|

市场调查报告书

商品编码

1698300

水下造粒市场机会、成长动力、产业趋势分析及2025-2034年预测Underwater Pelletizing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

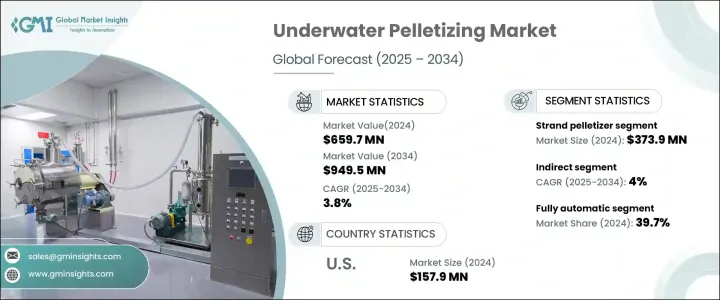

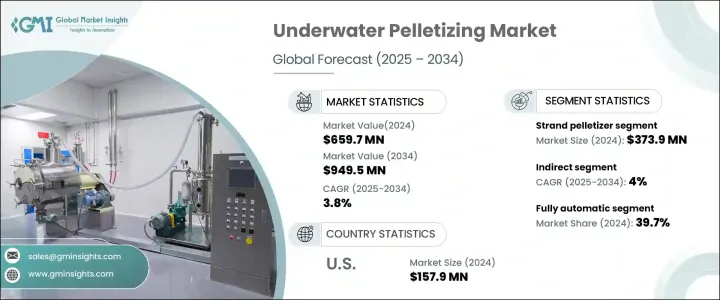

2024 年全球水下造粒市场规模达到 6.597 亿美元,并有望稳定扩张,预计 2025 年至 2034 年期间的复合年增长率为 3.8%。汽车、包装、医疗和电子等行业对高品质塑胶颗粒的需求不断增长,推动了这一成长。随着製造商不断推动创新,聚合物生产技术的进步正在塑造製粒系统的未来,提高精度、效率和整体成本效益。该公司正在开发更节能的解决方案,以适应从传统塑胶到高性能聚合物的各种材料。

对永续性的日益重视进一步推动了市场扩张。各行各业正在转向环保製造工艺,越来越多地采用先进的製粒系统来减少能源消耗和材料浪费。製造商还将自动化和人工智慧驱动的监控整合到製粒设备中,以确保一致的颗粒品质并最大限度地减少停机时间。汽车和电子产业对轻质耐用塑胶零件的需求正在增强对高性能造粒技术的需求。随着全球供应链的发展,企业正在优化生产策略,以满足对可扩展和可靠的製粒解决方案日益增长的需求,从而巩固市场的上升趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.597亿美元 |

| 预测值 | 9.495亿美元 |

| 复合年增长率 | 3.8% |

2024 年,拉条造粒机市场规模达到 3.739 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.1%。这些系统广泛用于加工低黏度材料,提供一种简化的工艺,将熔融的聚合物挤出成条状,在水中冷却,然后精确切割成均匀的颗粒。它们的效率和高吞吐量能力使其成为消费品、汽车和包装领域不可或缺的一部分。随着各行业扩大生产规模以满足不断增长的需求,拉条造粒机的采用率持续激增,确保了大规模製造业务的可靠性、一致性和成本效益。

水下造粒市场分为直接和间接销售管道,其中间接销售在 2024 年占 55.1% 的份额。在第三方经销商、经销商和代理商的战略优势的推动下,预计该细分市场在 2025 年至 2034 年期间的复合年增长率为 4%。透过利用间接销售,製造商可以扩大其业务范围,进入直接经营可能有限的地区,确保广泛的市场渗透。这种分销模式提供了对安装、维护和培训等专业客户支援服务的简化存取。间接销售的效率提高了供应链的流动性,减少了物流障碍,同时确保了在全球不同市场上可靠的产品供应。

美国水下造粒市场在 2024 年达到 1.579 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 3.9%。汽车、塑胶、回收和製药业对优质塑胶颗粒的强劲需求推动了市场成长。旨在减少製造业能源消耗和排放的监管措施正在加速先进製粒技术的采用。随着企业优先考虑永续性和营运效率,市场正在稳步增长,与整个行业向环保生产实践发展的趋势保持一致。这些因素继续塑造水下造粒的不断发展的格局,推动创新和市场扩张。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算。

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析。

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 全球日益关注环境永续性

- 自动化、物联网和即时监控技术的采用日益增多

- 产业陷阱与挑战

- 与高能耗相关的担忧

- 与材料处理和加工相关的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 拉条切粒机

- 水下切粒机

第六章:市场估计与预测:依生产能力,2021-2034

- 主要趋势

- 高达100公斤/小时

- 100公斤/小时至500公斤/小时

- 500 公斤/小时至 5000 公斤/小时

- 超过5000公斤/小时

第七章:市场估计与预测:依自动化程度,2021-2034 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第八章:市场估计与预测:依材料类型,2021-2034

- 主要趋势

- 通用塑料

- 塑胶工程

- 高性能聚合物

- 生物塑料

- 弹性体和热塑性弹性体(TPE)

