|

市场调查报告书

商品编码

1684838

三相家用备用发电机组市场机会、成长动力、产业趋势分析与预测 2025 - 2034Three Phase Home Standby Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

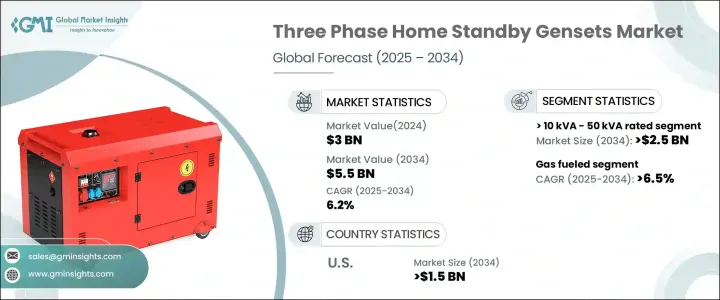

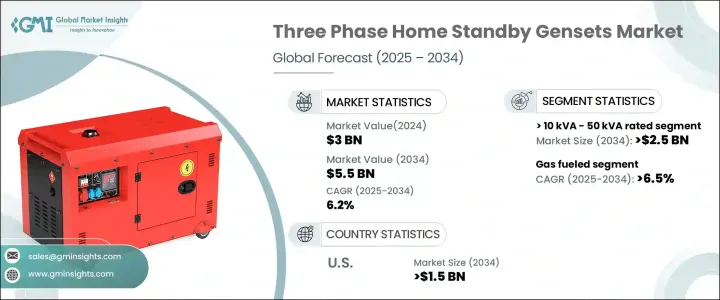

2024 年全球三相家用备用发电机组市场价值为 30 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.2%。随着天气相关灾害发生的频率和强度不断增加,再加上老化电力基础设施的脆弱性,对可靠备用电源解决方案的需求持续上升。由于飓风、冬季风暴和电网故障导致停电现象变得更加普遍,房主将电力安全放在首位。随着现代家庭采用更多高能耗电器和智慧家居技术,对不间断电力供应的需求进一步推动了市场的扩张。此外,政府旨在加强住宅基础设施的措施和家庭自动化的兴起趋势也促进了市场成长。随着技术进步提高了发电机的效率、噪音和燃油经济性,越来越多的房主投资三相备用发电机组作为长期电力解决方案。

预计到 2034 年,额定功率在 >10 kVA 和 50 kVA 之间的发电机组的细分市场将产生 25 亿美元的收入。这些系统被广泛用于支援基本家庭功能,包括 HVAC 系统、家庭安全网路和其他高能耗设备。尤其是较大的房屋,依赖这些发电机组来无缝管理大量内部负载。儘管与其他备用解决方案相比,前期成本较高,但这些设备的长期可靠性和效率使其成为在停电期间寻求不间断电力的房主的首选。自动转换开关和远端监控功能的整合进一步增强了它们的吸引力,为房主提供了更大的便利性和对备用电源系统的控制。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 55亿美元 |

| 复合年增长率 | 6.2% |

到 2034 年,三相家用备用发电机组市场的瓦斯部分预计将以 6.5% 的复合年增长率成长。这些发电机因其使用寿命长、易于维护以及颗粒物和氮氧化物 (NOx) 排放量显着降低而越来越受到青睐。随着天然气基础设施的扩大和环境法规的收紧,房主选择使用燃气发电机组来符合永续发展目标。与柴油动力替代品相比,燃气发电机组运作更安静,燃料储存问题减少,能源供应更稳定,使其成为住宅应用的理想选择。此外,随着技术进步提高燃油效率和排放控制,预计未来几年燃气备用发电机的采用将会加速。

预计到 2034 年,美国三相家用备用发电机组市场将创收 15 亿美元。对电子设备和家庭自动化系统的依赖日益增加,再加上正在进行的住房开发计划,推动了市场需求。房地产行业的扩张,加上快速的城市化和人口成长,进一步促进了备用发电机的普及。电网基础设施老化和频繁停电凸显了可靠备用电源解决方案的重要性。随着极端天气条件变得越来越难以预测,越来越多的美国房主投资备用发电机组以确保能源安全。此外,可支配收入的增加和对能源弹性的认识的增强推动了住宅环境对高性能三相发电机组的需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021 – 2034 年

