|

市场调查报告书

商品编码

1871124

车载支付系统硬体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)In-Vehicle Payment System Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

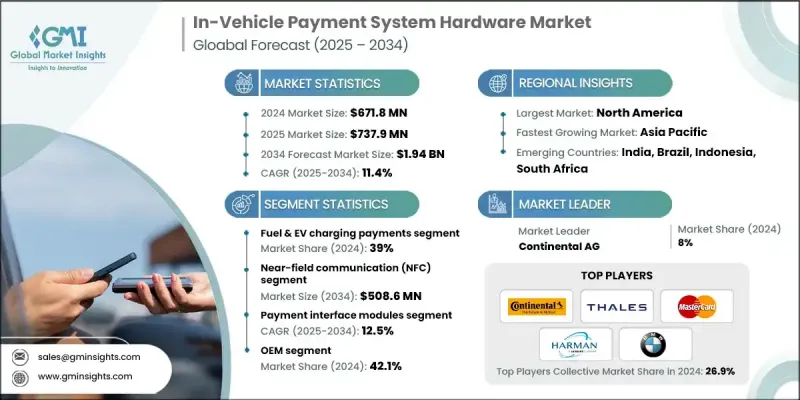

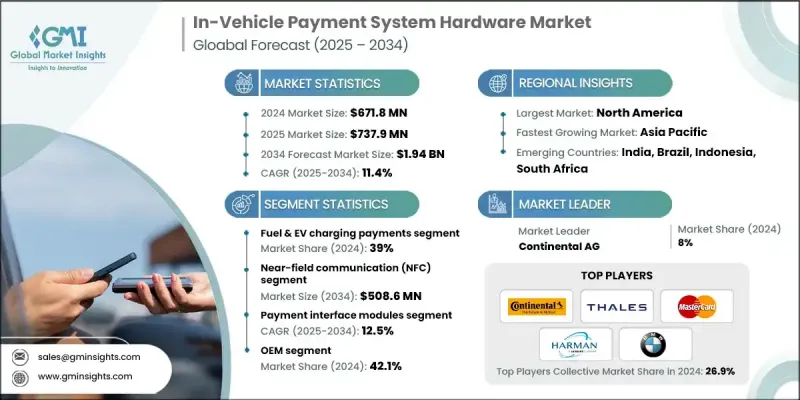

2024 年全球车载支付系统硬体市值为 6.718 亿美元,预计到 2034 年将以 11.4% 的复合年增长率成长至 19.4 亿美元。

全球互联和自动驾驶汽车的普及正在加速车载支付技术的普及。先进的硬体组件,例如安全晶片、生物识别感测器和NFC模组,使得车辆能够直接进行即时、无缝的交易。这一发展趋势正在重塑出行格局,简化了出行即服务(MaaS)生态系统中加油、停车和通行费等服务的自动支付流程。尤其是在疫情之后,消费者对数位化和非接触式交易的偏好普遍增强,这进一步提升了对安全、便利、快速支付体验的需求。汽车製造商正积极回应,增加对嵌入式车载支付系统的投资,这些系统采用蓝牙、NFC和RFID等技术。这些系统可与车载资讯娱乐平台和数位钱包集成,实现与外部支付网路的安全同步。同时,城市和交通管理部门正在利用V2X和DSRC技术对收费、停车和充电基础设施进行现代化改造,这些技术依赖车载支付硬体来实现互通性和跨境功能。汽车製造商、金融科技公司和支付提供者之间的合作正在扩大透过车载商务、订阅和互联数位服务实现盈利的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.718亿美元 |

| 预测值 | 19.4亿美元 |

| 复合年增长率 | 11.4% |

预计2025年至2034年间,支付介面模组市场将以12.5%的复合年增长率成长。这些模组嵌入车载资讯娱乐系统,支援停车、加油和通行费等非现金及非接触式交易,透过代币化支付方式提供便利性和高安全性。汽车製造商和顶级供应商正大力投资于汽车级介面模组,这些模组的设计旨在确保可靠性、可扩展性并符合全球安全标准。这些整合模组有助于实现不同车型支付体验的标准化,并增强用户对安全且便利的行动支付的信心。

