|

市场调查报告书

商品编码

1685152

可可豆衍生性商品市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Cocoa Bean Derivatives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

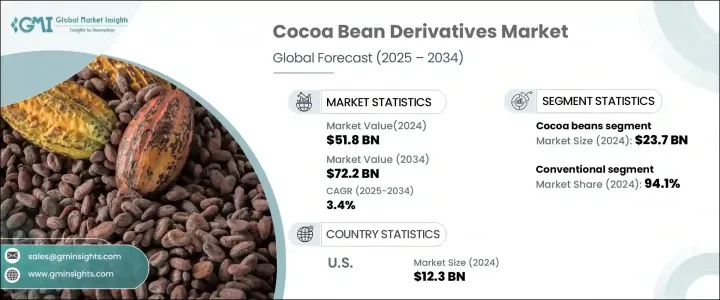

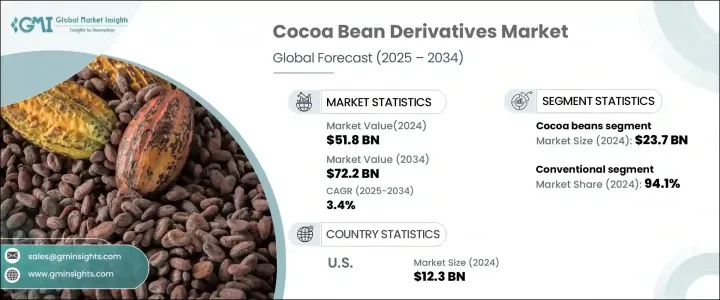

2024 年全球可可豆衍生性商品市场价值为 518 亿美元,并有望稳步扩张,预计 2025 年至 2034 年期间的复合年增长率为 3.4%。作为更广泛的可可产业的重要组成部分,该市场涵盖了在食品、饮料、化妆品和製药领域发挥重要作用的各种产品。可可衍生物因其浓郁的风味、营养价值和功能特性而受到广泛认可,多个行业的需求正在稳步增长。

可可製品的受欢迎程度不断飙升,这主要是由于消费者对优质巧克力、清洁标籤成分和符合道德标准的原材料的偏好日益增长。由于可可的高抗氧化剂含量和相关的健康益处,注重健康的消费者也推动了这一成长。同时,永续性议题和道德采购实践重塑了可可产业,企业也越来越关注透明的供应链和公平贸易措施。加工技术的进步进一步优化了生产效率,降低了成本,同时确保了最高的产品品质。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 518亿美元 |

| 预测值 | 722亿美元 |

| 复合年增长率 | 3.4% |

根据类型,可可豆衍生性商品市场包括可可脂、可可粉和其他基本衍生性商品。作为基本原料的可可豆在 2024 年创造 237 亿美元,成为市场上最有价值的部分。天气条件、作物产量和全球供需动态等各种因素都会影响可可豆的价值。可可脂以其柔滑的质地和浓郁的口感而闻名,占据了相当大的市场份额,尤其是在糖果和个人护理产品领域。

市场也分为有机和传统可可衍生物。 2024 年,传统产品占据了 94.1% 的主导份额,这主要归功于涉及合成肥料和农药的具有成本效益的生产方法。这些产品仍然广泛供应,满足大型食品製造商和巧克力製造商的需求。然而,随着消费者越来越倾向于永续、符合道德规范且无化学成分的替代品,有机可可衍生物正在获得发展动力。这种转变在高端巧克力品牌和健康食品製造商中尤其明显,他们对有机、非基因改造和公平贸易认证原料的需求持续成长。

2024 年美国可可豆衍生性商品市场规模将达到 123 亿美元,反映出受高品质巧克力和植物产品需求成长所推动的强劲成长。美国消费者越来越青睐富含黄酮类化合物、抗氧化剂和天然健康益处的可可製品。这一趋势不仅限于食品和饮料,可可脂和可可粉在化妆品和製药行业也越来越受欢迎。可可具有滋养皮肤和治疗功效,是护肤配方中备受追捧的成分,而药物应用则利用可可的生物活性化合物来获得各种健康益处。

随着消费者群体的不断扩大、健康意识的不断增强以及可可加工的不断创新,全球可可豆衍生物市场有望实现长期成长。随着品牌继续优先考虑永续性和优质产品,各行各业对高品质可可衍生物的需求将保持强劲。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 全球巧克力产品消费量不断成长

