重塑服务交付模式,有利于拥有符合国际标准的基础设施和合规准备的公司。向基于服务的产品的转变为汽车生态系统的长期客户参与和持续创造收入奠定了基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 210亿美元 |

| 预测值 | 570亿美元 |

| 复合年增长率 | 10.8% |

就服务而言,市场分为远端操作、安全保障、导航和资讯娱乐、驾驶辅助、车辆管理等。安全保障领域在2024年引领市场,创造了约50亿美元的产值,占了超过25%的总市场。消费者高度重视紧急警报、碰撞侦测、防盗和路边援助等即时功能,这些功能对感知和实际车辆安全都做出了重要贡献。这些服务不仅受到个人用户的重视,也受到车队营运商和保险公司的重视,他们依靠即时监控进行车辆追踪、驾驶员行为分析和风险评估。这些功能通常透过提供安心保障来提升顾客偏好和品牌忠诚度。

根据最终用途,车联网服务市场分为OEM)和售后市场。 2024 年,原厂(OEM)占据主导地位,占据近 88% 的整体市场。汽车製造商越来越多地在生产阶段嵌入硬体和软体,以提供导航、诊断和远端存取等整合服务。消费者更倾向于使用由值得信赖的製造商预先安装在车辆上的车联网服务。原厂 (OEM) 受益于对服务基础设施的完全控制,使他们能够独立提供更新、收集资料和推出新功能,从而增强盈利潜力并加强客户关係。

车辆连接通常分为嵌入式、有线或整合式。其中,嵌入式连结在2024年引领了市场。这些系统因其能够透过内建SIM卡和数据机提供持续的互联网访问,从而实现不间断的服务交付而备受青睐。远端诊断、OTA更新和预测性维护等功能可以无缝交付,从而提升车主体验。原始设备製造商和车队管理者都更青睐嵌入式系统,因为它们具有集中控制功能,且无需依赖外部设备即可提供一致的使用者体验。

依车辆类型划分,市场可分为乘用车、商用车、两轮车、三轮车、非公路用车。由于全球销售高企,乘用车在2024年引领了市场。随着大多数新车都配备了互联繫统,对整合服务的需求显着增长。消费者期望安全通知、驾驶员檔案和行动装置整合等高级功能成为标配,这促使汽车製造商优先考虑服务捆绑和数位化增强作为关键差异化因素。这些数位化产品对于现代汽车行销策略和客户维繫工作至关重要。

从地区来看,亚太地区在2024年占据了最大的市场份额,超过35%,其中中国贡献巨大,预计价值将达到20亿美元。该地区拥有强大的生产能力,消费者对连网智慧汽车技术也已做好准备。该地区的製造商正致力于提升其车辆的数位化能力,以满足日益增长的智慧出行需求。亚太地区的基础设施,尤其是强大的4G和5G网络,支援连网服务所需的即时资料交换,包括云端处理、OTA更新和基于位置的功能。

塑造车联网服务市场的关键公司包括 AT&T、博世、宝马、大陆集团、通用汽车、福特、Geotab、HERE Technologies、哈曼国际和 Verizon Connect。这些公司正在利用先进的远端资讯处理、云端基础设施和基于服务的模式来满足不断变化的消费者需求,同时应对各个市场的合规性和资料安全挑战。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 汽车製造商

- 汽车技术提供者

- 云端和 IT 服务供应商

- 最终用途

- 利润率分析

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 用例

- 保险

- 共享出行

- 车队管理

- 其他的

- 顶级互联汽车服务

- 监管格局

- 衝击力

- 成长动力

- 向软体定义汽车转变

- 扩充 4G/5G 和 V2X 连接

- 对车载安全性、便利性和效率的需求不断增加

- 车队管理和商业远端资讯处理

- 产业陷阱与挑战

- 网路安全与资料隐私风险

- 技术整合成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按服务,2021 - 2034 年

- 主要趋势

- 安全和保障

- 远端操作

- 导航和资讯娱乐

- 车辆管理

- 驾驶员辅助

- 其他的

第六章:市场估计与预测:依连结性,2021 - 2034 年

- 主要趋势

- 嵌入式

- 繫留

- 融合的

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- 轻型商用车

- 平均血红素 (MCV)

- 丙型肝炎病毒

- 两轮车和三轮车

- 非公路车辆

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AT&T

- BMW

- Bosch

- Continental

- Ford

- General Motors

- Geotab

- Harman

- HERE Technologies

- Hyundai

- Ituran

- Nissan

- Octo Telematics

- Qualcomm

- Sierra Wireless

- SiriusXM Connected Vehicle Services

- Tesla

- Toyota

- Verizon Connect

- Volkswagen

- Zubie

The Global Connected Vehicle Services Market was valued at USD 21 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 57 billion by 2034. This growth is driven by the increasing transition from traditional vehicles to software-defined vehicles, which has significantly reshaped how automotive services are developed, offered, and monetized. Unlike conventional vehicles, modern vehicles are designed around adaptable software platforms that enable real-time updates and on-demand services even after purchase. This dynamic architecture allows manufacturers to introduce features like remote diagnostics, driver assistance, and system upgrades through over-the-air updates, enhancing both customer satisfaction and service scope. As a result, connected vehicle services have become a fundamental component of automotive development strategies, driven by rising demand for smarter, more responsive, and safer mobility solutions.

