|

市场调查报告书

商品编码

1698295

汽车保险丝市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Fuse Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

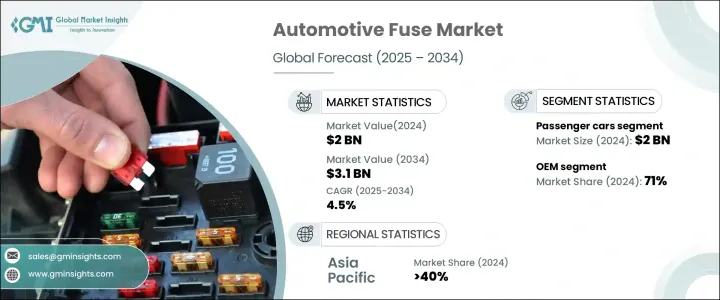

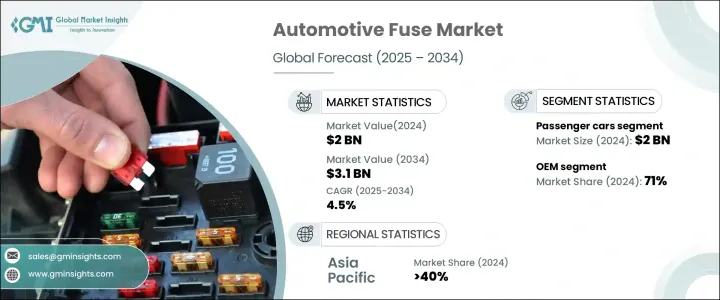

2024 年全球汽车保险丝市场价值为 20 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.5%。随着汽车产业加速向电动车生产转变,对高性能保险丝的需求也在增加。随着汽车产量年增 10.3%,汽车製造商寻求先进的电路保护解决方案来支援日益增长的电气元件整合。监管机构要求采用强大的电气安全系统,因此保险丝对于防止短路、过热和电气故障至关重要。

保险丝技术的快速进步增强了系统保护,特别是在高压电动车中。製造商专注于开发能够承受快速充电环境和极端条件的耐用保险丝。研究和开发工作旨在提高保险丝效率,确保符合不断发展的安全法规。随着汽车製造商采用创新保险丝来保护车辆电子设备、支援电源管理并提高整体可靠性,市场经历了显着增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 20亿美元 |

| 预测值 | 31亿美元 |

| 复合年增长率 | 4.5% |

先进驾驶辅助系统、数位仪表板和电动辅助转向的日益普及推动了对快速响应的保险丝的需求。投资高性能保险丝解决方案可确保符合新兴的安全标准,同时保护车辆电气元件。从传统保险丝到智慧保险丝的转变引入了远端诊断功能,透过监控电气负载和防止故障来提高安全性。这些智慧保险丝有利于电动和连网汽车,它们依靠高效的电源管理来实现最佳性能。

汽车製造商与保险丝製造商合作,将智慧保险丝技术整合到现代车辆架构中。数位化带来新机会,优化汽车电路保护。向电动动力系统的过渡需要能够处理高电压和电流负载的保险丝,同时增强热管理并防止电气风险。这些进步推动了电动和混合动力车的快速普及,使得高性能保险丝对于其发展不可或缺。

製造商投资智慧保险丝技术来提高车辆的可靠性,提供即时故障侦测和预测性维护。智慧保险丝可立即报告电气系统问题,提高安全性并最大限度地减少停机时间。汽车製造商将这些保险丝整合到现代车辆电子设备中,以简化维护操作并确保持续监控,增强安全性和性能。

汽车製造商与供应商合作开发符合特定车辆结构和操作要求的客製化保险丝系统。优化的电气保护可提高车辆性能、延长使用寿命并降低维修成本。客製化的保险丝设计支援复杂的电力系统,同时确保遵守严格的安全法规。

市场按燃料类型分为汽油、柴油、全电动、混合动力和燃料电池汽车。预计汽油产业在整个预测期内将大幅成长。儘管电动车日益兴起,但汽油车仍占据主导地位,对传统和高性能保险丝的需求持续增长。这些保险丝保护关键电气元件,包括点火系统、燃油喷射系统和照明系统。

根据保险丝类型,市场分为刀片式保险丝、玻璃保险丝、慢熔保险丝、电动车保险丝和其他保险丝。刀片式保险丝因其相容性、成本效益和易于更换而在 2024 年占据了最大的市场份额。它们在传统汽车和电动车中的广泛应用凸显了其在电路保护方面的可靠性。随着电动车普及率的提高,人们正在开发具有增强电压和电流容量的刀片式保险丝,以支援电池管理和配电系统。

受汽车产量增加和消费者需求上升的推动,亚太地区市场成长强劲。政府对电动车的奖励措施鼓励采用高压保险丝,促进汽车电路保护的技术进步。该地区的汽车製造商专注于增强车辆电子设备,推动对确保高效配电和系统安全的智慧、高速回应保险丝的需求。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件供应商

- 製造商

- 服务提供者

- 经销商

- 最终用途

- 利润率分析

- 成本細項分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 电动和混合动力车的普及率不断提高

- 对先进车辆安全功能的需求不断增长

- 汽车电子和连接解决方案的成长

- 严格的车辆安全和排放法规

- 产业陷阱与挑战

- 与现代车辆架构的整合挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按 Fuse,2021 - 2034 年

