|

市场调查报告书

商品编码

1644664

汽车保险丝:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Automotive Fuse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

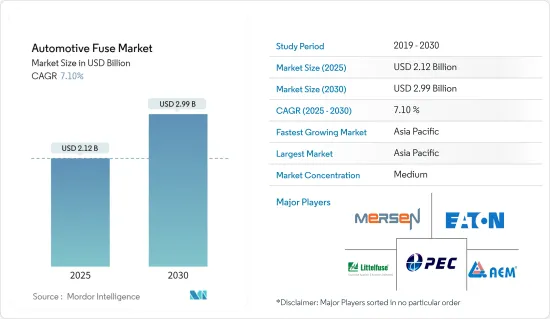

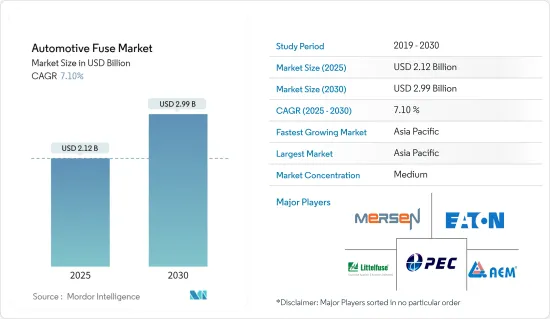

预计 2025 年汽车保险丝市场规模为 21.2 亿美元,到 2030 年将达到 29.9 亿美元,在市场估计和预测期(2025-2030 年)内复合年增长率为 7.1%。

汽车保险丝可保护车辆内的线路和电气元件。这些保险丝的额定电压通常为 32 伏特直流电,但也可以以 42 伏特电压运作。它们位于一个或多个保险丝盒内,通常位于引擎室的一侧或仪表板下方,靠近方向盘。这些保险丝可防止短路和过流,如果检测到潜在的危险电流水平,则会断开电路。

主要亮点

- 汽车保险丝可保护电路免受过流和短路的影响。汽车保险丝是从商用卡车到乘用车等所有车型的必备部件,预计未来市场将迅速扩大。这种成长是由多种因素推动的,包括电动车日益普及、对先进安全功能的需求不断增加以及汽车电气系统日益复杂。

- 电气化和自动驾驶技术的引入给汽车行业带来了巨大的变化。这种发展推动了对汽车保险丝的需求,汽车保险丝是确保现代车辆安全性和可靠性的关键部件。

- 汽车产业的技术进步、无人驾驶汽车的兴起以及物联网 (IoT) 技术的整合进一步推动了汽车保险丝的需求。这些进步需要强大的电路保护方法来维持车辆电子设备的可靠性和完整性。保险丝技术的创新,特别是满足电动和混合动力汽车需求的创新,预计将推动市场成长。

- 儘管现代汽车的复杂性和电气需求日益增加,但低压保险丝技术的进步却落后了。现代车辆配备了许多电子系统,包括高级驾驶辅助系统 (ADAS)、资讯娱乐系统和电动动力传动系统,这些系统都需要坚固可靠的保险丝。然而,这种技术差距限制了保险丝满足当今汽车电气系统不断变化的需求的能力。

- 由于需求减弱(尤其是已开发国家的需求),预计 2024 年汽车产量成长将放缓。由于家庭收入仍然紧张且资金筹措选择变得越来越昂贵,持续的高利率对汽车生产和销售造成压力。此外,由于现有订单积压已被填满,我们预计 2024 年和 2025 年汽车生产需求将下降。该行业面临重大的下行风险,包括持续的通货膨胀和可能扰乱汽车供应链的零件短缺。

汽车保险丝市场趋势

电动/混合动力汽车将大幅成长

- 电池电动车(BEV),通常称为全电动汽车,使用马达取代传统的内燃机。相较之下,混合动力电动车将内燃机与一个或多个马达结合在一起,并从电池中获取能量。与纯电动车不同,混合动力电动车不能插入电源充电。电池透过再生煞车和内燃机充电。马达的额外动力允许使用更小的发动机,并且电池还可以支撑辅助负载,从而最大限度地减少车辆静止时的发动机空转。