Consumers are increasingly expecting their vehicles to offer built-in connectivity features that improve the driving experience while ensuring safety and convenience. This demand shift is compelling automakers to integrate services like infotainment, safety alerts, navigation, and remote controls directly into new models. The ability to continuously update features and provide personalized services is turning vehicles into digital platforms, encouraging subscription-based service models. Manufacturers are now focusing on enhancing user experiences through predictive maintenance alerts, usage tracking, and voice-assisted commands. As vehicles continue to integrate AI and IoT technologies, companies offering scalable telematics and strong cloud capabilities are well-positioned to lead. In addition, evolving global regulations around data privacy, cybersecurity, and vehicular safety are reshaping service delivery models, favoring firms with the infrastructure and compliance readiness to meet international standards. The shift toward service-based offerings is setting the stage for long-term customer engagement and ongoing revenue generation in the automotive ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21 Billion |

| Forecast Value | $57 Billion |

| CAGR | 10.8% |

In terms of services, the market is divided into remote operations, safety and security, navigation and infotainment, driver assistance, vehicle management, and others. The safety and security segment led the market in 2024, generating approximately USD 5 billion and capturing over 25% of the total market share. Consumers place high importance on real-time features like emergency alerts, crash detection, theft prevention, and roadside assistance, which contribute significantly to both perceived and actual vehicle safety. These services are valued not only by individual users but also by fleet operators and insurers, who rely on real-time monitoring for vehicle tracking, driver behavior analysis, and risk assessment. These features often drive customer preference and brand loyalty by providing peace of mind.

By end use, the connected vehicle services market is classified into OEM and aftermarket segments. The OEM segment dominated the landscape in 2024, holding nearly 88% of the overall market share. Automakers are increasingly embedding hardware and software at the production stage to deliver integrated services such as navigation, diagnostics, and remote access capabilities. Consumers are more inclined to use connected services when they come pre-installed in the vehicle from a trusted manufacturer. OEMs benefit from full control over the service infrastructure, allowing them to offer updates, collect data, and roll out new features independently, which enhances monetization potential and strengthens customer relationships.

Connectivity in vehicles is typically categorized as embedded, tethered, or integrated. Among these, embedded connectivity led the market in 2024. These systems are favored for their ability to provide continuous internet access via built-in SIM cards and modems, enabling uninterrupted service delivery. Features such as remote diagnostics, OTA updates, and predictive maintenance can be delivered seamlessly, improving the ownership experience. OEMs and fleet managers alike prefer embedded systems for their centralized control and ability to provide a consistent user experience without external dependencies.

By vehicle type, the market is segmented into passenger vehicles, commercial vehicles, two- and three-wheelers, and off-highway vehicles. Passenger vehicles led the market in 2024 due to high global sales volume. As the majority of new vehicles are now equipped with connected systems, the demand for integrated services has expanded significantly. Consumers expect advanced features like safety notifications, driver profiles, and mobile device integration to become standard, which pushes automakers to prioritize service bundling and digital enhancements as key differentiators. These digital offerings are becoming essential to modern automotive marketing strategies and customer retention efforts.

Regionally, Asia Pacific held the largest market share of over 35% in 2024, with China contributing significantly at an estimated value of USD 2 billion. The region benefits from strong production capabilities and high consumer readiness for connected and intelligent automotive technologies. Manufacturers in the region are focusing on enhancing the digital capabilities of their vehicles to cater to growing demands for smart mobility. The infrastructure in Asia Pacific, especially with robust 4G and 5G networks, supports real-time data exchange required for connected services, including cloud processing, OTA updates, and location-based functions.

Key companies shaping the connected vehicle services market include AT&T, Bosch, BMW, Continental, General Motors, Ford, Geotab, HERE Technologies, Harman International, and Verizon Connect. These players are leveraging advanced telematics, cloud infrastructure, and service-based models to meet evolving consumer demands while addressing compliance and data security challenges across markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive manufacturers

- 3.2.2 Automotive technology providers

- 3.2.3 Cloud and IT Service providers

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Use cases

- 3.8.1 Insurance

- 3.8.2 Shared mobility

- 3.8.3 Fleet management

- 3.8.4 Others

- 3.9 Top connected vehicles services

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Shift toward software-defined vehicles

- 3.11.1.2 Expansion of 4G/5G and V2X connectivity

- 3.11.1.3 Increasing demand for in-vehicle safety, convenience and efficiency

- 3.11.1.4 Fleet management and commercial telematics

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Cybersecurity and data privacy risks

- 3.11.2.2 High cost of technology integration

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Safety and security

- 5.3 Remote operations

- 5.4 Navigation and infotainment

- 5.5 Vehicle management

- 5.6 Driver assistance

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Embedded

- 6.3 Tethered

- 6.4 Integrated

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two and three wheelers

- 7.5 Off-highway vehicles

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AT&T

- 10.2 BMW

- 10.3 Bosch

- 10.4 Continental

- 10.5 Ford

- 10.6 General Motors

- 10.7 Geotab

- 10.8 Harman

- 10.9 HERE Technologies

- 10.10 Hyundai

- 10.11 Ituran

- 10.12 Nissan

- 10.13 Octo Telematics

- 10.14 Qualcomm

- 10.15 Sierra Wireless

- 10.16 SiriusXM Connected Vehicle Services

- 10.17 Tesla

- 10.18 Toyota

- 10.19 Verizon Connect

- 10.20 Volkswagen

- 10.21 Zubie