|

市场调查报告书

商品编码

1693726

美国和欧洲光纤电缆-市场占有率分析、行业趋势和成长预测(2025-2030年)United States And European Fiber Optic Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

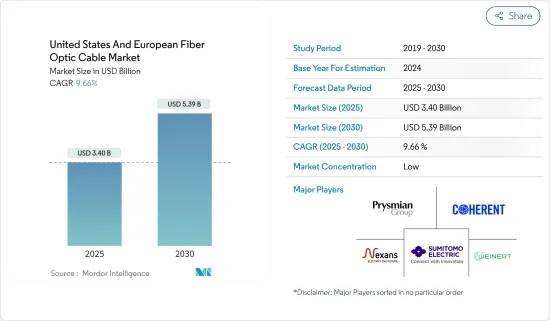

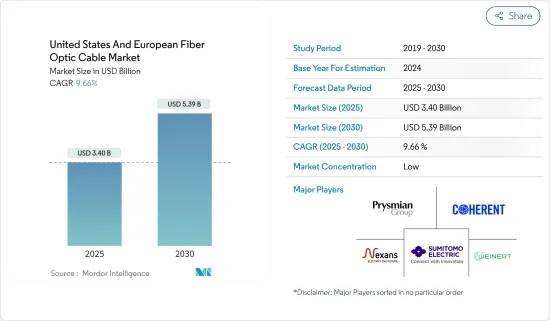

预计 2025 年美国和欧洲光纤电缆市场规模为 34 亿美元,到 2030 年将达到 53.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.66%。

关键亮点

- 5G网路和光纤基础设施的演进正在推动各行各业的数位转型。光纤电缆比铜缆具有更高的安全性、可靠性、频宽和安全性。光纤电缆与铜线的区别在于,光纤电缆利用光脉衝透过光纤线传输讯息,而不是利用电子脉衝透过铜线传输讯息。

- 随着线上交易和虚拟会议的兴起,企业需要 5G 和光纤电缆来保持竞争力。例如,根据欧洲央行的数据,付款非经常性消费者付款的份额将从 2019 年的 6% 增加到 2022 年的 17%。因此,为了支持这种趋势,需要高速网路等强大的基础设施,这有望为所研究的市场创造机会。

- 此外,光纤电缆是众多工业应用的经济高效、方便且简单的解决方案,包括照明和装饰、数据传输、手术和机器检查。在家工作和混合工作模式的兴起也推动了美国和欧洲对 FTTH 的需求。

- 资料流量的成长,尤其是网际网路通讯协定(IP),正倍增对高网路频宽的需求。领先的服务供应商每六到九个月就会将主干频宽频宽翻一番。由于网路流量的成长,频宽每 6 到 9 个月就会翻一番。

- 美国和欧洲市场综合光纤基础设施的扩张也推动了对光纤电缆的巨大需求,尤其是在电讯业。光纤网路和光纤线路也显着改善了宽频设施。这些架构包括 FTTH、FTTP、FTTC 和 FTTB。

- 开发中国家光纤生产商日益增长的连接需求带来了巨大的商业前景。然而,无线解决方案需求不断增加以及铺设光纤电缆的困难等因素对市场的成长构成了若干营运挑战。

- 此外,由于美国和欧洲都正在经历新冠疫情后的景气衰退,宏观经济因素也将对研究市场的成长产生重大影响。此外,俄罗斯与乌克兰的战争以及美国与中国的衝突等地缘政治问题也为市场持续成长带来了挑战。

美国和欧洲光纤电缆市场趋势

光纤和 5G 部署的投资增加将推动市场

- 美国和欧洲市场是最早采用先进通讯技术的市场之一,至今仍是如此。发达的生态系统和数位技术在消费者中的高渗透率等因素正在推动产业相关人员增加对光纤和通讯基础设施的投资。例如,通讯服务供应商康宁最近透露了在 2023 年设计亚利桑那州首个光纤网路的计画。

