|

市场调查报告书

商品编码

1684714

文件完整性监控市场机会、成长动力、产业趋势分析与预测 2025 - 2034File Integrity Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

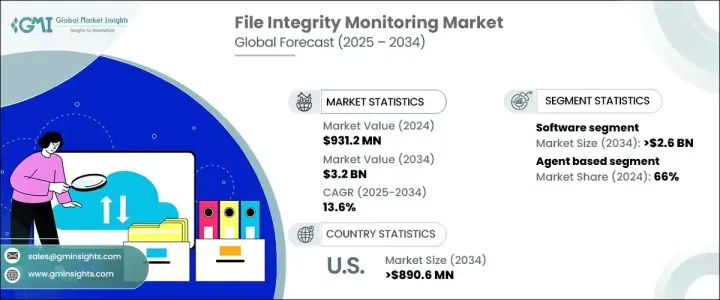

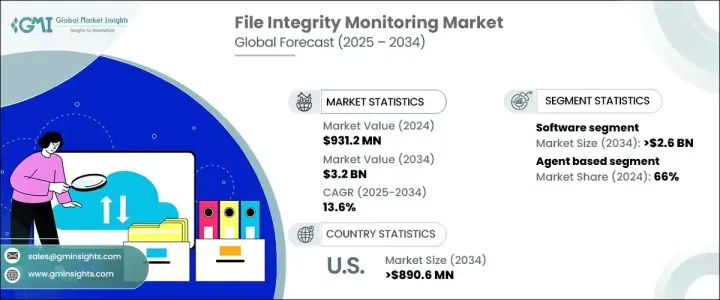

2024 年全球文件完整性监控市场价值为 9.312 亿美元,预计随着企业在不断升级的威胁中优先考虑网路安全,2025 年至 2034 年期间的复合年增长率将达到 13.6%。骇客攻击、恶意软体和檔案篡改等网路攻击日益复杂,加剧了对即时安全措施的需求。全球各地的组织都在积极投资先进的文件完整性监控解决方案,以检测未经授权的存取、防止资料外洩并遵守严格的监管框架。

随着勒索软体攻击持续扰乱产业,企业寻求主动防御策略来保护敏感资讯。监管机构制定了严格的合规要求,迫使企业采用先进的安全工具。快速的数位转型加上云端运算应用的激增,进一步推动了对监控解决方案的需求。虽然云端环境提供了操作灵活性和可扩展性,但也增加了网路威胁的风险,因此强大的安全协定不可或缺。整合混合云端模型的企业需要复杂的监控工具来追踪文件完整性并在异常升级为全面违规之前检测异常。网路安全领域人工智慧和机器学习的整合正在增强檔案完整性监控,使组织能够更准确地识别模式并预测潜在的安全漏洞。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.312亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 13.6% |

市场按组件细分为软体和服务,其中软体部分在 2024 年占据 74% 的主导份额。这些技术最大限度地减少了人为错误,降低了营运成本,并简化了安全合规性。随着企业面临的网路风险不断增加,企业优先考虑自动化以加强其安全态势,软体解决方案预计到 2034 年将产生 26 亿美元的收入。

根据安装模式,市场将解决方案分为基于代理的系统和无代理的系统。基于代理的监控将在 2024 年占据 66% 的市场份额,这得益于其在检测未经授权的文件修改方面的精确度。这些解决方案将监控代理直接部署到端点和伺服器上,提供对潜在安全威胁的即时洞察。金融、医疗保健和政府部门等监管合规性严格的行业依靠基于代理的监控来确保资料完整性并满足法律要求。组织对维护安全基础设施的需求日益增长,加速了这些先进解决方案的采用。

美国资料是文件完整性监控市场的主导者,到 2024 年占有 84% 的份额。在要求企业实施文件完整性监控解决方案的监管要求的推动下,美国市场规模预计到 2034 年将达到 8.5 亿美元。随着网路攻击越来越多地针对金融服务和医疗保健等关键产业,企业正在利用预测分析和即时监控来增强安全框架。美国领先的网路安全公司的存在确保了持续创新,为组织提供了最先进的解决方案,以降低风险并加强数位防御。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 解决方案提供者

- 系统整合商

- 监管机构

- 云端和混合基础设施供应商

- 最终用途

- 供应商概况

- 利润率分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 网路安全威胁日益增加

- 监理合规要求

- 基于云端的解决方案的采用日益增多

- 对营运效率和成本管理的需求日益增长

- 产业陷阱与挑战

- 实施成本高

- 误报和警报疲劳

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 软体

- 服务

第 6 章:市场估计与预测:按安装模式,2021 - 2034 年

- 主要趋势

- 基于代理

- 无代理

第 7 章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第 8 章:市场估计与预测:按企业规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 企业规模

