|

市场调查报告书

商品编码

1408396

下一代计算:市场占有率分析、行业趋势/统计、2024 年至 2029 年成长预测Next-generation Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

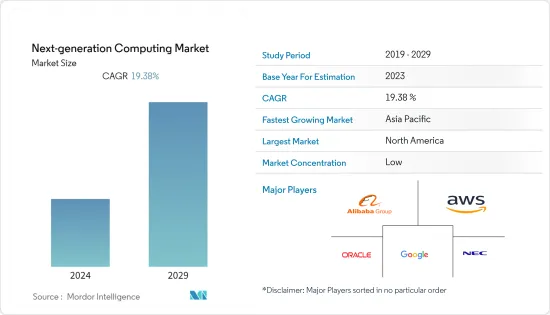

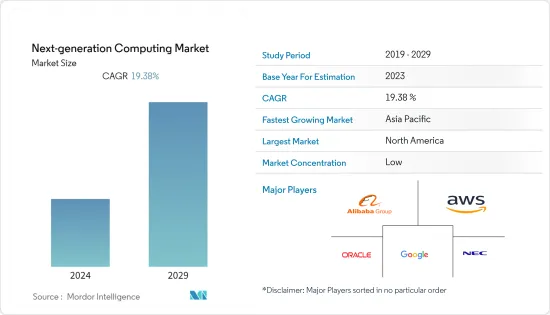

本财年全球下一代运算市场规模预估为1,605.1亿美元,预测期内复合年增长率为19.38%,预计五年内将达到4,174亿美元。

透过部署下一代运算解决方案,最终用户可以享受更短的产品开发週期、弹性、流程效率、更高的生产力、更高的品质、更直观的客户体验以及更高的盈利。我们已经实现了这些目标,并正在推动市场普及世界。

主要亮点

- 下一代运算市场由分散式运算、机器学习、人工智慧和云端运算等新技术的出现推动,这些技术透过集中储存、记忆体、处理和频宽。各种最终用途。

- 高效能运算的需求正在不断增加,对于组织来说变得至关重要,因为它可以快速有效地计算和分析大量资料。高效能运算应用对下一代运算解决方案的需求正在推动市场发展。

- 此外,中小型企业也透过改进供应链管理、提高生产力和简化业务从数位转型中受益。中小企业正在利用云端运算、人工智慧和区块链来实现流程自动化并降低成本,这将在预测期内推动市场发展。例如,2022年12月,数位转型解决方案供应商UST宣布与英特尔和SAP合作,为马来西亚北部的中小企业开启工业4.0数位转型之旅,工业4.0的下一代运算解决方案为市场供应商创造了机会。

- 然而,下一代解决方案和计算技术涉及共用本地设备、行动设备、云端基础的伺服器等之间共享的资料,这使得最终用户在将解决方案实施到其业务流程中时很难使用资料。在预测期内,可能会出现隐私风险,并限制许多最终用户(例如国防、BFSI 等)的市场采用。

- COVID-19 的爆发推迟了製造半导体晶片所需原材料的供应链,从而减缓了市场增长,而半导体晶片对于下一代计算解决方案的 SOC 和其他硬体组件的开发至关重要。我做到了。此外,在 COVID-19 大流行之后,对云端运算的需求增加,透过可提高最终用户运算能力的应用程式支援下一代运算解决方案的成长。

下一代运算市场趋势

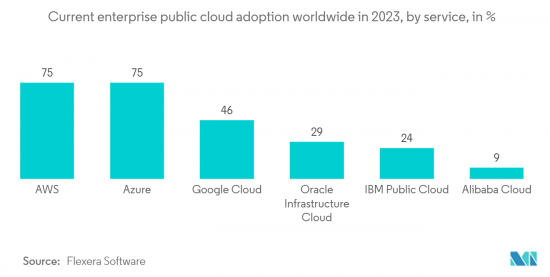

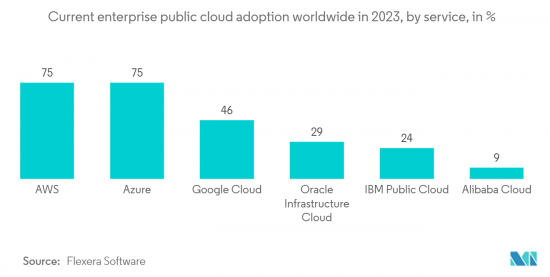

解决方案的云端部署极大地促进了市场成长

- 采用云端基础的运算解决方案在世界各地的大型和小型企业中越来越受欢迎,因为它具有节省成本、安全性、弹性、移动性、增强协作、轻鬆灾害復原和损失预防以及自动软体更新等优点。正在获得包括大型企业在内的所有最终用户的认可,并正在加速市场上采用下一代云端基础的运算解决方案。