- 可可衍生物在非食品领域的应用日益广泛

- 製造技术的进步

- 产业陷阱与挑战

- 来自其他食品和饮料原料的竞争

- 可可豆价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 可可脂

- 可可粉

- 其他的

第六章:市场估计与预测:依类别,2021-2034 年

- 主要趋势

- 传统的

- 有机的

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 个人护理

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Barry Callebaut

- Cargill

- CEMOI

- Cocoa Touton

- ECOM Agroindustrial

- Ecuakao Group

- Ferrero

- Indcre

- JB Foods

- Mondelez International

- Moner Cocoa

- Natra

- Nestlé

- Olam Group

- United Cocoa Processor

The Global Cocoa Bean Derivatives Market, valued at USD 51.8 billion in 2024, is on track for steady expansion, projected to grow at a CAGR of 3.4% between 2025 and 2034. As a critical component of the broader cocoa industry, this market encompasses various products that play a fundamental role in the food, beverage, cosmetics, and pharmaceutical sectors. With cocoa derivatives widely recognized for their rich flavor, nutritional benefits, and functional properties, demand is steadily increasing across multiple industries.

Cocoa-based products have witnessed a surge in popularity, largely driven by growing consumer preference for premium-quality chocolates, clean-label ingredients, and ethically sourced raw materials. Health-conscious consumers are also fueling this growth, given cocoa's high antioxidant content and associated wellness benefits. Meanwhile, sustainability concerns and ethical sourcing practices have reshaped the cocoa industry, with businesses increasingly focusing on transparent supply chains and fair-trade initiatives. Advances in processing technologies have further optimized production efficiency, reducing costs while ensuring the highest product quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $51.8 Billion |

| Forecast Value | $72.2 Billion |

| CAGR | 3.4% |

By type, the cocoa bean derivatives market includes cocoa butter, cocoa powder, and other essential derivatives. Cocoa beans, the fundamental raw material, generated USD 23.7 billion in 2024, making them the most valuable segment of the market. Various factors, including weather conditions, crop yields, and global supply-demand dynamics, influence the value of cocoa beans. Cocoa butter, renowned for its smooth texture and rich taste, commands a substantial market share, particularly in confectionery and personal care products.

The market is also segmented into organic and conventional cocoa derivatives. Conventional products accounted for a dominant 94.1% share in 2024, primarily due to cost-effective production methods involving synthetic fertilizers and pesticides. These products remain widely available, meeting the needs of large-scale food manufacturers and chocolatiers. However, organic cocoa derivatives are gaining momentum as consumers increasingly gravitate toward sustainable, ethically sourced, and chemical-free alternatives. This shift is especially evident among premium chocolate brands and wellness-oriented food manufacturers, where demand for organic, non-GMO, and fair-trade certified ingredients continues to grow.

The U.S. cocoa bean derivatives market stood at USD 12.3 billion in 2024, reflecting robust growth driven by heightened demand for high-quality chocolate and plant-based products. Consumers in the U.S. are increasingly favoring cocoa-based items rich in flavonoids, antioxidants, and natural health benefits. This trend extends beyond food and beverages, with cocoa butter and cocoa powder gaining traction in the cosmetics and pharmaceutical industries. Their skin-nourishing and therapeutic properties make them sought-after ingredients in skincare formulations, while pharmaceutical applications leverage cocoa's bioactive compounds for various health benefits.

With an expanding consumer base, rising health consciousness, and ongoing innovation in cocoa processing, the global cocoa bean derivatives market is positioned for long-term growth. As brands continue to prioritize sustainability and premium product offerings, demand for high-quality cocoa derivatives will remain strong across diverse industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 The growing global consumption of chocolate products

- 3.6.1.2 Growing adoption of cocoa derivatives in non-food applications

- 3.6.1.3 Advancements in manufacturing technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Competition from other food and beverage ingredients

- 3.6.2.2 Fluctuating cocoa bean prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cocoa butter

- 5.3 Cocoa powder

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Category, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conventional

- 6.3 Organic

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.3 Personal care

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Barry Callebaut

- 9.2 Cargill

- 9.3 CEMOI

- 9.4 Cocoa Touton

- 9.5 ECOM Agroindustrial

- 9.6 Ecuakao Group

- 9.7 Ferrero

- 9.8 Indcre

- 9.9 JB Foods

- 9.10 Mondelez International

- 9.11 Moner Cocoa

- 9.12 Natra

- 9.13 Nestlé

- 9.14 Olam Group

- 9.15 United Cocoa Processor