第 9 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 金融保险业协会

- 政府

- 医疗保健与生命科学

- 教育

- 媒体与娱乐

- 零售与电子商务

- 製造和汽车

- 其他的

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- AlienVault (AT&T Cybersecurity)

- Cimcor

- Cisco Systems

- ESET

- IBM Security

- LogRhythm

- ManageEngine

- McAfee

- Netwrix

- New Net Technologies (NNT)

- OSSEC

- Paessler PRTG

- Qualys

- Samhain

- SolarWinds

- Splunk

- Symantec (Broadcom)

- Trend Micro

- Tripwire

- Trustwave

The Global File Integrity Monitoring Market, valued at USD 931.2 million in 2024, is projected to expand at a CAGR of 13.6% from 2025 to 2034 as businesses prioritize cybersecurity amid escalating threats. The increasing sophistication of cyberattacks, including hacking, malware, and file tampering, has intensified the need for real-time security measures. Organizations worldwide are actively investing in advanced file integrity monitoring solutions to detect unauthorized access, prevent data breaches, and comply with stringent regulatory frameworks.

As ransomware attacks continue to disrupt industries, enterprises seek proactive defense strategies to safeguard sensitive information. Regulatory bodies impose strict compliance requirements, compelling businesses to adopt cutting-edge security tools. The rapid digital transformation, combined with the surge in cloud adoption, has further propelled demand for monitoring solutions. While cloud environments offer operational flexibility and scalability, they also heighten the risk of cyber threats, making robust security protocols indispensable. Businesses integrating hybrid cloud models need sophisticated monitoring tools to track file integrity and detect anomalies before they escalate into full-scale breaches. The convergence of artificial intelligence and machine learning in cybersecurity is enhancing file integrity monitoring, allowing organizations to identify patterns and predict potential security vulnerabilities with greater accuracy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $931.2 Million |

| Forecast Value | $3.2 Billion |

| CAGR | 13.6% |

The market is segmented by component into software and services, with the software segment holding a dominant 74% share in 2024. Software-based solutions offer automated monitoring capabilities that instantly detect unauthorized file changes while maintaining baseline configurations. These technologies minimize human error, reduce operational costs, and streamline security compliance. With businesses facing increased cyber risks, software solutions are expected to generate USD 2.6 billion by 2034 as enterprises prioritize automation to strengthen their security posture.

By installation mode, the market categorizes solutions into agent-based and agentless systems. Agent-based monitoring accounted for 66% of the market in 2024, driven by its precision in detecting unauthorized file modifications. These solutions deploy monitoring agents directly onto endpoints and servers, providing real-time insights into potential security threats. Industries with stringent regulatory compliance, such as finance, healthcare, and government sectors, rely on agent-based monitoring to ensure data integrity and meet legal mandates. The growing need for organizations to maintain secure infrastructures has accelerated the adoption of these advanced solutions.

The US remains the dominant player in the file integrity monitoring market, holding an 84% share in 2024. The country's leadership in cybersecurity, along with stringent data protection laws and large-scale investments in security technologies, has fueled demand for sophisticated monitoring tools. The US market is set to reach USD 850 million by 2034, driven by regulatory mandates requiring enterprises to implement file integrity monitoring solutions. With cyberattacks increasingly targeting critical industries such as financial services and healthcare, businesses are leveraging predictive analytics and real-time monitoring to enhance security frameworks. The presence of leading cybersecurity firms in the US ensures continuous innovation, providing organizations with access to state-of-the-art solutions that mitigate risks and strengthen digital defenses.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution providers

- 3.1.2 System integrators

- 3.1.3 Regulatory bodies

- 3.1.4 Cloud & hybrid infrastructure providers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing cybersecurity threats

- 3.7.1.2 Regulatory compliance requirements

- 3.7.1.3 Growing adoption of cloud-based solutions

- 3.7.1.4 Growing need for operational efficiency & cost management

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High implementation costs

- 3.7.2.2 False positives & alert fatigue

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Installation Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Agent-based

- 6.3 Agentless

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Enterprise size

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Government

- 9.4 Healthcare & life science

- 9.5 Education

- 9.6 Media & entertainment

- 9.7 Retail & eCommerce

- 9.8 Manufacturing & automotive

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AlienVault (AT&T Cybersecurity)

- 11.2 Cimcor

- 11.3 Cisco Systems

- 11.4 ESET

- 11.5 IBM Security

- 11.6 LogRhythm

- 11.7 ManageEngine

- 11.8 McAfee

- 11.9 Netwrix

- 11.10 New Net Technologies (NNT)

- 11.11 OSSEC

- 11.12 Paessler PRTG

- 11.13 Qualys

- 11.14 Samhain

- 11.15 SolarWinds

- 11.16 Splunk

- 11.17 Symantec (Broadcom)

- 11.18 Trend Micro

- 11.19 Tripwire

- 11.20 Trustwave