|

市场调查报告书

商品编码

1684763

网路即服务 (NaaS) 市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Network as a Service (NaaS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

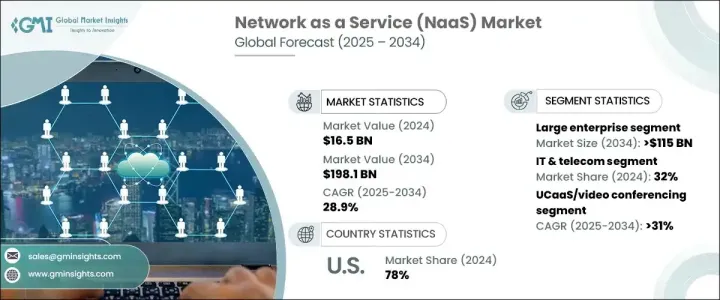

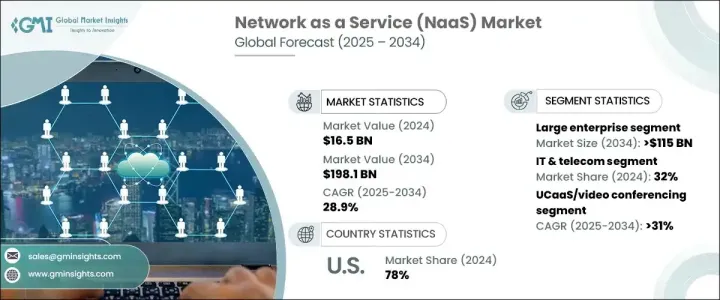

2024 年全球网路即服务市场价值为 165 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 28.9%。向分散式资料处理的转变日益加剧,推动了对灵活高效的网路解决方案的需求。随着企业越来越依赖即时资料处理,边缘运算的采用推动了对 NaaS 的需求,实现了无缝连接和最小延迟。医疗保健、製造业和物联网等行业需要更具适应性的网路基础设施来满足不断变化的技术需求。

随着企业寻求可扩展且经济高效的网路解决方案以增强跨本地、私有和公有云环境的连接性,向混合云端模式的快速转变进一步加速了市场的发展。无需大量前期投资即可扩展网路服务的能力是推动 NaaS 采用的主要因素。随着大型组织不断扩张,对强大的网路控制解决方案的需求也不断上升。不同产业的大型企业数量不断增加,尤其是在欧洲和北美,对提供效率和可扩展性的 NaaS 解决方案的需求庞大。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 165亿美元 |

| 预测值 | 1981亿美元 |

| 复合年增长率 | 28.9% |

企业正在转向 NaaS 来维护灵活且经济高效的网路基础设施,而无需在实体硬体上进行大量投资。随着组织在全球扩张,他们需要能够优化资源同时控製成本的适应性网路系统。企业越来越重视允许其有效扩展营运的网路解决方案,这使得 NaaS 成为业务成长策略的重要组成部分。 2024 年占据了相当大市场份额的 IT 和电信业处于 NaaS 采用的最前沿。随着电信公司利用 NaaS 来增强云端驱动世界中的服务交付,整个产业的快速数字转型正在创造新的机会。随着电信供应商寻求提供可扩展且灵活的网路服务,对高速连接、5G 和边缘运算的不断增长的需求进一步推动了市场的发展。 IT 服务的扩展也在市场成长中发挥至关重要的作用,企业需要自动化和整合的解决方案来提高效率并降低营运成本。

远端和混合式工作环境的兴起加速了对 WAN 即服务的需求,该服务在 2024 年引领市场,估值超过 600 亿美元。公司需要安全、灵活、高效的网路解决方案来管理分散式团队,而 WANaaS 提供了经济实惠的即用即付模式,无需大量资本投资。在保持全球营运无缝连接的同时虚拟创建和扩展网路的能力增加了 WANaaS 的吸引力,使其成为 NaaS 成长的主要驱动力。

统一通讯即服务 (UCaaS) 和视讯会议正受到广泛关注,预计预测期内该领域的复合年增长率将超过 31%。为了实现无缝远端交互,企业越来越依赖基于云端的通讯工具,这促使企业采用更可靠、更安全和可扩展的网路解决方案。随着企业寻求先进的网路功能来支援跨多个地点的协作,对不间断全球通讯的需求正在推动 NaaS 的扩张。

2024 年美国在全球 NaaS 市场占据主导地位,占有超过 78% 的市场。该国先进的技术基础设施、云端运算的快速应用以及各行业强大的数位转型倡议正在推动市场成长。 5G 和边缘运算的扩展以及连网设备数量的增加推动了对高速、低延迟网路解决方案的需求。随着美国企业继续整合这些技术,对提供速度、效能和可扩展性的 NaaS 解决方案的需求预计将大幅上升。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 服务提供者

