|

市场调查报告书

商品编码

1626885

石油精製-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Oil Refining - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

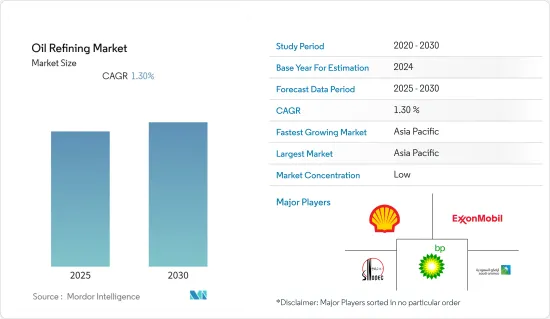

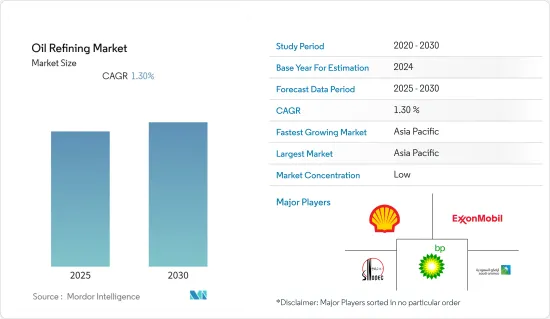

精製市场预计在预测期内复合年增长率为1.3%

主要亮点

- 从中期来看,下游基础设施预计将在全球扩张,以满足对精製石油产品不断增长的需求,从而在预测期内推动市场。

- 另一方面,有关石油及其产品的环境问题和法规预计将阻碍预测期内的市场成长。

- 世界上许多炼油厂都在老化,需要升级以提高效率、增加产能并遵守环境法规。现有设施的升级为预测期内的市场研究提供了机会。

- 预计亚太地区仍将是精製市场的主要企业。这是因为中国和印度正在规划大型炼油计划。

石油精製市场趋势

全球对精製石油产品的需求不断增长推动市场

- 汽油、柴油、喷射机燃料和润滑油等石油产品消费量的增加正在推动精製需求。人口成长、都市化和工业化推动了需求的成长。

- 世界人口持续成长,特别是在开发中国家。随着越来越多的人迁移到都市区,对汽油和柴油等交通燃料的需求不断增加,以满足日益增长的汽车交通需求。

- 此外,经济发展和工业化导致能源消耗增加。随着经济成长,製造业活动、基础设施发展和商业部门增加,所有这些都需要精炼石油产品的稳定供应。

- 此外,交通运输部门严重依赖精製石油产品用于汽车、卡车、飞机、船舶和火车等各种运输方式。不断扩大的全球运输网络和不断增加的流动性需求导致对精炼石油产品的需求增加。

- 根据国际汽车工业协会统计,2021年至2022年全球汽车产量成长超过6%。汽车产量的增加预计将增加预测期内的燃料需求。

- 此外,各国正在投资扩大精製能力,以满足对石油产品不断增长的需求。产能扩张有利于缩小供需缺口,保障能源安全。

- 例如,2022 年 11 月,奈及利亚政府宣布 Petrol Integrated International (GII) 已在该州购买 800 公顷土地,用于建设计画炼油厂。这刺激了越来越多炼油厂的出现,结束了尼日利亚长达数十年的原油生产大国和精炼石油产品进口大国的悖论。

