|

市场调查报告书

商品编码

1684701

十亿位元乙太网路网路测试设备市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Gigabit Ethernet Test Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

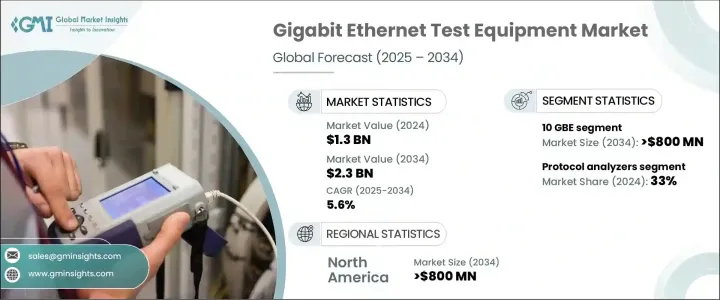

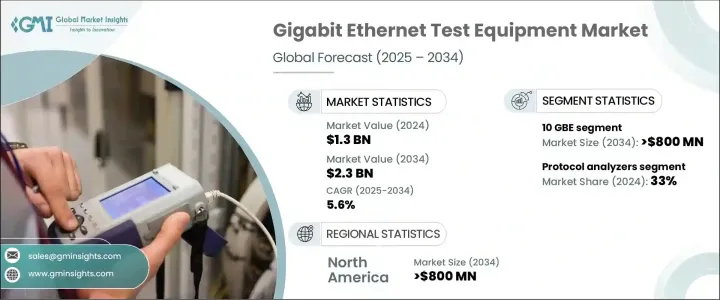

2024 年全球十亿位元乙太网路网路测试设备市场价值为 13 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 5.6%。电信、资料中心、云端服务和企业 IT 领域的企业正在迅速采用先进的网路解决方案,需要强大的测试工具来确保无缝连接。人工智慧、边缘运算和5G部署的兴起进一步增加了对精准、高效网路测试的需求。

该公司正在大力投资先进的测试解决方案,以提高效能、最大限度地减少停机时间并优化网路配置。确保跨装置、网路和资料中心不间断的通讯已成为当务之急。随着资料流量和网路架构日益复杂,测试解决方案必须持续发展以满足下一代网路环境的动态需求。因此,在技术进步和各行业不断扩大的用例的推动下,市场正在经历稳步增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 5.6% |

市场按技术细分,其中 10GbE资料市场在 2024 年占据 37% 的份额。对更高资料速度、低延迟效能和卓越连接解决方案的需求持续推动 10GbE 网路的采用。企业不断升级其基础设施以支援密集型应用程序,包括人工智慧驱动的分析、云端运算和即时通讯。随着网路架构的发展,透过可靠的测试解决方案确保平稳的效能和强大的安全性仍然是重点。企业越来越多地利用高效能乙太网路测试工具来验证网路效率并解决快速发展的数位环境中的潜在营运挑战。

就产品类型而言,市场分为协定分析仪、一致性测试仪、网路效能测试仪、误码率测试仪(BERT)和其他类别。由于网路基础设施日益复杂以及专用乙太网路网路协定的激增,协定分析仪领域在 2024 年的份额将达到 33%。随着企业向 100GbE 和 400GbE 等超高速标准过渡,协定分析仪在故障排除和网路优化中的作用变得比以往任何时候都更加重要。这些工具有助于识别资料包传输错误,分析协定效能并增强网路可靠性。人工智慧的预测诊断和电子标记的整合显着提高了协定分析仪的效率,使其成为现代网路环境中不可或缺的一部分。专注于大规模资料处理和基于云端的应用程式的公司依靠这些解决方案来维持无缝运作并防止效能瓶颈。

2024资料,北美占据十亿位元乙太网路网路测试设备市场的 36%,预计到 2034 年将创收 8.3 亿美元。该地区的企业持续投资先进的人工智慧、云端运算和边缘运算解决方案,增强了高效能网路验证工具的必要性。对网路安全、法规遵循和网路弹性的日益关注进一步推动了对下一代乙太网路测试解决方案的需求。随着各行业扩展其数位基础设施,对准确、可扩展和可靠的测试设备的需求仍然是影响北美市场成长轨蹟的关键因素。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原物料供应商

- 零件製造商

- 原始设备製造商

- 分销商和系统整合商

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 技术差异化

- 速度支援和频宽处理

- 协议和标准合规性

- 自动化和人工智慧功能

- 衝击力

- 成长动力

- 云端资料中心的采用率不断上升

- 全球 5G 网路基础设施扩张

- 高速乙太网路连线的需求不断增长

- 增加对物联网和边缘运算的投资

- 产业陷阱与挑战

- 先进测试设备成本高

- 技术快速进步导致产品频繁淘汰

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 协议分析仪

- 一致性测试仪

- 网路效能测试员

- 误码率测试仪 (BERT)

