|

市场调查报告书

商品编码

1698550

资料中心电力市场机会、成长动力、产业趋势分析及 2025-2034 年预测Data Center Power Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

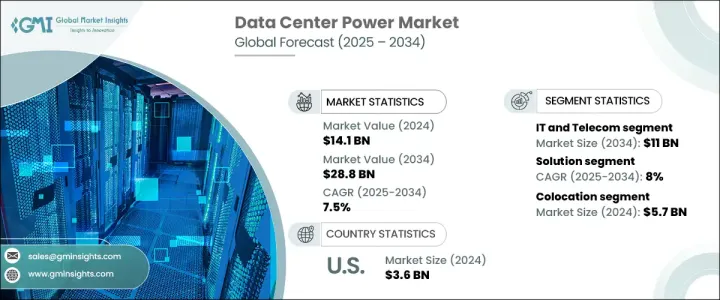

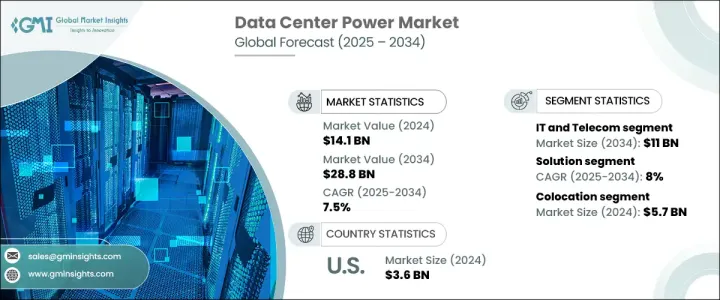

全球资料中心电力市场价值 2024 年将达到 141 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.5%。模组化资料中心的日益普及是推动这一成长的主要因素,因为这些设施提供了更高的效率、可扩展性和灵活性。它们正在成为满足日益增长的资料处理和储存需求的首选解决方案。模组化电力系统将发电机、配电装置和不间断电源整合在预製设计中,从而降低成本和能源消耗,从而降低营运费用并减少碳足迹。随着数位基础设施的扩展,对强大且节能的电源解决方案的需求持续增长。

领先的科技公司和网路公司已经采用模组化资料中心技术来优化成本、降低能耗并加速部署。与传统资料中心相比,模组化设施降低了土木工程成本,并将设计、管理和统包承包费用减少了约 30%。在边缘人工智慧、5G 网路和云端运算的推动下,低延迟资料处理的推动进一步刺激了资料中心对高效能电源解决方案的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 141亿美元 |

| 预测值 | 288亿美元 |

| 复合年增长率 | 7.5% |

市场按应用细分为 BFSI、主机託管、能源、政府、医疗保健、製造、IT 和电信等。 2024 年,IT 和电信占据了 24% 的市场份额,预计到 2034 年主机託管部分的收入将超过 110 亿美元。 IT 和电信供应商都优先考虑节能资料中心,并专注于提高效能、降低成本和最大限度减少环境影响的冷却技术。随着高效能运算需求的成长,节能冷却和电力系统对于管理高耗电工作负载变得至关重要。

资料中心电力市场也按组件分为解决方案和服务。 2024 年,解决方案部门占据 63% 的市场份额,而服务业预计到 2034 年将以约 8% 的复合年增长率扩张。由于成本效率和环境问题,向风能和太阳能等再生能源的转变正在获得动力。这种转变正在改变配电单元(PDU)和不间断电源(UPS),它们现在结合了先进的监控和管理功能,以优化资料中心的电力可靠性和效率。

根据资料中心类型,市场分为超大规模、主机託管、边缘和企业设施。受能源成本上涨和节能营运需求的推动,主机託管产业将在 2024 年以 57 亿美元的规模引领市场。主机託管服务供应商正在积极投资再生能源解决方案,并采用液体和人工智慧驱动冷却等先进的冷却方法来提高效率并降低营运费用。这些创新有助于降低对传统空调的依赖,同时改善高密度 IT 基础架构的冷却管理。

在北美,美国在 2024 年占据资料中心电力领域的主导地位,创造了 36 亿美元的收入。该地区的成长受到科技巨头投资高效电力基础设施以支持不断扩大的资料中心营运的推动。各种规模的企业越来越多地采用云端运算服务,进一步刺激了对先进电源解决方案的需求。随着数位基础设施的不断进步,高效、永续的电力系统仍将是全球资料中心营运商的首要任务。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 电源分配器

- 技术提供者

- 资料中心营运商

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 建置与维护资料中心的成本明细

- 资料中心年度电源使用效率(PUE)

- 监管格局

- 衝击力

- 成长动力

- 全球资料中心功耗不断上升

- 全球资料中心库存不断成长

- 模组化资料中心需求不断成长

- 区块链和机器学习(ML)等数位技术的出现

- 转向智慧电源管理解决方案

- 产业陷阱与挑战

- 与资料中心功耗相关的环境永续性挑战

- 与资料中心电源相关的高管理成本

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 电源分配单元 (PDU)

