|

市场调查报告书

商品编码

1684716

下一代运算市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Next Generation Computing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

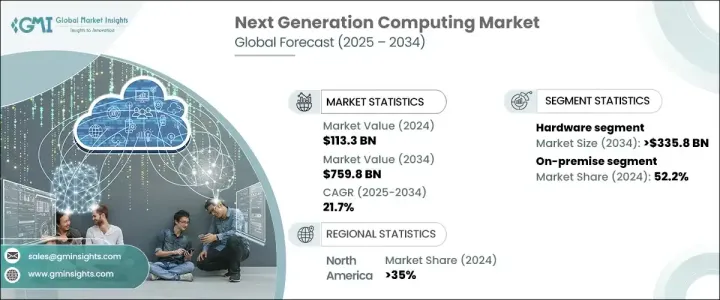

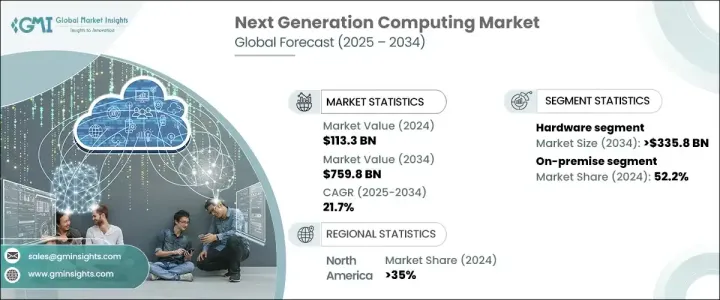

2024 年全球新一代运算市场规模将达到 1,133 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 21.7%,这得益于对能够解决跨行业复杂计算挑战的高效能运算解决方案的需求不断增长。多个行业的组织都在积极投资尖端运算解决方案,以提高营运效率、优化决策并保持竞争优势。随着人工智慧 (AI)、机器学习 (ML) 和巨量资料分析的不断发展,企业寻求提供卓越速度、效率和可扩展性的运算技术。处理海量资料集、运行复杂模拟和支援即时分析的需求也推动了下一代运算的需求,推动企业采用简化工作流程和提高生产力的先进解决方案。

对云端运算、边缘运算和量子运算的日益依赖正在彻底改变医疗保健、金融、製造业和国防等各行各业。企业正在利用下一代运算来驱动自主系统、优化供应链营运并增强网路安全框架。人工智慧驱动的应用程式和高频交易平台的快速普及进一步增加了对高速运算基础设施的需求。政府机构和研究机构也对量子运算和百亿亿次系统进行了大量投资,加速了重新定义运算能力的技术突破。随着运算架构的不断进步,企业越来越优先考虑整合AI加速、超快速处理和安全运算环境的解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1133亿美元 |

| 预测值 | 7598亿美元 |

| 复合年增长率 | 21.7% |

按组件划分,市场分为硬体、软体和服务,其中硬体占据主导地位,到 2024 年占 40%。受对 AI 专用处理器、高效能 GPU 和高阶记忆体组件的需求不断增长的推动,预计到 2034 年该细分市场的规模将达到 3,358 亿美元。各组织正在投资专用硬件,以支援对人工智慧推理、深度学习模型和量子计算应用日益增长的需求。高速处理器和新一代 GPU 在优化运算效能、确保无缝可扩展性以及为资料密集型工作负载提供无与伦比的处理能力方面发挥着至关重要的作用。晶片架构的演变,加上半导体技术的突破,正在推动下一代运算硬体解决方案的扩展。

市场还根据部署分为本地部署和云端,其中本地部署解决方案在 2024 年占据 52.2% 的市场份额。处理敏感资料和专有技术的企业优先考虑内部运算基础设施,以实现更高的安全性、法规遵循和营运控制。银行、医疗保健和国防等行业继续青睐内部部署,以维护资料主权并最大限度地降低网路风险。管理关键任务工作负载的组织需要根据其安全策略量身定制的运算环境,这进一步推动了对内部部署解决方案的需求。随着网路安全威胁的不断发展,企业正在将人工智慧驱动的安全框架整合到其运算基础设施中,以增强弹性并防止资料外洩。

2024 年,美国占了 35% 的市场份额,并在人工智慧、云端运算和半导体生产方面进行了大量投资,引领下一代运算领域。该国完善的研究生态系统,加上技术驱动的企业和先进的基础设施,加速了先进计算技术的采用。人工智慧模型、量子研究计画和下一代资料中心的快速部署巩固了美国在高效能运算领域的全球领先地位。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 解决方案提供者

- 服务提供者

- 技术提供者

- 整合商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 高效能运算的需求不断增长

- 人工智慧和机器学习的进步

- 资料产生量不断增加,处理速度越来越快

- 产业陷阱与挑战

- 实施成本高

- 可扩展性挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 软体

- 服务

第六章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 云

- 本地

第七章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第 8 章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 量子计算

