|

市场调查报告书

商品编码

1685908

北美资料中心电源:市场占有率分析、产业趋势与成长预测(2025-2031)North America Data Center Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

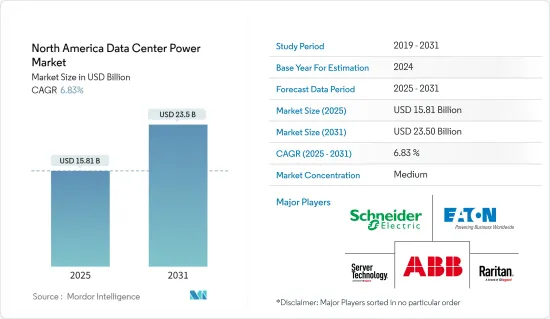

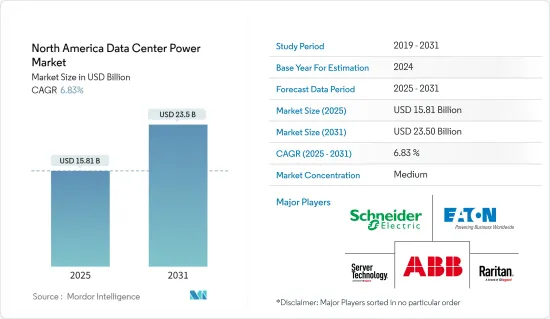

北美资料中心电力市场规模预计在 2025 年为 158.1 亿美元,预计到 2031 年将达到 235 亿美元,预测期内(2025-2031 年)的复合年增长率为 6.83%。

资料中心是能源最密集的建筑类型之一,其每层占地面积的能源消费量是典型商业办公大楼的 10 到 50 倍。这些空间约占美国总用电量的 2%,随着美国资讯科技的使用范围扩大,资料中心和伺服器可能需要更多的能源。此外, IT基础设施、机械化、云端运算的发展,凸显了资料中心和伺服器空间持续供电和稳定运作的重要性,从而推动市场成长。

主要亮点

- 在建IT负载容量:北美资料中心市场未来的IT负载容量预计到2030年将超过25,000MW。

- 在建高层建筑面积:到 2030 年,该国的占地面积预计将超过 8,500 万平方英尺。

- 计划安装的机架数量:预计到 2030 年,该地区计划安装的机架总数将超过 400 万台。预计到 2030 年,美国将安装最多的机架数量。

- 规划中的海底电缆:目前有近100条海底电缆连接北美,其中许多正在兴建中。其中GigNet-1将于2023年投入使用,全长1,104公里,登陆点位于美国博卡拉顿。

北美资料中心电力市场趋势

IT和电讯占很大份额

- 云端处理等技术对高效能运算的需求,带动了可扩展、高效、灵活的业务营运的发展,鼓励许多中小企业建立有效的资料中心,如网路託管云端和主机託管中心。这导致资料中心利用率的提高以及人们对云端和超级资料中心的兴趣日益浓厚。这些资料中心需要大量电力来进行资料密集型操作,这增加了对 PDU 和 UPS 的需求。

- 预计到 2025 年,智慧型手机连线数将增加 3,000 万,而从旧网路(2G 和 3G)的迁移将推动未来几年智慧型手机的成长。预计到 2027 年,北美的行动资料流量将成长两倍以上,这在很大程度上得益于智慧型手机用户数量的成长。

- 疫情后经济復苏,加上5G智慧型手机的强劲销售和有针对性的行销努力,带来了成长势头的激增。消费者对升级到 5G 的兴趣日益增长,现有的 5G 客户对升级其计划以包括视讯和音乐串流、线上游戏、体育直播和云端储存等附加功能表现出浓厚的兴趣。

- 随着 5G 网路不断扩展和改进,预计它将促进需要高速、大容量资料传输的新边缘应用的成长。为了适应这种转变,大型服务供应商正在考虑使用下一代配电单元(PDU)升级其自动化系统,考虑到容量的增加和空间的有限,下一代配电单元(PDU)优先考虑模组化和安全性设计。

- 资料中心电力市场的成长与各市场参与者投资推出资料中心以及在全国扩展资料中心直接相关。预计未来资料中心电源市场将变得更加活跃。例如,2023年,全球知名的网路和基础设施解决方案供应商NetActuate宣布将在蒙特娄启动新的资料中心。除 NetActuate 在多伦多的现有设施外,该地点还为客户提供了额外的国内冗余和灾难復原机会。

