|

市场调查报告书

商品编码

1698274

石油和天然气资料管理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Oil and Gas Data Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

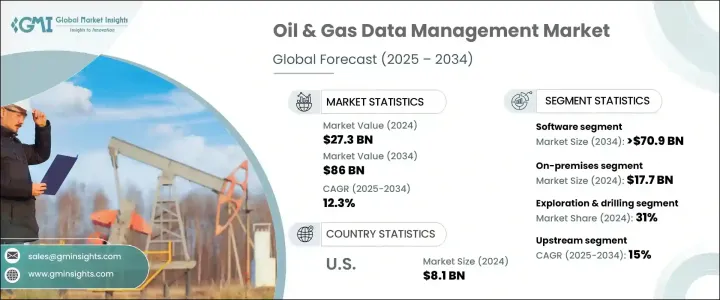

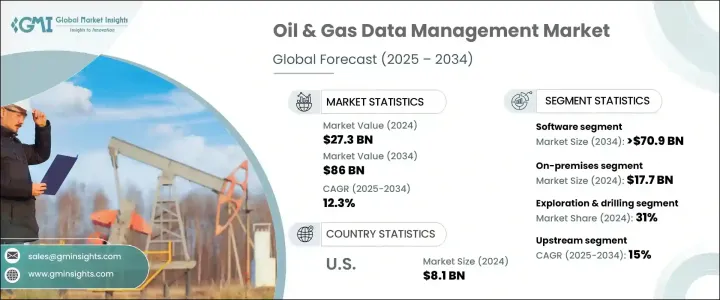

2024 年全球石油和天然气数据管理市场估值达 273 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 12.3%。业界对人工智慧、巨量资料和云端运算的快速应用正在提高效率、优化资产追踪并减少停机时间。随着公司努力加强运营,对资料管理解决方案的需求正在激增。世界各地的严格法规强化了高效资料管理的必要性,确保遵守环境政策和安全标准,同时避免法律纠纷。

各国政府正在加强有关排放、营运安全和资源利用的监管,迫使石油和天然气公司实施先进的资料报告和治理解决方案。作为回应,各组织正在整合复杂的软体来追踪排放、监控资产并遵守不断发展的行业标准。随着数位转型,网路威胁的风险不断升级,促使企业投资强大的安全框架。加密、多层身份验证和即时威胁检测现在是资料管理系统中必不可少的功能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 273亿美元 |

| 预测值 | 860亿美元 |

| 复合年增长率 | 12.3% |

软体解决方案在石油和天然气资料管理市场占据主导地位,2024 年的市占率超过 67%,预计到 2034 年将超过 709 亿美元。人工智慧、机器学习和巨量资料分析越来越多地被部署来处理大型资料集,从而实现预测性维护、即时监控和增强决策能力。公司也正在转向基于云端和物联网的平台,确保跨多个地点的远端存取和无缝资料交换。云端技术提供经济高效且安全的资料存储,而物联网感测器提供即时营运洞察,进一步提高效率。

内部部署持续占据市场主导地位,到 2024 年将达到 177 亿美元。石油和天然气行业处理高度敏感的资料,包括地质报告、钻井分析和生产预测。组织优先考虑内部部署解决方案,以严格控制专有讯息,确保遵守法规并最大限度地降低网路安全风险。许多政府执行资料主权法,进一步推动了对内部部署基础设施的偏好。此外,离岸业务依赖在地化资料储存来确保在网路连线有限的情况下也能不间断地进行处理。

勘探和钻井仍然是石油和天然气资料管理的关键应用,到 2024 年将占据 31% 的市场份额。这些过程会产生大量的地质和地震资料,因此需要先进的管理解决方案来优化钻井精度并最大限度地降低风险。人们越来越重视高效的资源开采,这推动了对人工智慧资料建模的投资,使公司能够改善决策并减少营运的不确定性。随着全球能源需求的成长,企业正在加强勘探力度,从而推动对高效能资料管理技术的需求。

上游产业引领产业采用资料管理解决方案,预计到 2034 年将以 15% 的复合年增长率成长。勘探、钻井和生产活动会产生大量资料集,需要进行复杂的分析才能提高效率和碳氢化合物回收率。石油和天然气公司正在增加对勘探和生产的支出,需要使用数位工具进行地质测绘、油藏监测和钻井优化。人工智慧、物联网和巨量资料分析等技术在即时追踪、预测性维护和整体营运效率方面发挥着至关重要的作用。

北美占据全球石油和天然气资料管理市场的最大份额,到 2024 年将占 34%,其中美国的收入为 81 亿美元。该地区在将人工智慧、物联网和云端解决方案融入石油和天然气工作流程方面处于领先地位。监管机构执行严格的合规要求,迫使公司采用先进的资料管理系统进行排放追踪、安全监控和风险缓解。随着数位转型的加速,高效的资料管理对于优化整个产业的物流、仓储和运输营运仍然至关重要。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 软体供应商

- 云端提供者

- 技术提供者

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 石油天然气产业数位转型日益深入

- 越来越多地采用基于云端的解决方案

- 对预测分析和人工智慧的需求不断增长

- 严格的监管和环境合规性

- 对能源效率和成本优化的需求不断增长

- 产业陷阱与挑战

- 实施成本高且遗留系统集成

- 网路安全风险与资料隐私问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按解决方案,2021 - 2034 年

