|

市场调查报告书

商品编码

1755391

船用往復式发动机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Marine Reciprocating Engine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

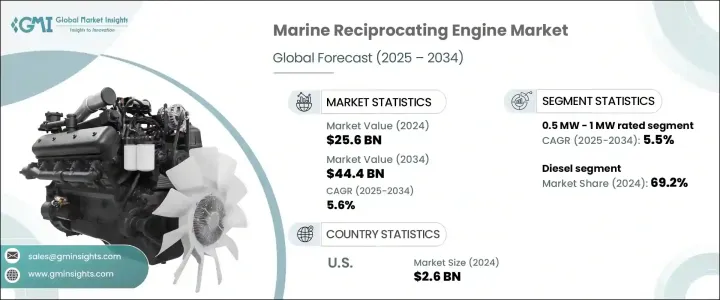

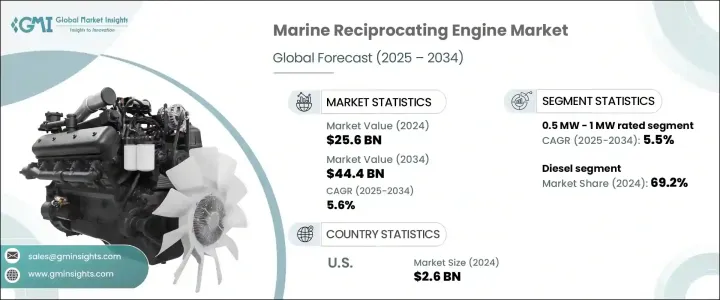

2024年,全球船用往復式引擎市场规模达256亿美元,预计到2034年将以5.6%的复合年增长率成长,达到444亿美元。推动这一成长的因素包括全球排放法规趋于严格,以及市场对可根据成本和供应情况灵活切换燃料类型的燃料灵活系统的需求不断增长。船东和营运商正在升级其引擎系统,以满足环保要求并降低燃料消耗,这进一步推动了市场成长。

此外,发展中国家港口基础设施的不断扩张也促进了海上交通的繁荣,加剧了对高效环保电力解决方案的需求。即时监控和诊断能力的技术进步也使营运商能够追踪关键效能指标,防止意外故障,并提高系统可靠性和正常运行时间。製造商正致力于设计更紧凑的发动机,以满足小型船舶、近海支援船和空间有限的船舶应用的需求,从而提升其在细分领域的应用。国际海事组织 Tier III 标准等监管框架持续推动引擎精度和优化的提高,促使製造商快速创新,以在不断变化的海洋能源格局中保持竞争力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 256亿美元 |

| 预测值 | 444亿美元 |

| 复合年增长率 | 5.6% |

预计到2034年,额定功率为0.5兆瓦至1兆瓦的船用往復式发动机市场将以5.5%的复合年增长率增长,这得益于中型船舶对紧凑高效推进系统日益增长的需求。这些引擎在尺寸、功率和运营成本之间实现了理想的平衡,使其成为各种注重机动性和燃油经济性的应用的首选。沿海保安船、客渡轮和小型货船的部署日益增多,加速了它们的普及。此外,这些引擎更易于维护,并可整合到有限的船上空间,这对于希望在不牺牲性能或合规性的情况下优化船舶布局的营运商来说极具吸引力。

预计到2034年,燃气驱动的船用往復式发动机市场将以6.5%的复合年增长率成长。这一增长与全球排放标准的日益严格以及整个航运业对永续发展的高度重视密切相关。随着监管机构强制推行清洁的海上作业,船舶营运商纷纷转向燃气发动机,因为燃气发动机的温室气体排放量和含硫量显着降低。这些引擎不仅符合国际法规要求,还能透过使用更清洁、通常更经济的燃料来源,带来长期成本效益,尤其是在排放控制区域。

2024年,美国船用往復式发动机市场规模达26亿美元。这一成长源自于国际航运量的稳定成长、海上石油和风能基础设施的持续投资,以及休閒游艇活动的强劲成长。美国完善的港口系统和支援性的监管环境进一步促进了先进船舶推进技术的普及。这种良好的生态系统鼓励商业和休閒船舶营运商投资于符合现代性能和环保标准的更新、更有效率的引擎。

市场的主要参与者包括卡特彼勒、瓦锡兰、珀金斯发动机、IHI 公司、MAN 能源解决方案、洋马控股、通用电气、百力通、川崎重工、康明斯、雅马哈发动机、斯堪尼亚、沃尔沃遍达、Rehlko、久保田公司、三菱重工、劳斯莱斯、JC Bamford Guas、美国能源汽车和本田汽车。为提升市场地位,各公司利用投资研发等策略来开发符合法规要求的低排放、省油的引擎。许多公司专注于混合动力和燃气引擎技术,以顺应脱碳趋势。与造船厂和船队营运商的合作有助于确保长期供应协议,而在新兴沿海经济体的地理扩张则开闢了新的收入来源。先进的数位监控系统正在被纳入其中,以提供预测性维护和即时诊断。各大品牌扩展服务网络以改善售后支持,确保长期客户参与度和性能关键型应用的可靠性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:按燃料,2021 - 2034