- 例如,康普是光纤技术创新领域的领导者,不断突破最具挑战性的网路高效能光纤连接的界限。该公司还制定了行业标准,因此其光纤布线系统始终超出要求。

- 美国和欧洲市场对 5G 的日益普及也推动了所研究市场的成长。例如,爱立信最近宣布到2025年将在德国推出3.5GHz(5G)。至2025年,3.5GHz频段的5G网路将占德国网路总量的43%,高于2023年预期的42%。然而,预计到2025年,只有7%的德国地理区域将被覆盖。

- 同样,美国国家科学基金会(NSF)也致力于加速5G解决方案,以确保美国关键基础设施和政府营运商能够随时随地安全通讯。例如,2022年9月,NSF宣布与国防部建立合作关係。美国国家科学基金会投资 1,200 万美元,为其 2022 年融合加速器计画挑选了 16 个团队。这些团队被选为「G 轨道:透过 5G 基础设施安全运作」团队。 G轨道将加速技术进步,为美国联邦政府和军队开发5G通讯。

- Adtran 是一家美国网路和通讯解决方案供应商,利用无源光纤网路技术创建全光纤网络,为企业和家庭提供Gigabit和基础设施回程传输。 2023年1月,该公司宣布推出SDX 6330 10Gbit/s组合无源光纤网路光纤接取平台。该平台使服务供应商能够以经济高效的方式快速地将企业和家庭与光纤宽频连接起来。这项新解决方案提供了业界最高的连接埠密度,并率先推出了具有 400 Gbit/s 上行链路的光线路终端。

- 此外,数据消费的成长也透过鼓励对新的光纤电缆网路的投资来支持数据连接,为研究市场创造了机会。例如,2022年11月,瑞典连线供应商Arelion宣布计画在墨西哥和美国之间透过德克萨斯建立两条高容量光纤路线。新的密集分波多工路由将满足对高容量、可扩展频宽传输日益增长的需求,并简化来自美国、亚洲和欧洲的Over-The-Top供应商进入墨西哥国内市场的途径。

通讯终端用户产业占较大市场占有率

- 光纤电缆(OFC)是通讯基础设施的重要组成部分。在过去的十年中,光纤已经成为首选的传输介质,特别是因为它满足了电信业者对频宽的巨大需求。研究区域是 AT&T、Verizon、Sprint 和沃达丰集团等主要电信业者的所在地,这些公司正在不断扩展其光纤网路以增强其全球和区域影响力。

- 来自互联网、电子商务、电脑网路和多媒体(语音、数据和视讯)等各种来源的数据流量的快速增长表明,需要能够管理更高频宽的传输媒体来处理这些海量资讯。根据欧盟统计局的数据,欧盟每日网路使用者比例将从 2028 年的 74.07% 成长至 2022 年的 84%。光纤电缆以其相对无限的频宽,是解决此问题的重要解决方案之一,因此在可预见的未来,其需求预计仍将保持高位。

- 在通讯网路中,光纤电缆连接不同的网路节点,例如手机讯号塔、资料中心和网路服务供应商,从而允许大量资料在不同位置之间传输。光纤电缆也非常适合高速网路连线和视讯会议、线上游戏和云端运算等先进通讯技术的发展。因此,预计美国和欧洲 5G 网路的扩张将推动所研究的市场机会。

- 此外,选择光纤电缆还因为其安全性、可扩展性和无限频宽潜力,可以处理产生的大量回程传输流量,以支援5G、巨量资料和物联网等不断发展的技术所需的频宽水平,这些技术严重依赖即时数据收集和传输。 5G的推出可望提高网路容量并减少延迟。

- 互联网是研究区域内突出的变革性和快速发展的技术之一,随着光纤电缆广泛应用于数据和通讯行业,它正在推动市场机会。例如,爱立信表示,其覆盖地区的每部智慧型手机数据流量持续增加,预计北美每部智慧型手机的数据流量将从 2021 年的每月 13GB 增长到 2028 年的每月 58GB。同样,西欧预计将从 2021 年的每月 16GB 增长到 2028 年的每月 56GB。

