|

市场调查报告书

商品编码

1698565

光纤电缆市场机会、成长动力、产业趋势分析及2025-2034年预测Fiber Optic Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

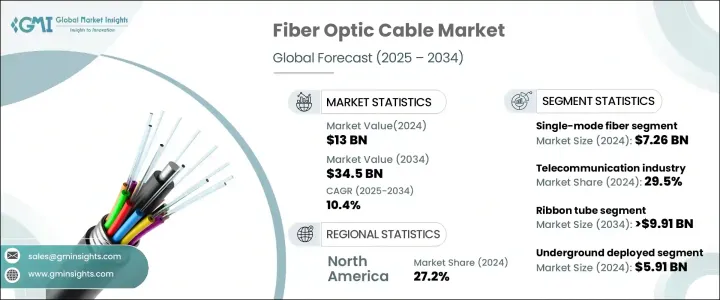

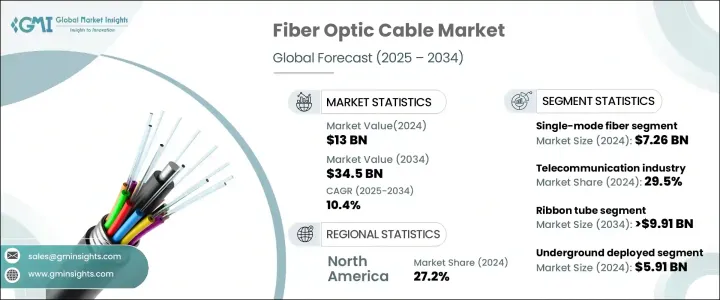

2024 年全球光纤电缆市场价值为 130 亿美元,预计 2025 年至 2034 年的复合年增长率为 10.4%。对高速连接的需求不断增长、5G 网路的扩展以及资料中心部署的激增是推动这一增长的关键因素。随着 5G 技术在全球范围内的扩展,对支援无缝、低延迟通讯的强大基础设施的需求日益加剧。为了实现更好的网路覆盖,小型基地台的部署日益普及,对光纤电缆的需求也十分强劲,因为光纤电缆可确保高效的回程和前传连接。全球 5G 普及率预计将到 2030 年超过 56%,促使光纤製造商提高电缆效率、耐用性和传输速度,以支援现代电信网路。

随着电信公司和云端服务供应商大力投资可扩展、高频宽基础设施,资料中心营运的扩张进一步促进了市场成长。光纤电缆使资料中心能够管理复杂的网路需求,确保安全和高速的连接。随着对电信和云端运算的投资增加,製造商正专注于光纤技术创新,以提高超大规模和边缘资料中心的效率和可扩展性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 130亿美元 |

| 预测值 | 345亿美元 |

| 复合年增长率 | 10.4% |

市场依光纤类型分为单模光纤和多模光纤。单模光纤在 2024 年以 72.6 亿美元的市场规模领先,提供卓越的长距离资料传输能力。多模光纤预计将以 8.5% 的复合年增长率成长,在高速短距离通讯领域,尤其是在区域网路和资料中心,越来越受到人们的关注。

从产业来看,受 5G 网路高频宽连线需求不断增长的推动,电信业在 2024 年占据主导地位,占据 29.5% 的市场份额。预计电力公用事业部门的复合年增长率将达到 10.9%,并且智慧电网应用中光纤电缆的使用将持续增加。国防工业占有 14.2% 的市场份额,依靠光纤进行安全、高速的资料传输,这对于现代通讯和监控系统至关重要。在自动化和数位转型措施不断推进的推动下,到 2034 年,工业领域的规模预计将超过 73.4 亿美元。医疗产业预计将以 8.2% 的复合年增长率成长,利用光纤进行精密诊断和成像技术。

市场也按电缆类型分类,由于带状管光纤电缆具有高光纤密度,预计到 2034 年其市值将超过 99.1 亿美元。鬆管光缆在 2024 年的价值为 43.5 亿美元,广泛应用于长程电信网络,而紧缓衝光缆的复合年增长率为 9.8%,为室内应用提供了增强的灵活性。中央核心电缆预计到 2034 年将达到 41.9 亿美元,透过光纤到府 (FTTH) 和光纤到楼 (FTTB) 部署支援宽频扩充。

从部署角度来看,地下光纤电缆在 2024 年将达到 59.1 亿美元,为关键基础设施提供安全连接。水下通讯领域预计将以 11.8% 的复合年增长率成长,在跨洋通讯中发挥关键作用。预计到 2034 年,空中部署将超过 91.4 亿美元,提供经济高效且易于维护的网路扩充。

从地区来看,受先进网路解决方案的快速采用和政府支持 5G 基础设施发展的倡议的推动,北美在 2024 年占据了 27.2% 的市场份额。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商矩阵

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 宽频普及率提高

- 电信公司持续扩张

- 高速互联网的需求不断增长

- 资料中心的激增

- 采用5G技术

- 产业陷阱与挑战

- 实施和维护成本高

- 克服讯号损失和衰减

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依纤维类型,2021 - 2034 年

- 主要趋势

- 单模光纤

- 多模光纤

第六章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 地下

- 水下

- 天线

第七章:市场估计与预测:依电缆类型,2021 - 2034 年

- 主要趋势

- 带状管

- 鬆套管

- 紧缓衝

- 中央核心

- 其他的

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 电信

- 电力设施

- 国防/军事

- 工业的

- 医疗的

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

- MEA 其余地区

第十章:公司简介

- Belden Inc.

- Coherent Corporation

- CommScope Holding Company Inc.

