|

市场调查报告书

商品编码

1684793

高速资料转换器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测High-speed Data Converter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

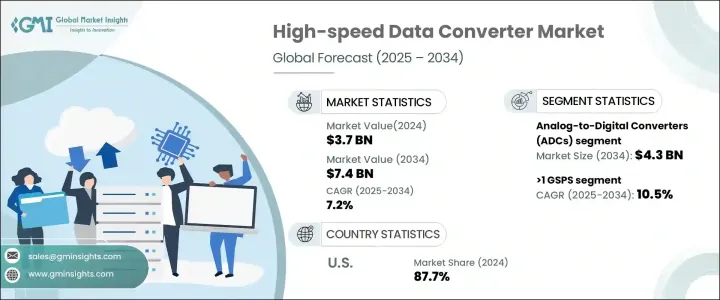

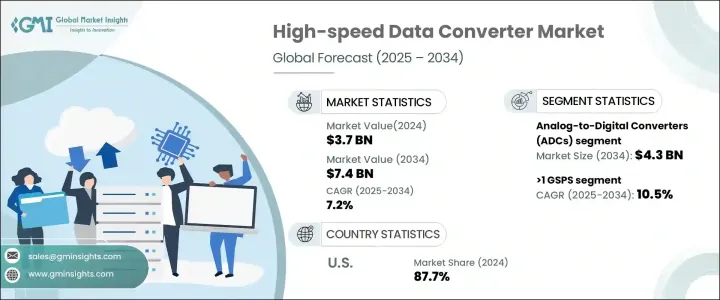

2024 年全球高速数据转换器市场价值为 37 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.2%。这一成长是由 5G 技术和下一代通讯网路的快速发展所推动的,这推动了对高速资料转换器的需求。这些设备对于高效的讯号传输和处理至关重要,使其成为现代电信基础设施中不可或缺的一部分。随着各行各业努力满足对更高资料速率和更低延迟日益增长的需求,高速资料转换器在确保无缝连接和最佳效能方面发挥关键作用。

市场也受益于这些转换器在电信、工业自动化和汽车等领域的日益普及,因为即时资料处理和系统效率至关重要。此外,向节能和高解析度组件的转变正在加速先进资料转换器的发展,以满足高科技应用对速度和准确性日益增长的需求。物联网设备整合度不断提高,再加上人工智慧和机器学习的进步,进一步增加了对高速资料转换器的需求,因为这些技术严重依赖精确、高效的资料处理。半导体技术的不断创新也支持了市场的成长轨迹,这使得生产更紧凑、更节能、更高性能的转换器成为可能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 74亿美元 |

| 复合年增长率 | 7.2% |

市场按类型细分,主要类别为类比数位转换器 (ADC) 和数位类比转换器 (DAC)。随着对类比讯号精确数位化的需求不断增长,ADC 的市场规模预计到 2034 年将达到 43 亿美元。需要即时资料转换的行业正在推动具有更低功耗和更高解析度的高效能 ADC 的发展。这些转换器对于需要高速资料处理的应用至关重要,使其成为不断发展的数位生态系统的基石。随着各行各业寻求提高各种应用中讯号转换的品质和效率,对 DAC 的需求也不断增加。

根据频段,市场分为 125 MSPS、125 MSPS 至 1 GSPS 和 >1 GSPS。预计 >1 GSPS 部分将以最快的速度成长,预测期内预计复合年增长率为 10.5%。这种成长归因于高阶应用中对高速资料处理的需求不断增加。同时,125 MSPS 至 1 GSPS 段由于其性能和功率效率的平衡仍然是一个受欢迎的选择。汽车、卫星通讯和中端电信等行业正在推动这些转换器的采用,因为它们增强了网路功能并支援中等位元率。

受5G基础设施的快速扩张、半导体领域的强劲需求以及物联网服务的广泛采用的推动,美国在2024年占据了高速资料转换器市场的87.7%。对国防和航太应用的日益关注也促进了对高性能资料转换器的需求不断增长。行业领导企业之间的策略合作正在促进创新和研究,进一步推动市场的成长。随着技术进步和基础设施发展为高速资料转换器创造新的机会,美国市场的主导地位预计将继续保持。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 高速通讯网路的需求不断增加

- 以数据为中心的应用程式的成长

- 不断扩大的消费性电子产品市场

- 汽车电子的进步

- 软体定义无线电 (SDR) 的采用日益增多

- 产业陷阱与挑战

- 设计复杂度高,製造成本高

- 科技快速发展,产品生命週期短

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 类比数位转换器 (ADC)

- 数位类比转换器 (DAC)

第六章:市场估计与预测:依决议,2021 年至 2034 年

- 主要趋势

- 8 位元

- 10 位元

- 12 位元

- 16 位元

- 24 位元及以上

第 7 章:市场估计与预测:按频段,2021-2034 年

- 主要趋势

- <125 MSPS

- 125 MSPS 至 1 GSPS

- >1 GSPS

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 电信

- 工业的

- 测试与管理

- 卫生保健

- 消费性电子产品

- 其他的

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- IQ-ANALOG

- Advanced Micro Devices, Inc.