美国持续强劲成长

- 预计到2024年初,美国网路普及率将达到总人口的97.1%,数位化趋势引人注目。最近的经济和税收激励措施成为该国资料中心建设的主要推动力。大约有27个州正在利用这些因素来吸引资料中心计划。伊利诺伊州通过了资料中心税收优惠政策,作为其 450 亿美元基本建设预算的一部分。该法案规定,受监管的资料中心在未来 10 年内无需缴纳其设备的州和地方销售税。

- 2023 年,大约有四分之一的资金被投资于全部区域的新兴企业。人工智慧比以往任何时候都更受关注,最近有多轮巨额资金筹措针对该领域的公司,其中包括 OpenAI 和 Anthropic。

- 资料中心电力消耗量和 IT 负载能力的不断增加,导致全部区域越来越多地采用新的电力基础设施解决方案。例如,美国电力公司 Dominion 预计,在 2023 年连接 15 个资料中心后,到 2024 年,该公司将在维吉尼亚将 15 个资料中心连接到电网,总合容量接近 1 千兆瓦。据该公用事业公司称,单一资料中心的需求已从约 30 兆瓦增长到 60-90 兆瓦,而园区的需求现在从 300 兆瓦到数千兆瓦不等。

- 为了满足资料中心电源解决方案日益增长的需求,主要企业正致力于扩大生产能力并根据不断变化的市场趋势开发新产品。例如,Schneider Electric推出了业界首款四合一组合插座-APC NetShelter Rack PDU Advanced。它可提供高达 50% 的电力,每个机架 PDU 的插座数量增加一倍,适用于高密度应用和增加的伺服器机架密度。

- Schneider Electric计画在2024年投资约1.4亿美元扩建其製造设施。新的朱丽叶山工厂预计将于 2024 年投入营运并运送产品,并于 2025 年达到运作。因此,增加对资料中心的投资和即将到来的技术创新可能会刺激该国资料中心电力市场的需求。

北美资料中心电力产业概况

北美资料中心电力市场中等分散,近年来获得了竞争优势。主要公司包括 ABB、西门子和 Raritan (Legrand)。这些拥有强大市场占有率的大型企业正致力于扩大在全部区域的基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。

- 2024 年 1 月—罗格朗收购了位于加州弗里蒙特的 ZPE Systems Inc.,这是一家关键解决方案和服务供应商,为客户业务基础设施提供弹性和安全性。此次收购将把 ZPE 针对资料中心、分店和边缘环境的安全开放管理基础设施和服务配送平臺与罗格朗的综合资料中心解决方案(包括架空母线槽、自订机柜、智慧 PDU、KVM 交换器和先进的光纤解决方案)结合起来。 ZPE Systems 将成为罗格朗资料电源控制 (DPC) 部门的一个业务部门。

- 2023 年 3 月 - Vertiv Group Corp. 宣布其 Vertiv Geist 可升级机架 PDU 现包括组合插座 C13/19,简化了采购、库存和部署。 Vertiv Geist 可升级机架 PDU 的通用 C13/C19 插座可轻鬆适应新的机架配置,无需在机架密度增加时更改或更换 RPDU。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业吸引力-波特五力分析

- 近期地缘政治发展对资料中心基础设施市场的影响

- 产业生态系分析-资料中心电力基础设施

- 市场驱动因素

- 超级资料中心和云端运算的日益普及

- 降低营运成本的需求日益增加

- 市场挑战

- 安装和维护成本高

- 市场机会

- 绿色资料中心的出现和现有资料中心能源效率的提高

- 资料中心电源和备援解决方案的主要趋势分析

- 微电网的发展和向再生能源来源的转变

- 软体定义电源解决方案的出现

- 采用先进的UPS解决方案

- 北美资料中心电力消耗的现行监管情况和标准

5. 北美资料中心足迹分析

- 从 IT 负载能力和资料中心数量分析美国和加拿大目前的资料中心布局

- 美国主要热点分析(Top15热点分析)

- 北美资料中心基础设施总体支出分析

6. 北美资料中心电力市场细分

- 按类型

- 按解决方案类型

- 配电解决方案

- 电源备援解决方案

- 按服务(设计与咨询、整合、支援与维护)

- 按解决方案类型

- 依资料中心类型

- 搭配

- 企业和云端

- 超大规模资料中心业者

- 按最终用户应用程式

- BFSI

- 资讯科技和电信

- 政府

- 製造业

- 媒体与娱乐

- 其他最终用户

- 按国家

- 美国

- 加拿大

第七章竞争格局

- 公司简介

- Vertiv Group Corp.