- 电动车 (EV) 和混合动力电动车 (HEV) 中的保险丝可保护电路、设备和电池免受过载和短路等故障的影响。电动车使用直流(DC)电压来运行电路。

- 随着充电时间的减少,对支援更高电压和电流的系统的需求也日益增加。从400V到800V的转变对电池电路保护提出了重大挑战。减少充电时间需要提高系统电压,但较长的行驶距离会增加故障电流。随着各种电动车的规划,对更高工作电流的需求也日益增长。这些动态正在重塑电路保护的需求。

- 在中国,每註册新车就有超过三分之一是电动车,在欧洲,这一数字超过五分之一,而在美国,这一数字为十分之一。相反,即使在日本和印度这样的已开发汽车市场,电动车销售也表现低迷。这种销售集中度正在影响全球电动车库存,并凸显了中国趋势的重要性,中国约占汽车总销量和库存的三分之二。

亚太地区成长强劲

- 中国是汽车和旅游产业的全球领导者,拥有强大的国内市场和巨大的潜力。根据工业信部预测,到2025年,国内汽车产量可望达到3,500万辆,巩固中国作为世界领先汽车製造国之一的地位。这一成长推动了中国汽车产业各个领域的快速发展。

- 根据国际贸易管理局的报告,日本是世界第四大汽车市场,仅次于中国、美国和印度。日本是全球汽车製造强国,主要汽车製造商有丰田、本田、日产、马自达和铃木等。汽车业占日本GDP的2.9%,凸显其经济重要性。因此,日本製定了严格的车辆安全和污染防治法律。

- 日本支持测量燃油经济性、二氧化碳和其他排放气体的测试循环的国际标准。值得注意的是,日本在联合国世界汽车法规协调论坛制定的世界统一轻型车辆测试循环(WLTC)中发挥了关键作用。为了体现这一承诺,日本正在将其乘用车和非重型车辆测试週期从 JC08 过渡到 WLTC。

- 汽车产业对经济成长和创造就业至关重要,对印度GDP的贡献率为7.1%。消费需求的增加、收入的提高、都市化和消费行为的改变是汽车产业成长的主要驱动力。

- 光是2024年4月,乘用车、三轮车、两轮车和四轮车的产量就达到了2,358,041辆。此外,2023财年印度的汽车出口总量为4,761,487辆。过去几年,汽车业对GDP的贡献大幅增加至7.1%。此外,汽车业为约1900万人提供了直接和间接的就业机会。

汽车保险丝产业概况

由于大量本地製造商的存在,汽车保险丝市场处于半固体。市场的主要企业包括 Pacific Engineering Corporation、Littelfuse Inc.、Eaton Corporation、Mersen Electrical Power、AEM Components (USA) Inc. 等。

由于整合不断加强、技术进步和地缘政治情势的变化,市场出现波动。此外,随着新兴中小企业的增加及其收益带来的投资能力的增强,市场竞争预计还将继续加剧。

此外,在透过创新获得永续竞争优势的市场中,由于预计各个终端用户行业的新客户需求将增加,竞争预计会更加激烈。在此背景下,由于最终用户对保险丝製造商的品质期望,品牌识别起着重要作用。此外,伊顿公司、Little Fuse Inc.、太平洋工程公司、美尔森电力、AEM Components USA Inc. 等现有主要参与者也高度渗透了该市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠肺炎疫情和其他宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 汽车新时代的演进-电气化与自动化

- 汽车上安装的电气和电子装置数量不断增加

- 市场挑战/限制

- 低压保险丝领域发展有限,保险丝市场售后市场混乱

第六章 市场细分

- 按类型

- 刀刃

- 玻璃

- 慢击

- 高压保险丝

- 贴片保险丝

- 其他类型

- 按车型

- 乘用车(传统 - ICE)

- 商用车(传统内燃机)

- 电动/混合动力汽车

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 法国

- 德国

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Pacific Engineering Corporation

- Littelfuse Inc.