- 云端服务供应商

- 技术提供者

- 最终用户

- 利润率分析

- 供应商概况

- 技术与创新格局

- 专利分析

- 使用案例

- 监管格局

- 衝击力

- 成长动力

- 对可扩展和灵活网路的需求不断增加

- 转向基于云端的基础设施和服务

- 各行各业日益采用数位转型

- 网路安全和资料隐私日益重要

- 产业陷阱与挑战

- 网路管理和整合的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按服务,2021 - 2034 年

- 主要趋势

- LAN 即服务

- WAN 即服务

- VPN 即服务

- 通讯即服务

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- UCaaS/视讯会议

- 虚拟私人网路

- 云端和 SaaS 连接

- 随选频宽

- 多分支机构连接

- WAN 优化

- 安全网关

- 网路存取控制

- 其他的

第 7 章:市场估计与预测:按组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 资讯科技和电信

- 金融保险业协会

- 製造业

- 政府和公共部门

- 卫生保健

- 零售

- 其他的

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aerohive

- Akamai

- ALE

- Amazon Web Services

- Aryaka

- AT&T

- AWS

- Brocade

- Ciena

- Cisco

- Citrix

- Cloudgenix

- Cradlepoint

- Extreme Networks

- IBM

- NEC

- Rackspace

- Talari

- Tata Communications

- Verizon

The Global Network As A Service Market was valued at USD 16.5 billion in 2024 and is projected to expand at a CAGR of 28.9% between 2025 and 2034. The growing shift toward decentralized data processing is driving demand for flexible and efficient networking solutions. As businesses increasingly rely on real-time data processing, the adoption of edge computing fuels the demand for NaaS, enabling seamless connectivity and minimal latency. Industries such as healthcare, manufacturing, and IoT require more adaptable network infrastructures to keep up with evolving technological needs.

The rapid move to hybrid cloud models is further accelerating the market as enterprises seek scalable and cost-effective network solutions that enhance connectivity across on-premises, private, and public cloud environments. The ability to scale network services without significant upfront investment is a major factor driving NaaS adoption. As large organizations continue expanding, the demand for robust network control solutions is rising. The increasing number of large enterprises across different industries, particularly in Europe and North America, has created a substantial need for NaaS solutions that provide efficiency and scalability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.5 billion |

| Forecast Value | $198.1 billion |

| CAGR | 28.9% |

Businesses are turning to NaaS to maintain flexible and cost-effective networking infrastructures without requiring heavy investments in physical hardware. As organizations expand globally, they need adaptable network systems that optimize resources while keeping costs under control. Enterprises are increasingly prioritizing network solutions that allow them to scale operations efficiently, making NaaS an essential component of business growth strategies. The IT and telecom industry, which accounted for a significant share of the market in 2024, is at the forefront of NaaS adoption. The rapid digital transformation across the industry is creating new opportunities as telecom companies leverage NaaS to enhance service delivery in a cloud-driven world. The growing demand for high-speed connectivity, 5G, and edge computing is further fueling the market as telecom providers seek to offer scalable and agile network services. The expansion of IT services is also playing a crucial role in market growth, with businesses requiring automated and integrated solutions to improve efficiency and reduce operational costs.

The rise of remote and hybrid work environments is accelerating demand for WAN as a service, which led the market in 2024 with a valuation exceeding USD 60 billion. Companies require secure, flexible, and efficient networking solutions to manage distributed teams, and WANaaS offers an affordable pay-as-you-go model that eliminates the need for significant capital investment. The ability to create and expand networks virtually while maintaining seamless connectivity across global operations is increasing the appeal of WANaaS, making it a key driver of NaaS growth.

Unified communications as a service (UCaaS) and video conferencing are seeing significant traction, with the segment projected to grow at a CAGR of over 31% during the forecast period. The increasing reliance on cloud-based communication tools to facilitate seamless remote interactions is pushing companies to adopt more reliable, secure, and scalable network solutions. The demand for uninterrupted global communication is fueling the expansion of NaaS as businesses seek advanced networking capabilities to support collaboration across multiple locations.

The United States dominated the global NaaS market in 2024, holding over 78% of the total market share. The country's advanced technological infrastructure, rapid adoption of cloud computing, and strong digital transformation initiatives across industries are propelling market growth. The expansion of 5G and edge computing, along with the increasing number of connected devices, is driving the need for high-speed, low-latency network solutions. As businesses in the US continue integrating these technologies, the demand for NaaS solutions that offer speed, performance, and scalability is expected to rise significantly.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Service provider

- 3.1.2 Cloud service provider

- 3.1.3 Technology providers

- 3.1.4 End users

- 3.2 Profit margin analysis

- 3.3 Supplier landscape

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for scalable and flexible networks

- 3.8.1.2 Shift to cloud-based infrastructure and services

- 3.8.1.3 Rising adoption of digital transformation across industries

- 3.8.1.4 Growing importance of cybersecurity and data privacy

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Complexity in network management and integration

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 LAN as a service

- 5.3 WAN as a service

- 5.4 VPN as a service

- 5.5 Communication as a service

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 UCaaS/video conferencing

- 6.3 Virtual private network

- 6.4 Cloud and SaaS connectivity

- 6.5 Bandwidth on Demand

- 6.6 Multi-branch connectivity

- 6.7 Wan optimization

- 6.8 Secure web gateway

- 6.9 Network access control

- 6.10 Others

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 IT & telecom

- 8.3 BFSI

- 8.4 Manufacturing

- 8.5 Government & public sector

- 8.6 Healthcare

- 8.7 Retail

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aerohive

- 10.2 Akamai

- 10.3 ALE

- 10.4 Amazon Web Services

- 10.5 Aryaka

- 10.6 AT&T

- 10.7 AWS

- 10.8 Brocade

- 10.9 Ciena

- 10.10 Cisco

- 10.11 Citrix

- 10.12 Cloudgenix

- 10.13 Cradlepoint

- 10.14 Extreme Networks

- 10.15 IBM

- 10.16 NEC

- 10.17 Rackspace

- 10.18 Talari

- 10.19 Tata Communications

- 10.20 Verizon