|

市场调查报告书

商品编码

1630210

文件完整性监控:市场占有率分析、产业趋势/统计、成长预测(2025-2030)File Integrity Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

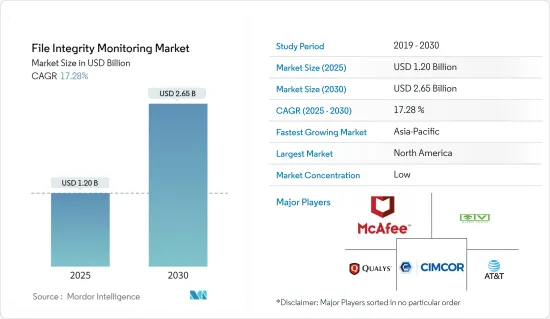

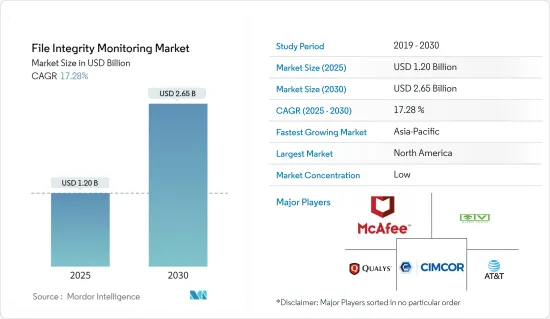

文件完整性监控市场规模预计到 2025 年为 12 亿美元,预计到 2030 年将达到 26.5 亿美元,预测期内(2025-2030 年)复合年增长率为 17.28%。

文件完整性监控市场允许组织以安全的方式测试和检查作业系统(OS)、资料库和应用程式软体文件,以确保文件、照片、影片和文件没有被篡改或损坏。组织正在采用这些技术,使员工能够储存、存取、管理和确保资料安全,而无需使用消费群的文件共用应用程式或软体。

主要亮点

- 例如,企业工作站主要使用 Windows、Mac OS 和 Linux OS。另一方面,员工使用平板电脑和智慧型手机等行动设备,其中 Android 和 iOS 是主要作业系统。云端服务的激增和活动目录使用者的激增使得管理员很难控制授予组织内人员的权利和特权。结果,漏洞增加,这对您的组织来说可能是灾难性的。

- 文件完整性监控已成为简化管理员流程并应对组织当今面临的网路威胁的重要工具。文件完整性监控解决方案还负责监控共用文件活动并向管理员提供及时警报以最大程度地减少威胁。

- 文件完整性监控市场解决的关键问题是特权滥用。滥用特权是指网路策略中的使用者未更新且该使用者的凭证被用来存取和变更檔案。

- 文件监控和完整性管理解决方案的格局正在迅速变化。以前,系统管理员手动授予存取权限并检查漏洞。儘管如此,随着事件数量的增加,管理员无法识别威胁。因此,来自 Netwrix、Lepide 和 Dell 的解决方案应运而生,为市场提供独立的解决方案。然而,这些解决方案限制了用户数量并管理许多事件。

- 卡巴斯基和McAfee等防毒供应商已经意识到这一附加安全层的重要性,并将其整合到他们的防毒解决方案中。然而,IBM 和 SolarWinds 等公司拥有满足大型企业需求的解决方案,并拥有识别误报的先进技术,以清理发送给管理员的通知。

- 在 COVID-19 爆发期间,许多国家的网路威胁呈上升趋势。例如,澳洲网路安全中心(ACSC)已宣布在疫情期间防范网路攻击。各国进一步加强加强文件完整性监控系统。

- 在 COVID-19 大流行期间,网路安全已成为重中之重。人们越来越依赖数位技术来维持文件完整性监控流程的运作。此外,根据美国劳工统计局 (BLS) 的数据,从 2022 年到 2032 年,资讯安全分析师的就业人数预计将增加 32%,明显快于所有职业的平均值。

文件完整性监控市场趋势

BFSI产业预计将经历最高成长

- 由于其广泛的基本客群和金融资讯的重要性,BFSI 行业是遭受资料外洩和网路攻击的关键基础设施领域之一。与其他行业相比,金融服务机构受到网路攻击的可能性高出四倍,预计这将推动对此类解决方案的需求。