- 在政府对 ICT 基础设施投资的支持下,已开发经济体和新兴经济体的公司正在采用云端基础的软体,从而推动预测期内云端基础的下一代运算解决方案市场的成长。我支持你。例如,2022年11月,亚马逊网路服务与杜拜数位经济商会合作开发超大规模云端运算解决方案,包括可扩展的云端储存、服务和运算能力,并发布了一份报告,表示预计将带来经济效益2022年至2030年间,为阿联酋的中小企业和新兴企业提供价值171亿美元的资金。

- 微软、亚马逊、IBM 和谷歌等供应商正在大力投资量子计算机,并合作为云端基础的量子电脑提供 SaaS 模型。这些都是按计量收费的模式,正在推动支援云端的下一代运算解决方案的市场。

- 例如,2023年3月,HCL Technologies与微软量子云端处理服务Azure Quantum合作,为使用微软平台作为其技术堆迭的企业提供云端基础的量子运算服务。 HCLTech 的 Q-Labs 是 Microsoft 提供 Azure 量子积分的合作伙伴之一。

- 此外,透过与量子运算领域的其他组织合作,云端基础的量子运算供应商一直在建议有效利用量子运算的需求,并协助企业实施云端基础的服务,我做到了。例如,IBM开发了IBM的Q Network。它是先进量子运算领域合作并探索其潜在应用的组织的全球合作伙伴关係,支持市场采用下一代云端基础的运算。

亚太地区市场成长率最高

- 亚太地区是许多采用数位化解决方案的新兴经济体的所在地,包括印度、中国、日本和韩国。由于需要基于 AI/ML 的运算来提高企业生产力,医疗保健、汽车/运输、BFSI、IT/通讯等各种最终用户的数位化正在推动下一代运算解决方案供应商的市场。供应商的机会。

- 例如,2023年6月,领先的企业级人工智慧(AI)软体公司Beyond Limits宣布将打造量子计算机,以推动亚太地区量子人工智慧技术的进步,并签署了一份合作协议。与IQM 量子计算机签署的谅解备忘录显示了该地区对量子运算的需求,并将在预测期内推动亚太地区的市场。

- 包括亚太地区医院在内的小型和大型企业采用线上服务会产生大量业务资料,因此需要下一代运算解决方案,使企业能够从这些资料中获得业务洞察,从而满足需求。例如,2022 年 11 月,印度马尼帕尔医院集团 (Manipal Hospitals Group) 与 Google Cloud 合作,改善连锁医院的病患照护体验和网路效率。透过 Google Cloud 基于对话式 AI 的解决方案提供始终在线的患者照护,增强客户互动。

- 此外,新加坡、马来西亚和印尼正在建造许多大型资料中心,以支援亚太地区大型工业企业下一代运算的发展。

- 例如,2023年7月,拥有TikTok的Equinix、GDS、微软、AirTrunk和位元组跳动组成的联盟被新加坡经济发展局和通讯媒体发展局选中,营运位于新加坡的80MW资料中心。

下一代运算产业概述

全球新一代运算市场由阿里巴巴集团控股有限公司、亚马逊网路服务公司、Oracle公司和谷歌公司主导,高度分散,由许多全球公司(例如NEC公司)占据整体市场份额。下一代运算市场的供应商将越来越注重透过产品创新、联盟和研发投资来提供增强的解决方案,以提高他们在预测期内的市场占有率。我是。

2023 年 6 月,Google Llc 与 T-Mobile 合作增强 5G 和边缘运算能力,协助企业扩大数位转型。在此次合作之后,T-Mobile 将其公共、私有和混合5G 网路的 5G ANS 套件与 Google Distributed Cloud Edge (GDC Edge) 连接起来,使客户能够利用 AR/VR 体验等下一代 5G 应用。马苏。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对高效能运算的需求不断增长

