|

市场调查报告书

商品编码

1698315

肝吸虫治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Liver Fluke Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

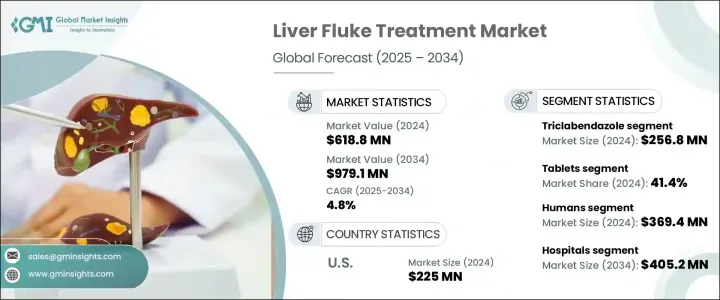

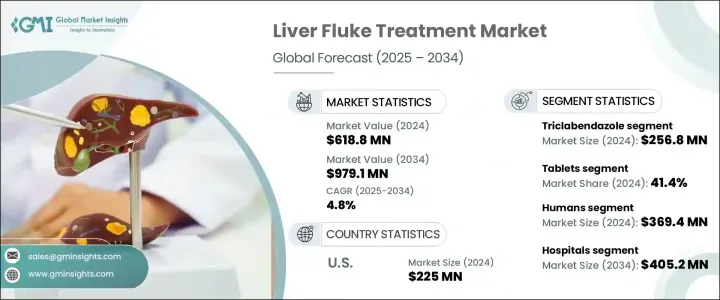

2024 年全球肝吸虫治疗市值为 6.188 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.8%,这得益于肝吸虫感染患病率的增加和抗寄生虫药物配方的进步。肝吸虫是一种影响人类和动物的寄生虫疾病,会带来严重的健康风险,包括肝损伤、胆管感染,甚至胆管癌。人们对这些健康併发症的认识不断提高,刺激了对有效治疗方案的需求。製药公司正在大力投资研发,以推出可提高药物疗效、生物利用度和可及性的创新疗法。

这一市场的扩张很大程度上受到人们对早期诊断和治疗的日益重视以及驱虫药物日益普及的影响。世界各地的卫生组织都在强调预防措施和治疗策略以控制感染率,预计这将进一步推动市场需求。药物配方技术的进步,包括控製药物释放机制和提高生物利用度,也促进了市场扩张。此外,远距医疗和线上医药平台的广泛整合使偏远和服务欠缺地区更容易获得肝吸虫治疗,进一步提高了市场渗透率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.188亿美元 |

| 预测值 | 9.791亿美元 |

| 复合年增长率 | 4.8% |

市场按製剂类型细分,包括片剂、注射剂和口服混悬液。平板电脑在 2024 年占据了 41.4% 的市场份额,预计到 2034 年将以 4.7% 的复合年增长率增长。其较长的保质期和最低的储存要求使其成为首选,尤其是在冷藏条件有限的地区。片剂配方的创新,例如改进的控释机制,正在提高药物疗效和患者依从性。随着製药公司不断改进口服药物,预计整个预测期内对药片的需求将保持强劲。

根据应用,市场分为人类治疗和动物治疗。 2024 年,人力资本市场创造了 3.694 亿美元的收入,预计到 2034 年将达到 5.758 亿美元,复合年增长率为 4.6%。人们越来越意识到肝吸虫感染相关的健康风险,包括肝硬化和胆管癌等严重疾病,这推动了对有效治疗的需求。兽医应用在市场扩张中也发挥着至关重要的作用,因为受感染的牲畜是人类的主要传播源。控制动物感染的努力仍然是全球卫生当局的首要任务,这进一步促进了市场的成长。

2024年美国肝吸虫治疗市值为2.25亿美元。驱虫药物的进步显着提高了治疗效果,导致公认的疗法广泛采用。美国製药业持续推动创新,正在进行的研究重点是扩大治疗选择和改进药物配方。美国肝吸虫感染发生率不断上升,部分原因是来自流行地区的移民,这进一步刺激了市场扩张。随着持续的研发倡议和不断增长的医疗保健投资,肝吸虫治疗市场预计将在未来几年实现持续成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 肝吸虫感染盛行率不断上升

