|

市场调查报告书

商品编码

1698261

汽车HUD(抬头显示器)市场机会、成长动力、产业趋势分析及2025-2034年预测Automotive HUD (Head-up Displays) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

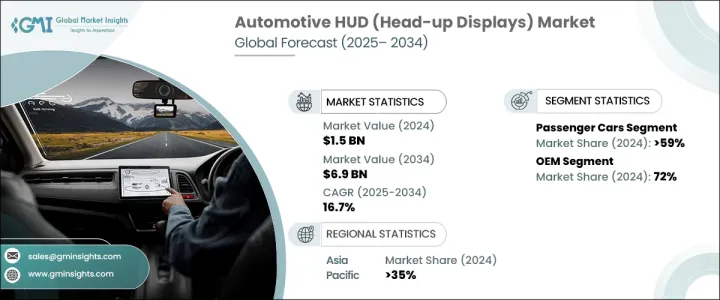

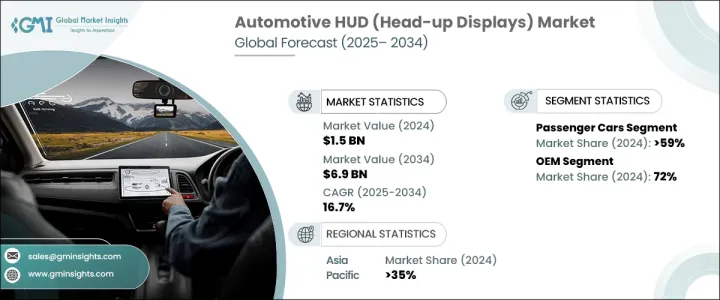

2024 年全球汽车 HUD 市场规模达到 15 亿美元,预计 2025 年至 2034 年的复合年增长率为 16.7%。电动和自动驾驶汽车的需求不断增长是这一扩张的主要驱动力。在电动车中,HUD 允许驾驶员监控电池状态、充电水平和预计行驶里程等基本细节,从而增强驾驶体验。在自动驾驶汽车中,这些系统是显示导航、车辆状态和自主程度的组成部分,从而实现乘客和车辆之间的无缝互动。随着电动车和自动驾驶汽车成为主流,HUD 正在从可选功能转变为安全和便利的必备组件。扩增实境和全息显示器等先进技术正在重塑行业,使 HUD 更具互动性和用户友好性。扩增实境 HUD 透过将导航和即时路况迭加到挡风玻璃上来减少驾驶者的干扰。与先进驾驶辅助系统(ADAS) 的整合提高了显示清晰度,确保准确、即时的讯息传递。

根据车辆类型,市场分为乘用车、商用车和非公路用车。 2024年,乘用车占59%的市场份额,价值超过8.5亿美元。高端和中檔乘用车越来越多地整合HUD以提高安全性和驾驶舒适度。这些系统提供有关速度、导航和危险警告的即时资料,让驾驶者随时了解情况,同时又不会分散对道路的注意力。随着 ADAS 的普及,HUD 对于车道维持辅助、自适应巡航控制和碰撞警告变得至关重要。预计到 2034 年,ADAS 市场本身将达到 2,122 亿美元,凸显驾驶辅助技术日益增长的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 69亿美元 |

| 复合年增长率 | 16.7% |

市场按销售管道细分为OEM和售后市场,其中 OEM 将在 2024 年占据 72% 的市场份额。汽车製造商会根据价格和客户需求,将 HUD 作为其车型的标准或可选功能。许多消费者更喜欢工厂安装的 HUD,因为它们可以与车载导航、气候控制和娱乐系统无缝整合。 OEM安装的 HUD 还提供保固和长期支持,从而增强买家信心。这些系统专为特定车型打造,确保高相容性和可靠性,使其成为售后替代品的首选。

按技术划分,市场包括传统 HUD、扩增实境 HUD 和全像 HUD,其中扩增实境 HUD 将在 2024 年引领该领域。这些系统将导航和警告等关键资料直接投射到挡风玻璃上,使驾驶者能够专注于道路。较低的製造成本和技术进步使得 AR HUD 更加普及,其应用范围已扩展到豪华车之外。

市场根据显示类型进一步分为挡风玻璃 HUD 和组合式 HUD,其中挡风玻璃 HUD 将在 2024 年占据领先地位。这些系统将资讯直接投射到挡风玻璃上,确保在所有光照条件下都能清晰可见。雷射投影和 OLED 技术等创新显着提高了显示清晰度,使挡风玻璃 HUD 成为首选。

亚太地区占有最大份额,超过 35%,其中中国将以 2024 年 1.292 亿美元的规模领先区域市场。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 零件供应商

- 技术提供者和软体开发商

- 云端服务供应商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 价格趋势

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 电动和自动驾驶汽车的成长

- 更加重视车辆安全

- HUD 系统的技术进步

- 消费者对增强车载使用者体验的需求

- 产业陷阱与挑战

- 技术限制和显示清晰度问题

- 相容性和标准化问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- 轻型商用车

- 平均血红素

- 丙型肝炎病毒

- 越野车

第六章:市场估计与预测:按显示类型,2021 - 2034 年

- 主要趋势

- 挡风玻璃抬头显示

- 组合式HUD

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 传统HUD

- 扩增实境HUD

- 全息HUD

第八章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 显示面板

- 投影机单元

- 感应器

- 其他的

- 软体

第九章:市场预估与预测:依显示器尺寸,2021 - 2034 年

- 主要趋势

- 小尺寸显示器(<5吋)

