|

市场调查报告书

商品编码

1699243

电脑微晶片市场机会、成长动力、产业趋势分析及 2025-2034 年预测Computer Microchips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

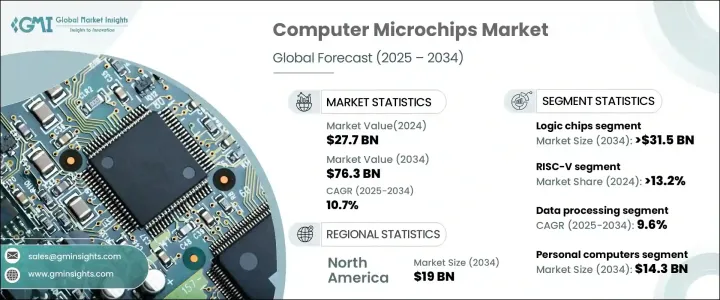

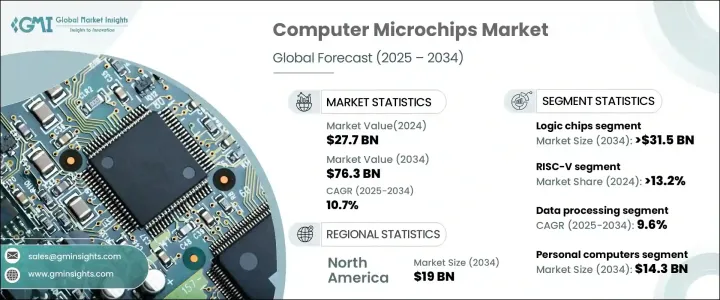

2024 年全球电脑微晶片市场价值为 277 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 10.7%。人工智慧、机器学习和云端运算的日益普及正在推动对高效能、低功耗微晶片的需求。随着企业和消费者越来越依赖数位转型,对先进处理器、记忆体晶片和网路组件的需求持续上升。该公司正专注于可扩展且节能的晶片,以支援人工智慧驱动的应用程式、资料密集型工作负载和基于云端的操作。随着企业投资先进的微晶片以优化电源效率并降低营运成本,不断扩大的资料中心基础设施也在加速市场的成长。半导体製造的创新和人工智慧优化晶片的兴起正在塑造产业的发展。

製造商优先考虑针对人工智慧和云端运算应用的高效能、低功耗晶片。人工智慧工作负载需要专门为深度学习、神经网路和巨量资料分析设计的处理器。人们越来越重视更快、更有效率的运算,这推动了微晶片架构的创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 277亿美元 |

| 预测值 | 763亿美元 |

| 复合年增长率 | 10.7% |

根据晶片类型,市场分为记忆体晶片、逻辑晶片、SoC 和 ASIC。在半导体技术进步以及 5G 和物联网日益普及的推动下,逻辑晶片领域预计将大幅扩张。预计到 2034 年逻辑晶片市场规模将超过 315 亿美元,智慧型手机、平板电脑、笔记型电脑和游戏设备的需求不断增长将推动其成长。将多种处理功能整合到单一单元的系统单晶片 (SoC) 架构正在提高行动和穿戴式装置的效能。

按架构分類的市场包括 x86、ARM、RISC-V 等。 RISC-V 领域因其开源框架、灵活性和成本效益而正在经历快速成长。 2024年,RISC-V占超过13.2%的市占率。其开源特性使得公司无需支付许可费用即可开发客製化晶片设计,从而节省大量成本并避免对供应商的依赖。

根据应用,市场分为资料处理、图形渲染、人工智慧和机器学习、网路、感测器整合、加密和安全。预计到 2034 年,资料处理领域的复合年增长率将达到 9.6%。对基于人工智慧的分析、巨量资料、云端运算和高效能运算的需求不断增长,推动了对能够处理大规模运算工作负载的复杂晶片的需求。

最终用途细分包括个人电脑、伺服器和资料中心、智慧型手机和平板电脑、游戏机等。受远距工作、线上教育和数位内容创作需求不断增长的推动,个人电脑市场预计到 2034 年将达到 143 亿美元。人工智慧笔记型电脑和基于 ARM 的处理器的日益普及正在重塑 PC 行业。

从地区来看,预计到 2034 年北美的市场规模将达到 190 亿美元,这得益于强劲的研发投资、先进的半导体供应链以及对人工智慧和基于云端的技术不断增长的需求。在政府扩大国内半导体生产和减少对外部供应链依赖的措施的支持下,仅美国市场规模就预计将达到 167 亿美元。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 人工智慧和机器学习的进步

