|

市场调查报告书

商品编码

1698235

PEM 燃料电池市场机会、成长动力、产业趋势分析及 2025-2034 年预测PEM Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

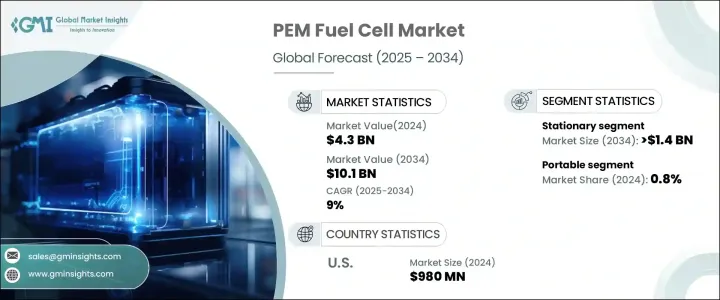

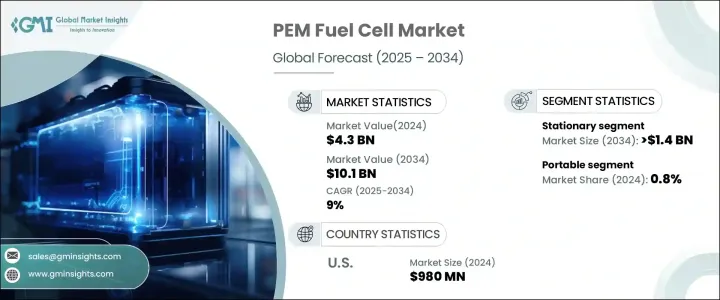

2024 年全球 PEM 燃料电池市场规模达到 43 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 9%。对再生能源的日益重视,加上对低排放和高效电源的需求不断增长,正在加速质子交换膜 (PEM) 燃料电池的采用。这些燃料电池具有多种优势,包括卓越的能量转换效率、减少的环境影响和快速的启动时间,使其成为各种应用的理想选择。随着全球各行各业寻求更清洁、更永续的能源替代品,它们越来越多地转向 PEM 燃料电池。政府和私人实体正在大力投资研发(R&D),以提高这些燃料电池的性能和可负担性,进一步推动市场扩张。

向清洁能源解决方案的转变在发电、运输和消费电子等多个行业都有所体现。交通电气化正在推动对氢燃料电池技术的大量投资,其中 PEM 燃料电池在推动零排放汽车发展方面发挥关键作用。美国、德国、中国和日本等拥有雄心勃勃的碳中和目标的国家正在实施政策和激励措施,以加速部署氢动力解决方案。此外,氢气生产和燃料电池基础设施的不断进步使得 PEM 技术更适合大规模应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 43亿美元 |

| 预测值 | 101亿美元 |

| 复合年增长率 | 9% |

预计到 2034 年,PEM 燃料电池市场的固定部分将达到 14 亿美元,这得益于其高效率、低排放以及在离网地区提供可靠电力的能力。工业设施、商业建筑以及传统电网接入有限的偏远地区越来越多地采用 PEM 燃料电池作为永续能源解决方案。这些燃料电池能够以最小的环境影响产生清洁电力,使其成为备用电源系统和分散式能源发电的首选。随着企业和政府越来越关注永续发展,对固定式质子交换膜燃料电池的需求预计将激增,为产业参与者创造新的成长机会。

便携式市场虽然规模较小,但也正在经历显着的成长。 2024年约占0.8%的市占率。随着对紧凑、高效和环保电源的需求不断增长,PEM 燃料电池在智慧型手机、笔记型电脑、无人机和医疗设备等消费性电子产品中越来越受欢迎。旨在提高燃料电池的效率、稳定性和寿命的技术创新使其在便携式应用中越来越有吸引力。

2024 年,美国 PEM 燃料电池市场产值达 9.8 亿美元,其中北美占了 24% 的市场份额。政府措施、激励措施和资助计画在促进氢能技术发展方面发挥着至关重要的作用。旨在实现减排目标的支援政策正在加速燃料电池在从汽车到固定发电等多个行业的部署。氢能基础设施的持续发展,加上私营部门投资的增加,预计将进一步巩固北美作为 PEM 燃料电池技术关键市场的地位。

目录

第一章:方法论与范围

- 研究设计

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:PEM燃料电池产业洞察

- 产业生态系统分析

- 供应商矩阵

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:PEM 燃料电池市场:依应用划分,2021 年至 2034 年

