|

市场调查报告书

商品编码

1685062

船用发动机市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Marine Engines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

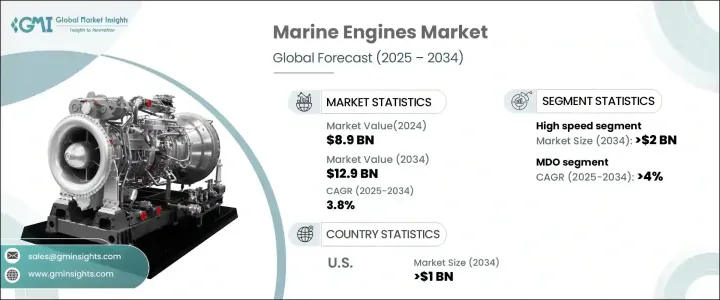

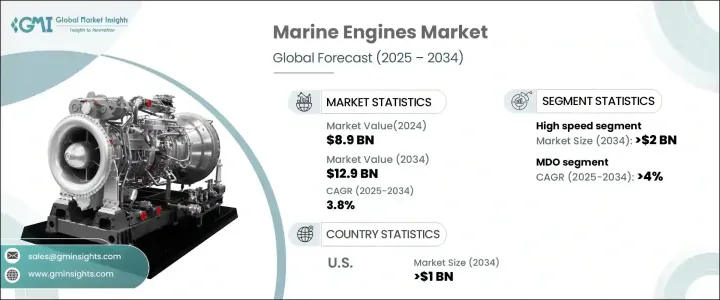

2024 年全球船用引擎市场价值为 89 亿美元,预计 2025 年至 2034 年的复合年增长率为 3.8%。随着全球贸易和运输发生重大转型,不断变化的成本、供应链模型和物流框架正在重塑国际贸易格局。这些变化正在影响各国的竞争力,并使其进一步融入全球交通网络。贸易仍然是经济发展的重要驱动力,推动了对更高效船用引擎的需求。港口基础设施投资的不断增加、船舶技术的快速进步以及海运量的不断增加都是推动市场发展的因素。随着人们对环境问题的关注度不断上升,人们明显转向寻求环保解决方案,特别是在燃油效率和减少排放方面。随着全球范围内实施更加严格的法规,对永续船用引擎技术的关注正成为市场的主要驱动力。

预计到 2034 年,高速船用引擎的需求将达到 20 亿美元。这一增长可归因于港口设施的不断发展以及对强力拖船的需求不断增加。小型船舶、游艇、渡轮和渔船尤其采用紧凑型引擎设计,不仅可以提高效率,还可以降低燃料消耗和营运成本。这些引擎不仅性能出色,而且有助于减少整体环境影响,使其成为各种船舶应用中极具吸引力的选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 89亿美元 |

| 预测值 | 129亿美元 |

| 复合年增长率 | 3.8% |

另一方面,到 2034 年,MDO(船用柴油)船用引擎领域的复合年增长率将达到 4%。这些引擎因其效率高、能够保持高速运转同时保持低噪音水平的能力而越来越受欢迎。它们的四衝程引擎设计透过每隔一个循环消耗燃料来提高燃油效率,这一特点使它们有别于每次衝程都消耗燃料的二衝程引擎。此外,MDO 引擎不需要注入油或润滑油,从而减少排放,更环保,符合日益严格的环境法规。

美国船用引擎市场也正在经历长足的扩张,预计到 2034 年将创造 10 亿美元的产值。随着製造商不断创新以获得更好的性能,柴油引擎技术的进步在推动需求方面发挥着重要作用。经济成长、对可靠引擎性能的日益关注以及对豪华和舒适功能的投资增加是这项扩张的主要推动力。此外,海上运输的持续成长将长期需要更先进、更有效率的船用引擎。这种多方面的发展反映了美国市场的持续成长轨迹

