|

市场调查报告书

商品编码

1684834

石油精炼市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Oil Refining Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

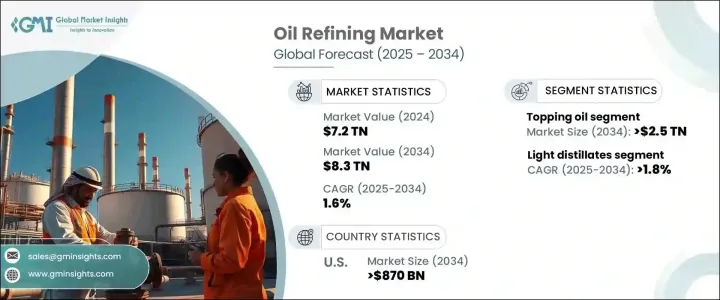

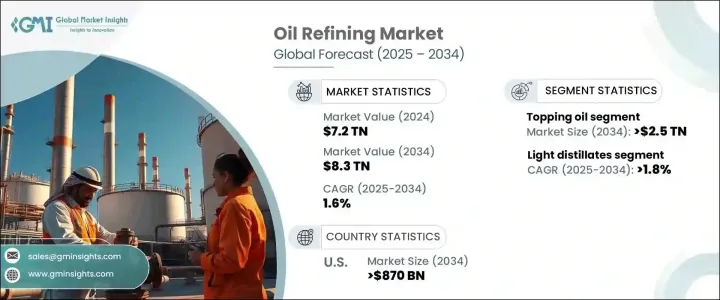

2024 年全球炼油市场规模达到 7.2 兆美元,预计 2025 年至 2034 年期间的复合年增长率为 1.6%。快速的工业化、经济扩张和全球人口的成长正在推动对精炼石油产品的需求。随着城镇化进程加快和生活水准提高,发展中经济体,特别是亚洲和非洲的能源消耗正在增加。航空和运输业是这一成长的主要驱动力,需要稳定的精炼燃料供应来支持不断扩大的全球流动性。

同时,更严格的环境法规正在重塑炼油业务,推动企业投资更清洁的技术和永续的实践。该行业正在平衡燃料安全需求和向低碳解决方案的过渡,将炼油厂现代化作为首要任务。世界各国政府都在鼓励对炼油基础设施的投资,以减少进口依赖并提高能源生产的自给自足能力。加氢裂解和催化重整等先进的炼油製程正在提高效率、最大限度提高原油产量,支持市场稳步扩张。正在进行的新石油储备的勘探和炼油厂管理中数位技术的采用进一步增强了该行业的前景。随着炼油能力的不断提高以及对燃料和石化产品的持续需求,全球炼油市场有望实现长期成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.2兆美元 |

| 预测值 | 8.3兆美元 |

| 复合年增长率 | 1.6% |

预计到 2034 年,顶级石油产业将创收 2.5 兆美元,这得益于其将大型碳氢化合物分子分解为高价值精炼产品的效率。随着工业製造和能源生产对石化原料的依赖性不断增强,对优质油的需求持续上升。提高产量效率的强化炼油技术正在成为行业标准,帮助炼油厂最大限度地提高产量和盈利能力。该部门在为工业运营提供关键燃料方面发挥的作用,进一步巩固了其在满足全球能源需求方面的重要性。

受全球可支配收入增加和中产阶级人口扩大的推动,到 2034 年,轻质馏分油市场预计将以 1.8% 的复合年增长率成长。汽油、石脑油和其他精炼石油产品在製造业、运输业和住宅供暖等多个领域的广泛使用正在推动需求。基础设施扩张,特别是发展中经济体的基础设施扩张,正在增加对高品质精炼燃料的需求。随着工业化进程的加快,该领域将保持稳定成长,巩固其在石油炼製领域的关键作用。

受国产石油产品强劲需求的推动,美国炼油市场预计到 2034 年将创收 8,700 亿美元。随着国家寻求减少对外国石油的依赖,有利于炼油厂扩建和技术进步的政策正在加速产业成长。对数位化炼油厂管理、自动化和流程优化的投资正在提高效率,使美国炼油厂在全球舞台上更具竞争力。此外,政府探索未开发石油储备和提高炼油能力的措施正在确保供应链的稳定性和弹性。凭藉着不断的进步和对能源独立的承诺,美国仍然是全球石油炼製市场的主导力量。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模及预测:依复杂程度,2021 年至 2034 年