- 主要趋势

- 固定式

- 便携的

- 运输

第六章:PEM 燃料电池市场:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 奥地利

- 亚太地区

- 日本

- 韩国

- 中国

- 印度

- 菲律宾

- 越南

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 拉丁美洲

- 巴西

- 秘鲁

- 墨西哥

第七章:公司简介

- Cummins

- Ballard Power Systems

- Plug Power

- Nuvera Fuel Cells

- Nedstack Fuel Cell Technology

- Panasonic Corporation

- Doosan Fuel Cell

- SFC Energy

- Robert Bosch

- TW Horizon Fuel Cell Technologies

- Air Liquide Energies

- Hyundai Motor Company

The Global PEM Fuel Cell Market reached USD 4.3 billion in 2024 and is expected to expand at a CAGR of 9% between 2025 and 2034. The growing emphasis on renewable energy, coupled with the rising demand for low-emission and high-efficiency power sources, is accelerating the adoption of proton exchange membrane (PEM) fuel cells. These fuel cells offer several advantages, including superior energy conversion efficiency, reduced environmental impact, and fast start-up times, making them an ideal choice for various applications. Industries worldwide are increasingly turning to PEM fuel cells as they seek cleaner and more sustainable energy alternatives. Governments and private entities are investing heavily in research and development (R&D) to enhance the performance and affordability of these fuel cells, further fueling market expansion.

The shift toward clean energy solutions is evident across multiple industries, including power generation, transportation, and consumer electronics. The electrification of transport is driving substantial investments in hydrogen fuel cell technology, with PEM fuel cells playing a critical role in advancing zero-emission vehicles. Countries with ambitious carbon neutrality goals, such as the United States, Germany, China, and Japan, are implementing policies and incentives to accelerate the deployment of hydrogen-powered solutions. Additionally, ongoing advancements in hydrogen production and fuel cell infrastructure are making PEM technology more viable for large-scale adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 9% |

The stationary segment of the PEM fuel cell market is projected to reach USD 1.4 billion by 2034, driven by its high efficiency, low emissions, and ability to provide reliable power in off-grid locations. Industrial facilities, commercial buildings, and remote areas with limited access to traditional power grids are increasingly adopting PEM fuel cells as a sustainable energy solution. The ability of these fuel cells to generate clean electricity with minimal environmental impact makes them a preferred choice for backup power systems and distributed energy generation. As corporations and governments intensify their focus on sustainability, the demand for stationary PEM fuel cells is expected to surge, creating new growth opportunities for industry players.

The portable segment, although smaller in size, is experiencing notable growth as well. In 2024, it accounted for approximately 0.8% of the market share. With the rising demand for compact, efficient, and eco-friendly power sources, PEM fuel cells are gaining traction in consumer electronics, including smartphones, laptops, drones, and medical devices. Technological innovations aimed at enhancing the efficiency, stability, and longevity of these fuel cells are making them increasingly attractive for portable applications.

The United States PEM Fuel Cell Market generated USD 980 million in 2024, while North America captured a significant 24% market share. Government initiatives, incentives, and funding programs are playing a crucial role in fostering the growth of hydrogen-based technologies. Supportive policies aimed at achieving emission reduction targets are accelerating the deployment of fuel cells across multiple industries, from automotive to stationary power generation. The ongoing development of hydrogen infrastructure, combined with increasing private sector investments, is expected to further strengthen North America's position as a key market for PEM fuel cell technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 PEM Fuel Cell Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Vendor matrix

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 PEM Fuel Cell Market, By Application, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Stationary

- 5.3 Portable

- 5.4 Transport

Chapter 6 PEM Fuel Cell Market, By Region, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Austria

- 6.4 Asia Pacific

- 6.4.1 Japan

- 6.4.2 South Korea

- 6.4.3 China

- 6.4.4 India

- 6.4.5 Philippines

- 6.4.6 Vietnam

- 6.5 Middle East & Africa

- 6.5.1 South Africa

- 6.5.2 Saudi Arabia

- 6.5.3 UAE

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Peru

- 6.6.3 Mexico

Chapter 7 Company Profiles

- 7.1 Cummins

- 7.2 Ballard Power Systems

- 7.3 Plug Power

- 7.4 Nuvera Fuel Cells

- 7.5 Nedstack Fuel Cell Technology

- 7.6 Panasonic Corporation

- 7.7 Doosan Fuel Cell

- 7.8 SFC Energy

- 7.9 Robert Bosch

- 7.10 TW Horizon Fuel Cell Technologies

- 7.11 Air Liquide Energies

- 7.12 Hyundai Motor Company