- 添加剂母粒和填料

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 塑胶和聚合物製造

- 纺织品和纤维生产

- 食品包装

- 回收和废弃物管理

- 混炼和母粒生产

- 其他的

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 汽车

- 纺织品

- 製药

- 建造

- 电子产品

- 其他的

第 11 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十三章:公司简介

- CGC Technology

- Chuangbo Machine

- Coperion

- Cowell Extrusion

- Cowin Extrusion

- Crown Machine

- ECON

- Farrel Pomini

- MAAG

- Neoplast

- Nordson

- Prime Margo Machines

- USEON

- Wuxi Huachen

- Xinda

The Global Underwater Pelletizing Market reached USD 659.7 million in 2024 and is poised for steady expansion, projected to grow at a CAGR of 3.8% between 2025 and 2034. Increasing demand for high-quality plastic pellets across industries such as automotive, packaging, medical, and electronics is fueling this growth. As manufacturers push for innovation, advancements in polymer production technology are shaping the future of pelletizing systems, improving precision, efficiency, and overall cost-effectiveness. Companies are developing more energy-efficient solutions to accommodate a diverse range of materials, from conventional plastics to high-performance polymers.

Growing emphasis on sustainability is further driving market expansion. Industries are shifting toward eco-friendly manufacturing processes, increasing the adoption of advanced pelletizing systems that reduce energy consumption and material waste. Manufacturers are also integrating automation and AI-driven monitoring into pelletizing equipment, ensuring consistent pellet quality and minimizing downtime. The trend toward lightweight and durable plastic components in the automotive and electronics industries is adding momentum to the demand for high-performance pelletizing technologies. As global supply chains evolve, companies are optimizing production strategies to meet growing requirements for scalable and reliable pelletizing solutions, reinforcing the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $659.7 Million |

| Forecast Value | $949.5 Million |

| CAGR | 3.8% |

The strand pelletizer segment reached USD 373.9 million in 2024 and is expected to expand at a CAGR of 4.1% from 2025 to 2034. These systems are widely used for processing lower-viscosity materials, delivering a streamlined process where molten polymer is extruded into strands, cooled in water, and precisely cut into uniform pellets. Their efficiency and high-throughput capabilities make them indispensable in consumer goods, automotive, and packaging sectors. As industries scale up production to meet rising demand, the adoption of strand pelletizers continues to surge, ensuring reliability, consistency, and cost efficiency in large-scale manufacturing operations.

The underwater pelletizing market is divided into direct and indirect sales channels, with indirect sales holding a 55.1% share in 2024. This segment is anticipated to grow at a CAGR of 4% between 2025 and 2034, driven by the strategic advantages of third-party distributors, resellers, and agents. By leveraging indirect sales, manufacturers can expand their reach into regions where direct operations may be limited, ensuring broad market penetration. This distribution model provides streamlined access to specialized customer support services such as installation, maintenance, and training. The efficiency of indirect sales enhances supply chain fluidity, reducing logistical hurdles while ensuring reliable product availability across diverse global markets.

The U.S. underwater pelletizing market reached USD 157.9 million in 2024 and is set to grow at a CAGR of 3.9% between 2025 and 2034. Strong demand for premium-quality plastic pellets in the automotive, plastics, recycling, and pharmaceutical industries propel market growth. Regulatory initiatives aimed at reducing energy consumption and emissions in manufacturing are accelerating the adoption of advanced pelletizing technologies. As companies prioritize sustainability and operational efficiency, the market is witnessing steady growth, aligning with industry-wide trends toward environmentally conscious production practices. These factors continue to shape the evolving landscape of underwater pelletizing, driving innovation and market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing global focus on environmental sustainability

- 3.6.1.2 Growing adoption of automation, IoT, and real-time monitoring technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Concerns associated with high energy consumption

- 3.6.2.2 Complexities associated with the material handling and processing

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Strand pelletizer

- 5.3 Underwater pelletizer

Chapter 6 Market Estimates & Forecast, By Production Capacity, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 100 kg/hr

- 6.3 100 kg/hr to 500 kg/hr

- 6.4 500 kg/hr to 5000 kg/hr

- 6.5 More than 5000 kg/hr

Chapter 7 Market Estimates & Forecast, By Level of Automation, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Fully automatic

Chapter 8 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Commodity plastics

- 8.3 Plastics Engineering

- 8.4 High-performance polymers

- 8.5 Bioplastics

- 8.6 Elastomers and thermoplastic elastomers (TPEs)

- 8.7 Additive masterbatch and fillers

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Plastics and polymers manufacturing

- 9.3 Textile and fiber production

- 9.4 Food packaging

- 9.5 Recycling and waste management

- 9.6 Compounding and masterbatch production

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Textile

- 10.4 Pharmaceutical

- 10.5 Construction

- 10.6 Electronics

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 CGC Technology

- 13.2 Chuangbo Machine

- 13.3 Coperion

- 13.4 Cowell Extrusion

- 13.5 Cowin Extrusion

- 13.6 Crown Machine

- 13.7 ECON

- 13.8 Farrel Pomini

- 13.9 MAAG

- 13.10 Neoplast

- 13.11 Nordson

- 13.12 Prime Margo Machines

- 13.13 USEON

- 13.14 Wuxi Huachen

- 13.15 Xinda