- 主要趋势

- 刀刃

- 玻璃

- 慢击

- 电动汽车保险丝

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 商用车

第七章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 全电动

- 杂交种

- 燃料电池电动车

第八章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AEM Components

- Blue Sea Systems

- Conquer

- Dongguan Better Electronics Technology

- Eaton

- ETA Elektrotechnische Apparate

- Fuzetec Technology

- GLOSO TECH

- Halfords

- Littelfuse

- Mersen

- MTA

- ON Semiconductor

- OptiFuse

- Pacific Engineering Corporation (PEC)

- Protectron Electromech

- Rainbow Power

- SCHURTER

- Siba

- Ultra Wiring Connectivity System

The Global Automotive Fuse Market, valued at USD 2 billion in 2024, is projected to grow at a CAGR of 4.5% from 2025 to 2034. As the automotive industry accelerates its shift toward electric vehicle production, demand for high-performance fuses rises. With vehicle production increasing by 10.3% year-over-year, automakers seek advanced circuit protection solutions to support the growing integration of electrical components. Regulatory bodies mandate robust electrical safety systems, making fuses essential for preventing short circuits, overheating, and electrical failures.

Rapid advancements in fuse technology enhance system protection, particularly in high-voltage electric vehicles. Manufacturers focus on developing durable fuses that withstand fast-charging environments and extreme conditions. Research and development efforts aim to enhance fuse efficiency, ensuring compliance with evolving safety regulations. The market experiences significant growth as automakers adopt innovative fuses that safeguard vehicle electronics, support power management, and improve overall reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 4.5% |

The increasing incorporation of advanced driver assistance systems, digital dashboards, and electric power steering drives the need for faster-response fuses. Investment in high-performance fuse solutions ensures compliance with emerging safety standards while protecting vehicle electrical components. The shift from conventional to smart fuses introduces remote diagnostic capabilities, improving safety by monitoring electrical loads and preventing failures. These intelligent fuses benefit electric and connected vehicles, which rely on efficient power management for optimal performance.

Automakers collaborate with fuse manufacturers to integrate smart fuse technologies into modern vehicle architectures. Digitalization fosters new opportunities, optimizing automotive circuit protection. The transition to electric powertrains requires fuses capable of handling high voltage and current loads while enhancing thermal management and preventing electrical risks. These advancements drive rapid adoption of electric and hybrid vehicles, making high-performance fuses indispensable to their development.

Manufacturers invest in smart fuse technology to enhance vehicle reliability, providing real-time fault detection and predictive maintenance. Intelligent fuses instantly report electrical system issues, improving safety and minimizing downtime. Automakers integrate these fuses into modern vehicle electronics to streamline maintenance operations and ensure continuous monitoring, reinforcing safety and performance.

Automakers collaborate with suppliers to develop customized fuse systems that align with specific vehicle structures and operational requirements. Optimized electrical protection enhances vehicle performance, extends lifespan, and reduces maintenance costs. Tailored fuse designs support sophisticated power systems while ensuring adherence to strict safety regulations.

The market is segmented by fuel type into gasoline, diesel, all-electric, hybrid, and fuel-cell vehicles. The gasoline segment is expected to witness substantial growth throughout the forecast period. Despite the rise of electric vehicles, gasoline cars remain dominant, sustaining demand for conventional and high-performance fuses. These fuses protect key electrical components, including ignition, fuel injection, and lighting systems.

By fuse type, the market is categorized into blade, glass, slow-blow, EV fuses, and others. Blade fuses held the largest market share in 2024 due to their compatibility, cost-effectiveness, and ease of replacement. Their widespread adoption in both traditional and electric vehicles underscores their reliability in circuit protection. As EV adoption rises, blade fuses with enhanced voltage and current capacities are being developed to support battery management and power distribution systems.

The Asia Pacific region experiences strong market growth, driven by increasing vehicle production and rising consumer demand. Government incentives for electric mobility encourage high-voltage fuse adoption, promoting technological advancements in automotive circuit protection. Automakers in the region focus on enhancing vehicle electronics, fueling demand for intelligent, high-speed response fuses that ensure efficient power distribution and system safety.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Component supplier

- 3.2.3 Manufacturer

- 3.2.4 Service provider

- 3.2.5 Distributor

- 3.2.6 End use

- 3.3 Profit margin analysis

- 3.4 Cost breakdown analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing adoption of electric and hybrid vehicles

- 3.8.1.2 Rising demand for advanced vehicle safety features

- 3.8.1.3 Growth in automotive electronics and connectivity solutions

- 3.8.1.4 Stringent regulations for vehicle safety and emissions

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Integration challenges with modern vehicle architectures

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fuse, 2021 - 2034 ($Mn & Units)

- 5.1 Key trends

- 5.2 Blade

- 5.3 Glass

- 5.4 Slow blow

- 5.5 EV fuse

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn & Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicle

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Mn & Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 All-electric

- 7.5 Hybrid

- 7.6 FCEV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn & Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Argentina

- 9.5.3 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AEM Components

- 10.2 Blue Sea Systems

- 10.3 Conquer

- 10.4 Dongguan Better Electronics Technology

- 10.5 Eaton

- 10.6 ETA Elektrotechnische Apparate

- 10.7 Fuzetec Technology

- 10.8 GLOSO TECH

- 10.9 Halfords

- 10.10 Littelfuse

- 10.11 Mersen

- 10.12 MTA

- 10.13 ON Semiconductor

- 10.14 OptiFuse

- 10.15 Pacific Engineering Corporation (PEC)

- 10.16 Protectron Electromech

- 10.17 Rainbow Power

- 10.18 SCHURTER

- 10.19 Siba

- 10.20 Ultra Wiring Connectivity System