|

市场调查报告书

商品编码

1773244

酱料及调味品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sauces and Condiments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

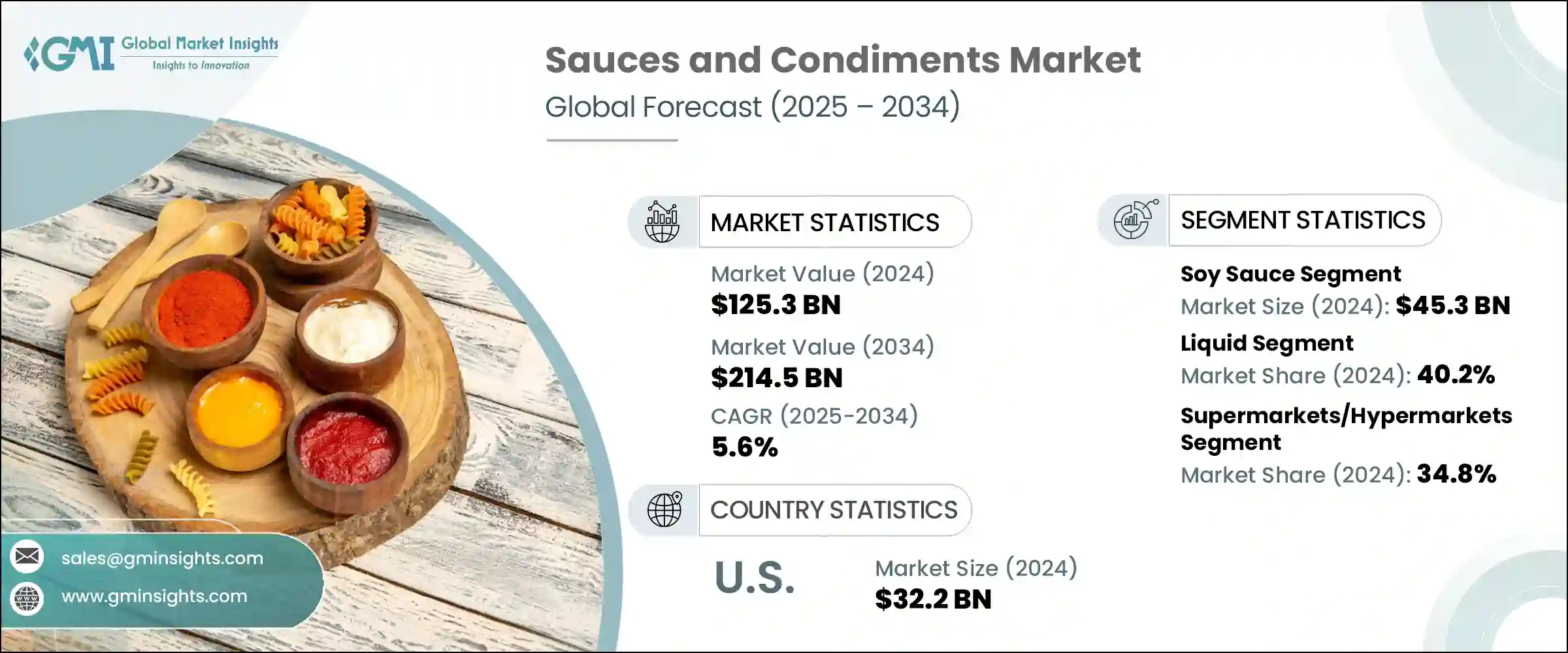

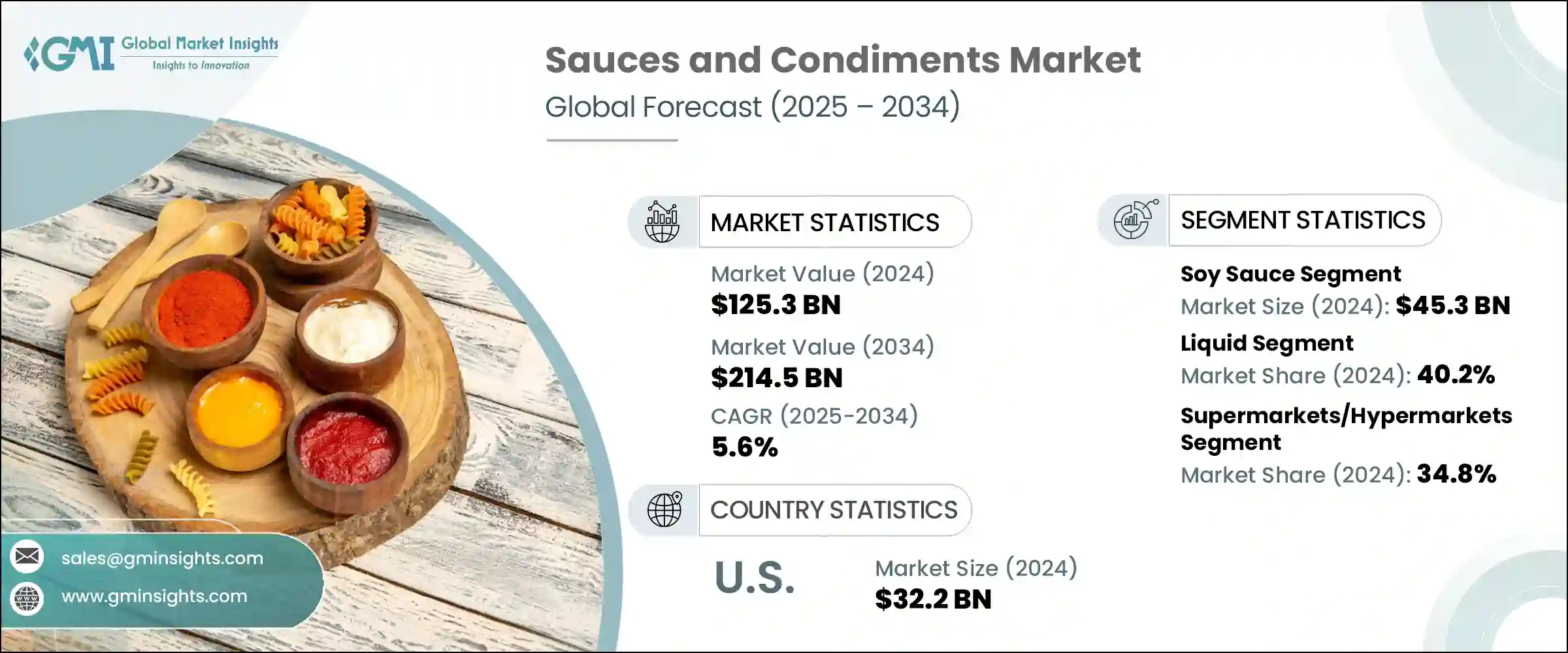

2024年,全球酱料和调味品市场规模达1,253亿美元,预计到2034年将以5.6%的复合年增长率成长,达到2,145亿美元。这一增长源自于消费者对便利性和更佳烹饪体验的日益追求。随着生活节奏的加快和全球消费者口味的不断提升,许多消费者如今更青睐那些能够快速便捷地丰富膳食的即食酱料和调味品。

家庭烹饪和膳食准备的兴起进一步刺激了需求,促使製造商不断创新,重新配製食谱以提升口味和健康益处,探索新的食材,并改进包装以满足不断变化的消费者需求。这些因素共同推动市场的发展。然而,随着越来越多的参与者以激进的定价、新颖的产品和强大的行销策略进入市场,来自新兴品牌和成熟企业的激烈竞争也给利润率带来了压力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1253亿美元 |

| 预测值 | 2145亿美元 |

| 复合年增长率 | 5.6% |

此外,自有品牌的激增正以低价吸引註重预算的消费者,这对品牌酱料製造商维持其市场份额和盈利能力构成挑战。这些自有品牌不仅在价格上竞争,而且越来越注重提升品质、口味和包装,以缩小与知名品牌的差距。零售商正在增加货架空间和产品线的曝光度,并提供促销和忠诚度激励措施,以推动消费者对自有品牌调味品的偏好。

