|

市场调查报告书

商品编码

1687828

网路即服务 (NaaS):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Network As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

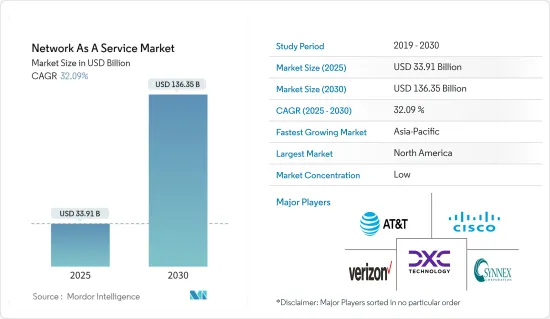

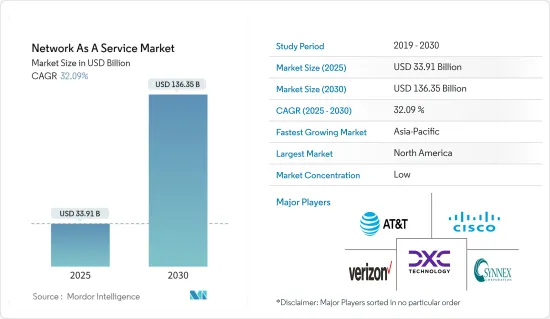

网路即服务 (NaaS) 市场规模预计在 2025 年为 339.1 亿美元,预计到 2030 年将达到 1363.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 32.09%。

网路即服务 (NaaS) 为组织和企业提供灵活性并提高其网路基础设施的效能。按需购买使企业能够注重成本,只需为所需的网路服务付费。网路即服务 (NaaS) 还可以帮助需要更灵活配置的组织,而无需重新建构其网路或重新发明轮子。

主要亮点

- 全球范围内新资料中心基础设施的广泛建设正在推动网路即服务 (NaaS) 市场的成长。推动这一扩展的关键驱动因素有几个,包括越来越多地使用云端运算进行资料储存、采用巨量资料分析以及中心内的虚拟以提高工作负载的移动性。这些进步为关键企业应用程式提供了更有效率的资源利用率、更高的可用性、更低的整体成本以及更高的可靠性和安全性。

- 此外,网路虚拟、云端处理和软体定义网路(SDN)中对基于订阅和按使用付费的经营模式的需求日益增长,正在显着影响市场的发展轨迹。云端服务的使用越来越多地满足大型企业和小型企业的需求,在塑造产业格局方面发挥着重要作用。

- NaaS 为企业提供了灵活性并提供了改善网路效能的机会。按需购买使企业能够精确支付其所需的网路服务费用,从而注重成本效益。 NaaS 也让需要更灵活配置的企业无需重新设计轮子或重新设计网路或合约。

- 虽然网路即服务 (NaaS) 提供了显着的优势,但重要的是要注意某些障碍和潜在的可靠性问题可能会在可预见的未来阻碍其成长。选择第三方网路基础设施提供者来託管您公司的关键基础设施需要信任您的供应商的长期稳定性。如果供应商无法保持竞争力,公司可能面临更换基本基础设施的挑战。

- 自新冠疫情爆发以来,由于企业采用远距工作模式,对云端基础的解决方案的需求显着增长,而零售、製造、BFSI等各个行业的收益都出现了大幅下滑。随着远距工作模式的扩展,企业正在加大对云端基础的分析和保证、边缘运算和人工智慧网路技术的投资,预计将推动 NaaS 市场的成长。

- 根据 Aruba 对 2,400 名 IT 决策者的调查,为应对疫情,38% 的 IT 领导者计划增加对云端基础的投资,35% 的 IT 领导者计划增加对基于 AI 的网路的投资,因为他们寻求为混合工作环境提供更灵活、更自动化的基础设施。随着企业适应后疫情环境,网路即服务的采用预计将在未来两年内加速 38%。

NaaS(网路即服务)市场的趋势

企业越来越多采用云端服务来推动市场

- 技术的广泛使用和客户对远端资料存取的偏好导致了对云端基础的解决方案的需求日益增长。随着企业意识到迁移到云端与维护内部部署基础架构相比可以节省成本和资源,大大小小的企业都在越来越多地采用这种技术。云端处理和虚拟预计在未来五年内降低软体安装成本和硬体使用率。

- 据泰雷兹集团称,去年超过 60% 的企业资料储存在云端,高于 30%。随着企业越来越多地采用云端处理,扩大了市场基础,这些趋势为该市场的製造商创造了更大的潜力。

