|

市场调查报告书

商品编码

1698588

热能储存系统市场机会、成长动力、产业趋势分析及 2025-2034 年预测Thermal Energy Storage Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

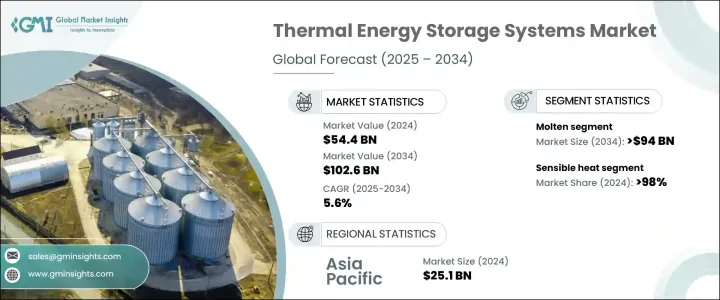

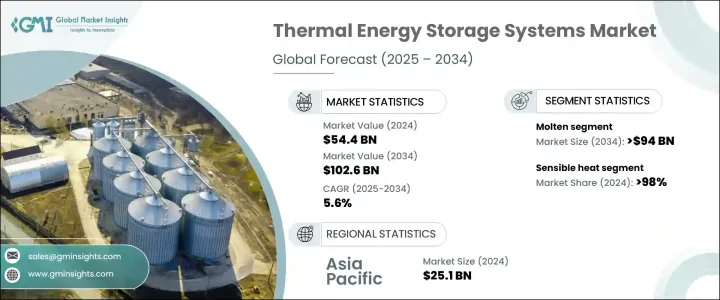

2024 年全球热能储存系统市场价值为 544 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.6%。不断增长的电力需求是推动市场成长的主要因素,各行各业越来越多地转向热能储存来优化能源使用并降低成本。发电、化学加工、食品饮料和暖通空调产业越来越多地采用能源管理解决方案,从而推动市场扩张。这些行业正在整合热能储存以提高效率并降低营运费用,导致全球电力消耗激增。该技术能够在生产高峰期储存剩余能源,确保在再生能源不可用时稳定供应。随着风能和太阳能发电量的不断增加,对可靠储存解决方案的需求也不断增加。

热能储存是电网稳定的关键因素,尤其是在再生能源采用加速的情况下。熔盐系统因其能够提供稳定的电力输出而成为储能的首选。相变材料、热化学储存和熔盐溶液的进步进一步提高了效率和储存容量。世界各国政府正在实施严格的能源效率法规,并向该领域投入大量资金。 2023年,欧洲将向再生能源专案拨款超过1,050亿美元,将增强对热能储存解决方案的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 544亿美元 |

| 预测值 | 1026亿美元 |

| 复合年增长率 | 5.6% |

随着对再生能源整合的日益重视,熔盐市场的规模预计到 2034 年将超过 940 亿美元。显热储存在 2024 年占据了 98% 以上的市场份额,并且预计在全球能源消耗、工业化和城市化不断增长的支持下,这一份额将进一步扩大。这些因素持续推动全球对高效能储存技术的需求。

亚太地区热能储存市场经历了大幅成长,估值在 2022 年达到 91 亿美元,2023 年达到 187 亿美元,2024 年达到 251 亿美元。发展中国家快速的城市化和工业成长产生了大量的电力需求,从而增强了对储能的需求。作为更广泛的永续发展措施的一部分,政府政策和财政激励措施正在进一步加速热能储存的采用。全球对减少碳排放和扩大再生能源的承诺需要部署大规模储存系统,以确保长期的市场成长。

目录

第一章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依储存资料,2021 年至 2034 年

- 主要趋势

- 水

- 熔盐

- 相控阵相机

- 其他的

第六章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 显热

- 潜热

- 热化学

第七章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 发电

- 区域供热和製冷

- 製程加热和冷却

第 8 章:市场规模与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅和商业

- 实用工具

- 工业的

第九章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- Abengoa SA

- Baltimore Aircoil Company

- Burns & McDonnell

- Caldwell Energy Company

- CALMAC

- Deepchill Solutions Inc.