- Eaton Corporation

- Mersen Electrical Power

- AEM Components(USA)Inc.

- On Semiconductor Corporation

- OptiFuse

- Bel Fuse Inc.

第八章投资分析

第九章:市场的未来

The Automotive Fuse Market size is estimated at USD 2.12 billion in 2025, and is expected to reach USD 2.99 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030).

Automotive fuses safeguard a vehicle's wiring and electrical components. Typically set at 32 volts DC, these fuses can operate at 42 volts. Housed in one or more fuse boxes, they are usually located on one side of the engine compartment or under the dashboard near the steering wheel. These fuses protect against short circuits and over-currents, disconnecting the circuit upon detecting potentially dangerous current levels.

Key Highlights

- Automotive fuses protect electrical circuits from overcurrent and short-circuit situations. Essential for all vehicle types, from commercial trucks to passenger cars, the automotive fuse market is poised for rapid expansion in the coming years. This growth is driven by several factors: the surging popularity of electric vehicles, an increasing demand for advanced safety features, and the escalating complexity of automotive electrical systems.

- The automotive industry underwent a significant transformation with the introduction of electrification and autonomous driving technologies. This evolution is driving the demand for automotive fuses, which are critical components for ensuring the safety and reliability of modern vehicles.

- Technological advancements in the automotive industry, the rise of driverless cars, and the integration of Internet of Things (IoT) technologies further drive the demand for automotive fuses. These advancements require robust circuit protection methods to maintain the dependability and integrity of vehicle electronics. Innovations in fuse technology, particularly those catering to the needs of electric and hybrid vehicles, are expected to propel the growth of the market.

- Despite modern vehicles' growing complexity and electrical demands, advancements in low-voltage fuse technology have lagged. Modern vehicles incorporate numerous electronic systems, such as advanced driver-assistance systems (ADAS), infotainment systems, and electric powertrains, which require robust and reliable fuses. However, this technological gap limits the fuses' ability to cater to the evolving requirements of today's automotive electrical systems.

- The anticipated growth in automotive production is projected to decelerate in 2024 due to a decline in demand, especially within advanced economies. The ongoing high interest rates are exerting pressure on both automotive production and sales as household incomes continue to be strained and financing options have become increasingly expensive. Furthermore, as existing order backlogs are fulfilled, a reduction in demand for automotive production is expected in 2024 and 2025. The sector faces significant downside risks, including persistent inflation and potential component shortages that may disrupt automotive supply chains.

Automotive Fuse Market Trends

Electric/Hybrid Vehicles to Witness Major Growth

- Battery electric vehicles (BEVs), commonly known as all-electric vehicles, utilize an electric motor instead of a traditional internal combustion engine. In contrast, hybrid electric vehicles combine an internal combustion engine with one or more electric motors, drawing energy from stored batteries. Unlike BEVs, hybrid electric vehicles cannot be plugged in for charging; their batteries recharge through regenerative braking and the internal combustion engine. This electric motor's added power can enable a smaller engine, and the battery can also support auxiliary loads, minimizing engine idling when the vehicle is stationary.

- Fuses in Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) safeguard electrical circuits, equipment, and batteries from faults like overloads and short circuits. EVs operate their electrical circuits using direct current (DC) voltage.

- As charging times decrease, a growing demand for systems supporting higher voltage and current is growing. Transitioning from 400V to 800V introduces significant challenges for battery circuit protection. While the push for quicker charging times necessitates elevated system voltages, an extended driving range increases fault currents. The diverse range of planned EVs amplifies the demand for higher operating currents. These dynamics are reshaping circuit protection needs.

- Electric cars are making significant inroads in global markets: in China, over one in three new car registrations were electric; in Europe, the figure surpassed one in five; and in the United States, it reached one in ten. Conversely, electric car sales remain subdued even in advanced automotive markets like Japan and India. This concentration in sales shapes the global electric car stock and underscores the significance of trends in China, which accounts for about two-thirds of total car sales and stocks.