- 例如,据印度 Druva 公司称,许多公司转向企业资料主要是因为非结构化资料量庞大。据该公司称,这种资料类型保存在企业储存系统中。此外,根据最新的思科全球指数,云端资料中心目前管理着 94% 的所有运算工作负载,而传统资料中心仅管理 6%。这个数字凸显了未来云端基础的客服中心在全球范围内部署的潜力。

- 银行和其他重要企业预计将迅速部署云端基础的服务。这是因为 IT 产业不断追求基础架构简化,以及解决方案开发人员透过从不同供应商采购应用程式和基础架构元件来建立混合云端解决方案的能力。这一趋势正在推动网路即服务 (NaaS) 市场向前发展。

- 根据 Pluralsight LLC 的预测,到 2023 年,94% 的组织将使用云端服务进行其技术计画。在一项对全球各行各业 1,000 多名领导者和技术专家进行的关于公司如何使用云端运算的调查中,70% 的公司表示,他们一半以上的基础设施在云端运行。此外,约有 49% 的企业正在积极将更多资料迁移到云端。这些资料显示新的云端服务正在迅速采用。

北美占据主要市场占有率

- 美国正在发展成为一个拥抱先进技术的经济体,这有助于推动网路自动化、云端基础的服务和网路即服务 (NaaS) 市场的扩张。未来五年内,IT 团队计划采用供应商提供的 NaaS 解决方案,这些供应商提供包括软体、云端智慧和自主管理内部硬体在内的混合解决方案。

- 作为技术采用的先锋,美国正经历行动装置的大规模成长,从而推动对增强型网路服务的需求。随着云端软体定义网路 (SDN) 和虚拟网路功能 (VNF) 等虚拟设定的成长,该地区的各种网路服务供应商(NSP) 正在实现按需基础架构。然而,为组织规划和获取网路连接需要时间和精力,这对寻求跟上数位趋势并以软体主导速度运作的企业来说是一个挑战。

- 随着新产品发布、收购、合併、合作伙伴关係和协作正在改变北美市场,加拿大 NaaS 市场也不断扩大。针对 IT 服务供应商的网路攻击明显增加,导致资料外洩。因此,加拿大网路安全中心发布了建议,帮助组织在选择网路服务供应商时更具选择性。

- 随着自动化和连网设备的不断部署,市场需求正在大幅成长。 NaaS 模式对小型企业尤其有利。这是因为我们可以将您设备的日常维护外包委託,让您专注于您的核心竞争力,例如客户服务。鑑于加拿大拥有大量小型企业,预计 NaaS 的采用将很快变得更加广泛。

网路即服务 (NaaS) 产业概览

网路即服务市场非常分散,有许多大大小小的参与者。占据主导市场占有率的主要企业正致力于扩大跨地域的基本客群。这些公司正在利用战略合作计划来提高其市场盈利和份额。市场的主要企业包括 AT&T 智慧财产权公司、Verizon 和思科系统公司。

- 2024 年 2 月,诺基亚与融合视讯、宽频和通讯公司 Liberty Worldwide 合作,使 Liberty Worldwide 的比利时子公司 Telenet 能够使用诺基亚的网路即代码平台为安特卫普港提供的服务提供支援。开发人员可以使用应用程式介面 (API) 和软体开发套件(SDK) 存取网路功能和资料,并透过诺基亚的 Network as Code 平台和开发人员入口网站存取。这使您能够根据使用案例建立新的应用程式。

- 2023 年 10 月,Lumen Technologies 宣布其网路即服务 (NaaS) 平台与 Equinix Fabric 整合。这将使客户能够立即购买、使用和管理 Lumen Internet On-Demand 和未来的 Lumen NaaS 服务。透过与 Equinix 合作,该公司将为企业提供快速、简单的网路购买体验,并让客户获得快速的频宽提升和个人化的随选服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 企业越来越多采用云端服务

- 软体定义网路 (SDN) 与现有网路基础架构的整合度不断提高

- 市场限制

- 隐私和资料安全问题

第六章 市场细分

- 按类型

- 区域网路服务

- 广域网路服务

- 按应用

- 云端基础的服务 (vCPE)

- 按需频宽(BoD)

- 整合网路和安全即服务

- 广域网路 (WAN)

- 虚拟私人网路 (VPN)

- 按行业

- 卫生保健

- BFSI

- 零售与电子商务

- 资讯科技和电讯

- 製造业

- 运输和物流

- 公共部门

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- AT&T Intellectual Property

- Verizon

- DXC Technology Company

- TD SYNNEX Corporation

- Cisco Systems Inc.