- DN Tanks

- Dunham-Bush Limited

- EVAPCO, Inc.

- FAFCO, Inc.

- Goss Engineering, Inc.

- McDermott

- New BrightSource, Ltd.

- Siemens Gamesa Renewable Energy, SA

- Steffes, LLC

The Global Thermal Energy Storage Systems Market was valued at USD 54.4 billion in 2024 and is projected to expand at a 5.6% CAGR from 2025 to 2034. Growing electricity demand is a primary factor fueling market growth, with industries increasingly turning to thermal energy storage to optimize energy use and reduce costs. The rising adoption of energy management solutions across power generation, chemical processing, food and beverages, and HVAC industries is driving market expansion. These industries are integrating thermal storage to enhance efficiency and lower operational expenses, leading to a surge in global electricity consumption. The technology enables surplus energy storage during peak production periods, ensuring a stable supply when renewable sources are unavailable. With increasing energy production from wind and solar power, the need for reliable storage solutions continues to rise.

Thermal energy storage is a key enabler of grid stability, particularly as renewable energy adoption accelerates. Molten salt-based systems are becoming the preferred choice in energy storage due to their ability to provide consistent electricity output. Advancements in phase change materials, thermochemical storage, and molten salt solutions are further improving efficiency and storage capacity. Governments worldwide are implementing stringent energy efficiency regulations, directing significant investments into the sector. In 2023, Europe allocated over USD 105 billion toward renewable energy projects, reinforcing the demand for thermal storage solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $54.4 Billion |

| Forecast Value | $102.6 Billion |

| CAGR | 5.6% |

The molten salt segment is expected to surpass USD 94 billion by 2034, driven by the growing emphasis on renewable energy integration. Sensible heat storage accounted for over 98% of the market share in 2024 and is projected to expand further, supported by increasing global energy consumption, industrialization, and urbanization. These factors continue to drive the need for efficient storage technologies worldwide.

Asia Pacific thermal energy storage market witnessed substantial growth, with valuations reaching USD 9.1 billion in 2022, USD 18.7 billion in 2023, and USD 25.1 billion in 2024. Rapid urbanization and industrial growth in developing countries are generating high electricity demand, bolstering the need for energy storage. Government policies and financial incentives are further accelerating thermal storage adoption as part of broader sustainability initiatives. Global commitments to carbon reduction and renewable energy expansion necessitate the deployment of large-scale storage systems, ensuring long-term market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Storage Material, 2021 – 2034 (USD Million, MW)

- 5.1 Key trends

- 5.2 Water

- 5.3 Molten Salt

- 5.4 PCM

- 5.5 Others

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million, MW)

- 6.1 Key trends

- 6.2 Sensible Heat

- 6.3 Latent Heat

- 6.4 Thermochemical

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, MW)

- 7.1 Key trends

- 7.2 Power Generation

- 7.3 District Heating & Cooling

- 7.4 Process Heating & Cooling

Chapter 8 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, MW)

- 8.1 Key trends

- 8.2 Residential & Commercial

- 8.3 Utilities

- 8.4 Industrial

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 Abengoa S.A.

- 10.2 Baltimore Aircoil Company

- 10.3 Burns & McDonnell

- 10.4 Caldwell Energy Company

- 10.5 CALMAC

- 10.6 Deepchill Solutions Inc.

- 10.7 DN Tanks

- 10.8 Dunham-Bush Limited

- 10.9 EVAPCO, Inc.

- 10.10 FAFCO, Inc.

- 10.11 Goss Engineering, Inc.

- 10.12 McDermott

- 10.13 New BrightSource, Ltd.

- 10.14 Siemens Gamesa Renewable Energy, S.A.

- 10.15 Steffes, LLC