- ABB Ltd

- Schneider Electric

- Tripp Lite(Eaton)

- Raritan Inc.(Legrand)

- Enlogic(nvent)

- Kohler Co.

- LayerZero Power Systems

- Toshiba International Corporation

- Siemens AG

- Cummins Inc.

- Legrand

第八章投资分析

第九章:未来市场展望

The North America Data Center Power Market size is estimated at USD 15.81 billion in 2025, and is expected to reach USD 23.50 billion by 2031, at a CAGR of 6.83% during the forecast period (2025-2031).

Data centers are among the most energy-intensive building types, which consume 10 to 50 times the energy per floor space as a typical commercial office building. These spaces contribute to approximately 2% of the total US electricity use, and as the country's use of information technology grows, data centers and servers are likely to need more energy as well. The growing establishment of IT infrastructure, mechanization, and cloud-oriented operations has additionally highlighted the significance of constant power supply and steady operation of data centers and server spaces, leading to the growth of the market.

Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the North American data center market is expected to reach above 25,000 MW by 2030.

- Under Construction Raised Floor Space: The country's construction of raised floor areas is expected to exceed 85 million sq. ft. by 2030.

- Planned Racks: The region's total number of racks to be installed is expected to reach more than 4 million units by 2030. The United States is expected to house the maximum number of racks by 2030.

- Planned Submarine Cables: Close to 100 submarine cable systems connect North America, and many are under construction. One such cable, GigNet-1, started its service in 2023. It stretches over 1,104 kilometers and has landing points in Boca Raton, United States.

North America Data Center Power Market Trends

IT and Telecom to Hold Significant Share

- The need for high-performance computing in technologies like cloud computing has led to the development of scalable, efficient, and flexible business operations, prompting many mid-sized companies to establish effective data centers like web hosting clouds and colocation centers. As a result, the increasing use of data centers has sparked a growing interest in cloud and mega data centers, which require massive amounts of power for data-intensive operations, thus creating a high demand for PDUs and UPSs.

- An additional 30 million smartphone connections are expected by 2025, which will drive the ongoing shift away from outdated networks (2G and 3G) and fuel smartphone growth in the coming years. The projected more-than-threefold increase in mobile data traffic in North America by 2027 will be largely driven by the growing number of smartphone users.

- The post-pandemic economic rebound, combined with robust sales of 5G smartphones and targeted marketing efforts, have collectively contributed to a surge in momentum. There is a growing consumer appetite to upgrade to 5G, with existing 5G customers demonstrating a heightened interest in augmenting their plans to encompass additional features such as video and music streaming, online gaming, live sports, and cloud storage.

- As the 5G network continues to expand and improve, it is expected to facilitate the growth of emerging edge applications that require fast and high-capacity data transfer. To accommodate this shift, large-scale service providers are looking to upgrade their automation with next-generation power distribution units (PDUs) that prioritize modularity and safety in design, given the increasing capacity and limited space.

- The growth of the data center power market is directly related to the launch of data centers and various market players investing in the data center expansion in the country. The data center power market is anticipated to flourish. For instance, in 2023, NetActuate, a prominent worldwide provider of network and infrastructure solutions, publicized the launch of a new data center location in Montreal. In addition to NetActuate's existing location in Toronto, this location gives its clientele new opportunities for in-country redundancy and disaster recovery.

United States to Hold Significant Growth

- The US internet penetration rate stood at 97.1% of the total population at the start of 2024, and such a factor focuses on the significant digitization trend. Recent economic incentives and tax benefits have been significant drivers of data center construction in the country. Approximately 27 states leverage these factors to attract data center projects. Sweeping Data Center Tax Exemptions were passed in Illinois as part of its USD 45 billion capital construction budget. The law exempts qualifying data centers from state and local sales tax on the equipment front for the next ten years.

- In 2023, around 1 in 4 dollars was invested in startups across the region; AI is generating more buzz compared to the previous years and has seen a plethora of enormous financings recently looking for companies in the space, including those to OpenAI and Anthropic.

- The increasing power consumption and IT load capacities from the data center resulted in increasing the adoption of new power infrastructure solutions across the region. For instance, Dominion, a US utility, expects to connect 15 data centers to the grid in Virginia throughout 2024 after connecting 15 facilities in 2023, totaling almost a gigawatt of capacity. The utility stated that individual facility demand is growing from around 30MW to 60-90MW, and campus requests now range from 300MW to several GW.

