|

市场调查报告书

商品编码

1684781

智慧标籤包装市场机会、成长动力、产业趋势分析与预测 2025-2034Smart Tag Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

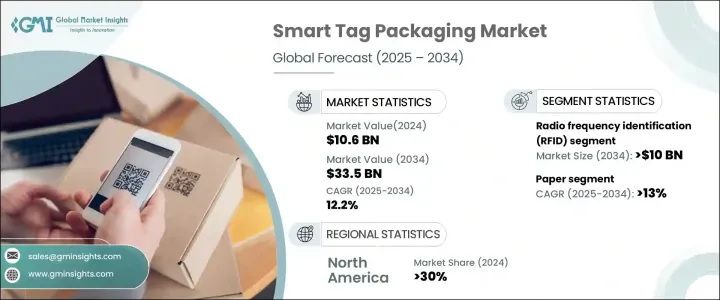

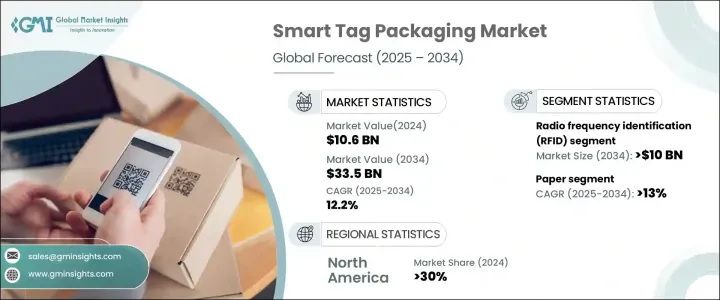

2024 年全球智慧标籤包装市场规模将达到 106 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 12.2%。这项快速扩张的推动因素包括消费者对永续性的需求不断增长、循环经济原则的日益普及以及数位追踪技术的进步。各行各业的企业都在利用智慧标籤技术来提高效率、优化供应链、提高透明度并最大限度地减少对环境的影响。随着公司努力实现更好的产品追踪和认证,将智慧标籤整合到包装中正在成为现代物流和库存管理的关键组成部分。对即时资料、减少浪费和增强安全性的需求正在加速采用,将智慧标籤包装定位为下一代供应链解决方案的关键推动因素。随着世界各地的监管框架强调可追溯性和减少浪费,企业正在转向智慧包装解决方案以保持合规性和竞争力。

根据技术,市场分为二维码和条码、近场通讯 (NFC)、低功耗蓝牙 (BLE) 标籤、无线射频识别 (RFID) 等。到 2034 年,RFID 市场预计将创收 100 亿美元,这得益于其促进即时产品追踪、简化库存管理和打击假冒的能力。与传统的条码系统不同,RFID 不需要直接扫描,从而提高了操作效率。该技术可以实现精确的位置追踪和自动资料收集,使其成为追求自动化和安全的行业的首选解决方案。由于 RFID 可以减少损失、提高工作流程准确性并加强防盗措施,零售、物流和医疗保健行业的应用日益广泛。随着企业专注于数位转型,对RFID在高阶资产追踪方面的依赖预计会增加,从而巩固其作为主导智慧标籤技术的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 106亿美元 |

| 预测值 | 335亿美元 |

| 复合年增长率 | 12.2% |

市场也按材料分类,包括纸张、塑胶、金属和复合材料。受永续和环保包装解决方案需求不断增长的推动,预测期内纸张产业预计将以 13% 的复合年增长率成长。随着全球对塑胶污染的担忧日益加剧,企业正积极寻求可生物降解的替代方案。针对一次性塑胶的规定正在加速向可回收材料的转变,使得纸质智慧标籤成为首选。智慧标籤整合到纸质包装中,既保持了功能性,又减少了对环境的影响,符合品牌和消费者的永续发展目标。

2024年北美智慧标籤包装市场占有30%的份额,其中美国引领区域成长。美国对智慧标籤包装的需求源自于增强供应链透明度、高效库存管理和先进防盗解决方案的需求。该地区强大的技术基础设施支援创新追踪系统的广泛采用,符合自动化和数位化的行业趋势。强调透明度和减少浪费的监管要求进一步推动了智慧标籤在零售、物流和医疗保健领域的整合。由于企业优先考虑客户满意度和预防损失,智慧标籤技术在转变营运效率方面发挥着至关重要的作用。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 永续发展和循环经济倡议

- RFID 和物联网的技术进步

- 消费者对透明度和产品认证的需求不断增长

- 零售和电子商务中智慧包装的采用率不断提高

- 政府对可追溯性的法规和业界标准

- 产业陷阱与挑战

- 智慧标籤生产成本高

- 相容性和整合问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 无线射频识别 (RFID)

- 近场通讯 (NFC)