- 因此,如上所述,石油产品需求的增加预计将推动市场。

亚太地区主导市场

- 亚太地区是世界上大多数人口的家园,其中包括中国和印度等快速发展的国家。这些国家的人口成长和都市化正在推动对精製石油产品的需求,包括运输燃料和石化原料。

- 此外,亚太地区在过去几十年中经历了强劲的经济成长。这种经济扩张导致工业活动、基础设施发展和商业部门的增加,这需要大量的精製石油产品供应。

- 此外,随着中国和印度等国家收入的增加和中产阶级的扩大,对汽车的需求增加,流动性增加。这一趋势将导致汽车持有率上升,增加对汽油和柴油的需求,从而增加精製活动。

- 例如,根据国际汽车工业协会的数据,2021年至2022年亚太地区的汽车销售将成长4%以上,这意味着汽车销量的增加,并将带动该地区对石油产品的需求。

- 在亚太地区,以精炼石油产品为原料的石化工业正经历显着成长。对塑胶、聚合物和化学品等石化产品的需求不断增长,支持了该地区提高精製能力的需求。

- 例如,2022年8月,越南国营油气集团子公司PetroVietnam宣布计划在南部头顿省巴巴建造一座原油加工能力为每年24至2600万吨的炼油厂。建设将分为两个阶段。一期预计产生135亿美元,二期预计产生50亿美元。

- 考虑到这些因素,亚太地区仍然是精製行业最大的市场,预计将出现大量投资和产能扩张,以满足日益增长的精製油需求。

精製业概况

精製市场适度整合。市场上营运的主要企业包括(排名不分先后)埃克森美孚公司、壳牌公司、中国石化公司、英国石油公司和沙乌地阿拉伯石油公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年精製能力及预测(单位:百万桶/日)

- 2022年精製能力(桶/天)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 全球对精製石油产品的需求不断增加

- 经济成长和工业化

- 抑制因素

- 环境问题和法规

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(到2028年的市场规模与需求预测(按地区))

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 亚太地区

- 中国

- 印度

- 韩国

- 日本

- 其他亚太地区

- 欧洲

- 俄罗斯

- 德国

- 义大利

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 委内瑞拉

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 伊朗

- 奈及利亚

- 科威特

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Exxon Mobil Corporation

- Shell PLC

- Sinopec Corp.

- BP PLC

- Saudi Arabian Oil Co.

- Valero Energy Corporation

- Petroleos de Venezuela SA

- China National Petroleum Corporation

- Chevron Corporation

- Rosneft PAO

- TotalEnergies SE

第七章 市场机会及未来趋势

- 升级现有炼油厂

简介目录

Product Code: 48420

The Oil Refining Market is expected to register a CAGR of 1.3% during the forecast period.

Key Highlights

- Over the medium term, expanding downstream infrastructure worldwide to meet the increasing demand for refined petroleum products is expected to drive the market during the forecast period.

- On the other hand, the environmental concerns and regulations regarding oil and its products are expected to hinder the market's growth during the forecasted period.

- Nevertheless, many refineries worldwide are aging and require upgrades to improve efficiency, increase capacity, and comply with environmental regulations. Upgrading existing facilities presents opportunities for market studies during the forecasted period.

- Asia-Pacific is expected to remain the major player in the oil refining market. Owing to the upcoming major refinery projects in China and India.

Oil Refining Market Trends

Increasing Global Demand For Refined Petroleum Products To Drive The Market

- The growing consumption of petroleum products, such as gasoline, diesel, jet fuel, and lubricants, is driving the demand for oil refining. Rising population, urbanization, and industrialization contribute to this increased demand.

- The world's population continues to expand, particularly in developing countries. As more people migrate to urban areas, there is a higher demand for transportation fuels, such as gasoline and diesel, to meet the needs of increased vehicular traffic.

- Moreover, economic development and industrialization lead to increased energy consumption. As economies grow, there is a rise in manufacturing activities, infrastructure development, and commercial sectors, all of which require a steady supply of refined petroleum products.

- Additionally, the transportation sector heavily relies on refined petroleum products for various modes of transportation, including cars, trucks, airplanes, ships, and trains. The expanding global transportation network and the increasing mobility needs contribute to the growing demand for refined products.

- According to the International Organization of Motor Vehicle Manufacturers, global vehicle production increased by more than 6% between 2021 and 2022. This growth in vehicle production is expected to increase fuel demand during the forecasted period.

- Furthermore, various countries are investing in expanding their refining capacities to meet the growing demand for petroleum products. Capacity expansions help to bridge the supply-demand gap and ensure energy security.