美国和欧洲光纤光缆产业概况

美国和欧洲光纤电缆市场主要由耐克森公司、普睿司曼集团、威纳特工业股份公司、相干公司和住友公司等主要参与者组成。该市场中的参与企业正在采用伙伴关係、收购和合併等策略来加强其产品供应并获得可持续的竞争优势。

- 2023 年 3 月 - 全球网路连接解决方案公司康普宣布扩大光纤电缆生产,以加速美国宽频部署并连接更多社区和服务不足的地区。该公司表示,此举将增加美国的光纤电缆产量,并加速向服务不足的地区推出宽频。此外,该公司的 HeliARC 线路预计每年将支援 50 万个家庭的 FTTH 部署。

- 2023 年 3 月—欧盟宣布,根据其 2030 年数位十年政策计划,有义务在建筑物中安装光纤电缆。根据新规定,新契约的建筑物和正在进行大规模维修的建筑物必须配备无源基础设施(微型管道)和室内光纤电缆(光缆),一直到公寓/单元内的网路终端点。欧盟还计划为「光纤就绪」建筑提供认证。预计这些趋势将推动对光纤电缆的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 关键宏观经济主题的影响

第五章市场动态

- 市场驱动因素

- 数据流量的增加带来了对光纤电缆网路的需求

- 增加对光纤和5G部署的投资

- 市场问题

- 对无线解决方案和复杂安装流程的需求不断增加

第六章市场区隔

- 按最终用户产业

- 通讯

- 电力公共产业

- 国防/军事

- 产业

- 医疗保健

- 其他的

- 按国家

- 美国

- 德国

- 奥地利、瑞士

第七章竞争格局

- 公司简介

- Nexans SA

- Prysmian Group

- Weinert Industries AG

- Coherent Corporation

- Sumitomo Corporation

- Corning Inc.

- Finisar Corporation

- Leoni AG

- Folan

- Molex LLC

- Fujikura Ltd

- Sterlite Technologies

- Furukawa Electric Co. Ltd

- Smiths Interconnect(Smiths Group PLC)

第8章:光纤在工业上的现状

第九章:未来市场展望

The United States And European Fiber Optic Cable Market size is estimated at USD 3.40 billion in 2025, and is expected to reach USD 5.39 billion by 2030, at a CAGR of 9.66% during the forecast period (2025-2030).

Key Highlights

- The evolution of fifth-generation networks & fiber optic infrastructure has driven digital transformation across industries. Optic fiber cable presents better security, reliability, bandwidth, and security than copper cables. The distinction between a fiber optic cable and a copper wire is that the fiber optic cable utilizes light pulses to transfer information down the fiber lines rather than electronic pulses to transmit information through the copper lines.

- With increasing online transactions & virtual meetings, companies need 5G and optic fiber cable to remain competitive. For instance, according to the European Central Bank, online payments share in consumers' non-recurring payments increased to 17% in 2022 from just 6% in 2019. Hence, to support such trends robust infrastructure such as high-speed internet is required which is anticipated to create opportunities in the studied market.

- Furthermore, fiber optic cables are cost-effective, convenient, & easy solutions for numerous industrial applications, like lighting and decorations, data transmission, surgeries, and mechanical inspections. The growing work-from-home & hybrid work model also drives the need for FTTH throughout the United States and Europe.

- Data traffic growth, specifically Internet Protocol (IP), drives the surge in need for high network bandwidth. Prominent service providers registered bandwidth doubling on their backbones every six to nine months. Due to growing internet traffic, bandwidth doubles every 6 to 9 months.

- The expansion of fiber-integrated infrastructure in the US and the European market has also immensely raised the need for fiber-optic cables, particularly in the telecom industry. Fiber-optic networks and fiberoptic wires have also greatly improved owing to broadband installations. These architectures include FTTH, FTTP, FTTC, & FTTB.

