|

市场调查报告书

商品编码

1685150

荞麦市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Buckwheat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

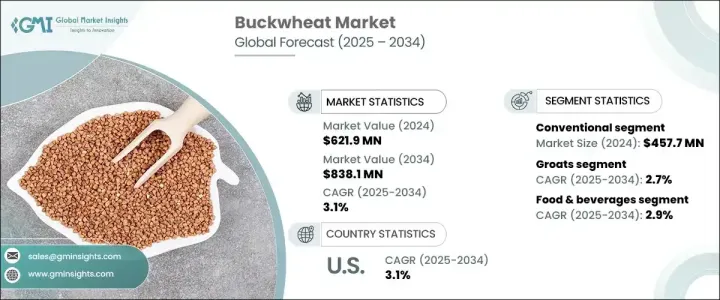

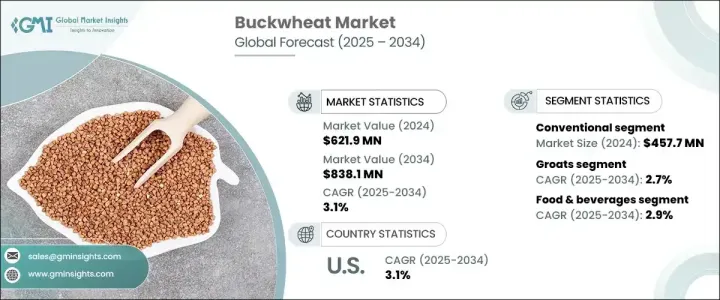

2024 年全球荞麦市场价值为 6.219 亿美元,预计 2025 年至 2034 年期间将以 3.1% 的复合年增长率稳步增长。这一增长主要得益于消费者对荞麦显着健康益处的认识不断提高。这种谷物以天然无麸质而闻名,这对那些有饮食限制的人很有吸引力,特别是患有乳糜泻的人。此外,荞麦还富含必需营养素,包括优质蛋白质、膳食纤维、B 群维生素和镁等重要矿物质,这进一步增强了其作为健康多功能食品的声誉。随着越来越多的人寻求更健康的植物替代品,对荞麦的需求激增。这一趋势与消费者对有机和无麸质产品日益增长的偏好相一致,使其成为采用更清洁、更注重健康饮食的人的理想选择。

荞麦的营养成分使其成为那些希望降低慢性病风险和更有效管理健康的人们备受追捧的替代品。荞麦可以加入到麵粉、麵条和零食等各种产品中,因此越来越多地出现在消费者的厨房中。市场未来的成长也受到永续和生态友善农业的持续发展趋势的支持,因为与其他谷物相比,荞麦相对容易种植,需要的杀虫剂更少。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.219 亿美元 |

| 预测值 | 8.381 亿美元 |

| 复合年增长率 | 3.1% |

传统荞麦市场一直占据市场主导地位,2024 年的营收为 4.577 亿美元。预计在预测期内将维持 2.8% 的稳定复合年增长率。传统的荞麦产品随处可见,价格低廉,对于那些注重预算但仍想享受这种营养谷物益处的消费者来说,是一个有吸引力的选择。这些产品在价格与健康之间取得了平衡,确保了它们在全球各个市场持续的需求。

就产品类型而言,荞麦粒在 2024 年创造了 2.444 亿美元的收入,预计到 2034 年这一细分市场的复合年增长率为 2.7%。荞麦粒以其丰富的营养成分而闻名,在註重健康的消费者中广受欢迎。它们因其高蛋白质和纤维含量以及多种必需维生素和矿物质而闻名,使其成为注重营养人士的强大饮食补充。

2024 年,美国荞麦市场规模达到 1.214 亿美元,预计到 2034 年将以 3.1% 的复合年增长率成长。随着对无麸质、植物性和健康产品的需求不断增加,荞麦在该地区迅速流行起来。随着越来越多的消费者采用素食和纯素食饮食,荞麦因其多功能性和卓越的营养成分而成为主食。这种谷物在无麸质麵粉、麵条和各种零食生产中的作用进一步推动了其在美国市场的成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 健康与保健趋势