- 此外,根据安全提供者 Bit Defender 的说法,目前银行机构基于活动目录的骇客攻击最为普遍。此外,安全机构发出的各种警告进一步强调了监控文件完整性的必要性。

- 安全机构指出,lockerGoga 勒索软体等勒索软体和 APT15(也称为 K3chang、Mirage、Vixen Panda、GREF 和 Playful Dragon)等骇客组织是攻击 BFSI 机构活动目录的最常见形式。

- 此外,资料外洩可能导致成本飙升和有价值的客户资讯遗失。例如,2023 年 6 月,EpiSource LLC 发现其 Amazon Web Services 环境中的可疑活动导致未授权存取敏感客户资料后,向加州总检察长办公室提出了资料外洩投诉(我已通知您)。此外,2023年5月,美国联邦贸易委员会宣布亚马逊将因侵犯隐私而支付两项罚款:因未删除儿童资料而罚款2,500万美元;因限制存取安全影片而罚款580万美元。

- 为了保护 IT 流程和系统、保护关键客户资料并遵守政府法规,私人和公共银行机构正在专注于实施最新技术来防止网路攻击。此外,客户期望的提高、技术力的提高以及监管要求的收紧,迫使银行机构采取积极主动的安全措施。

亚太地区成长迅速

- 预计亚太地区很快就会为市场提供利润丰厚的机会。不断增长的行业日益增长的安全需求、保护组织中高价值目标的需要以及法规遵从性等因素正在推动该地区采用文件完整性监控解决方案。

- 亚太地区的中小型企业正在从传统的本地环境过渡到混合云端环境。这是因为混合云环境带来了可扩充性和安全性问题。

- 亚太国家正被用作网路攻击的发射台,作为不安全基础设施的脆弱温床,大量电脑很容易受到大规模攻击的感染,或作为全球连接的单点存取点。因此,该地区对文件完整性监控系统的需求正在增加。

- 中国备受争议的网路安全法(CSL)旨在透过新法律保护中国的网路和个人用户资讯。这包括电力和公共产业、交通服务、金融机构,以及作为「关键」部门主要供应商或持有大量中国公民资讯的外国公司,因此市场需求正在增加。

文件完整性监控产业概述

文件完整性监控市场是分散的,同一市场中的大多数全球参与者都在采取措施,透过专注于产品多样化和开发来扩大其市场份额。该市场的主要企业包括 AT&T、McAfee LLC、Qualys Inc.、AlienVault Inc. 和 Cimcor Inc.。

2023 年 8 月,全球IT安全公司 LogRhythm 与美国安全、完整性和合规性软体解决方案供应商 Cimcor 宣布建立合作伙伴关係,共同开发创新的安全和完整性软体解决方案。透过将Cimcor 的文件完整性监控(FIM) 解决方案CimTrak 与LogRhythm 的全面安全资讯和事件管理(SIEM) 平台结合,两家公司将携手合作,帮助世界各地的组织提高可见性,并协助保护您免受最新的网路攻击。

IT安全与合规平台供应商 Qualis 将于 2023 年 2 月发布其 GovCloud 平台,并表示该平台在高影响力等级上符合 FedRAMP 严格的网路安全保证要求。联邦机构可以使用 Qualys 的 GovCloud 平台来开发和实施网路安全计画。 GovCloud 的功能之一包括檔案完整性监控,它符合 NIST SI-7 要求,并通知最终用户对软体、韧体和资讯进行诈欺的更改。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估 COVID-19 对文件完整性监控市场的影响

第五章市场动态

- 市场动态介绍

- 市场驱动因素

- 资料安全威胁日益增加

- 对组织资料管理和人为错误检测的需求不断增长

- Microsoft OS AD 基础架构中的漏洞

- 市场限制因素

- 财务限制和创新成本高

第六章 市场细分

- 按组织规模

- 小型企业

- 大公司

- 依部署类型

- 本地

- 云

- 依部署方式

- 代理基地

- 云

- 按最终用户产业

- 零售

- BFSI

- 款待

- 卫生保健

- 政府机构

- 娱乐

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- McAfee, LLC

- AlienVault, Inc.