- The increase in the need for connectivity in developing nations for fiber-optic producers offers significant business prospects. Yet factors like the advancement in wireless solution demand & the difficulty of deploying fibreoptic cables provide several operational difficulties for the market's growth.

- Macroeconomic factors also influence the studied market's growth significantly as both the United States and the European regions have been witnessing economic downturns post-covid. Furthermore, geopolitical issues such as the Russia-Ukraine war, and the US-China disputes also creates a challenging environment for an uninterrupted growth of the market.

US & European Fiber Optic Cable Market Trends

Rising Investment in Fiber Optic and 5G Deployment Drives the Market

- The US and European markets have been among the early adopters of advanced telecom technologies and continue to remain so. Factors such as the presence of developed ecosystems and higher consumer penetration of digital technologies support encourage the industry stakeholders to increase investments in fiber optic and telecom infrastructure. For instance, Corning, the telecom service provider, recently disclosed plans to design Arizona's first fiber network in 2023, anticipated to serve over 100,000 residences.

- Additionally, the studied regions also have the presence of some of the biggest fiber optic cable companies who continue to expand their regional presence; for instance, CommScope is among the leaders in fibreoptic innovation and drives the boundaries of high-performance fiber connectivity for the most challenging networks. Since the company also sets industry standards, its fiber-optic cabling systems always transcend requirements.

- The growing deployment of 5G in the US and European markets also favors the studied market's growth. For instance, Ericsson, recently stated that the 3.5 GHz (5G) roll-out will be conducted in Germany by 2025. The 3.5 GHz 5G network would constitute 43% of the total German population by 2025, up from 42%, which is anticipated in 2023. However, only 7% of the geographical region in Germany is expected to be covered in 2025.

- Similarly, the US National Science Foundation (NSF) concentrates on accelerating 5G solutions to support US critical infrastructure and government operators to communicate securely anytime and anywhere. For instance, in September 2022, NSF announced a partnership with the Department of Defense Office. With an investment of USD 12 million, NSF selected 16 teams for the Convergence Accelerator program in 2022. These teams were chosen for "Track G: Securely Operating Through 5G Infrastructure". Track G promotes technology advancement to develop 5G communications for the US federal government & military.

- Adtran, the US-based networking & communications solutions provider, enables the building of full-fiber networks employing passive optical network technologies that provide gigabit access to businesses and homes and for infrastructure backhaul. In January 2023, the company established its SDX 6330 10 Gbit/s combo passive optical network fiber access platform, which allows service providers to cost-effectively and quickly connect businesses & homes with fiber-based broadband. The new solution provides the highest port density in the industry and is the foremost optical line terminal incorporated with 400 Gbit/s uplinks.

- Furthermore, the growing data consumption is also creating opportunities in the studied market by driving investment in new optical fiber cable networks which supports the data connectivity. For instance, in November 2022, Arelion, a Swedish connectivity provider, unveiled a plan to create two high-capacity fiber optic routes through Texas between Mexico & the United States. The new dense wavelength division multiplexing routes will meet the increasing demand for high-capacity, scalable bandwidth transport & simplify access to Mexico's local markets for over-the-top suppliers in the United States, Asia, and Europe.

Telecommunication End-user Industry Holds Significant Market Share

- Optical fiber cable (OFC) is a vital building block in the telecommunication infrastructure. Over the last decade, fiber optics have been catering to forceful bandwidth needs, especially from telecommunication companies, and have become the choice of transmission medium. The Studied regions have the presence of some of the biggest telecommunication companies, such as AT&T, Verizon, Sprint, Vodafone Group, etc., who are continuously expanding their optical fiber network to increase their global and regional presence, which creates opportunities in the studied market.