- 消费增加

- 产业陷阱与挑战

- 天气和气候状况

- 地理范围有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按来源,2021 年至 2034 年

- 主要趋势

- 有机的

- 传统的

第六章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 格罗特

- 麵粉

- 薄片

- 其他的

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 动物饲料

- 个人护理和化妆品

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Archer Daniels Midland Company (ADM)

- Birkett Mills

- Bob's Red Mill Natural Foods

- Bulk Barn Foods

- Galinta IR Partneriai

- Homestead Organics

- Krishna India

- Lee Kum Kee

- Minn-Dak Growers

- Ningxia Newfield Foods

- Skvyrskyi Grain Processing Factory

- UA Global

- Wilmar International

The Global Buckwheat Market, valued at USD 621.9 million in 2024, is expected to grow at a steady CAGR of 3.1% from 2025 to 2034. This growth is largely driven by the rising consumer awareness of buckwheat's impressive health benefits. The grain is known for being naturally gluten-free, which appeals to those with dietary restrictions, particularly individuals with celiac disease. Additionally, buckwheat is packed with essential nutrients, including high-quality protein, dietary fiber, B vitamins, and crucial minerals such as magnesium, which further bolsters its reputation as a healthful and versatile food option. As more people seek healthier, plant-based alternatives, the demand for buckwheat has surged. This trend aligns with the growing consumer preference for organic and gluten-free products, making it an ideal choice for individuals adopting cleaner, more health-conscious diets.

Buckwheat's nutritional profile positions it as a highly sought-after alternative for those looking to reduce chronic disease risks and manage their health more effectively. With its ability to be incorporated into a variety of products, such as flour, noodles, and snacks, buckwheat is increasingly found in consumer kitchens. The market's future growth is also supported by the ongoing trend toward sustainable and eco-friendly agriculture, as buckwheat is known for being relatively easy to grow and requiring fewer pesticides compared to other grains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $621.9 Million |

| Forecast Value | $838.1 Million |

| CAGR | 3.1% |

The conventional buckwheat segment has been the dominant player in the market, with a revenue of USD 457.7 million in 2024. It is expected to maintain a steady growth rate of 2.8% CAGR during the forecast period. Conventional buckwheat products are widely accessible and cost-effective, making them an attractive choice for consumers who are budget-conscious but still want to enjoy the benefits of this nutritious grain. These products offer a balance between affordability and health, ensuring their sustained demand across various markets globally.

In terms of product type, buckwheat groats generated USD 244.4 million in revenue in 2024, and this segment is projected to grow at a CAGR of 2.7% through 2034. Groats, known for their rich nutritional content, have gained substantial popularity among health-conscious consumers. They are recognized for their high protein and fiber content, along with their broad range of essential vitamins and minerals, making them a powerful dietary addition for those focused on nutrition.

The U.S. buckwheat market reached USD 121.4 million in 2024 and is forecast to grow at a CAGR of 3.1% through 2034. As demand for gluten-free, plant-based, and health-focused products increases, buckwheat is rapidly gaining popularity in this region. With more consumers adopting vegetarian and vegan diets, buckwheat is becoming a staple due to its versatility and remarkable nutritional profile. The grain's role in the production of gluten-free flour, noodles, and a variety of snacks has further propelled its growth in the U.S. market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Health and wellness trends

- 3.6.1.2 Increased consumption

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Weather and climate condition

- 3.6.2.2 Limited geographical range

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Source, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Organic

- 5.3 Conventional

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Groats

- 6.3 Flour

- 6.4 Flakes

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Animal feed

- 7.4 Personal care & cosmetics

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland Company (ADM)

- 9.2 Birkett Mills

- 9.3 Bob's Red Mill Natural Foods

- 9.4 Bulk Barn Foods

- 9.5 Galinta IR Partneriai

- 9.6 Homestead Organics

- 9.7 Krishna India

- 9.8 Lee Kum Kee

- 9.9 Minn-Dak Growers

- 9.10 Ningxia Newfield Foods

- 9.11 Skvyrskyi Grain Processing Factory

- 9.12 UA Global

- 9.13 Wilmar International