- QR 码和条码

- 低功耗蓝牙 (BLE) 标籤

- 其他的

第 6 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 纸

- 塑胶

- 金属

- 复合材料

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 追踪和监控

- 身份验证和安全

- 防盗防损

- 环境监测

- 其他的

第 8 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 汽车

- 食品和饮料

- 医疗保健和製药

- 物流与供应链

- 零售和消费品

- 其他的

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amcor

- Checkpoint Systems

- Impinj

- International Paper

- Invengo Technology

- Multi-Color Corporation

- Schreiner Group

- Sealed Air

- Smart Label Solutions

- Stora Enso

- Tageos

- Zebra Technologies

The Global Smart Tag Packaging Market reached USD 10.6 billion in 2024 and is projected to expand at a CAGR of 12.2% from 2025 to 2034. This rapid expansion is fueled by increasing consumer demand for sustainability, the growing adoption of circular economy principles, and advancements in digital tracking technologies. Businesses across various industries are leveraging smart tag technologies to enhance efficiency, optimize supply chains, improve transparency, and minimize environmental impact. As companies strive for better product tracking and authentication, the integration of smart tags into packaging is becoming a critical component of modern logistics and inventory management. The demand for real-time data, reduced waste, and enhanced security is accelerating adoption, positioning smart tag packaging as a key enabler of next-generation supply chain solutions. With regulatory frameworks worldwide emphasizing traceability and waste reduction, organizations are turning to smart packaging solutions to stay compliant and competitive.

By technology, the market is segmented into QR codes and barcodes, near-field communication (NFC), Bluetooth Low Energy (BLE) tags, radio frequency identification (RFID), and others. The RFID segment is set to generate USD 10 billion by 2034, driven by its ability to facilitate real-time product tracking, streamline inventory management, and combat counterfeiting. Unlike traditional barcode systems, RFID does not require direct scanning, offering enhanced operational efficiency. The technology enables precise location tracking and automated data collection, making it a preferred solution for industries seeking automation and security. Retail, logistics, and healthcare sectors are witnessing increased adoption as RFID reduces losses, improves workflow accuracy, and strengthens anti-theft measures. As businesses focus on digital transformation, the reliance on RFID for advanced asset tracking is expected to rise, solidifying its role as the dominant smart tag technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $33.5 Billion |

| CAGR | 12.2% |

The market is also categorized by material, including paper, plastic, metal, and composite materials. The paper segment is poised to grow at a CAGR of 13% during the forecast period, fueled by the rising demand for sustainable and eco-friendly packaging solutions. With increasing global concerns over plastic pollution, businesses are actively seeking biodegradable alternatives. Regulations against single-use plastics are accelerating the shift toward recyclable materials, making paper-based smart tags a preferred choice. Smart tag integration into paper packaging maintains functionality while reducing environmental impact, aligning with the sustainability goals of brands and consumers alike.

The North American smart tag packaging market accounted for a 30% share in 2024, with the United States leading regional growth. The demand for smart tag packaging in the U.S. is driven by the need for enhanced supply chain transparency, efficient inventory management, and advanced anti-theft solutions. The region's strong technological infrastructure supports the widespread adoption of innovative tracking systems, aligning with industry trends in automation and digitalization. Regulatory requirements emphasizing transparency and waste reduction are further boosting the integration of smart tags across retail, logistics, and healthcare. With businesses prioritizing customer satisfaction and loss prevention, smart tag technologies are playing an essential role in transforming operational efficiencies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Sustainability and circular economy initiatives

- 3.4.1.2 Technological advancements in RFID and IoT

- 3.4.1.3 Rising consumer demand for transparency and product authentication

- 3.4.1.4 Increased adoption of smart packaging in retail and e-commerce

- 3.4.1.5 Government regulations and industry standards for traceability

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs of smart tags

- 3.4.2.2 Compatibility and integration issues

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Radio frequency identification (RFID)

- 5.3 Near field communication (NFC)

- 5.4 QR codes and barcodes

- 5.5 Bluetooth low energy (BLE) Tags

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Paper

- 6.3 Plastic

- 6.4 Metal

- 6.5 Composite materials

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Tracking & monitoring

- 7.3 Authentication & security

- 7.4 Anti-theft & loss prevention

- 7.5 Environmental monitoring

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Food & beverages

- 8.4 Healthcare & pharmaceuticals

- 8.5 Logistics & supply chain

- 8.6 Retail and consumer goods

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 Checkpoint Systems

- 10.3 Impinj

- 10.4 International Paper

- 10.5 Invengo Technology

- 10.6 Multi-Color Corporation

- 10.7 Schreiner Group

- 10.8 Sealed Air

- 10.9 Smart Label Solutions

- 10.10 Stora Enso

- 10.11 Tageos

- 10.12 Zebra Technologies