- 主要趋势

- 柴油引擎

- 气体

- 其他的

第六章:市场规模及预测:依额定功率,2021 - 2034

- 主要趋势

- 0.5 兆瓦 - 1 兆瓦

- > 1 兆瓦 - 2 兆瓦

- > 2 兆瓦 - 3.5 兆瓦

- > 3.5 兆瓦 - 5 兆瓦

- > 5 兆瓦 - 7.5 兆瓦

- > 7.5 兆瓦

第七章:市场规模及预测:依汽缸配置,2021 - 2034 年

- 主要趋势

- 排队

- V型

- 径向

- 对置活塞

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 西班牙

- 荷兰

- 丹麦

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 泰国

- 新加坡

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 卡达

- 阿曼

- 科威特

- 埃及

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第九章:公司简介

- AB Volvo Penta

- American Honda Motor

- Briggs & Stratton

- Caterpillar

- Cummins

- General Electric

- Guascor Energy

- IHI Corporation

- JC Bamford Excavators

- Kawasaki Heavy Industries

- KUBOTA Corporation

- MAN Energy Solutions

- MITSUBISHI HEAVY INDUSTRIES

- Perkins Engines

- Rehlko

- Rolls-Royce

- Scania

- Wartsilä

- Yamaha Motor

- Yanmar HOLDINGS

The Global Marine Reciprocating Engine Market was valued at USD 25.6 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 44.4 billion by 2034. The growth is driven by the stricter global emission regulations, combined with rising demand for fuel-flexible systems that can shift between fuel types based on cost and availability. Ship owners and operators are upgrading their engine systems to meet environmental requirements and reduce fuel consumption, further fueling market growth.

In addition, expanding port infrastructure across developing nations is boosting marine traffic, intensifying the need for efficient and environmentally compliant power solutions. Technological improvements in real-time monitoring and diagnostic capabilities also allow operators to track key performance indicators prevent unexpected failures and raise system reliability and uptime. Manufacturers are focusing on designing more compact engines to meet the needs of smaller vessels, offshore support crafts, and limited-space marine applications, enhancing adoption across niche sectors. Regulatory frameworks such as the International Maritime Organization's Tier III standards continue to push for higher engine precision and optimization, prompting manufacturers to innovate rapidly to stay competitive in the evolving marine energy landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.6 Billion |

| Forecast Value | $44.4 Billion |

| CAGR | 5.6% |

The 0.5 MW to 1 MW rated marine reciprocating engine segment is projected to grow at a CAGR of 5.5% through 2034, fueled by rising demand for compact and efficient propulsion systems in medium-duty vessels. These engines offer the ideal balance between size, power, and operational cost, making them a preferred choice for various applications where maneuverability and fuel economy are essential. Increasing deployment in coastal security vessels, passenger ferries, and small cargo ships accelerates their adoption. Additionally, these engines are easier to maintain and integrate into limited space on board, which appeals to operators looking to optimize vessel layout without sacrificing performance or compliance.

The gas-powered marine reciprocating engine segment is expected to grow at a CAGR of 6.5% through 2034. This growth is closely linked to the tightening of global emissions standards and a heightened focus on sustainability across the marine industry. As regulators enforce cleaner maritime operations, vessel operators shift toward gas-fueled engines due to their significantly lower greenhouse gas emissions and reduced sulfur content. These engines not only support compliance with international mandates but also offer long-term cost benefits by using cleaner, often more economical fuel sources, especially in emission-controlled areas.

United States Marine Reciprocating Engine Market was valued at USD 2.6 billion in 2024. This growth stems from the steady rise in international shipping traffic, continued investment in offshore oil and wind energy infrastructure, and a robust increase in leisure boating activities. The country's well-developed port systems and supportive regulatory environment further enhance the uptake of advanced marine propulsion technologies. This favorable ecosystem encourages commercial and recreational marine operators to invest in newer, more efficient engines that meet modern performance and environmental standards.

Key players in the market include Caterpillar, Wartsila, Perkins Engines, IHI Corporation, MAN Energy Solutions, Yanmar HOLDINGS, General Electric, Briggs & Stratton, Kawasaki Heavy Industries, Cummins, Yamaha Motor, Scania, AB Volvo Penta, Rehlko, KUBOTA Corporation, MITSUBISHI HEAVY INDUSTRIES, Rolls-Royce, J C Bamford Excavators, American Honda Motor, and Guascor Energy. To enhance their market standing, companies leverage strategies such as investing in R&D to develop low-emission, fuel-efficient engines tailored for regulatory compliance. Many focus on hybrid and gas engine technologies to align with decarbonization trends. Partnerships with shipbuilders and fleet operators help secure long-term supply agreements, while geographic expansion in emerging coastal economies opens new revenue streams. Advanced digital monitoring systems are being incorporated to offer predictive maintenance and real-time diagnostics. Brands expand service networks to improve aftersales support, ensuring long-term customer engagement and reliability in performance-critical applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Diesel

- 5.3 Gas

- 5.4 Others

Chapter 6 Market Size and Forecast, By Rated Power, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 0.5 MW - 1 MW

- 6.3 > 1 MW - 2 MW

- 6.4 > 2 MW - 3.5 MW

- 6.5 > 3.5 MW - 5 MW

- 6.6 > 5 MW - 7.5 MW

- 6.7 > 7.5 MW

Chapter 7 Market Size and Forecast, By Cylinder Configuration, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Inline

- 7.3 V-Type

- 7.4 Radial

- 7.5 Opposed piston

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Thailand

- 8.4.7 Singapore

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 Qatar

- 8.5.4 Oman

- 8.5.5 Kuwait

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 AB Volvo Penta

- 9.2 American Honda Motor

- 9.3 Briggs & Stratton

- 9.4 Caterpillar

- 9.5 Cummins

- 9.6 General Electric

- 9.7 Guascor Energy

- 9.8 IHI Corporation

- 9.9 J C Bamford Excavators

- 9.10 Kawasaki Heavy Industries

- 9.11 KUBOTA Corporation

- 9.12 MAN Energy Solutions

- 9.13 MITSUBISHI HEAVY INDUSTRIES

- 9.14 Perkins Engines

- 9.15 Rehlko

- 9.16 Rolls-Royce

- 9.17 Scania

- 9.18 Wartsilä

- 9.19 Yamaha Motor

- 9.20 Yanmar HOLDINGS