|

市场调查报告书

商品编码

1685219

麦芽糊精市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Maltodextrin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

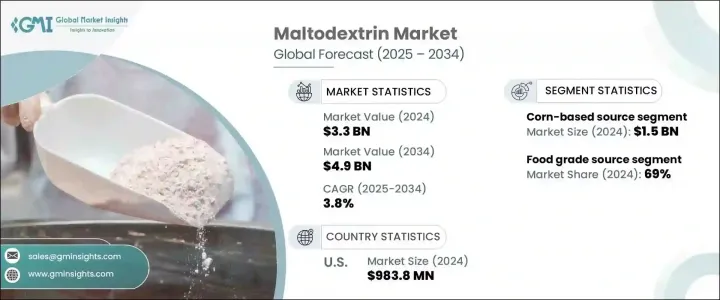

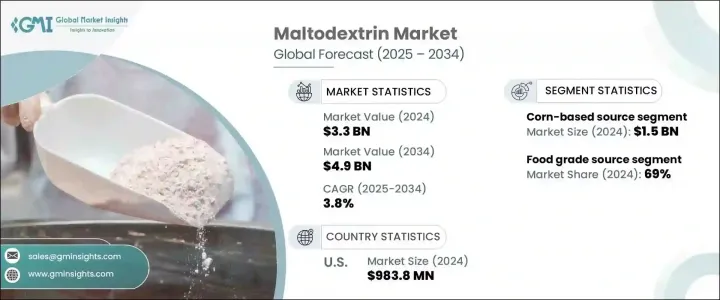

2024 年全球麦芽糊精市场价值为 33 亿美元,预计将在 2025 年至 2034 年期间以 3.8% 的复合年增长率强劲增长。麦芽糊精在食品和饮料、製药和化妆品等各行业有着广泛而多样的应用,因此对麦芽糊精的需求正在激增。特别是食品和饮料行业仍然是市场扩张的主要驱动力,因为麦芽糊精被广泛用作加工食品中的填充剂、增稠剂和稳定剂。随着消费者对方便食品和功能性成分的偏好日益增加,麦芽糊精的需求预计将稳定上升。为了满足不断变化的消费者需求(包括更健康、更便利的选择),产品开发的创新进一步推动了这一成长。随着全球麦芽糊精市场继续丰富其产品供应,各行各业都在利用其成本效益和功能优势,确保未来十年的持续成长。

麦芽糊精市场分为各种来源,包括玉米、马铃薯、木薯、小麦等。玉米麦芽糊精是主要细分市场,2024 年其产值为 15 亿美元,预计到 2034 年将达到 21 亿美元。玉米麦芽糊精的广泛可用性、价格实惠性和多功能性使其成为食品和饮料製造商的首选。同时,小麦麦芽糊精也占据了相当大的市场份额,因其功能特性和在众多行业的适应性而受到青睐。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 49亿美元 |

| 复合年增长率 | 3.8% |

就产品等级而言,麦芽糊精市场分为医药级、食品级及工业级。食品级麦芽糊精将在 2024 年占据 69% 的市场份额,占据市场主导地位,这主要归功于其在增稠、稳定和膨胀各种食品方面的作用。它能够改善质地并延长保质期,这使得它在加工食品中不可或缺。药用级麦芽糊精虽然份额较小,但它作为药片和胶囊生产中的填充剂和粘合剂至关重要,有助于市场稳定成长。

美国麦芽糊精市场价值 2024 年为 9.838 亿美元,在全球市场仍占有重要地位。美国蓬勃发展的食品加工产业,加上麦芽糊精作为多功能添加剂的广泛使用,确保了美国仍然占据主导地位。此外,美国製药业持续推动稳定的需求,进一步推动成长。麦芽糊精配方的技术进步和创新有望满足消费者对功能性、便利性和健康意识食品日益增长的需求,从而进一步推动区域市场的发展。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 食品饮料产业需求不断成长