- Corning Incorporated

- Encore Wire Corporation

- Finolex Cables Limited

- Fujikura Ltd.

- Furukawa Electric

- Hengtong Group Co., Ltd.

- Hexatronic Group AB

- LS Cable & System Ltd.

- Nexans SA

- Proterial Cable America Inc. (Proterial Ltd)

- Prysmian Group

- Sterlite Technologies

- Sumitomo Electric Industries Ltd

- Yangtze Optical Fiber and Cable Joint Stock Ltd Co.

The Global Fiber Optic Cable Market, valued at USD 13 billion in 2024, is expected to grow at a CAGR of 10.4% from 2025 to 2034. Rising demand for high-speed connectivity, the expansion of 5G networks, and the surge in data center deployments are key factors fueling this growth. As 5G technology expands worldwide, the need for robust infrastructure to support seamless, low-latency communication has intensified. The increasing adoption of small cell deployments for better network coverage has created a strong demand for fiber optic cables, which ensure efficient backhaul and fronthaul connectivity. The rise in global 5G penetration, expected to surpass 56% by 2030, is driving fiber optic manufacturers to enhance cable efficiency, durability, and transmission speeds to support modern telecommunication networks.

Expanding data center operations further contributes to market growth, with telecom firms and cloud service providers investing heavily in scalable, high-bandwidth infrastructure. Fiber optic cables enable data centers to manage complex networking demands, ensuring secure and high-speed connectivity. With increased investments in telecom and cloud computing, manufacturers are focusing on fiber technology innovations that enhance efficiency and scalability for hyperscale and edge data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13 Billion |

| Forecast Value | $34.5 Billion |

| CAGR | 10.4% |

The market is segmented by fiber type into single-mode and multi-mode fibers. Single-mode fiber led the market with USD 7.26 billion in 2024, offering superior long-distance data transfer capabilities. Multi-mode fiber, projected to grow at a CAGR of 8.5%, is gaining traction for high-speed, short-distance communication, particularly in local area networks and data centers.

By industry, telecommunications dominated in 2024, accounting for 29.5% of market share, driven by the growing demand for high-bandwidth connectivity in 5G networks. The power utilities sector, projected to expand at a CAGR of 10.9%, is seeing increased adoption of fiber optic cables for smart grid applications. The defense industry, with a 14.2% market share, relies on fiber optics for secure, high-speed data transmission, essential for modern communication and surveillance systems. The industrial segment is set to surpass USD 7.34 billion by 2034, supported by rising automation and digital transformation initiatives. The medical industry, expected to grow at a CAGR of 8.2%, leverages fiber optics for precision diagnostics and imaging technologies.

The market is also categorized by cable type, with ribbon tube fiber optic cables projected to exceed USD 9.91 billion by 2034 due to their high fiber density. Loose tube cables, valued at USD 4.35 billion in 2024, are widely used in long-haul telecom networks, while tight-buffered cables, growing at a CAGR of 9.8%, offer enhanced flexibility for indoor applications. Central core cables, expected to reach USD 4.19 billion by 2034, support broadband expansion through Fiber-to-the-Home (FTTH) and Fiber-to-the-Building (FTTB) deployments.

Deployment-wise, underground fiber optic cables led with USD 5.91 billion in 2024, providing secure connectivity for critical infrastructure. The underwater segment, expected to grow at a CAGR of 11.8%, plays a key role in transoceanic communication. Aerial deployments, forecasted to surpass USD 9.14 billion by 2034, offer cost-effective and easily maintainable network expansion.

Regionally, North America held a 27.2% market share in 2024, driven by the rapid adoption of advanced networking solutions and government initiatives supporting 5G infrastructure development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increased broadband penetration

- 3.8.1.2 Continuous expansion of telecom companies

- 3.8.1.3 Growing demand for high-speed internet

- 3.8.1.4 Proliferation of data center

- 3.8.1.5 Adoption of 5G technologies

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High Implementation and maintenance cost

- 3.8.2.2 Overcoming signal loss and attenuation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.10.1 Supplier power

- 3.10.2 Buyer power

- 3.10.3 Threat of new entrants

- 3.10.4 Threat of substitutes

- 3.10.5 Industry rivalry

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021 - 2034 (USD Million)

- 5.1 Key Trends

- 5.2 Single-mode fiber

- 5.3 Multi-mode fiber

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD Million)

- 6.1 Key Trends

- 6.2 Underground

- 6.3 Underwater

- 6.4 Aerial

Chapter 7 Market Estimates & Forecast, By Cable Type, 2021 - 2034 (USD Million)

- 7.1 Key Trends

- 7.2 Ribbon tube

- 7.3 Loose tube

- 7.4 Tight buffered

- 7.5 Central core

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million)

- 8.1 Key Trends

- 8.2 Telecommunication

- 8.3 Power utilities

- 8.4 Defense/military

- 8.5 Industrial

- 8.6 Medical

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Belden Inc.

- 10.2 Coherent Corporation

- 10.3 CommScope Holding Company Inc.

- 10.4 Corning Incorporated

- 10.5 Encore Wire Corporation

- 10.6 Finolex Cables Limited

- 10.7 Fujikura Ltd.

- 10.8 Furukawa Electric

- 10.9 Hengtong Group Co., Ltd.

- 10.10 Hexatronic Group AB

- 10.11 LS Cable & System Ltd.

- 10.12 Nexans S.A.

- 10.13 Proterial Cable America Inc. (Proterial Ltd)

- 10.14 Prysmian Group

- 10.15 Sterlite Technologies

- 10.16 Sumitomo Electric Industries Ltd

- 10.17 Yangtze Optical Fiber and Cable Joint Stock Ltd Co.