- 中型显示器(5-10吋)

- 大尺寸显示器(> 10吋)

第 10 章:市场估计与预测:按销售管道,2021 年至 2034 年

- 主要趋势

- OEM

- 售后市场

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十二章:公司简介

- BAE Systems

- BMW

- Continental

- CY Vision

- Denso

- Foryou

- Garmin

- Harman International

- Huawei

- Hudway

- Hyundai Mobis

- JVCKENWOOD

- Kyocera

- LG Electronics

- Nippon Seiki

- Panasonic

- Valeo

- Visteon

- WayRay

- YAZAKI

The Global Automotive HUD Market reached USD 1.5 billion in 2024 and is projected to grow at a CAGR of 16.7% from 2025 to 2034. Increasing demand for electric and autonomous vehicles is a major driver of this expansion. In electric vehicles, HUDs allow drivers to monitor essential details like battery status, charge levels, and estimated driving range, enhancing the driving experience. In autonomous vehicles, these systems are integral for displaying navigation, vehicle status, and autonomy levels, creating a seamless interaction between passengers and the vehicle. As EVs and autonomous vehicles become mainstream, HUDs are transitioning from optional features to essential components for safety and convenience. Advanced technologies like augmented reality and holographic displays are reshaping the industry, making HUDs more interactive and user-friendly. Augmented reality HUDs reduce driver distractions by overlaying navigation and real-time road conditions onto the windshield. Integration with advanced driver assistance systems (ADAS) enhances display clarity, ensuring accurate and real-time information relay.

The market is categorized based on vehicle type into passenger cars, commercial vehicles, and off-highway vehicles. In 2024, passenger cars held a 59% market share, valued at over USD 850 million. Premium and mid-range passenger vehicles are increasingly integrating HUDs to enhance safety and driving comfort. These systems provide real-time data on speed, navigation, and hazard warnings, keeping drivers informed without diverting their attention from the road. With the rise of ADAS adoption, HUDs are becoming essential for lane-keeping assistance, adaptive cruise control, and collision warnings. The ADAS market itself is expected to reach USD 212.2 billion by 2034, highlighting the growing significance of driver assistance technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 16.7% |

The market is segmented by sales channel into OEM and aftermarket, with OEMs dominating at 72% market share in 2024. Automakers are incorporating HUDs as standard or optional features in their models, depending on price and customer demand. Many consumers prefer factory-installed HUDs due to their seamless integration with onboard navigation, climate control, and entertainment systems. OEM-installed HUDs also offer warranties and long-term support, increasing buyer confidence. These systems are built for specific vehicle models, ensuring high compatibility and reliability, which makes them a preferred choice over aftermarket alternatives.

By technology, the market includes conventional HUDs, augmented reality HUDs, and holographic HUDs, with augmented reality HUDs leading the segment in 2024. These systems project critical data, such as navigation and warnings, directly onto the windshield, allowing drivers to stay focused on the road. Lower manufacturing costs and technological advancements have made AR HUDs more accessible, extending their reach beyond luxury vehicles.

The market is further divided by display type into windshield HUDs and combiner HUDs, with windshield HUDs leading in 2024. These systems directly project information onto the windshield glass, ensuring clear visibility under all lighting conditions. Innovations like laser projection and OLED technology have significantly improved display clarity, making windshield HUDs the preferred option.

Asia Pacific holds the largest share of over 35%, with China leading the regional market at USD 129.2 million in 2024.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Technology providers & software developers

- 3.2.3 Cloud service providers

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Price trend

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growth of electric & autonomous vehicles

- 3.9.1.2 Increasing focus on vehicle safety

- 3.9.1.3 Technological advancements in HUD systems

- 3.9.1.4 Consumer demand for enhanced in-vehicle user experience

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Technical limitations and display clarity issues

- 3.9.2.2 Compatibility and standardization issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedan

- 5.2.2 SUV

- 5.2.3 Hatchback

- 5.3 Commercial vehicle

- 5.3.1 LCV

- 5.3.2 MCV

- 5.3.3 HCV

- 5.4 Off highway vehicle

Chapter 6 Market Estimates & Forecast, By Display Type, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Windshield HUD

- 6.3 Combiner HUD

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Conventional HUD

- 7.3 Augmented reality HUD

- 7.4 Holographic HUD

Chapter 8 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Hardware

- 8.2.1 Display panel

- 8.2.2 Projector unit

- 8.2.3 Sensors

- 8.2.4 Others

- 8.3 Software

Chapter 9 Market Estimates & Forecast, By Display Size, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Small-sized display (< 5 inches)

- 9.3 Medium-sized display (5-10 inches)

- 9.4 Large-sized display (> 10 inches)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 BAE Systems

- 12.2 BMW

- 12.3 Continental

- 12.4 CY Vision

- 12.5 Denso

- 12.6 Foryou

- 12.7 Garmin

- 12.8 Harman International

- 12.9 Huawei

- 12.10 Hudway

- 12.11 Hyundai Mobis

- 12.12 JVCKENWOOD

- 12.13 Kyocera

- 12.14 LG Electronics

- 12.15 Nippon Seiki

- 12.16 Panasonic

- 12.17 Valeo

- 12.18 Visteon

- 12.19 WayRay

- 12.20 YAZAKI