因此,老牌企业面临巨大的压力,需要透过提升风味、简化成分标籤和永续包装,打造差异化产品、创新产品线,并证明高价位的合理性。自有品牌的日益壮大正在改变竞争格局,迫使传统品牌重新思考其在不断发展变化且价格敏感的市场中的定位策略。

2024年,酱油市场估值达453亿美元,预计2025年至2034年的复合年增长率为5.7%。酱油的受欢迎程度源自于其用途广泛,例如烹饪、腌製和作为餐桌调味品。酱油的全球吸引力跨越了文化界限,使其成为各种美食的必备食材。目前的消费趋势表明,在註重健康的消费者的推动下,对无麸质和低钠酱油的需求不断增长。添加大蒜、柑橘或鬆露等成分的调味酱油正日益流行,因为它们为寻求新颖口味体验的消费者提供了便利和多样性。

2024年,液体酱料市场占据了40.2%的市场份额,这主要归功于其易用性。这些酱料占据了调味品市场的一半以上,用途广泛,既可用作烹饪配料,也可作为蘸料。酱油、辣酱和油醋汁等产品是全球家庭必需品。消费者越来越青睐那些标榜纯天然、无糖或富含益生菌的液体酱料。挤压瓶和小袋等包装创新因其便利性和份量控製而广受欢迎,进一步刺激了该领域的需求。

2024年,美国酱料和调味品市场产值达322亿美元。多元文化人口、广泛的全球旅行和媒体消费推动了国际风味的日益普及。这一趋势体现在各种辛辣浓郁的调味品消费量的增长。社群媒体对烹饪潮流的影响力激增,使得国际酱料更容易被美国消费者接受,也更受消费者青睐,加速了对新奇风味的需求。

酱料和调味品市场的领先公司包括康尼格拉品牌、雀巢、味好美公司、卡夫亨氏公司、玛氏公司、伯纳食品、龟甲万株式会社、联合利华、Bay Valley、Casa Fiesta、Fuchs Gewurze GmbH、李锦记、荷美尔食品公司和汇丰食品。为巩固市场地位,酱料和调味品产业的公司采取了多种策略方针。产品创新始终处于领先地位,各公司不断开发更健康、纯天然和特色酱料,以满足不断变化的消费者偏好。他们还大力投资可持续和环保的包装解决方案,以符合环境目标并吸引环保意识的买家。透过传统零售和电子商务通路扩大分销网路可以扩大市场覆盖率和可及性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计资料(HS 编码)(註:仅提供主要国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 酱油

- 辣酱

- 蘑菇酱

- 鸡尾酒酱

- 其他的

第六章:市场估计与预测:依形式,2021 年至 2034 年

- 主要趋势

- 液体

- 贴上

- 干燥

第七章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 超市/大卖场

- 便利商店

- 网路零售

- 专卖店

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Bay Valley

- Berner Foods

- Casa Fiesta

- Conagra Brands

- Fuchs Gewurze GmbH

- General Mills

- Hormel Foods Corporation

- Huy Fong Foods

- Kikkoman Corporation

- Lee Kum Kee

- Mars, Incorporated

- McCormick & Company

- Nestle

- The Kraft Heinz Company

- Unilever

The Global Sauces and Condiments Market was valued at USD 125.3 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 214.5 billion by 2034. This growth is driven by consumers' increasing preference for convenience and enhanced culinary experiences. With hectic lifestyles and expanding global palates, many consumers now favor ready-to-use sauces and condiments that enrich meals quickly and easily.