预计到2024年,燃油和电动车充电支付领域将占据39%的市场。电动车的日益普及以及对高效加油和充电解决方案需求的成长,正在推动车载支付系统的应用。这些系统使驾驶员能够直接透过车载资讯娱乐系统完成燃油或电动车充电交易,从而减少对实体卡或现金的依赖。非接触式支付支援以及与多种支付平台的兼容性,增加了灵活性,简化了用户交互,提升了消费者的便利性。

2024年,美国车载支付系统硬体市占率达86.4%。美国车主对直接整合到车辆系统中的安全、非接触式即时支付方式的强烈偏好,持续推动市场成长。汽车製造商正优先实施先进的安全功能,包括生物辨识验证、嵌入式钱包和符合PCI标准的令牌化技术,以保护消费者资料并确保支付安全。对隐私标准和合规要求的重视,以及汽车製造商与金融网路之间的合作,正在巩固美国在该领域的领先地位。

全球车载支付系统硬体市场的主要参与者包括宝马、大陆集团、戴姆勒、泰雷兹集团、万事达卡、哈曼国际、现代汽车和本田汽车。这些关键企业正积极推行策略性倡议,以巩固自身竞争力并提昇技术能力。各公司致力于开发整合支付模组,这些模组配备先进的身份验证、加密和连接功能,以确保交易的无缝和安全。汽车製造商、金融科技公司和支付技术公司之间的策略合作正在促进创新并扩大生态系统的兼容性。对研发的大量投入正在推动符合全球安全和资料保护标准的标准化、可互通硬体解决方案的开发。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预报

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 价值链分析与产业结构

- 原料与晶圆製造

- BMS IC设计与开发

- 半导体製造与测试

- BMS模组组装与集成

- 电池组整合与验证

- OEM车辆整合与部署

- 售后市场及服务生态系统

- 报废回收与永续性

- 价值链分析与产业结构

- 供应商格局

- 原物料供应商

- 零件製造商

- 系统整合商

- OEM

- 最终用途

- 产业影响因素

- 成长驱动因素

- 连网智慧汽车激增

- 消费者对非接触式支付的偏好日益增强

- 电动车和充电基础设施的成长

- OEM金融科技合作

- 智慧城市与智慧交通发展

- 产业陷阱与挑战

- 高昂的硬体和整合成本

- 网路安全和资料隐私问题

- 市场机会

- 与出行即服务 (MaaS) 的集成

- 电动车充电和绿色出行的扩展

- 原始设备製造商与数位钱包提供商之间的合作关係

- 车辆生物辨识认证的兴起

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 新兴技术

- 专利分析

- 价格趋势分析

- 按组件

- 按地区

- 成本細項分析

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 市场成熟度与采纳分析

- 技术准备程度评估

- 区域采用成熟度比较

- 应用领域成熟度分析

- 生产准备和规模评估

- 商业部署时程

- 未来趋势

- 主要市场趋势和颠覆性因素

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重要新闻和倡议

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 支付介面模组

- 生物辨识认证设备

- 显示与资讯娱乐单元

- 连接组件

- 感测器和控制器

- 嵌入式安全硬体

第六章:市场估算与预测:依支付应用类型划分,2021-2034年

- 主要趋势

- 燃油和电动车充电付款

- 收费站

- 停车费

- 免下车支付和零售支付

- 订阅及车载服务

第七章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 近场通讯(NFC)

- 无线射频识别(RFID)

- 专用短程通讯(DSRC)

- 蜂窝网路(4G/5G)

- Wi-Fi/蓝牙低功耗

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- OEM

- 车队营运商

- 行动服务提供者

- 收费和停车运营商

- 燃料和电动车基础设施供应商

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- BMW AG

- Continental AG

- Daimler AG (Mercedes-Benz Group)

- Denso Corporation

- Harman International

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Mastercard Incorporated

- NXP Semiconductors

- Qualcomm Technologies Inc.

- Robert Bosch GmbH

- Thales Group

- 区域玩家

- Aisin Corporation

- Aptiv PLC

- Garmin Ltd.

- Hyundai Mobis

- LG Electronics

- Magna International Inc.