- The eruption of data traffic from different sources, like the internet, e-commerce, computer networks, and multimedia (voice, data, and video), has shown the requirement for a transmission medium capable of managing higher bandwidth to handle such vast amounts of information. According to Eurostat, the share of daily internet users in the European Union had increased to 84% in 2022, compared to 74.07% in 2028. As fiber-optic cables, with comparatively infinite bandwidth, are among the key solutions to this problem, the demand is anticipated to remain high.

- In telecommunication networks, fiber optic cables join different network nodes, like cell towers, data centers, and internet service providers, allowing the exchange of extensive amounts of data between different locations. Fiber-optic cables also have suitable for developing high-speed internet connections & other advanced communication technologies such as video conferencing, online gaming, and cloud computing. Hence, the expanding 5G network footprint in the United States and the European region is anticipated to drive opportunities in the studied market.

- Moreover, owing to their security, scalability, and the unlimited bandwidth potential to handle the vast amount of backhaul traffic being generated, fiber-optic cables are also being selected to support the bandwidth levels catering to evolved technologies like 5G, Big Data and IoT that rely heavily on real-time data gathering and transfer. The launch of 5G is predicted to improve the capacity and lower latency straight to networks.

- The internet has been one of the significantly transformative and fast-growing technologies in the studied regions which is driving opportunities in the studied market as optical fiber cables are widely used in the data and the telecommunication industry. For instance, according to Ericsson, datatraffic per smartphone continues to grow in the studied regions, for instance, in North America, data traffic per smartphone is anticipated to growth from 13 GB/month in 2021 to 58 GB/month in 2028. Similarly, in Western Europe, it is anticipated to grow from 16GB/month in 2021 to 56GB/month by 2028.

US & European Fiber Optic Cable Industry Overview

The United States and European fiber optic cable market is fragmented, with major players like Nexans SA, Prysmian Group, Weinert Industries AG, Coherent Corporation, and Sumitomo Corporation. Players in the market are embracing strategies like partnerships, acquisitions, and mergers to enhance their product offerings and gain sustainable competitive advantage.

- March 2023 - CommScope, a global network connectivity solution, announced expansions to its fiber-optic cable production to accelerate broadband rollout across the U.S., connecting more communities and underserved areas. According to the company, this initiative will increase fiber-optic cable output in the U.S., hastening broadband deployment to underserved communities. Additionally, the company's HeliARC lines are expected to support 500,000 homes per year in FTTH deployments.

- March 2023 - European Eunion announced obligations to equip buildings with fiber-optic cables in line with its 2030 policy program for the digital decade. As per the new regulation, it will be mandatory to keep passive infrastructure (mini ducts) and in-building fiber wiring (fiber optic cables) in newly contracted buildings or buildings undergoing major renovations, up to the network termination point in the apartment/unit. EU is also planning to provide certification to the buildings that are 'fiber ready. Such trends are anticipated to drive the demand for fiber optic cables.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of Key Macro-economic themes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increased Data Traffic Creates the Demand for Fiber Optic Cable Network

- 5.1.2 Rising Investment in Fiber Optic and 5G Deployment

- 5.2 Market Challenges

- 5.2.1 Rising Demand For Wireless Solutions and Complex Installation Process

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Telecommunication

- 6.1.2 Power Utilities

- 6.1.3 Defence/military

- 6.1.4 Industrial

- 6.1.5 Medical

- 6.1.6 Other End-user Industries

- 6.2 By Country

- 6.2.1 United States

- 6.2.2 Germany

- 6.2.3 Austria and Switzerland

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nexans SA

- 7.1.2 Prysmian Group

- 7.1.3 Weinert Industries AG

- 7.1.4 Coherent Corporation

- 7.1.5 Sumitomo Corporation

- 7.1.6 Corning Inc.

- 7.1.7 Finisar Corporation

- 7.1.8 Leoni AG

- 7.1.9 Folan

- 7.1.10 Molex LLC

- 7.1.11 Fujikura Ltd

- 7.1.12 Sterlite Technologies

- 7.1.13 Furukawa Electric Co. Ltd

- 7.1.14 Smiths Interconnect (Smiths Group PLC)