- 其他的

第六章:市场估计与预测:依技术,2021 - 2034 年

- 主要趋势

- 1 GBE

- 10 GBE 内存

- 25/50 英石

- 其他的

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 电信

- 资料中心

- 企业网路

- 汽车

- 卫生保健

- 媒体与娱乐

- 其他的

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Anritsu

- Aukua Systems

- Beijing Xinertel

- Exfo

- Fluke Networks

- GAO Instruments

- GL Communications

- Keysight Technologies

- Marvell Technology

- MultiLane

- NetScout Systems

- NextGig Systems

- Rohde & Schwarz

- Spirent Communication

- TE Connectivity

- Tektronix

- Teledyne LeCroy

- ThinkRF

- Viavi Solutions

- Xena Networks

The Global Gigabit Ethernet Test Equipment Market, valued at USD 1.3 billion in 2024, is set to expand at a CAGR of 5.6% between 2025 and 2034. As industries accelerate digital transformation, the demand for high-speed, reliable network infrastructure continues to surge. Businesses across telecommunications, data centers, cloud services, and enterprise IT are rapidly adopting advanced networking solutions, necessitating robust testing tools to ensure seamless connectivity. The rise of artificial intelligence, edge computing, and 5G deployment further amplifies the need for precise and efficient network testing.

Companies are investing heavily in sophisticated testing solutions to enhance performance, minimize downtime, and optimize network configurations. Ensuring uninterrupted communication across devices, networks, and data centers has become a critical priority. With increasing complexities in data traffic and network architectures, testing solutions must evolve to meet the dynamic needs of next-generation networking environments. As a result, the market is experiencing steady growth, driven by technological advancements and expanding use cases in various industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 billion |

| Forecast Value | $2.3 billion |

| CAGR | 5.6% |

The market is segmented by technology, with the 10GbE segment holding a commanding 37% share in 2024. This segment is projected to generate USD 800 million by 2034, fueled by increasing demand for high-bandwidth solutions in data centers, telecom infrastructure, and large enterprises. The need for higher data speeds, low-latency performance, and superior connectivity solutions continues to push the adoption of 10GbE networking. Businesses are consistently upgrading their infrastructures to support intensive applications, including AI-driven analytics, cloud computing, and real-time communications. As network architectures evolve, ensuring smooth performance and robust security through reliable testing solutions remains a key focus. Enterprises are increasingly leveraging high-performance Ethernet testing tools to validate network efficiency and address potential operational challenges in rapidly advancing digital environments.

In terms of product types, the market is divided into protocol analyzers, conformance testers, network performance testers, bit error rate testers (BERT), and other categories. The protocol analyzer segment held a 33% share in 2024, driven by the rising complexity of network infrastructures and the proliferation of specialized Ethernet networking protocols. As enterprises transition to ultra-high-speed standards like 100GbE and 400GbE, the role of protocol analyzers in troubleshooting and network optimization has become more vital than ever. These tools help identify packet transmission errors, analyze protocol performance, and enhance network reliability. The integration of artificial intelligence for predictive diagnostics and electronic tagging has significantly improved the efficiency of protocol analyzers, making them indispensable in modern networking environments. Companies focused on large-scale data processing and cloud-based applications rely on these solutions to maintain seamless operations and prevent performance bottlenecks.

North America held a 36% share of the Gigabit Ethernet test equipment market in 2024 and is expected to generate USD 830 million by 2034. The region's strong demand is driven by a rapidly growing number of data centers and the widespread deployment of 5G networks. Businesses across the region continue to invest in advanced AI, cloud computing, and edge computing solutions, reinforcing the necessity for high-performance network validation tools. The increasing focus on cybersecurity, regulatory compliance, and network resilience further fuels the demand for next-generation Ethernet testing solutions. As industries expand their digital infrastructure, the need for accurate, scalable, and reliable testing equipment remains a crucial factor shaping the market's growth trajectory in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 OEMs

- 3.2.4 Distributors and system integrators

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Technology differentiators

- 3.8.1 Speed support & bandwidth handling

- 3.8.2 Protocol and standards compliance

- 3.8.3 Automation & AI capabilities

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of cloud-based data centers

- 3.9.1.2 Expansion of 5G network infrastructure globally

- 3.9.1.3 Growing demand for high-speed Ethernet connectivity

- 3.9.1.4 Increased investments in IoT and edge computing

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost of advanced test equipment

- 3.9.2.2 Rapid technological advancements causing frequent obsolescence

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Protocol analyzers

- 5.3 Conformance testers

- 5.4 Network performance testers

- 5.5 Bit error rate testers (BERT)

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 1 GBE

- 6.3 10 GBE

- 6.4 25/50 GBE

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Telecommunications

- 7.3 Data centers

- 7.4 Enterprise networks

- 7.5 Automotive

- 7.6 Healthcare

- 7.7 Media and entertainment

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Anritsu

- 9.2 Aukua Systems

- 9.3 Beijing Xinertel

- 9.4 Exfo

- 9.5 Fluke Networks

- 9.6 GAO Instruments

- 9.7 GL Communications

- 9.8 Keysight Technologies

- 9.9 Marvell Technology

- 9.10 MultiLane

- 9.11 NetScout Systems

- 9.12 NextGig Systems

- 9.13 Rohde & Schwarz

- 9.14 Spirent Communication

- 9.15 TE Connectivity

- 9.16 Tektronix

- 9.17 Teledyne LeCroy

- 9.18 ThinkRF

- 9.19 Viavi Solutions

- 9.20 Xena Networks