- 高效能运算

- 近似和机率计算

- 能源效率计算

- 热力学计算

- 基于记忆体的计算

- 光学运算

- 其他的

第 9 章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 金融保险业协会

- 卫生保健

- 资讯科技和电信

- 运输与物流

- 能源与公用事业

- 教育

- 製造业

- 政府

- 其他的

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Alibaba

- Atos

- Cambridge

- Cisco

- Dell

- D-Wave Systems

- Fujitsu

- Hewlett Packard Enterprise (HPE)

- Honeywell International

- IBM

- Intel

- IonQ

- Microsoft

- NVIDIA

- PsiQuantum

- Rigetti Computing

- Samsung

- TSMC

- Xanadu Quantum

The Global Next Generation Computing Market reached USD 113.3 billion in 2024 and is estimated to grow at a CAGR of 21.7% from 2025 to 2034, fueled by the rising demand for high-performance computing solutions that can tackle complex computational challenges across industries. Organizations across multiple sectors are actively investing in cutting-edge computing solutions to drive operational efficiency, optimize decision-making, and maintain a competitive edge. As artificial intelligence (AI), machine learning (ML), and big data analytics continue to evolve, businesses seek computing technologies that deliver superior speed, efficiency, and scalability. The demand for next-generation computing is also driven by the need to process massive datasets, run intricate simulations, and support real-time analytics, pushing enterprises to adopt advanced solutions that streamline workflows and enhance productivity.

The growing reliance on cloud computing, edge computing, and quantum computing is revolutionizing industries, from healthcare and finance to manufacturing and defense. Enterprises are harnessing next-gen computing to power autonomous systems, optimize supply chain operations, and enhance cybersecurity frameworks. The rapid proliferation of AI-driven applications and high-frequency trading platforms further amplifies the need for high-speed computing infrastructures. Government agencies and research institutions are also making significant investments in quantum computing and exascale systems, accelerating technological breakthroughs that redefine computational capabilities. With continuous advancements in computing architectures, businesses are increasingly prioritizing solutions that integrate AI acceleration, ultra-fast processing, and secure computing environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $113.3 Billion |

| Forecast Value | $759.8 Billion |

| CAGR | 21.7% |

By component, the market is segmented into hardware, software, and services, with hardware dominating at a 40% share in 2024. This segment is expected to reach USD 335.8 billion by 2034, driven by the increasing need for AI-specific processors, high-performance GPUs, and advanced memory components. Organizations are investing in specialized hardware to support the growing demand for AI inference, deep learning models, and quantum computing applications. High-speed processors and next-gen GPUs play a crucial role in optimizing computing performance, ensuring seamless scalability, and delivering unmatched processing power for data-intensive workloads. The evolution of chip architectures, coupled with breakthroughs in semiconductor technology, is propelling the expansion of next-gen computing hardware solutions.

The market is also classified by deployment into on-premise and cloud, with on-premise solutions holding a 52.2% market share in 2024. Enterprises handling sensitive data and proprietary technologies prioritize in-house computing infrastructure for greater security, regulatory compliance, and operational control. Industries such as banking, healthcare, and defense continue to favor on-premise deployments to maintain data sovereignty and minimize cyber risks. Organizations managing mission-critical workloads require customized computing environments tailored to their security policies, further driving demand for on-premise solutions. As cybersecurity threats evolve, businesses are integrating AI-powered security frameworks into their computing infrastructures to enhance resilience and prevent data breaches.

The United States accounted for a dominant 35% market share in 2024, leading the next-generation computing sector with substantial investments in AI, cloud computing, and semiconductor production. The country's well-established research ecosystem, combined with tech-driven enterprises and cutting-edge infrastructure, accelerates the adoption of advanced computing technologies. The rapid deployment of AI models, quantum research initiatives, and next-gen data centers reinforces the US's position as a global leader in high-performance computing.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution provider

- 3.1.2 Services provider

- 3.1.3 Technology provider

- 3.1.4 Integrators

- 3.1.5 End user

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing demand for high-performance computing

- 3.7.1.2 Advancements in AI and machine learning

- 3.7.1.3 Increasing data generation and the need for faster processing

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High costs of implementation

- 3.7.2.2 Scalability challenges

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premise

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Quantum computing

- 8.3 HPC

- 8.4 Approximate and probabilistic computing

- 8.5 Energy efficiency computing

- 8.6 Thermodynamic computing

- 8.7 Memory based computing

- 8.8 Optical computing

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Healthcare

- 9.4 IT & telecom

- 9.5 Transportation & logistics

- 9.6 Energy & utility

- 9.7 Education

- 9.8 Manufacturing

- 9.9 Government

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Alibaba

- 11.2 Atos

- 11.3 Cambridge

- 11.4 Cisco

- 11.5 Dell

- 11.6 D-Wave Systems

- 11.7 Fujitsu

- 11.8 Google

- 11.9 Hewlett Packard Enterprise (HPE)

- 11.10 Honeywell International

- 11.11 IBM

- 11.12 Intel

- 11.13 IonQ

- 11.14 Microsoft

- 11.15 NVIDIA

- 11.16 PsiQuantum

- 11.17 Rigetti Computing

- 11.18 Samsung

- 11.19 TSMC

- 11.20 Xanadu Quantum