- 在中小型企业采用进阶分析

- 市场抑制因素

- 下一代计算大规模资料储存和处理中的资料外洩风险

- 实施解决方案面临巨大的营运挑战

第六章市场区隔

- 按成分

- 硬体

- 软体

- 按服务

- 依计算类型

- 高效能运算

- 量子计算

- 光计算

- 边缘运算

- 其他计算类型

- 按配置

- 云

- 本地

- 按最终用户

- 汽车与运输

- 能源/公用事业

- 卫生保健

- BFSI

- 航太/国防

- 媒体与娱乐

- 资讯科技与电信

- 零售

- 製造业

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Alibaba Group Holding Limited

- Amazon Web Services, Inc

- Oracle Corporation

- Google LLC

- NEC Corporation

- Cisco Systems

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- NVIDIA Corp

- *List not exhaustive

第八章投资分析

第九章 市场机会及未来趋势

Global Next-generation Computing Market is valued at USD 160.51 billion in the current year and is expected to register a CAGR of 19.38% during the forecast period, reaching USD 417.40 billion in five years. Implementing Next-generation computing solutions gives end users a shorter lead time in product development, flexibility, process efficiencies, enhanced productivity, higher quality, more intuitive customer experiences, and improved profitability, fueling market adoption worldwide.

Key Highlights

- Next-generation computing market is evolving from the emergence of new technologies such as Distributed computing, Machine learning, Artificial intelligence, and Cloud computing for efficient computing by using centralizing storage, memory, processing, and bandwidth, driving the market in various end-user applications.

- The demand for High-performance computing is increasing and becoming crucial for organizations as it enables them to compute and analyze large volumes of data quickly and efficiently, which is significantly essential in scientific research, engineering, and finance, where the ability to process large amounts of data to give insights for better operational efficiencies and customer services. The need for next-gen computing solutions for High-performance computing applications drives the market.

- Additionally, with better supply chain management, increased productivity, and streamlined operations, SMEs have benefited from digital transformation. SMEs have been automating their processes and reducing costs using cloud computing, AI, and blockchain, which would drive the market during the forecast period. For instance, in December 2022, UST, a digital transformation solutions provider, announced a collaboration with Intel and SAP to enable the Industry 4.0 digital transformation journey for small and medium-sized enterprises in northern Malaysia, creating an opportunity for the market vendors due to their next-gen computing solutions for Industry 4.0.

- However, the next-gen solutions and computing technology involve processing & data shared between local devices, mobile devices, cloud-based servers, etc., which generates a threat of data privacy risk in the end users while implementing the solutions for their business processes, which could restrict the market adoption in many end-users, such as defense, BFSIs, etc. during the forecast period.

- The COVID-19 pandemic reduced the market growth by delaying the supply chain of raw materials for the manufacturing of semiconductor chips, which are essential for developing SOCs and other hardware components of next-generation computing solutions. In addition, after the COVID-19 pandemic, as the demand for cloud computing increased, it supported the growth of Next-generation computing solutions due to its applications enabling end users to enhance their computational capabilities.

Next-generation Computing Market Trends

The Cloud Deployment of The Solutions Significantly Contributes to The Market Growth

- The adoption of cloud-based computing solutions is gaining traction in all end-users, including large and small-scale enterprises worldwide, due to its benefits such as Cost Savings, Security, Flexibility, Mobility, Increased Collaboration, Easy Disaster Recovery & Loss Prevention, Automatic Software Updates, etc., which is fueling the adoption of cloud-based next-generation computing solutions in the market.

- The enterprises in developed and developing economies, with the help of their countries' government investment in ICT infrastructure, are adopting cloud-based software, supporting the growth of the cloud-based next-generation computing solution market during the forecast period. For instance, in November 2022, Amazon Web Services, in partnership with the Dubai Chamber of Digital Economy, published a report stating that hyper-scale cloud computing solutions, which include scalable cloud storage, services, and computing capabilities, are expected to provide SMEs and startups in the UAE with USD 17.1 billion worth of economic benefits from 2022 and 2030.

- Market vendors such as Microsoft, Amazon, IBM, and Google have been investing significantly in quantum computing and partnering to offer SaaS models to their cloud-based quantum computers, enabling the technology to be accessible to mainstream enterprises, which can be shared among many companies. They can be used as a Pay-as-Use model, driving the Cloud-enabled next-generation computing solutions market.

- For instance, in March 2023, HCL Technologies partnered with Microsoft's quantum cloud computing service, Azure Quantum, to offer businesses cloud-based quantum computing services to clients using Microsoft's platform as the technology stack. The benefits would be provided through HCLTech's Q-Labs, which has already been among one of Microsoft's partners to offer Azure Quantum credits.