- Cimcor, Inc.

- Qualys, Inc.

- AT&T

- SolarWinds Worldwide, LLC

- LogRhythm, Inc.

- New Net Technologies LLC

- Trend Micro Inc.

- TrustWave Holdings, Inc.

- Ionx Solutions LLP

- Splunk Technology

- Software Diversified Services

- IBM Corporation

- Securonix Inc.

第八章投资分析

第9章 市场的未来

The File Integrity Monitoring Market size is estimated at USD 1.20 billion in 2025, and is expected to reach USD 2.65 billion by 2030, at a CAGR of 17.28% during the forecast period (2025-2030).

The file integrity monitoring market is a service that enables organizations to test and check operating system (OS), database, and application software files to determine whether or not they have been tampered with or corrupted documents, photos, videos, and files in a secure manner. Organizations adopt these technologies to help employees avoid using consumer-based file-sharing applications and software to store, access, and manage to ensure data security.

Key Highlights

- For instance, enterprises' workstation dominantly uses Windows, Mac OS, and Linux OS. In contrast, their employees utilize mobile devices like tablets and smartphones, with Android and iOS as the dominant operating systems. Due to the widespread adoption of cloud services and an increasing number of active directory users, admins find it difficult to manage privileges and rights granted to the people inside the organization. This has led to an increased vulnerability, which could be disastrous for the organization.

- File integrity monitoring eases the admin process and has been a critical tool in combating cyber threats organizations have recently faced. File integrity monitoring solution monitors the activity of the shared files and is also responsible for timely alerting the admin to minimize the threats.

- The key issue that the file integrity monitoring market resolves is privilege abuses. Privilege abuse is when the policies of the user within the network are not updated, due to which the user's credentials are used to access the files and then make changes to them.

- The landscape of file monitoring and integrity management solution has been changing rapidly. Earlier, the systems admin used to manually grant access and check for vulnerabilities. Still, as the number of events increased, it became impossible for the admins to identify the treats. This gave rise to Netwrix, Lepide, and Dell solutions, which offered standalone solutions for the market. However, these solutions limited the number of users and managed many events.

- The antivirus providers, like Kaspersky and McAfee, realized the importance of this additional layer of security and integrated the solution into their antivirus solutions. However, companies like IBM and SolarWinds have solutions that meet large enterprises' requirements and have advanced methodologies to identify false positives to declutter the notifications sent to the admins.

- During the outbreak of COVID-19, cyber threats were on the rise in numerous countries. For instance, the Australian Cyber Security Centre (ACSC) announced protecting itself from cyberattacks amid the pandemic. Various countries further enhanced their efforts to increase file integrity monitoring systems.

- Cybersecurity became a top priority during the global COVID-19 pandemic. There was an increasing dependence on digital technologies to keep the file integrity monitoring process running. Moreover, according to the US Bureau of Labor Statistics (BLS), from 2022 to 2032, information security analyst employment is expected to grow by 32%, substantially faster than the average for all occupations.

File Integrity Monitoring Market Trends

BFSI Industry is Expected to Witness The Highest Growth

- The BFSI sector is one of the critical infrastructure segments that suffer several data breaches and cyberattacks, owing to the large customer base that the industry serves and the financial information that is at stake. Financial service institutions have been identified to be four times more susceptible to cyberattacks when compared to other industries, which is expected to drive the demand for such solutions.

- Moreover, active directory-based hacking on banking institutions has become the most prevalent recently, according to security provider Bit defender. Also, the need for file integrity monitoring is further emphasized by different warnings sent out by security agencies.

- The security agencies have identified ransomware, like lockerGoga ransomware, and hacking groups, like APT15 - aka K3chang, Mirage, Vixen Panda, GREF, and Playful Dragon, have been most prevalent in attacking the active directory of the BFSI institutions.

- Furthermore, Data breaches lead to an exponential rise in costs and the loss of valuable customer information. For instance, in June 2023, EpiSource LLC notified the Attorney General of California of the data breach after identifying that unauthorized access to sensitive customer data had occurred due to suspicious activity in the company's Amazon Web Services environment. Additionally, in May 2023, the Federal Trade Commission announced that Amazon would pay two distinct fines for privacy violations: USD 25 million for allegedly failing to delete children's data and USD 5.8 million for limiting access to Ring security videos for employees and contractors.