- 主要趋势

- 软体

- 数据分析与视觉化

- 数据集成

- 主资料管理

- 元资料管理

- 其他的

- 服务

- 咨询与规划

- 整合与实施

- 支援与维护

第六章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 探勘与钻探

- 生产优化

- 精炼和加工

- 运输和储存

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 上游

- 中游

- 下游

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Argus Media

- AVEVA Group

- Baker Hughes Company

- Cognite

- Emerson Electric

- Halliburton Energy Services

- Honeywell International

- IBM

- IMS PEI

- Infosys

- NetApp

- Oracle

- P2 Energy Solutions

- Quorum Business Solutions

- Rystad Energy

- SAP SE

- Schlumberger

- Teradata

- TGS-NOPEC Geophysical Company

- Wood Mackenzie

The Global Oil And Gas Data Management Market reached a valuation of USD 27.3 billion in 2024 and is projected to expand at a CAGR of 12.3% from 2025 to 2034. The rapid adoption of AI, big data, and cloud computing in the industry is driving efficiency, optimizing asset tracking, and reducing downtime. As companies strive to enhance operations, demand for data management solutions is surging. Stringent regulations worldwide are reinforcing the need for efficient data management, ensuring compliance with environmental policies and safety standards while preventing legal complications.

Governments are tightening regulations around emissions, operational safety, and resource utilization, compelling oil and gas companies to implement advanced data reporting and governance solutions. In response, organizations are integrating sophisticated software to track emissions, monitor assets, and comply with evolving industry standards. The risk of cyber threats continues to escalate with digital transformation, prompting companies to invest in robust security frameworks. Encryption, multi-layer authentication, and real-time threat detection are now essential features in data management systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.3 Billion |

| Forecast Value | $86 Billion |

| CAGR | 12.3% |

Software solutions dominate the oil and gas data management market, holding a market share exceeding 67% in 2024, and are expected to surpass USD 70.9 billion by 2034. AI, machine learning, and big data analytics are increasingly being deployed to process large datasets, allowing predictive maintenance, real-time monitoring, and enhanced decision-making. Companies are also shifting towards cloud-based and IoT-enabled platforms, ensuring remote access and seamless data exchange across multiple locations. Cloud technology provides cost-effective and secure data storage, while IoT sensors offer real-time operational insights, further improving efficiency.

On-premises deployment continues to dominate the market, accounting for USD 17.7 billion in 2024. The oil and gas industry handles highly sensitive data, including geological reports, drilling analytics, and production forecasts. Organizations prioritize on-premises solutions to maintain strict control over proprietary information, ensuring regulatory compliance and minimizing cybersecurity risks. Many governments enforce data sovereignty laws, further driving the preference for on-premises infrastructure. Additionally, offshore operations rely on localized data storage to ensure uninterrupted processing despite limited internet connectivity.

Exploration and drilling remain critical applications within oil and gas data management, holding a 31% market share in 2024. These processes generate vast amounts of geological and seismic data, necessitating advanced management solutions to optimize drilling accuracy and minimize risks. The growing emphasis on efficient resource extraction has driven investments in AI-powered data modeling, enabling companies to improve decision-making and reduce operational uncertainties. As global energy demand rises, firms are intensifying exploration efforts, fueling the need for high-performance data management technologies.

The upstream sector leads the industry's adoption of data management solutions and is projected to grow at a CAGR of 15% through 2034. Exploration, drilling, and production activities generate extensive datasets that require sophisticated analytics for enhanced efficiency and hydrocarbon recovery. Oil and gas companies are ramping up spending on exploration and production, necessitating digital tools for geological mapping, reservoir monitoring, and drilling optimization. Technologies such as AI, IoT, and big data analytics play a crucial role in real-time tracking, predictive maintenance, and overall operational efficiency.

North America holds the largest share of the global oil and gas data management market, accounting for 34% in 2024, with the U.S. generating USD 8.1 billion in revenue. The region is at the forefront of integrating AI, IoT, and cloud solutions into oil and gas workflows. Regulatory bodies enforce strict compliance requirements, compelling companies to adopt advanced data management systems for emissions tracking, safety monitoring, and risk mitigation. As digital transformation accelerates, efficient data management remains essential for optimizing logistics, storage, and transportation operations across the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Software vendors

- 3.1.1.2 Cloud providers

- 3.1.1.3 Technology providers

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Growing digital transformation in the oil & gas industry

- 3.5.1.2 Increasing adoption of cloud-based solutions

- 3.5.1.3 Rising need for predictive analytics and ai

- 3.5.1.4 Stringent regulatory and environmental compliance

- 3.5.1.5 Rising demand for energy efficiency and cost optimization

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High implementation costs and legacy system integration

- 3.5.2.2 Cybersecurity risks and data privacy concerns

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Data analytics & visualization

- 5.2.2 Data integration

- 5.2.3 Master data management

- 5.2.4 Metadata management

- 5.2.5 Others

- 5.3 Services

- 5.3.1 Consulting & planning

- 5.3.2 Integration & implementation

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Exploration & drilling

- 7.3 Production optimization

- 7.4 Refining & processing

- 7.5 Transport & storage

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Upstream

- 8.3 Midstream

- 8.4 Downstream

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Argus Media

- 10.2 AVEVA Group

- 10.3 Baker Hughes Company

- 10.4 Cognite

- 10.5 Emerson Electric

- 10.6 Halliburton Energy Services

- 10.7 Honeywell International

- 10.8 IBM

- 10.9 IMS PEI

- 10.10 Infosys

- 10.11 NetApp

- 10.12 Oracle

- 10.13 P2 Energy Solutions

- 10.14 Quorum Business Solutions

- 10.15 Rystad Energy

- 10.16 SAP SE

- 10.17 Schlumberger

- 10.18 Teradata

- 10.19 TGS-NOPEC Geophysical Company

- 10.20 Wood Mackenzie