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模及预测:依产品,2021 – 2034 年

- 主要趋势

- 多学科行动

- 镁合金

- 液化天然气

- 杂交种

- 其他的

第六章:市场规模及预测:按功率,2021 – 2034 年

- 主要趋势

- < 1,000 生命值

- 1,000 - 5,000 匹马力

- 5,001 - 10,000 匹马力

- 10,001 - 20,000 点生命值

- > 20,000 生命值

- 20,000 点以上

第 7 章:市场规模与预测:依技术,2021 – 2034 年

- 主要趋势

- 低速

- 中速

- 高速

第 8 章:市场规模及预测:以推进方式,2021 – 2034 年

- 主要趋势

- 2衝程

- 四衝程

第 9 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 商人

- 货柜船

- 油轮

- 散货船

- 气体运输船

- 滚装船

- 其他的

- 海上

- 钻井平台和船舶

- 起锚船

- 离岸支援船

- 浮式生产装置

- 平台供应船

- 游轮和渡轮

- 邮轮

- 客运渡轮

- 客船/货船

- 海军

- 其他的

第 10 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 挪威

- 法国

- 俄罗斯

- 丹麦

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 越南

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 伊朗

- 安哥拉

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

第 11 章:公司简介

- AB Volvo Penta

- Anglo Belgian Corporation

- Brunswick Corporation

- Caterpillar

- Cummins

- Daihatsu Diesel

- DEUTZ

- Deere & Company

- Hyundai Heavy Industries

- IHI Corporation

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Rolls-Royce

- Société Internationale des Moteurs Baudouin

- Scania

- Shanghai Diesel Engine

- STX Engines

- Wärtsilä

- Weichai Holding

- Yamaha

- Yanmar

- Yuchai International

The Global Marine Engines Market, valued at USD 8.9 billion in 2024, is poised for steady growth with an expected CAGR of 3.8% from 2025 to 2034. As global trade and transportation undergo significant transformation, evolving costs, supply chain models, and logistics frameworks are reshaping the landscape of international commerce. These changes are influencing the competitiveness of nations, integrating them further into global transport networks. Trade remains an essential driver of economic development, fueling the demand for more efficient marine engines. The growing investments in port infrastructure, rapid advancements in vessel technology, and the increasing volume of seaborne transportation are all factors bolstering the market. As environmental concerns continue to rise, there is a notable shift towards eco-friendly solutions, particularly in fuel efficiency and emissions reduction. With more stringent regulations being enforced globally, the focus on sustainable marine engine technology is becoming a central market driver.

The demand for high-speed marine engines is projected to reach USD 2 billion by 2034. This surge can be attributed to the ongoing development of port facilities and the increasing demand for powerful tugboats. Small vessels, yachts, ferries, and fishing boats are particularly adopting compact engine designs that not only improve efficiency but also cut down fuel consumption and operational costs. These engines offer excellent performance while helping to reduce the overall environmental footprint, making them a highly attractive option across various marine applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 3.8% |

On the other hand, the MDO (Marine Diesel Oil) marine engine segment is set to grow at a CAGR of 4% through 2034. These engines are increasingly popular due to their efficiency and ability to maintain high-speed operations while keeping noise levels low. Their four-stroke engine design enhances fuel efficiency by consuming fuel every other cycle, a feature that distinguishes them from two-stroke engines that consume fuel with every stroke. Additionally, MDO engines don't require oil or lubricant injections, making them more eco-friendly by producing fewer emissions, thus aligning with tightening environmental regulations.

The U.S. marine engines market is also witnessing considerable expansion, projected to generate USD 1 billion by 2034. Advancements in diesel engine technology are playing a significant role in driving demand as manufacturers continue to innovate for better performance. Economic growth, an increasing focus on reliable engine performance, and rising investment in luxury and comfort features are key contributors to this expansion. Furthermore, the continuous growth in seaborne transportation is creating a long-term need for more advanced and efficient marine engines. This multi-faceted development reflects the sustained growth trajectory of the market in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 MDO

- 5.3 MGO

- 5.4 LNG

- 5.5 Hybrid

- 5.6 Others

Chapter 6 Market Size and Forecast, By Power, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 < 1,000 HP

- 6.3 1,000 - 5,000 HP

- 6.4 5,001 - 10,000 HP

- 6.5 10,001 - 20,000 HP

- 6.6 > 20,000 HP

Chapter 7 Market Size and Forecast, By Technology, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Low speed

- 7.3 Medium speed

- 7.4 High speed

Chapter 8 Market Size and Forecast, By Propulsion, 2021 – 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 2 stroke

- 8.3 4 stroke

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 Merchant

- 9.2.1 Container vessels

- 9.2.2 Tankers

- 9.2.3 Bulk carriers

- 9.2.4 Gas carriers

- 9.2.5 RO-RO

- 9.2.6 Others

- 9.3 Offshore

- 9.3.1 Drilling RIGS & ships

- 9.3.2 Anchor handling vessels

- 9.3.3 Offshore support vessels

- 9.3.4 Floating production units

- 9.3.5 Platform supply vessels

- 9.4 Cruise & Ferry

- 9.4.1 Cruise vessels

- 9.4.2 Passenger ferries

- 9.4.3 Passenger/cargo vessels

- 9.5 Navy

- 9.6 Others

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 Italy

- 10.3.4 Norway

- 10.3.5 France

- 10.3.6 Russia

- 10.3.7 Denmark

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Vietnam

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Iran

- 10.5.4 Angola

- 10.5.5 Egypt

- 10.5.6 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

- 10.6.3 Mexico

Chapter 11 Company Profiles

- 11.1 AB Volvo Penta

- 11.2 Anglo Belgian Corporation

- 11.3 Brunswick Corporation

- 11.4 Caterpillar

- 11.5 Cummins

- 11.6 Daihatsu Diesel

- 11.7 DEUTZ

- 11.8 Deere & Company

- 11.9 Hyundai Heavy Industries

- 11.10 IHI Corporation

- 11.11 MAN Energy Solutions

- 11.12 Mitsubishi Heavy Industries

- 11.13 Rolls-Royce

- 11.14 Société Internationale des Moteurs Baudouin

- 11.15 Scania

- 11.16 Shanghai Diesel Engine

- 11.17 STX Engines

- 11.18 Wärtsilä

- 11.19 Weichai Holding

- 11.20 Yamaha

- 11.21 Yanmar

- 11.22 Yuchai International