|

市场调查报告书

商品编码

1698578

合成钻石市场机会、成长动力、产业趋势分析及2025-2034年预测Synthetic Diamond Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

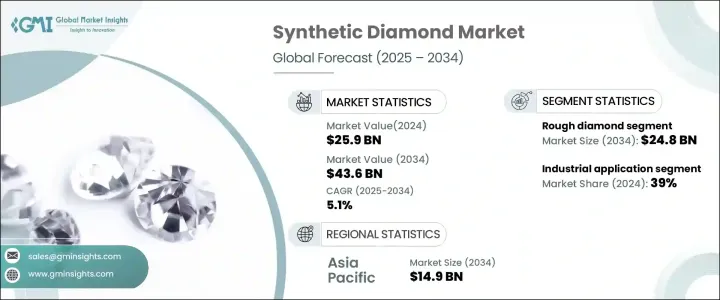

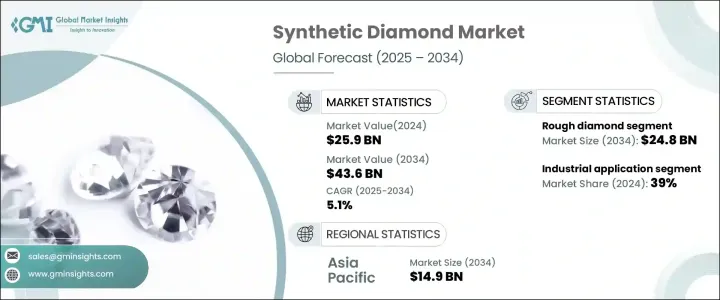

2024 年全球合成钻石市场价值为 259 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%。对实验室培育钻石的需求不断增长,正在重塑这个产业,吸引消费者和企业。与天然钻石不同,合成钻石适用于多种应用,包括电子、工业工具和医疗设备。向可持续且具有成本效益的替代品的转变正在推动采用,製造商利用先进的生产技术来提高品质和性能。

合成钻石分为抛光钻石和毛坯钻石。 2024 年,抛光钻石领域占据了市场收入的很大份额,创造了 259 亿美元的收入,高于 2020 年的 200 亿美元。 2024 年,毛坯钻石领域价值 150 亿美元,预计到 2034 年将增至 248 亿美元。毛坯钻石占整个市场的 58%,反映出强劲的国际需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 259亿美元 |

| 预测值 | 436亿美元 |

| 复合年增长率 | 5.1% |

抛光钻石主要用于高级珠宝、奢华配件和高端手錶。可支配收入的增加、消费者偏好的改变以及对个人化珠宝日益增长的倾向支持了他们的市场扩张。儘管其价格比毛坯钻石高出 30-40%,但由于其独特性,其需求预计还会增长。同时,钻石毛坯是钻石贸易的基础,为抛光商和珠宝商提供原料。

合成钻石的製造流程包括高压高温 (HPHT) 和化学气相沉积 (CVD)。后者发展迅速,线下销售增幅超过5.2%。 HPHT 和 CVD 方法因其在工业应用中(特别是在电子和高性能工具中)的关键作用而不断扩展。压力控制技术的创新正在提高晶体质量,使 HPHT 钻石在珠宝和工业市场上更具竞争力。

CVD 技术正在不断发展,以满足量子运算和热管理解决方案等下一代应用的需求。无缺陷钻石的生产正在加速其在半导体和光学产业的应用。随着这些产业将合成钻石融入高性能係统,预计市场将会扩大。

根据应用,合成钻石市场分为珠宝、工业、电子、医疗和其他用途。工业领域在 2024 年占据 39% 的份额,预计到 2034 年将保持成长。珠宝仍然是成长最快的领域,复合年增长率为 5.6%,到 2024 年将占整个市场的 29%。消费者对具有成本效益和可持续性的替代品的偏好日益增加,这推动了北美和亚太地区的需求。

工业级合成钻石市场正在稳步成长,特别是在切削工具和磨料领域。电子和医疗产业的应用也日益增多,利用合成钻石作为热导体和精密仪器。光学和航太领域的新兴应用正在进一步扩大市场潜力。

2024 年亚太地区的营收为 90 亿美元,预计到 2034 年将达到 149 亿美元。该地区强大的製造业基础和工业需求使其成为全球领导者。中国凭藉在研发方面的大量投资、先进的製造能力以及在工业级钻石生产领域的主导地位,仍然是钻石产业的关键参与者。预计2024年中国销售额将达63亿美元,延续前几年的上升趋势。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

- 初步研究和验证

- 主要来源

- 资料探勘来源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 半导体产业需求不断成长

- 先进技术的应用日益广泛

- 卓越的热性能和电气性能

- 电子产业的扩张

- 比天然钻石更具成本竞争力

- 增加研发投资

- 永续性和道德采购

- 工业应用的使用日益增多

- 产业陷阱与挑战

- 初始生产成本高

- 大规模采用的技术限制

- 来自替代材料的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 抛光

- 粗糙的

第六章:市场估计与预测:按製造工艺,2021 年至 2034 年

- 主要趋势

- 高压高温(HPHT)

- 化学气相沉积(CVD)

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 珠宝

- 工业的

- 电子产品

- 医疗的

- 其他(包括光学、航太等)