- To secure their IT processes and systems, secure critical customer data, and comply with government regulations, private and public banking institutes focus on implementing the latest technology to prevent cyber attacks. Additionally, with greater customer expectations, increasing technological capabilities, and regulatory requirements, banking institutions are pushed to adopt a proactive approach to security.

Asia-Pacific to Witness Fastest Growth

- Asia-Pacific is estimated to present lucrative opportunities for the market shortly. Factors such as the increased need for security in growing industries, the need to protect high-value targets in organizations, and regulatory compliance are driving the adoption of file integrity monitoring solutions in the region.

- Small and medium-sized businesses are transforming into a hybrid cloud environment in Asia-Pacific from the legacy on-premise environment. Numerous factors have triggered this, as the hybrid cloud environment provides scalability and security concerns.

- Asia-Pacific countries are being used as launchpads for cyber attacks, either as vulnerable hotbeds of unsecured infrastructures where numerous computers can be infected easily for large-scale attacks or as centers for a single point of attack to gain access to the hubs' global connections. So the demand for file integrity monitoring systems is rising in this region.

- China's controversial Cyber Security Law (CSL) is aimed at protecting China's networks and private user information with a new law. It includes power and utility providers, transportation services, and financial institutions, including any foreign company that is a key supplier to a 'critical' sector or holds significant amounts of information on Chinese citizens, increasing the market demand in this country.

File Integrity Monitoring Industry Overview

The file integrity monitoring market is fragmented as the vast majority of the global players functioning in the market are taking steps to raise their market footprint by concentrating on product diversification and development. Some of the key players in the market are AT&T, McAfee LLC, Qualys Inc., AlienVault Inc., and Cimcor Inc., among others.

In August 2023, LogRhythm, a global IT security company, and Cimcor, a United States-based security, integrity, and compliance software solutions provider, announced a partnership to develop innovative security and integrity software solutions. Combining Cimcor's file integrity monitoring (FIM) solution, CimTrak, with LogRhythm's comprehensive security information and event management (SIEM) platform, the two companies work together to help organizations all over the world increase visibility and protect against modern cyberattacks.

In February 2023, Qualys, a provider of IT security and compliance platforms, released its GovCloud platform, which it states meets the stringent cybersecurity assurance requirements of FedRAMP at the high impact level. Federal agencies can use Qualys' GovCloud platform to develop and implement cybersecurity programs. One of GovCloud's features includes File Integrity Monitoring, which notifies end users about unauthorized changes to software, firmware, and information in compliance with NIST SI-7 requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the File Integrity Monitoring Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Threats to Data Security

- 5.2.2 Increasing Need to Control Organization Data and Spot Human Errors

- 5.2.3 Vulnerabilities in AD Infrastructure of Microsoft OS

- 5.3 Market Restraints

- 5.3.1 Financial Constraints and High Innovation Costs

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium Enterprises

- 6.1.2 Large Enterprises

- 6.2 By Deployment Type

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By Installation Mode

- 6.3.1 Agent-Based

- 6.3.2 Cloud

- 6.4 By End-user Industry

- 6.4.1 Retail

- 6.4.2 BFSI

- 6.4.3 Hospitality

- 6.4.4 Healthcare

- 6.4.5 Government

- 6.4.6 Entertainment

- 6.4.7 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 McAfee, LLC

- 7.1.2 AlienVault, Inc.

- 7.1.3 Cimcor, Inc.

- 7.1.4 Qualys, Inc.

- 7.1.5 AT&T

- 7.1.6 SolarWinds Worldwide, LLC

- 7.1.7 LogRhythm, Inc.

- 7.1.8 New Net Technologies LLC

- 7.1.9 Trend Micro Inc.

- 7.1.10 TrustWave Holdings, Inc.

- 7.1.11 Ionx Solutions LLP

- 7.1.12 Splunk Technology

- 7.1.13 Software Diversified Services

- 7.1.14 IBM Corporation

- 7.1.15 Securonix Inc.