- NEC Corporation

- Hewlett Packard Enterprise Development LP

- IBM

- Oracle

- GTT Communications Inc.

- VMware Inc.

- Telstra Group Limited

- CenturyLink

- Meta Networks Ltd(Proofpoint)

- Masergy Communications Inc.

- Juniper Networks Inc.

- Nokia(Alcatel Lucent)

- Akamai Technologies

- Broadcom

第八章投资分析

第九章 市场机会与未来趋势

The Network As A Service Market size is estimated at USD 33.91 billion in 2025, and is expected to reach USD 136.35 billion by 2030, at a CAGR of 32.09% during the forecast period (2025-2030).

Network-as-a-Service (NaaS) offers organizations and companies greater flexibility and even performance gains in their network infrastructure. With on-demand purchasing, firms can be more cost-conscious and pay only for the necessary networking services. Network-as-a-Service (NaaS) can also enable organizations that need greater flexibility in provisioning without having to rearchitect networks or redo contracts from the ground up.

Key Highlights

- The broad construction of new data center infrastructures worldwide drives the growth of the Network-as-a-Service (NaaS) market. Several main drivers drive this expansion, including the increasing use of cloud computing for data storage, the incorporation of big data analytics, and virtualization within that center to improve workload mobility. These advancements have resulted in better resource utilization, higher availability, lower total costs, and increased reliability and security for critical corporate applications.

- Furthermore, the increasing need for subscription-based and pay-per-use business models in network virtualization, cloud computing, and software-defined networking (SDN) is significantly impacting the market trajectory. The growing use of cloud services, which cater to the demands of large and small organizations, plays a significant role in shaping the industry landscape.

- NaaS gives businesses more flexibility and the opportunity for improved network performance. Organizations can emphasize cost-effectiveness by paying for the precise networking services requested via on-demand purchases. NaaS also enables businesses that need more provisioning flexibility without redoing their network or contract.

- Network-as-a-Service (NaaS) offers significant advantages; it is important to acknowledge certain obstacles and potential reliability issues that could hinder its growth in the foreseeable future. Opting for a third-party network infrastructure provider to host critical corporate infrastructure requires faith in the supplier's long-term stability. Businesses may face the challenge of replacing essential infrastructure if the provider fails to remain competitive.

- Since the outbreak of the COVID-19 pandemic, the demand for cloud-based solutions has seen significant growth owing to remote working models being adopted by enterprises; however, various industries such as retail, manufacturing, and BFSI have seen a considerable revenue slump. With the growing remote working model, companies are increasing investments in cloud-based analytics and assurance, edge computing, and AI-powered networking technologies, which are expected to boost the NaaS market.

- According to a survey by Aruba of 2,400 IT decision-makers, in response to the pandemic, 38% of IT leaders plan to increase their investment in cloud-based networking and 35% in AI-based networking as they seek more agile, automated infrastructures for hybrid work environments. Network-as-a-Service's adoption is expected to accelerate by 38% within the next two years as businesses adapt to the post-pandemic environment.

Network as a Service Market Trends

Increased Adoption of Cloud Services among Enterprises to Drive the Market

- The growing use of technology and customer preference for remote data access drives the increased need for cloud-based solutions. Companies understand the cost and resource savings benefits of migrating to the cloud rather than maintaining on-premise infrastructure, leading to increased adoption among large corporations and SMEs. Cloud computing and virtualization are expected to lower software setup costs and hardware utilization during the next five years.

- According to Thales Group, more than 60% of corporate data was kept in the cloud last year, a massive increase from 30%. These trends create considerable potential prospects for manufacturers in this market, with the increasing adoption of cloud computing among organizations broadening the market's scope.

- For instance, according to Druva Inc., a company located in India, numerous companies focus on enterprise data mainly because of its substantial volume of unstructured data. According to the company, this data type is held in enterprise storage systems. Furthermore, according to the most recent Cisco Global Index, cloud data centers currently manage 94% of all computing workloads, while traditional data centers handle only 6%. This figure emphasizes the global potential for cloud-based contact center deployment in the future.

- Banking and other vital businesses are expected to embrace cloud-based service rollout rapidly. This is due to the IT industry's continued quest for simplified infrastructure and solution developers' ability to create hybrid cloud solutions by obtaining application and infrastructure components from different providers. This tendency is driving the Network-as-a-Service (NaaS) market forward.