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Adamas One

- Applied Diamond

- Blue Nile

- Clean Origin

- Diamond Foundry

- Element Six UK

- Henan Huanghe Whirlwind

- Iljin Diamond

- James Allen

- New Diamond Technology

- Pure Grown Diamonds (PGD)

- Rahi Impex

- Ritani

- Sumitomo Electric Industries

- Swarovski

- Vibranium Lab

The Global Synthetic Diamond Market was valued at USD 25.9 billion in 2024 and is projected to grow at a 5.1% CAGR from 2025 to 2034. The increasing demand for lab-grown diamonds is reshaping the industry, attracting consumers and businesses alike. Unlike natural diamonds, synthetic variants cater to diverse applications, including electronics, industrial tools, and medical equipment. The shift toward sustainable and cost-effective alternatives is driving adoption, with manufacturers leveraging advanced production technologies to improve quality and performance.

Synthetic diamonds are classified into polished and rough types. The polished diamond segment accounted for a significant share of market revenue in 2024, generating USD 25.9 billion, up from USD 20 billion in 2020. The rough diamond segment was valued at USD 15 billion in 2024 and is expected to rise to USD 24.8 billion by 2034. Rough diamonds comprised 58% of the total market, reflecting strong international demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.9 Billion |

| Forecast Value | $43.6 Billion |

| CAGR | 5.1% |

Polished diamonds are primarily used in fine jewelry, luxury accessories, and high-end watches. Their market expansion is supported by increasing disposable income, evolving consumer preferences, and a rising inclination toward personalized jewelry. Despite being 30-40% more expensive than rough diamonds, their demand is expected to grow due to exclusivity. Meanwhile, rough diamonds serve as the foundation of the diamond trade, supplying raw materials to polishers and jewelers.

The manufacturing process for synthetic diamonds includes High-Pressure, High-Temperature (HPHT) and Chemical Vapor Deposition (CVD). The latter is rapidly advancing, outpacing offline sales growth by 5.2%. HPHT and CVD methods continue to expand due to their critical role in industrial applications, particularly in electronics and high-powered tools. Innovations in pressure control technology are enhancing crystal quality, making HPHT diamonds more competitive in the jewelry and industrial markets.

CVD techniques are evolving to meet the demands of next-generation applications such as quantum computing and thermal management solutions. The production of defect-free diamonds is accelerating their adoption in the semiconductor and optical industries. As these sectors integrate synthetic diamonds into high-performance systems, market expansion is expected.

By application, the synthetic diamond market is divided into jewelry, industrial, electronics, medical, and other uses. The industrial segment led with a 39% share in 2024 and is projected to maintain growth through 2034. Jewelry remains the fastest-growing segment, registering a 5.6% CAGR and comprising 29% of the total market in 2024. Increasing consumer preference for cost-effective and sustainable alternatives is driving demand across North America and Asia Pacific.

The market for industrial-grade synthetic diamonds is growing steadily, particularly in cutting tools and abrasives. The electronics and medical industries are also witnessing increased adoption, utilizing synthetic diamonds as heat conductors and precision instruments. Emerging applications in optics and aerospace are further expanding market potential.

Asia Pacific generated USD 9 billion in revenue in 2024, with projections to reach USD 14.9 billion by 2034. The region's strong manufacturing base and industrial demand position it as a global leader. China remains a key player due to substantial investments in research and development, advanced manufacturing capacity, and a dominant presence in industrial-grade diamond production. Sales in China are expected to reach USD 6.3 billion in 2024, continuing the upward trajectory observed in previous years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing Demand in the Semiconductor Industry

- 3.6.1.2 Rising Adoption in Advanced Technologies

- 3.6.1.3 Superior Thermal and Electrical Properties

- 3.6.1.4 Expansion in the Electronics Industry

- 3.6.1.5 Cost Competitiveness Over Natural Diamonds

- 3.6.1.6 Increased Research & Development Investments

- 3.6.1.7 Sustainability and Ethical Sourcing

- 3.6.1.8 Growing Use in Industrial Applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High Initial Production Costs

- 3.6.2.2 Technical Limitations in Mass Adoption

- 3.6.2.3 Competition from Alternative Materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Carats)

- 5.1 Key trends

- 5.2 Polished

- 5.3 Rough

Chapter 6 Market Estimates and Forecast, By Manufacturing Process, 2021 – 2034 (USD Billion) (Carats)

- 6.1 Key trends

- 6.2 High-pressure, high-temperature (HPHT)

- 6.3 Chemical vapor deposition (CVD)

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Carats)

- 7.1 Key trends

- 7.2 Jewelry

- 7.3 Industrial

- 7.4 Electronics

- 7.5 Medical

- 7.6 Other (including optics, aerospace etc)

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Carats)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Adamas One

- 9.2 Applied Diamond

- 9.3 Blue Nile

- 9.4 Clean Origin

- 9.5 Diamond Foundry

- 9.6 Element Six UK

- 9.7 Henan Huanghe Whirlwind

- 9.8 Iljin Diamond

- 9.9 James Allen

- 9.10 New Diamond Technology

- 9.11 Pure Grown Diamonds (PGD)

- 9.12 Rahi Impex

- 9.13 Ritani

- 9.14 Sumitomo Electric Industries

- 9.15 Swarovski

- 9.16 Vibranium Lab