- Analog Devices, Inc.

- Asahi Kasei Microdevices Corporation

- Avia Semiconductor Ltd.

- Broadcom Inc.

- Datel, Inc.

- Faraday Technology Corporation

- GlobalSpec

- Infineon Technologies AG

- Microchip Technology Inc.

- Monolithic Power Systems, Inc.

- Mouser Electronics, Inc.

- NXP Semiconductors

- ON Semiconductor

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- ROHM Semiconductor

- STMicroelectronics

- Texas Instruments

The Global High-Speed Data Converter Market, valued at USD 3.7 billion in 2024, is expected to grow at a CAGR of 7.2% from 2025 to 2034. This growth is driven by the rapid evolution of 5G technology and next-generation communication networks, which are fueling the demand for high-speed data converters. These devices are critical for efficient signal transmission and processing, making them indispensable in modern telecommunications infrastructure. As industries strive to meet the increasing need for higher data rates and lower latency, high-speed data converters are playing a pivotal role in ensuring seamless connectivity and optimal performance.

The market is also benefiting from the growing adoption of these converters in sectors such as telecommunications, industrial automation, and automotive, where real-time data processing and system efficiency are paramount. Additionally, the shift toward energy-efficient and high-resolution components is accelerating the development of advanced data converters, which cater to the rising demand for speed and accuracy in high-tech applications. The increasing integration of IoT devices, coupled with advancements in artificial intelligence and machine learning, is further amplifying the need for high-speed data converters, as these technologies rely heavily on precise and efficient data processing. The market's growth trajectory is also supported by ongoing innovations in semiconductor technology, which are enabling the production of more compact, energy-efficient, and high-performance converters.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 7.2% |

The market is segmented by type, with Analog-to-Digital Converters (ADCs) and Digital-to-Analog Converters (DACs) being the primary categories. ADCs are projected to reach USD 4.3 billion by 2034, driven by the increasing demand for accurate digitalization of analog signals. Industries requiring real-time data conversion are pushing the development of high-performance ADCs that offer lower power consumption and enhanced resolution. These converters are essential for applications that demand high-speed data processing, making them a cornerstone of the evolving digital ecosystem. The demand for DACs is also rising as industries seek to improve the quality and efficiency of signal conversion in various applications.

Based on frequency bands, the market is divided into 125 MSPS, 125 MSPS to 1 GSPS, and >1 GSPS. The >1 GSPS segment is expected to grow at the fastest rate, with a projected CAGR of 10.5% during the forecast period. This growth is attributed to the increasing need for high-speed data processing in advanced applications. Meanwhile, the 125 MSPS to 1 GSPS segment remains a popular choice due to its balance of performance and power efficiency. Industries such as automotive, satellite communications, and mid-range telecommunications are driving the adoption of these converters as they enhance network capabilities and support moderate bit rates.

The United States held an 87.7% share of the high-speed data converter market in 2024, driven by the rapid expansion of 5G infrastructure, strong demand in the semiconductor sector, and the widespread adoption of IoT services. The growing focus on defense and aerospace applications is also contributing to the rising demand for high-performance data converters. Strategic collaborations among leading industry players are fostering innovation and research, further propelling the market's growth. The US market's dominance is expected to continue as advancements in technology and infrastructure development create new opportunities for high-speed data converters.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-speed communication networks

- 3.6.1.2 Growth in data-centric applications

- 3.6.1.3 Expanding consumer electronics market

- 3.6.1.4 Advancements in automotive electronics

- 3.6.1.5 Rising adoption of Software-Defined Radios (SDRs)

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High design complexity and manufacturing costs

- 3.6.2.2 Rapid technological evolution and short product lifecycles

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Analog-to-Digital Converters (ADCs)

- 5.3 Digital-to-Analog Converters (DACs)

Chapter 6 Market Estimates & Forecast, By Resolution, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 8-bit

- 6.3 10-bit

- 6.4 12-bit

- 6.5 16-bit

- 6.6 24-bit and above

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 <125 MSPS

- 7.3 125 MSPS TO 1 GSPS

- 7.4 >1 GSPS

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Telecommunications

- 8.4 Industrial

- 8.5 Test & management

- 8.6 Healthcare

- 8.7 Consumer Electronics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 IQ-ANALOG

- 10.2 Advanced Micro Devices, Inc.

- 10.3 Analog Devices, Inc.

- 10.4 Asahi Kasei Microdevices Corporation

- 10.5 Avia Semiconductor Ltd.

- 10.6 Broadcom Inc.

- 10.7 Datel, Inc.

- 10.8 Faraday Technology Corporation

- 10.9 GlobalSpec

- 10.10 Infineon Technologies AG

- 10.11 Microchip Technology Inc.

- 10.12 Monolithic Power Systems, Inc.

- 10.13 Mouser Electronics, Inc.

- 10.14 NXP Semiconductors

- 10.15 ON Semiconductor

- 10.16 Qualcomm Technologies, Inc.

- 10.17 Renesas Electronics Corporation

- 10.18 ROHM Semiconductor

- 10.19 STMicroelectronics

- 10.20 Texas Instruments