- Valeo SA

- ZF Friedrichshafen AG

- 新兴参与者和颠覆者

- Car IQ Inc.

- Cerence Inc.

- IDEMIA

- Ingenico (Worldline)

- PayByCar Inc.

- Rambus Inc.

- Secure-IC

- Utimaco GmbH

- Verifone Systems Inc.

- Xevo Inc. (Lear Corporation)

The Global In-Vehicle Payment System Hardware Market was valued at USD 671.8 million in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 1.94 Billion by 2034.

The expansion of connected and autonomous vehicles worldwide is accelerating the adoption of integrated in-vehicle payment technologies. Advanced hardware components such as secure chips, biometric sensors, and NFC modules enable real-time and seamless transactions directly from vehicles. This evolution is reshaping the mobility landscape by streamlining automated payments for services such as fueling, parking, and tolls within mobility-as-a-service ecosystems. The widespread shift in consumer preferences toward digital and contactless transactions, particularly following the pandemic, has further increased demand for secure, frictionless, and fast payment experiences. Automakers are responding by increasing their investment in embedded vehicle payment systems using technologies like Bluetooth, NFC, and RFID. These systems integrate with infotainment platforms and digital wallets, allowing secure synchronization with external payment networks. Meanwhile, cities and transport authorities are modernizing tolling, parking, and charging infrastructure using V2X and DSRC technologies that depend on in-vehicle payment hardware to enable interoperability and cross-border functionality. Partnerships between automakers, fintech firms, and payment providers are expanding opportunities for monetization through in-car commerce, subscriptions, and connected digital services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $671.8 Million |

| Forecast Value | $1.94 Billion |

| CAGR | 11.4% |

The payment interface module segment is expected to grow at a CAGR of 12.5% from 2025 to 2034. These modules, embedded into infotainment systems, enable cashless and contactless transactions for parking, fuel, and tolls, offering convenience and high security through tokenized payment methods. OEMs and top-tier suppliers are heavily investing in automotive-grade interface modules designed for reliability, scalability, and compliance with global safety standards. These integrated modules help standardize payment experiences across various vehicle models and enhance user confidence in secure, on-the-go transactions.

The fuel and EV charging payment segment held a 39% share in 2024. Growing adoption of electric vehicles and rising demand for efficient refueling and recharging solutions are fostering the use of in-vehicle payment systems. These systems enable drivers to complete transactions for fuel or EV charging directly from their infotainment systems, reducing reliance on physical cards or cash. The inclusion of contactless payment support and compatibility with diverse payment platforms adds flexibility and simplifies user interaction, enhancing convenience for consumers.

United States In-Vehicle Payment System Hardware Market held 86.4% share in 2024. The strong preference among U.S. drivers for secure, contactless, and instant payments integrated directly into vehicle systems continues to drive market growth. OEMs are prioritizing the implementation of advanced security features, including biometric verification, embedded wallets, and PCI-compliant tokenization to protect consumer data and ensure payment safety. The focus on privacy standards and compliance requirements, combined with collaboration between vehicle manufacturers and financial networks, is strengthening the country's leadership in this space.

Major companies operating in the Global In-Vehicle Payment System Hardware Market include BMW, Continental, Daimler, Thales Group, Mastercard Incorporated, Harman International, Hyundai Motor Company, and Honda Motor. Key players in the in-vehicle payment system hardware market are pursuing strategic initiatives to reinforce their competitive standing and expand their technological capabilities. Companies are focusing on developing integrated payment modules equipped with advanced authentication, encryption, and connectivity features to ensure seamless and secure transactions. Strategic collaborations between automakers, fintech providers, and payment technology companies are fostering innovation and expanding ecosystem compatibility. Heavy investment in R&D is driving the creation of standardized, interoperable hardware solutions that align with global security and data protection standards.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Payment Application

- 2.2.3 Technology

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Value Chain Analysis & Industry Structure