- 消费性电子产品的成长

- 云端运算和资料中心的扩展

- 半导体需求不断成长

- 电动车(EV)和自动驾驶汽车的兴起

- 产业陷阱与挑战

- 全球半导体供应链中断

- 复杂性和製造成本不断上升

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按晶片类型,2021 年至 2034 年

- 主要趋势

- 逻辑晶片

- 记忆体晶片

- ASIC

- 系统级晶片

第六章:市场估计与预测:按建筑,2021 年至 2034 年

- 主要趋势

- x86

- 手臂

- RISC-V

- 其他的

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 资料处理

- 图形渲染

- 人工智慧和机器学习

- 网路和连接

- 感测器集成

- 加密和安全

- 其他的

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 个人电脑

- 伺服器和资料中心

- 智慧型手机和平板电脑

- 游戏机

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Advanced Micro Devices

- Analog Devices

- Arm Holdings

- Broadcom

- Espressif Systems

- Infineon Technologies

- Intel

- Kioxia Holdings

- Marvell Technology Group

- Microchip Technology

- Micron Technology

- NVIDIA

- NXP Semiconductors

- Qualcomm

- Renesas Electronics

- Samsung Electronics

- STMicroelectronics

- Taiwan Semiconductor Manufacturing Company

- Texas Instruments

The Global Computer Microchips Market was valued at USD 27.7 billion in 2024 and is projected to expand at a CAGR of 10.7% from 2025 to 2034. Increasing adoption of artificial intelligence, machine learning, and cloud computing is fueling demand for high-performance, low-power microchips. With businesses and consumers increasingly relying on digital transformation, the need for advanced processors, memory chips, and networking components continues to rise. Companies are focusing on scalable and energy-efficient chips to support AI-driven applications, data-intensive workloads, and cloud-based operations. Expanding data center infrastructure is also accelerating the market's growth as firms invest in advanced microchips to optimize power efficiency and reduce operational costs. Innovations in semiconductor manufacturing and the rise of AI-optimized chips are shaping the industry's evolution.

Manufacturers are prioritizing high-performance, low-power chips tailored for AI and cloud computing applications. AI workloads require specialized processors designed for deep learning, neural networks, and big data analytics. The growing emphasis on faster, more efficient computing is driving innovation in microchip architecture.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.7 Billion |

| Forecast Value | $76.3 Billion |

| CAGR | 10.7% |

By chip type, the market is segmented into memory chips, logic chips, SoCs, and ASICs. The logic chips segment is expected to witness substantial expansion, driven by advancements in semiconductor technology and the increasing use of 5G and IoT. The market for logic chips is projected to exceed USD 31.5 billion by 2034, with rising demand for smartphones, tablets, laptops, and gaming devices contributing to its growth. System-on-chip (SoC) architectures that integrate multiple processing functions into a single unit are enhancing the performance of mobile and wearable devices.

Market segmentation by architecture includes x86, ARM, RISC-V, and others. The RISC-V segment is experiencing rapid growth due to its open-source framework, flexibility, and cost benefits. In 2024, RISC-V accounted for over 13.2% of the market. Its open-source nature allows companies to develop custom chip designs without licensing fees, offering significant cost savings and avoiding vendor dependency.

By application, the market is categorized into data processing, graphics rendering, AI and machine learning, networking, sensor integration, encryption, and security. The data processing segment is forecasted to grow at a CAGR of 9.6% by 2034. Expanding demand for AI-based analytics, big data, cloud computing, and high-performance computing is boosting the requirement for sophisticated chips that can handle large-scale computational workloads.

The end-use segmentation includes personal computers, servers and data centers, smartphones and tablets, gaming consoles, and others. The personal computers segment is expected to reach USD 14.3 billion by 2034, driven by increasing demand for remote work, online education, and digital content creation. The growing adoption of AI-powered laptops and ARM-based processors is reshaping the PC industry.

Regionally, North America is forecasted to reach USD 19 billion by 2034, benefiting from strong R&D investments, an advanced semiconductor supply chain, and rising demand for AI and cloud-based technologies. The U.S. market alone is expected to hit USD 16.7 billion, supported by government initiatives to expand domestic semiconductor production and reduce reliance on external supply chains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in AI and machine learning

- 3.2.1.2 Growth in consumer electronics

- 3.2.1.3 Expansion of cloud computing and data centres

- 3.2.1.4 Increasing demand for semiconductors

- 3.2.1.5 Rise in electric vehicles (EVs) and autonomous cars

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Global semiconductor supply chain disruptions

- 3.2.2.2 Rising complexity and manufacturing costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Chip Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Logic chips

- 5.3 Memory chips

- 5.4 ASICs

- 5.5 SoCs

Chapter 6 Market Estimates and Forecast, By Architecture, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 x86

- 6.3 ARM

- 6.4 RISC-V

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Data processing

- 7.3 Graphics rendering

- 7.4 Artificial intelligence and machine learning

- 7.5 Networking and connectivity

- 7.6 Sensor integration

- 7.7 Encryption and security

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End-use, 2021– 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Personal computers

- 8.3 Servers and data centers

- 8.4 Smartphones and tablets

- 8.5 Gaming consoles

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Micro Devices

- 10.2 Analog Devices

- 10.3 Arm Holdings

- 10.4 Broadcom

- 10.5 Espressif Systems

- 10.6 Infineon Technologies

- 10.7 Intel

- 10.8 Kioxia Holdings

- 10.9 Marvell Technology Group

- 10.10 Microchip Technology

- 10.11 Micron Technology

- 10.12 NVIDIA

- 10.13 NXP Semiconductors

- 10.14 Qualcomm

- 10.15 Renesas Electronics

- 10.16 Samsung Electronics

- 10.17 STMicroelectronics

- 10.18 Taiwan Semiconductor Manufacturing Company

- 10.19 Texas Instruments