- According to Pluralsight LLC, in 2023, 94% of organizations used cloud services for their technology initiatives. In a company survey of over 1,000 leaders and technologists across industries worldwide to find out how organizations leverage cloud computing, 70% of organizations report that more than half of their infrastructure exists in the cloud. Around 49% are actively moving more of their data to the cloud. Such data indicates a rapid adoption of new cloud services.

North America to Occupy Significant Market Share

- The United States has developed an economy that embraces advanced technology, propelling the expansion of network automation, cloud-based services, and the Network as-a-Service (NaaS) market. IT teams are set to adopt NaaS solutions from suppliers that offer hybrid solutions, including software, cloud intelligence, and the autonomy to manage on-premise hardware in the next five years.

- As a pioneer in technology adoption, the United States is experiencing a rise in demand for enhanced network services, driven by significant growth in mobile devices. With the growth of virtualized settings such as cloud software-defined networks (SDN) and virtual network functions (VNF), various network service providers (NSPs) in the region have enabled on-demand infrastructure. However, planning and acquiring network connectivity for organizations may take time and effort, posting difficulties for businesses attempting to stay up with digital trends and function at software-driven speeds.

- The Canadian NaaS market is expanding due to new product releases, acquisitions, mergers, partnerships, and collaborations transforming the North American market. There has been a noteworthy increase in cyberattacks on IT service providers, resulting in data breaches. As a result, the Canadian Center for Cybersecurity has issued recommendations to organizations, allowing them to be more selective when picking network service providers.

- Market demand is increasing significantly as automation and linked device deployment expand. The NaaS model is especially beneficial for small firms since it allows them to delegate day-to-day equipment upkeep and focus on their key capabilities, such as customer service. Given the prevalence of small enterprises in Canada, using NaaS is projected to grow considerably in popularity soon.

Network as a Service Industry Overview

The Network-as-a-Service market is fragmented due to the presence of several small and large players. The key players holding a prominent market share focus on expanding their customer base across regional boundaries. These companies leverage strategic collaborative initiatives to increase their market profitability and share. Some major players in the market are AT&T Intellectual Property, Verizon, and Cisco System Inc.

- February 2024: Nokia partnered with Liberty Global, a converged video, broadband, and communications company, in which Liberty Global's Belgian subsidiary Telenet utilizes Nokia's Network-as-a-Code platform to enhance the services offered at the Port of Antwerp. Developers can use application programming interfaces (APIs) and software development kits (SDKs) accessed via Nokia's Network as Code Platform with a developer portal to obtain network functionality and data. This will enable them to build new applications for use cases.

- October 2023: Lumen Technologies announced the integration of its Network-as-a-Service (NaaS) platform with Equinix Fabric, which will enable customers to instantly buy, use, and manage Lumen Internet On-Demand and future Lumen NaaS services. The company collaborates with Equinix to offer businesses a quick and easy network buying experience, providing customers access to quick bandwidth boosts and personalized on-demand services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Cloud Services among Enterprises

- 5.1.2 Augmentation in Software-defined Networking (SDN) Integration with Existing Network Infrastructure

- 5.2 Market Restraints

- 5.2.1 Privacy and Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LAN-as-a-Service

- 6.1.2 WAN-as-a-Service

- 6.2 By Application

- 6.2.1 Cloud-based Services (vCPE)

- 6.2.2 Bandwidth on Demand (BoD)

- 6.2.3 Integrated Network Security-as-a-Service

- 6.2.4 Wide Area Network (WAN)

- 6.2.5 Virtual Private Network (VPN)

- 6.3 By Industry Vertical

- 6.3.1 Healthcare

- 6.3.2 BFSI

- 6.3.3 Retail and E-commerce

- 6.3.4 IT and Telecom

- 6.3.5 Manufacturing

- 6.3.6 Transportation and Logistics

- 6.3.7 Public Sector

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Intellectual Property

- 7.1.2 Verizon

- 7.1.3 DXC Technology Company

- 7.1.4 TD SYNNEX Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 NEC Corporation

- 7.1.7 Hewlett Packard Enterprise Development LP

- 7.1.8 IBM

- 7.1.9 Oracle

- 7.1.10 GTT Communications Inc.

- 7.1.11 VMware Inc.

- 7.1.12 Telstra Group Limited

- 7.1.13 CenturyLink

- 7.1.14 Meta Networks Ltd (Proofpoint)

- 7.1.15 Masergy Communications Inc.

- 7.1.16 Juniper Networks Inc.

- 7.1.17 Nokia (Alcatel Lucent)

- 7.1.18 Akamai Technologies

- 7.1.19 Broadcom