- UPS

- 产生器

- 柴油发电机

- 瓦斯发电机

- 布线基础设施

- 其他的

- 服务

- 託管

- 专业的

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 金融服务业

- 主机託管

- 活力

- 政府

- 卫生保健

- 製造业

- IT和电信

- 其他的

第七章:市场估计与预测:按资料中心,2021 - 2034 年

- 主要趋势

- 超大规模

- 主机託管

- 边缘

- 企业

第八章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 波兰

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 新加坡

- 澳洲

- 南美洲

- 巴西

- 智利

- 秘鲁

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- ABB

- Active POWER

- Belkin International

- Black Box

- Caterpillar

- Cummins

- Cyber Power Systems

- Delta Electronics

- Eaton

- Hewlett Packard Enterprise

- Huawei Technologies

- Legrand

- Mitsubishi Electric Corporation

- NVIDIA

- Rittal

- Schneider Electric

- Siemens

- Toshiba

- Tripp Lite

- Vertiv

The Global Data Center Power Market, valued at USD 14.1 billion in 2024, is projected to grow at a CAGR of 7.5% from 2025 to 2034. The increasing adoption of modular data centers is a major factor driving this growth, as these facilities offer enhanced efficiency, scalability, and flexibility. They are becoming a preferred solution to meet the rising demand for data processing and storage. Modular power systems integrate generators, power distribution units, and uninterruptible power supplies in prefabricated designs that reduce costs and energy consumption, leading to lower operational expenses and a smaller carbon footprint. As digital infrastructure expands, the need for robust and energy-efficient power solutions continues to grow.

Leading technology firms and internet companies have already embraced modular data center technologies to optimize costs, reduce energy consumption, and accelerate deployment. Compared to traditional data centers, modular facilities lower civil engineering costs and cut design, management, and turnkey contracting expenses by approximately 30%. The push toward low-latency data processing, driven by advancements in edge AI, 5G networks, and cloud computing, is further fueling demand for high-performance power solutions in data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.1 Billion |

| Forecast Value | $28.8 Billion |

| CAGR | 7.5% |

The market is segmented by application into BFSI, colocation, energy, government, healthcare, manufacturing, IT & telecom, and others. In 2024, IT & telecom accounted for 24% of the market, with the colocation segment expected to surpass USD 11 billion in revenue by 2034. Both IT and telecommunications providers are prioritizing power-efficient data centers, focusing on cooling technologies that enhance performance, reduce costs, and minimize environmental impact. As high-performance computing requirements grow, energy-efficient cooling and power systems are becoming critical for managing power-intensive workloads.

The power market for data centers is also classified by component into solutions and services. In 2024, the solutions segment held a 63% market share, while the services sector is anticipated to expand at a CAGR of approximately 8% through 2034. The transition toward renewable energy sources, including wind and solar, is gaining momentum due to cost efficiency and environmental concerns. This shift is transforming power distribution units (PDUs) and uninterruptible power supplies (UPS), which are now incorporating advanced monitoring and management features to optimize power reliability and efficiency in data centers.

By data center type, the market is categorized into hyperscale, colocation, edge, and enterprise facilities. The colocation sector led the market with USD 5.7 billion in 2024, driven by increasing energy costs and the need for energy-efficient operations. Colocation providers are actively investing in renewable energy solutions and adopting advanced cooling methods such as liquid and AI-driven cooling to enhance efficiency and reduce operating expenses. These innovations help lower reliance on conventional air conditioning while improving the cooling management of high-density IT infrastructure.

In North America, the United States dominated the data center power sector in 2024, generating USD 3.6 billion in revenue. Growth in this region is propelled by technology giants investing in efficient power infrastructure to support expanding data center operations. The rising adoption of cloud computing services by enterprises of all sizes further fuels the demand for advanced power solutions. With continuous advancements in digital infrastructure, efficient and sustainable power systems will remain a priority for data center operators worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Power distributor

- 3.1.2 Technology provider

- 3.1.3 Data center operator

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown to build and maintain a data center

- 3.8 Annual power usage effectiveness (PUE) of data centers

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising data center power consumption across the globe

- 3.10.1.2 Growing global data center inventory

- 3.10.1.3 Rising demand for modular data centers

- 3.10.1.4 Emergence of digital technologies including blockchain and Machine Learning (ML)

- 3.10.1.5 Shift toward intelligent power managing solutions

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Environmental sustainability challenges associated with data center power consumption

- 3.10.2.2 High management costs related to data center power

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Power distribution units (PDUs)

- 5.2.2 UPS

- 5.2.3 Generators

- 5.2.3.1 Diesel generator

- 5.2.3.2 Gas generator

- 5.2.4 Cabling infrastructure

- 5.2.5 Others

- 5.3 Services

- 5.3.1 Managed

- 5.3.2 Professional

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 BFSI

- 6.3 Colocation

- 6.4 Energy

- 6.5 Government

- 6.6 Healthcare

- 6.7 Manufacturing

- 6.8 IT & telecom

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Hyperscale

- 7.3 Colocation

- 7.4 Edge

- 7.5 Enterprise

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 North America

- 8.1.1 U.S.

- 8.1.2 Canada

- 8.1.3 Mexico

- 8.2 Europe

- 8.2.1 UK

- 8.2.2 Germany

- 8.2.3 France

- 8.2.4 Spain

- 8.2.5 Poland

- 8.2.6 Benelux

- 8.3 Asia Pacific

- 8.3.1 China

- 8.3.2 India

- 8.3.3 Japan

- 8.3.4 Singapore

- 8.3.5 Australia

- 8.4 South America

- 8.4.1 Brazil

- 8.4.2 Chile

- 8.4.3 Peru

- 8.4.4 Argentina

- 8.5 MEA

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 South Africa

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Active POWER

- 9.3 Belkin International

- 9.4 Black Box

- 9.5 Caterpillar

- 9.6 Cummins

- 9.7 Cyber Power Systems

- 9.8 Delta Electronics

- 9.9 Eaton

- 9.10 Hewlett Packard Enterprise

- 9.11 Huawei Technologies

- 9.12 Legrand

- 9.13 Mitsubishi Electric Corporation

- 9.14 NVIDIA

- 9.15 Rittal

- 9.16 Schneider Electric

- 9.17 Siemens

- 9.18 Toshiba

- 9.19 Tripp Lite

- 9.20 Vertiv