- 主要趋势

- ≤ 10千伏安

- > 10 千伏安 - 50 千伏安

- > 50 千伏安 - 100 千伏安

- >100千伏安

第六章:市场规模及预测:依燃料,2021 – 2034 年

- 主要趋势

- 柴油引擎

- 气体

- 其他的

第 7 章:市场规模及预测:依产品,2021 – 2034 年

- 主要趋势

- 空气冷却

- 液体冷却

第 8 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第九章:公司简介

- Ashok Leyland

- Caterpillar

- Champion Power Equipment

- Cummins

- Eaton

- Generac Power Systems

- Gillette Generators

- HIMOINSA

- HIPOWER

- Kirloskar

- Mahindra Powerol

- Powerica

- PR Power

- Rehlko

- Rolls-Royce

The Global Three Phase Home Standby Gensets Market was valued at USD 3 billion in 2024 and is projected to grow at a CAGR of 6.2% between 2025 and 2034. With the increasing frequency and intensity of weather-related disasters, coupled with vulnerabilities in aging power infrastructure, the demand for reliable backup power solutions continues to rise. Homeowners are prioritizing power security as outages become more prevalent due to hurricanes, winter storms, and grid failures. As modern homes incorporate more energy-intensive appliances and smart home technologies, the need for uninterrupted electricity supply further drives the market's expansion. Additionally, government initiatives aimed at strengthening residential infrastructure and the rising trend of home automation contribute to market growth. With technological advancements enhancing generator efficiency, noise reduction, and fuel economy, more homeowners are investing in three-phase standby gensets as a long-term power solution.

The market segment comprising gensets with power ratings between >10 kVA and 50 kVA is anticipated to generate USD 2.5 billion by 2034. These systems are widely adopted to support essential household functions, including HVAC systems, home security networks, and other high-energy appliances. Larger homes, in particular, rely on these gensets for their ability to seamlessly manage substantial internal loads. Despite the higher upfront costs compared to alternative backup solutions, the long-term reliability and efficiency of these units make them a preferred choice for homeowners who seek uninterrupted power during outages. The integration of automatic transfer switches and remote monitoring capabilities further enhances their appeal, offering homeowners greater convenience and control over their backup power systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 6.2% |

The gas-fueled segment of the three-phase home standby gensets market is expected to grow at a CAGR of 6.5% through 2034. These generators are increasingly favored for their long operational life, ease of maintenance, and significantly lower emissions of particulate matter and nitrogen oxides (NOx). As natural gas infrastructure expands and environmental regulations tighten, homeowners are opting for gas-fueled gensets to align with sustainability goals. Compared to diesel-powered alternatives, gas gensets offer quieter operation, reduced fuel storage concerns, and a more consistent energy supply, making them an attractive choice for residential applications. Furthermore, with technological advancements improving fuel efficiency and emissions control, the adoption of gas-powered standby generators is expected to accelerate in the coming years.

The U.S. three-phase home standby gensets market is projected to generate USD 1.5 billion by 2034. Increasing reliance on electronic devices and home automation systems, combined with ongoing housing development initiatives, fuels market demand. The expansion of the real estate sector, coupled with rapid urbanization and population growth, further contributes to the rising adoption of standby generators. Aging power grid infrastructure and frequent blackouts have underscored the importance of reliable backup power solutions. As extreme weather conditions become more unpredictable, more U.S. homeowners are investing in standby gensets to ensure energy security. Additionally, increasing disposable incomes and greater awareness of energy resilience drive the demand for high-performance three-phase gensets across residential settings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 10 kVA

- 5.3 > 10 kVA - 50 kVA

- 5.4 > 50 kVA - 100 kVA

- 5.5 > 100 kVA

Chapter 6 Market Size and Forecast, By Fuel, 2021 – 2034 ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gas

- 6.4 Others

Chapter 7 Market Size and Forecast, By Product, 2021 – 2034 ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 Air cooled

- 7.3 Liquid cooled

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 ('000 Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Mexico

- 8.7.3 Argentina

Chapter 9 Company Profiles

- 9.1 Ashok Leyland

- 9.2 Caterpillar

- 9.3 Champion Power Equipment

- 9.4 Cummins

- 9.5 Eaton

- 9.6 Generac Power Systems

- 9.7 Gillette Generators

- 9.8 HIMOINSA

- 9.9 HIPOWER

- 9.10 Kirloskar

- 9.11 Mahindra Powerol

- 9.12 Powerica

- 9.13 PR Power

- 9.14 Rehlko

- 9.15 Rolls-Royce