- 主要趋势

- 食材

- 转换

- 深度转化

第 6 章:市场规模及预测:依产品,2021 – 2034 年

- 主要趋势

- 轻质馏分油

- 中间馏分

- 燃料油

- 其他的

第 7 章:市场规模与预测:按燃料,2021 – 2034 年

- 主要趋势

- 汽油

- 柴油

- 煤油

- 液化石油气

- 其他的

第 8 章:市场规模与预测:按应用,2021 年至 2034 年

- 主要趋势

- 公路运输

- 航空

- 海上燃油

- 石油化工

- 其他行业

- 住宅/商业/农业

- 发电

- 铁路和国内

第 9 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 英国

- 亚太地区

- 中国

- 韩国

- 印度

- 新加坡

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 科威特

- 埃及

- 南非

- 奈及利亚

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- ADNOC

- Bharat Petroleum

- BP

- Chevron

- CNPC

- ExxonMobil

- Fluor

- Hindustan Petroleum

- Indian Oil

- Kuwait Petroleum

- Marathon Petroleum

- PBF Energy

- Phillips 66

- Reliance Industries

- S-Oil

- Saudi Aramco

- Shell

- Valero

The Global Oil Refining Market reached USD 7.2 trillion in 2024 and is expected to grow at a CAGR of 1.6% between 2025 and 2034. Rapid industrialization, economic expansion, and the rising global population are fueling the demand for refined petroleum products. Developing economies, particularly in Asia and Africa, are witnessing increasing energy consumption as urbanization accelerates and living standards rise. The aviation and transportation industries are key drivers of this growth, requiring a steady supply of refined fuels to support expanding global mobility.

At the same time, stricter environmental regulations are reshaping refining operations, pushing companies to invest in cleaner technologies and sustainable practices. The industry is balancing the need for fuel security with the transition to lower-carbon solutions, making refinery modernization a top priority. Governments worldwide are incentivizing investments in refining infrastructure to reduce import dependency and boost self-sufficiency in energy production. Advanced refining processes, including hydrocracking and catalytic reforming, are enhancing efficiency and maximizing yield from crude oil, supporting steady market expansion. The ongoing exploration of new oil reserves and the adoption of digital technologies in refinery management further strengthen the sector's outlook. With continued advancements in refining capabilities and sustained demand for fuel and petrochemical products, the global oil refining market is poised for long-term growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Trillion |

| Forecast Value | $8.3 Trillion |

| CAGR | 1.6% |

The topping oil segment is projected to generate USD 2.5 trillion by 2034, driven by its efficiency in breaking down large hydrocarbon molecules into high-value refined products. As industries increase their reliance on petrochemical feedstocks for manufacturing and energy production, demand for topping oil continues to rise. Enhanced refining techniques that improve yield efficiency are becoming industry standards, helping refiners maximize output and profitability. The segment's role in supplying crucial fuels for industrial operations further solidifies its importance in meeting global energy demands.

The light distillates segment is expected to grow at a CAGR of 1.8% through 2034, supported by rising disposable incomes and expanding middle-class populations worldwide. The widespread use of gasoline, naphtha, and other refined petroleum products across multiple sectors-including manufacturing, transportation, and residential heating-is driving demand. Infrastructure expansion, particularly in developing economies, is increasing the need for high-quality refined fuels. With industrialization gaining momentum, the segment is positioned for steady growth, reinforcing its critical role in the oil refining landscape.

The U.S. oil refining market is projected to generate USD 870 billion by 2034, bolstered by strong demand for domestically produced oil products. As the country seeks to reduce reliance on foreign oil, policies favoring refinery expansions and technological advancements are accelerating industry growth. Investments in digital refinery management, automation, and process optimization are improving efficiency, making U.S. refineries more competitive on the global stage. Additionally, government initiatives to explore untapped oil reserves and increase refining capacity are ensuring a stable and resilient supply chain. With ongoing advancements and a commitment to energy independence, the U.S. remains a dominant force in the global oil refining market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Complexity Level, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 5.1 Key trends

- 5.2 Topping

- 5.3 Conversion

- 5.4 Deep conversion

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 6.1 Key trends

- 6.2 Light distillates

- 6.3 Middle distillates

- 6.4 Fuel oil

- 6.5 Others

Chapter 7 Market Size and Forecast, By Fuel, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Gasoil

- 7.4 Kerosene

- 7.5 LPG

- 7.6 Others

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 8.1 Key trends

- 8.2 Road transport

- 8.3 Aviation

- 8.4 Marine bunker

- 8.5 Petrochemical

- 8.6 Other industry

- 8.7 Residential/Commercial/Agriculture

- 8.8 Electricity generation

- 8.9 Rail & domestic

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Italy

- 9.3.4 Netherlands

- 9.3.5 Russia

- 9.3.6 Spain

- 9.3.7 UK

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 South Korea

- 9.4.3 India

- 9.4.4 Singapore

- 9.4.5 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Kuwait

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.5.6 Nigeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ADNOC

- 10.2 Bharat Petroleum

- 10.3 BP

- 10.4 Chevron

- 10.5 CNPC

- 10.6 ExxonMobil

- 10.7 Fluor

- 10.8 Hindustan Petroleum

- 10.9 Indian Oil

- 10.10 Kuwait Petroleum

- 10.11 Marathon Petroleum

- 10.12 PBF Energy

- 10.13 Phillips 66

- 10.14 Reliance Industries

- 10.15 S-Oil

- 10.16 Saudi Aramco

- 10.17 Shell

- 10.18 Valero