- 诊断技术的进步

- 畜牧业蓬勃发展

- 有效疗法的可用性

- 产业陷阱与挑战

- 来自替代疗法的竞争

- 对常用驱虫药的抗药性

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类型,2021 年至 2034 年

- 主要趋势

- 三氯苯达唑

- 吡喹酮

- 硫醇

- 阿苯达唑

- 硝唑尼特

- 其他药物类型

第六章:市场估计与预测:依配方类型,2021 年至 2034 年

- 主要趋势

- 平板电脑

- 注射

- 口服悬浮液

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 人类

- 动物

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊所

- 兽医设施

- 其他最终用途

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AdvaCare Pharma

- Bayer Healthcare

- GlaxoSmithKline

- Lupin Pharma

- Merck

- Novartis

- Par Pharmaceutical

- Pfizer

- Schering Corporation

- Vetoquinol

- Virbac

- Zoetis

The Global Liver Fluke Treatment Market was valued at USD 618.8 million in 2024 and is projected to register a CAGR of 4.8% from 2025 to 2034, driven by the increasing prevalence of liver fluke infections and advancements in antiparasitic drug formulations. Liver fluke, a parasitic disease affecting both humans and animals, poses severe health risks, including liver damage, bile duct infections, and even bile duct cancer. The rising awareness of these health complications has spurred demand for effective treatment options. Pharmaceutical companies are investing heavily in research and development to introduce innovative therapies that enhance drug efficacy, bioavailability, and accessibility.

The expansion of this market is largely influenced by the growing focus on early diagnosis and treatment, as well as the increasing adoption of anthelmintic medications. Health organizations worldwide are emphasizing preventive measures and treatment strategies to curb infection rates, which is expected to further propel market demand. Technological advancements in pharmaceutical formulations, including controlled drug release mechanisms and improved bioavailability, are also contributing to market expansion. Additionally, the widespread integration of telemedicine and online pharmaceutical platforms is making liver fluke treatment more accessible in remote and underserved areas, further boosting market penetration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $618.8 Million |

| Forecast Value | $979.1 Million |

| CAGR | 4.8% |

The market is segmented by formulation type, including tablets, injections, and oral suspensions. Tablets held a 41.4% market share in 2024 and are expected to grow at a CAGR of 4.7% through 2034. Their extended shelf life and minimal storage requirements make them the preferred choice, especially in regions with limited access to refrigeration. Innovations in tablet formulations, such as improved controlled-release mechanisms, are enhancing drug efficacy and patient compliance. As pharmaceutical companies continue to refine oral medications, the demand for tablets is expected to remain strong throughout the forecast period.

By application, the market is categorized into human and animal treatment. The human segment generated USD 369.4 million in 2024 and is projected to reach USD 575.8 million by 2034, growing at a CAGR of 4.6%. Rising awareness about the health risks associated with liver fluke infections, including serious conditions such as liver cirrhosis and bile duct cancer, has driven the demand for effective treatments. Veterinary applications also play a crucial role in market expansion, as infected livestock serve as a primary transmission source for humans. Efforts to control infections in animals remain a priority for global health authorities, further contributing to market growth.

The US liver fluke treatment market was valued at USD 225 million in 2024. Advances in anthelmintic medications have significantly improved treatment efficacy, leading to the widespread adoption of recognized therapies. The US pharmaceutical industry continues to drive innovation, with ongoing research focused on expanding treatment options and improving drug formulations. The rising incidence of liver fluke infections in the US, partly attributed to immigration from endemic regions, has further fueled market expansion. With continuous research and development initiatives and growing healthcare investments, the liver fluke treatment market is expected to witness sustained growth in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of liver fluke infection

- 3.2.1.2 Advancements in diagnostic techniques

- 3.2.1.3 Growing livestock industry

- 3.2.1.4 Availability of effective therapeutics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from alternative treatments

- 3.2.2.2 Resistance to commonly used anthelmintic drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Triclabendazole

- 5.3 Praziquantel

- 5.4 Bithionol

- 5.5 Albendazole

- 5.6 Nitazoxanide

- 5.7 Other drug types

Chapter 6 Market Estimates and Forecast, By Formulation Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tablets

- 6.3 Injections

- 6.4 Oral suspension

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Humans

- 7.3 Animals

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Clinics

- 8.4 Veterinary facilities

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AdvaCare Pharma

- 10.2 Bayer Healthcare

- 10.3 GlaxoSmithKline

- 10.4 Lupin Pharma

- 10.5 Merck

- 10.6 Novartis

- 10.7 Par Pharmaceutical

- 10.8 Pfizer

- 10.9 Schering Corporation

- 10.10 Vetoquinol

- 10.11 Virbac

- 10.12 Zoetis