- Additionally, cloud-based quantum computing providers have been helping in advising the need to use quantum computing effectively and supporting the enterprise's adoption of cloud-based services through collaboration with other organizations in the field of quantum computing. For instance, IBM has developed IBM's Q Network, a global partnership of organizations working together in advanced quantum computing and exploring its potential applications, supporting the adoption of cloud-based next-generation computing in the market.

The Asia-pacific Region is Registering The Highest Market Growth

- The Asia-Pacific region has many emerging economies, including India, China, Japan, South Korea, etc., adopting digitalization solutions in their countries. The digitalization in various end users, such as Healthcare, Automotive & Transportation, BFSIs, IT & Telecom, etc., in the countries are creating an opportunity for the market vendors of next-generation computing solution providers due to the need for AI & ML based Computing in increasing the productivity of the enterprises.

- For instance, in June 2023, Beyond Limits, a leading enterprise-grade artificial intelligence (AI) software company, signed a Memorandum of Understanding with IQM Quantum Computers, a company in building quantum computers, to drive the advancement of quantum AI technology in the Asia-pacific region, which shows the demand for quantum Computing in the area, fueling the market in APAC region during the forecast period.

- The adoption of online services in small and large-scale enterprises, including the hospitals in the APAC region, generates a significant amount of business data, which drives the requirement for Next-generation computing solutions to enable the enterprises to have business insights from those data. For instance, in November 2022, Manipal Hospitals Group of India partnered with Google Cloud to improve patient care experiences and the hospital chain's network efficiency. It would use Google Cloud's conversational AI-based solution to enhance customer interactions by offering all-time patient care.

- In addition, Singapore, Malaysia, and Indonesia have constructed many large data centers, which would support the growth of Next-generation computing in large-scale industrial enterprises within the APAC region because adopting these solutions, majorly the cloud-based next-generation computing solutions, would require Data centers to store the enterprise data for Computing.

- For instance, in July 2023, Equinix, GDS, Microsoft, and a consortium of AirTrunk and TikTok-owner ByteDance were selected to operate the Singapore-based 80 MW data center by the Singapore Economic Development Board and the Infocomm Media Development Authority, which would support the adoption of next-generation computing solutions in the APAC region.

Next-generation Computing Industry Overview

The Global Next-generation Computing Market is highly fragmented due to many global companies, such as Alibaba Group Holding Limited, Amazon Web Services Inc, Oracle Corporation, Google LLC, and NEC Corporation, contributing to the overall market share. Next-generation Computing Market vendors increasingly focus on delivering enhanced solutions through product innovations, collaborations, and investment in R&D to increase their market presence during the forecast period.

In June 2023, Google Llc partnered with T-Mobile to empower 5G and edge computing capabilities, enabling enterprises to increase their digital transformation. After this partnership, T-Mobile would connect the 5G ANS suite of public, private, and hybrid 5G networks with Google Distributed Cloud Edge (GDC Edge) to help customers have next-generation 5G applications such as AR/VR experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in demand for high performance computing

- 5.1.2 Adoption of Advanced Analytics in SMEs

- 5.2 Market Restraints

- 5.2.1 Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing

- 5.2.2 High operational challenges in Implementing the Solution

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Computing Type

- 6.2.1 High-Performance Computing

- 6.2.2 Quantum Computing

- 6.2.3 Optical Computing

- 6.2.4 Edge Computing

- 6.2.5 Other Computing Types

- 6.3 By Deployement

- 6.3.1 Cloud

- 6.3.2 On-Premise

- 6.4 By End-user

- 6.4.1 Automotive & Transportation

- 6.4.2 Energy & Utilities

- 6.4.3 Healthcare

- 6.4.4 BFSI

- 6.4.5 Aerospace & Defense

- 6.4.6 Media & Entertainment

- 6.4.7 IT & Telecom

- 6.4.8 Retail

- 6.4.9 Manufacturing

- 6.4.10 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alibaba Group Holding Limited

- 7.1.2 Amazon Web Services, Inc

- 7.1.3 Oracle Corporation

- 7.1.4 Google LLC

- 7.1.5 NEC Corporation

- 7.1.6 Cisco Systems

- 7.1.7 Intel Corporation

- 7.1.8 IBM Corporation

- 7.1.9 Microsoft Corporation

- 7.1.10 NVIDIA Corp

- 7.2 * List not exhaustive