- In order to serve the growing requirement for data center power solutions, key players in the country are focusing on expanding production capacities and developing new products based on evolving market trends. For instance, Schneider Electric introduced the industry's first 4-in-1 combination outlets, APC NetShelter Rack PDU Advanced, which provides up to 50% more power with double the outlets per Rack PDU to support high-density applications and rising server rack densities.

- Schneider Electric plans to expand its manufacturing facilities with an investment of around USD 140 million in 2024. The new plant in Mt. Juliet is expected to begin operations, including product shipping, by 2024 and be fully operational by 2025. Thus, rising investment in data centers and upcoming innovation would boost the demand for the country's data center power market.

North America Data Center Power Industry Overview

The North American data center power market is moderately fragmented and has gained a competitive edge in recent years. Some major players are ABB Ltd, Siemens AG, Raritan Inc. (Legrand), and other players. These major players with prominent market share focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

- January 2024 - Legrand acquired ZPE Systems Inc., a Fremont, California-based company that offers critical solutions and services to deliver resilience and security for customers' business-critical infrastructure. The acquisition brings together ZPE's secure and open management infrastructure and services delivery platform for data center, branch, and edge environments to Legrand's comprehensive data center solutions of overhead busways, custom cabinets, intelligent PDUs, KVM switches, and advanced fiber solutions. ZPE Systems will become a business unit of Legrand's Data, Power, and Control (DPC) Division.

- March 2023 - Vertiv Group Corp. announced that its Vertiv Geist Upgradeable Rack PDUs now come with a Combination Outlet C13/19, simplifying purchasing, inventory management and deployment. The universal C13/C19 outlet on Vertiv Geist Upgradeable Rack PDUs can easily accommodate new rack configurations, eliminating the need to modify or replace rPDUs as rack densities increase.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.1.1 Industry Attractiveness - Porter's Five Forces Analysis

- 4.1.1.1 Bargaining Power of Suppliers

- 4.1.1.2 Bargaining Power of Buyers

- 4.1.1.3 Threat of New Entrants

- 4.1.1.4 Threat of Substitutes

- 4.1.1.5 Intensity of Competitive Rivalry

- 4.1.1 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2 Impact of the Recent Geopolitical Developments of Data Center Infrastructure Market

- 4.3 Industry Ecosystem Analysis - Data Center Power Infrastructure

- 4.4 Market Drivers

- 4.4.1 Rising Adoption of Mega Data Centers and Cloud Computing

- 4.4.2 Increasing Demand to Reduce Operational Costs

- 4.5 Market Challenges

- 4.5.1 High Cost of Installation and Maintenance

- 4.6 Market Opportunities

- 4.6.1 Emergence of Green Data Centers and Increasing Energy Efficiency in Existing DC Facilities

- 4.7 Analysis of Key Trends in Data Center Power & Back-up Solutions

- 4.7.1 Advancements in Microgrid and Move Toward Renewable Energy-based Sources

- 4.7.2 Emergence of Software-defined Power Solutions

- 4.7.3 Adoption of Advanced UPS Solution

- 4.8 Current Regulatory Scenario and Standards Related to Power Consumption in Data Center in North America

5 ANALYSIS OF DATA CENTER FOOTPRINT IN NORTH AMERICA

- 5.1 Analysis of Current DC Footprint in Terms of IT Load Capacity & Number of Data Centers in United States & Canada

- 5.2 Analysis of Key Hotspots in the United States (Top 15 Hotspots will be Analyzed in the Region)

- 5.3 Analysis of Overall Spending on Data Center Infrastructure in North America

6 NORTH AMERICA DATA CENTER POWER MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 By Solution Type

- 6.1.1.1 Power Distribution Solution

- 6.1.1.2 Power Back Up Solutions

- 6.1.2 By Service (Design & Consulting, Integration, Support & Maintenance)

- 6.1.1 By Solution Type

- 6.2 By Data Center Type

- 6.2.1 Colocation

- 6.2.2 Enterprise & Cloud

- 6.2.3 Hyperscalers

- 6.3 By End-user Application

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Government

- 6.3.4 Manufacturing

- 6.3.5 Media & Entertainment

- 6.3.6 Other End User

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vertiv Group Corp.

- 7.1.2 ABB Ltd

- 7.1.3 Schneider Electric

- 7.1.4 Tripp Lite (Eaton)

- 7.1.5 Raritan Inc. (Legrand)

- 7.1.6 Enlogic (nvent)

- 7.1.7 Kohler Co.

- 7.1.8 LayerZero Power Systems

- 7.1.9 Toshiba International Corporation

- 7.1.10 Siemens AG

- 7.1.11 Cummins Inc.

- 7.1.12 Legrand