Asia Pacific to Register Major Growth

- China is a global leader in the automotive and mobility industry, driven by its strong domestic market and immense potential. The Chinese Ministry of Industry and Information Technology predicts domestic vehicle production is expected to reach 35 million by 2025, reinforcing China's position as the world's leading car manufacturer. This growth propels rapid advancements across various sectors of China's automobile industry.

- As reported by the International Trade Administration, Japan ranks as the world's fourth-largest automotive market, trailing only China, the United States, and India. Japan is a global powerhouse in automotive manufacturing, hosting major automakers like Toyota, Honda, Nissan, Mazda, and Suzuki. The automotive sector constitutes 2.9% of Japan's GDP, underscoring its economic significance. Consequently, Japan enforces stringent laws focused on vehicle safety and pollution control.

- Japan is championing international standards for testing cycles that gauge fuel consumption, CO2, and other emissions. Notably, Japan played a pivotal role in developing the World Harmonized Light Vehicle Test Cycle (WLTC) under the UN's World Forum for Harmonization of Vehicle Regulations. Reflecting this commitment, Japan is transitioning from its JC08 test cycle to the WLTC for passenger and non-heavy-duty vehicles.

- The automotive industry is crucial to economic growth and job creation, contributing 7.1% to India's GDP. The growing consumer demand, rising income, urbanization, and changing consumer behavior are the major driving forces for the automotive industry's growth.

- In April 2024 alone, production figures for passenger vehicles, three-wheelers, two-wheelers, and quadricycles reached 2,358,041 units. Additionally, in FY23, total automobile exports from India amounted to 4,761,487 vehicles. Over the years, the sector's contribution to the national GDP has significantly increased to 7.1%. Moreover, the automotive sector provides direct and indirect employment to approximately 19 million individuals.

Automotive Fuse Industry Overview

The automotive fuse market is semiconsolidated due to the large number of local manufacturers available in the automotive fuse market landscape. The significant players in the market include Pacific Engineering Corporation, Littelfuse Inc., Eaton Corporation, Mersen Electrical Power, and AEM Components (USA) Inc.

The market studied is fluctuating due to growing consolidation, technological advancement, and geopolitical scenarios. In addition, with the increasing number of new SMEs, the intense competition in the market studied is expected to continue to rise, considering their ability to invest, which results from their revenues.

Further, in a market where the sustainable competitive advantage through innovation is considerably high, competition is anticipated to grow, considering the projected increase in demand from new customers across various end-user industries. In such a situation, the brand identity plays a major role, considering the importance of quality that the end-users expect from a fuse manufacturing player. The market penetration levels are also high with large market incumbents, such as Eaton Corporation, Little Fuse Inc., Pacific Engineering Corporation, Mersen Electric Power, and AEM Components USA Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of New Automotive Era -Electrification and Autonomy

- 5.1.2 Increasing Incorporation of Electrical and Electronic Units in Automobiles

- 5.2 Market Challenges/Restraints

- 5.2.1 Limited Development in the Field of Low-Voltage Fuses and Unorganized Aftermarket in the Fuse Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Blade

- 6.1.2 Glass

- 6.1.3 Slow Blow

- 6.1.4 High-Voltage Fuses

- 6.1.5 Chip Fuse

- 6.1.6 Other Types

- 6.2 By Type of Vehicle

- 6.2.1 Passenger Cars (Traditional -ICE)

- 6.2.2 Commercial Vehicles (Traditional -ICE)

- 6.2.3 Electric/Hybrid Vehicles

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 France

- 6.3.2.2 Germany

- 6.3.2.3 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pacific Engineering Corporation

- 7.1.2 Littelfuse Inc.

- 7.1.3 Eaton Corporation

- 7.1.4 Mersen Electrical Power

- 7.1.5 AEM Components (USA) Inc.

- 7.1.6 On Semiconductor Corporation

- 7.1.7 OptiFuse

- 7.1.8 Bel Fuse Inc.