- 3.1.1.1 Raw Materials & Wafer Fabrication

- 3.1.1.2 BMS IC Design & Development

- 3.1.1.3 Semiconductor Manufacturing & Testing

- 3.1.1.4 BMS Module Assembly & Integration

- 3.1.1.5 Battery Pack Integration & Validation

- 3.1.1.6 OEM Vehicle Integration & Deployment

- 3.1.1.7 Aftermarket & Service Ecosystem

- 3.1.1.8 End-of-Life Recycling & Sustainability

- 3.1.1 Value Chain Analysis & Industry Structure

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators

- 3.2.4 OEM

- 3.2.5 End use

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Surge in Connected and Smart Vehicles

- 3.3.1.2 Rising Consumer Preference for Contactless Payments

- 3.3.1.3 Growth of EVs and Charging Infrastructure

- 3.3.1.4 OEM-Fintech Collaborations

- 3.3.1.5 Smart City and Intelligent Transportation Development

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Hardware and Integration Costs

- 3.3.2.2 Cybersecurity and Data Privacy Concerns

- 3.3.3 Market opportunities

- 3.3.3.1 Integration with Mobility-as-a-Service (MaaS)

- 3.3.3.2 Expansion of EV Charging and Green Mobility

- 3.3.3.3 Partnerships Between OEMs and Digital Wallet Providers

- 3.3.3.4 Emergence of Biometric Authentication in Vehicles

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle east and Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technology

- 3.8.2 Emerging technology

- 3.9 Patent analysis

- 3.10 Price Trends Analysis

- 3.10.1 By component

- 3.10.2 By region

- 3.11 Cost breakdown analysis

- 3.12 Production statistics

- 3.12.1 Production hubs

- 3.12.2 Consumption hubs

- 3.12.3 Export and import

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Market maturity & adoption analysis

- 3.14.1 Technology readiness level assessment

- 3.14.2 Regional adoption maturity comparison

- 3.14.3 Application domain maturity analysis

- 3.14.4 Manufacturing readiness & scale assessment

- 3.14.5 Commercial deployment timeline

- 3.15 Future trends

- 3.16 Major market trends and disruptions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Payment Interface Modules

- 5.3 Biometric Authentication Devices

- 5.4 Display & Infotainment Units

- 5.5 Connectivity Components

- 5.6 Sensors & Controllers

- 5.7 Embedded Security Hardware

Chapter 6 Market Estimates & Forecast, By Payment Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Fuel & EV Charging Payments

- 6.3 Toll Collection

- 6.4 Parking Fees

- 6.5 Drive-through & Retail Payments

- 6.6 Subscription & In-Car Services

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Near-Field Communication (NFC)

- 7.3 Radio Frequency Identification (RFID)

- 7.4 Dedicated Short-Range Communication (DSRC)

- 7.5 Cellular (4G/5G)

- 7.6 Wi-Fi/Bluetooth Low Energy

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Fleet Operators

- 8.4 Mobility Service Providers

- 8.5 Toll & Parking Operators

- 8.6 Fuel & EV Infrastructure Providers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 BMW AG

- 10.1.2 Continental AG

- 10.1.3 Daimler AG (Mercedes-Benz Group)

- 10.1.4 Denso Corporation

- 10.1.5 Harman International

- 10.1.6 Honda Motor Co., Ltd.

- 10.1.7 Hyundai Motor Company

- 10.1.8 Mastercard Incorporated

- 10.1.9 NXP Semiconductors

- 10.1.10 Qualcomm Technologies Inc.

- 10.1.11 Robert Bosch GmbH

- 10.1.12 Thales Group

- 10.2 Regional Players

- 10.2.1 Aisin Corporation

- 10.2.2 Aptiv PLC

- 10.2.3 Garmin Ltd.

- 10.2.4 Hyundai Mobis

- 10.2.5 LG Electronics

- 10.2.6 Magna International Inc.

- 10.2.7 Valeo SA

- 10.2.8 ZF Friedrichshafen AG

- 10.3 Emerging Players and Disruptors

- 10.3.1 Car IQ Inc.

- 10.3.2 Cerence Inc.

- 10.3.3 IDEMIA

- 10.3.4 Ingenico (Worldline)

- 10.3.5 PayByCar Inc.

- 10.3.6 Rambus Inc.

- 10.3.7 Secure-IC

- 10.3.8 Utimaco GmbH

- 10.3.9 Verifone Systems Inc.

- 10.3.10 Xevo Inc. (Lear Corporation)