- For instance, in November 2022, the Nigerian government stated that Petrol Integrated International (GII) had purchased 800 hectares of property in the state for its proposed oil refinery. This added to the growing number of refineries popping up to end Nigeria's decades-long paradoxical condition of being both a large producer of crude oil and a major importer of refined petroleum products.

- Therefore, as mentioned above, the increasing demand for petroleum products is expected to drive the market.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is home to a significant portion of the world's population, including rapidly developing countries like China and India. These countries' increasing population and urbanization drive the demand for refined petroleum products, including transportation fuels and petrochemical feedstocks.

- Moreover, the Asia-Pacific region has been experiencing robust economic growth over the past few decades. This economic expansion leads to increased industrial activities, infrastructure development, and commercial sectors, which require a substantial supply of refined petroleum products.

- Furthermore, as incomes rise and the middle class expands in countries like China and India, there is a growing demand for automobiles and increased mobility. This trend leads to higher vehicle ownership rates, driving the need for gasoline and diesel fuels, resulting in increased oil refining activities.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, vehicle sales in the Asia-Pacific region increased by more than 4% between 2021 and 2022, signifying the increasing vehicle sales, which drives the demand for petroleum products in the region.

- The Asia-Pacific region has witnessed significant growth in the petrochemical industry, which relies on refined petroleum products as feedstocks. The rising demand for petrochemical products, such as plastics, polymers, and chemicals, supports the region's need for increased oil refining capacity.

- For instance, in August 2022, PetroVietnam, a state-owned Vietnam Oil and Gas Group subsidiary, revealed plans to construct an oil refinery with a crude oil processing capacity of 24 to 26 Mt/year in Ba Ria, Vung Tau province, southern Vietnam. The building process was to be divided into two stages. The first and second phases are anticipated to cost USD 13.5 billion and USD 5 billion, respectively.

- Due to these factors, the Asia-Pacific region is expected to continue being the largest market for the oil refining industry, with significant investments and capacity expansions taking place to cater to the growing demand for refined petroleum products.

Oil Refining Industry Overview

The oil refining market is moderately consolidated. Some of the major players operating in the market (in no particular order) include Exxon Mobil Corporation, Shell PLC, Sinopec Corp., BP PLC, and Saudi Arabian Oil Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Refining Capacity and Forecast in million barrels per day (mbpd), till 2028

- 4.3 Refining Throughput in barrels per day, till 2022

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Global Demand For Refined Petroleum Products

- 4.6.1.2 Economic Growth And Industrialization

- 4.6.2 Restraints

- 4.6.2.1 Environmental Concerns And Regulations

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION - BY GEOGRAPHY Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.1 North America

- 5.1.1 United States

- 5.1.2 Canada

- 5.1.3 Rest of North America

- 5.2 Asia-Pacific

- 5.2.1 China

- 5.2.2 India

- 5.2.3 South Korea

- 5.2.4 Japan

- 5.2.5 Rest of Asia-Pacific

- 5.3 Europe

- 5.3.1 Russia

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Spain

- 5.3.5 Rest of Europe

- 5.4 South America

- 5.4.1 Brazil

- 5.4.2 Venezuela

- 5.4.3 Argentina

- 5.4.4 Rest of South America

- 5.5 Middle-East and Africa

- 5.5.1 Saudi Arabia

- 5.5.2 Iran

- 5.5.3 Nigeria

- 5.5.4 Kuwait

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Exxon Mobil Corporation

- 6.3.2 Shell PLC

- 6.3.3 Sinopec Corp.

- 6.3.4 BP PLC

- 6.3.5 Saudi Arabian Oil Co.

- 6.3.6 Valero Energy Corporation

- 6.3.7 Petroleos de Venezuela SA

- 6.3.8 China National Petroleum Corporation

- 6.3.9 Chevron Corporation

- 6.3.10 Rosneft PAO

- 6.3.11 TotalEnergies SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upgrading Existing Refineries

02-2729-4219

+886-2-2729-4219