- 健康意识不断增强

- 扩大在药品和化妆品领域的应用

- 产业陷阱与挑战

- 健康问题和看法

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:按来源,2021-2034 年

- 主要趋势

- 玉米基

- 小麦基

- 马铃薯为主

- 木薯为主

- 其他的

第六章:市场规模及预测:依等级,2021-2034 年

- 主要趋势

- 食品级

- 医药级

- 工业级

第 7 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 食品和饮料

- 烘焙食品

- 糖果

- 乳製品

- 饮料

- 方便食品

- 其他的

- 药品

- 药物製剂中的赋形剂

- 营养补充品

- 化妆品和个人护理

- 保养产品

- 护髮产品

- 工业应用

- 黏合剂

- 黏合剂

- 涂层和封装

- 其他的

- 动物饲料

- 发酵过程

第 8 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AGRANA Group

- Archer Daniels Midland

- Avebe

- Cargill

- Golden Grain Group

- Grain Processing Corporation

- Gulshan Polyols

- Ingredion

- Matsutani America

- Mengzhou Tailijie

- Roquette Frères

- Tate & Lyle

- Zhucheng Dongxiao Biotechnology

The Global Maltodextrin Market, valued at USD 3.3 billion in 2024, is set to experience robust growth at a CAGR of 3.8% from 2025 to 2034. The demand for maltodextrin is surging due to its broad and versatile applications across various industries, such as food and beverage, pharmaceuticals, and cosmetics. In particular, the food and beverage industry remains the primary driver of market expansion, as maltodextrin is widely used as a filler, thickener, and stabilizer in processed foods. With the increasing consumer preference for convenience foods and functional ingredients, the demand for maltodextrin is expected to rise steadily. This growth is further fueled by the innovation in product development to meet evolving consumer needs, including healthier, on-the-go options. As the global maltodextrin market continues to diversify its product offerings, industries are capitalizing on its cost-effectiveness and functional benefits, ensuring sustained growth well into the next decade.

The maltodextrin market is divided into various sources, including corn, potato, cassava, wheat, and others. Corn-based maltodextrin, the leading segment, generated USD 1.5 billion in 2024 and is projected to reach USD 2.1 billion by 2034. The widespread availability, affordability, and multifunctionality of corn-based maltodextrin make it the go-to choice for food and beverage manufacturers. Meanwhile, wheat-based maltodextrin also maintains a significant share in the market, prized for its functional qualities and adaptability across numerous industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 3.8% |

In terms of product grade, the maltodextrin market is segmented into pharmaceutical grade, food grade, and industrial grade. Food-grade maltodextrin dominates the market with a 69% share in 2024, largely due to its role in thickening, stabilizing, and bulking various food products. Its ability to improve texture and enhance shelf life makes it indispensable in processed foods. Pharmaceutical-grade maltodextrin, while a smaller segment, is crucial as a filler and binder in the production of medical tablets and capsules, contributing to the market's steady growth.

The U.S. maltodextrin market, valued at USD 983.8 million in 2024, remains a major player in the global landscape. The country's thriving food processing industry, coupled with the widespread use of maltodextrin as a multifunctional additive, ensures the U.S. remains a dominant market. Additionally, the pharmaceutical industry in the U.S. continues to drive consistent demand, further fueling growth. Technological advancements and innovations in maltodextrin formulations are expected to meet the growing consumer demand for functional, convenient, and health-conscious food products, boosting the regional market even further.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand in food and beverage industry

- 3.6.1.2 Rising health consciousness

- 3.6.1.3 Expanding applications in pharmaceuticals and cosmetics

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Health concerns and perception

- 3.6.2.2 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Corn-based

- 5.3 Wheat-based

- 5.4 Potato-based

- 5.5 Cassava-based

- 5.6 Others

Chapter 6 Market Size and Forecast, By Grade, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food grade

- 6.3 Pharmaceutical grade

- 6.4 Industrial grade

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.2.1 Baked goods

- 7.2.2 Confectionery

- 7.2.3 Dairy products

- 7.2.4 Beverages

- 7.2.5 Convenience foods

- 7.2.6 Others

- 7.3 Pharmaceuticals

- 7.3.1 Excipient in drug formulations

- 7.3.2 Nutritional supplements

- 7.4 Cosmetics and personal care

- 7.4.1 Skincare products

- 7.4.2 Haircare products

- 7.5 Industrial applications

- 7.5.1 Adhesives

- 7.5.2 Binders

- 7.5.3 Coating and encapsulation

- 7.6 Others

- 7.6.1 Animal feed

- 7.6.2 Fermentation processes

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AGRANA Group

- 9.2 Archer Daniels Midland

- 9.3 Avebe

- 9.4 Cargill

- 9.5 Golden Grain Group

- 9.6 Grain Processing Corporation

- 9.7 Gulshan Polyols

- 9.8 Ingredion

- 9.9 Matsutani America

- 9.10 Mengzhou Tailijie

- 9.11 Roquette Frères

- 9.12 Tate & Lyle

- 9.13 Zhucheng Dongxiao Biotechnology