The rising trend of home cooking and meal preparation has further fueled demand, prompting manufacturers to innovate by reformulating recipes for better taste and health benefits, exploring new ingredients, and improving packaging to align with evolving consumer needs. These factors collectively are propelling the market forward. However, intensified competition from emerging brands and well-established companies alike is putting pressure on profit margins, as more players enter the market with aggressive pricing, novel products, and robust marketing strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $125.3 Billion |

| Forecast Value | $214.5 Billion |

| CAGR | 5.6% |

Additionally, the proliferation of private label brands is attracting budget-conscious consumers with lower-priced options, challenging branded sauce manufacturers to maintain their market share and profitability. These private labels are not only competing on price but are increasingly focusing on improving quality, taste, and packaging-closing the gap with well-established brands. Retailers are giving more shelf space and visibility to their product lines, offering promotions and loyalty incentives that drive customer preference toward store-brand condiments.

As a result, established players are under pressure to differentiate their offerings, innovate product lines, and justify premium pricing through enhanced flavor profiles, cleaner ingredient labels, and sustainable packaging. The intensifying presence of private labels is shifting the competitive landscape, forcing traditional brands to rethink their positioning strategies in an evolving, price-sensitive market.

In 2024, the soy sauce segment held a valuation of USD 45.3 billion and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Its popularity stems from versatile applications such as cooking, marinating, and serving as a table condiment. Soy sauce's global appeal crosses cultural boundaries, making it a staple in diverse cuisines. Current consumer trends show a rising demand for gluten-free and low-sodium soy sauces, driven by health-conscious shoppers. Flavored soy sauces infused with ingredients like garlic, citrus, or truffle are gaining momentum as they offer convenience and variety to consumers seeking novel taste experiences.

The liquid sauces segment accounted for a 40.2% share in 2024, largely due to their ease of use. These sauces cover over half of the condiments market, serving multiple purposes as cooking ingredients or dipping options. Products like soy sauce, hot sauce, and vinaigrette are household essentials globally. Consumers increasingly prefer liquid sauces marketed as all-natural, sugar-free, or enriched with probiotics. Packaging innovations such as squeeze bottles and sachets have gained popularity for their convenience and portion control, further boosting demand in this segment.

United States Sauces and Condiments Market generated USD 32.2 billion in 2024. The rising popularity of international flavors is fueled by a multicultural population and widespread global travel and media consumption. This trend is reflected in the growing consumption of diverse spicy and bold condiments. The surge in social media's influence on culinary trends has made international sauces more accessible and desirable to American consumers, accelerating demand for new and exotic flavors.

Leading companies in the Sauces and Condiments Market include Conagra Brands, Nestle, McCormick & Company, The Kraft Heinz Company, Mars, Incorporated, Berner Foods, Kikkoman Corporation, Unilever, Bay Valley, Casa Fiesta, Fuchs Gewurze GmbH, Lee Kum Kee, Hormel Foods Corporation, Huy Fong Foods. To solidify their market presence, companies in the sauces and condiments industry adopt several strategic approaches. Product innovation remains at the forefront, with firms continuously developing healthier, all-natural, and specialty sauces to meet shifting consumer preferences. They also invest heavily in sustainable and eco-friendly packaging solutions to align with environmental goals and appeal to eco-conscious buyers. Expanding distribution networks through both traditional retail and e-commerce channels enables broader market reach and accessibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By form

- 2.2.4 By distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soy sauce

- 5.3 Hot sauce

- 5.4 Mushroom sauce

- 5.5 Cocktail sauce

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Paste

- 6.4 Dry

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets/hypermarkets

- 7.3 Convenience stores

- 7.4 Online retail

- 7.5 Specialty stores

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Bay Valley

- 9.2 Berner Foods

- 9.3 Casa Fiesta

- 9.4 Conagra Brands

- 9.5 Fuchs Gewurze GmbH

- 9.6 General Mills

- 9.7 Hormel Foods Corporation

- 9.8 Huy Fong Foods

- 9.9 Kikkoman Corporation

- 9.10 Lee Kum Kee

- 9.11 Mars, Incorporated

- 9.12 McCormick & Company

- 9.13 Nestle

- 9.14 The Kraft Heinz Company

- 9.15 Unilever