|

市场调查报告书

商品编码

1699256

电线电缆管理市场机会、成长动力、产业趋势分析及 2025-2034 年预测Wire and Cable Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

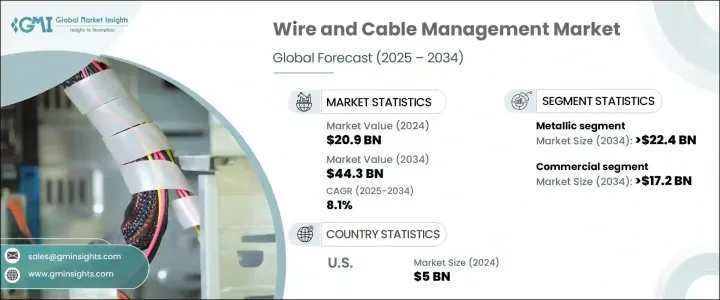

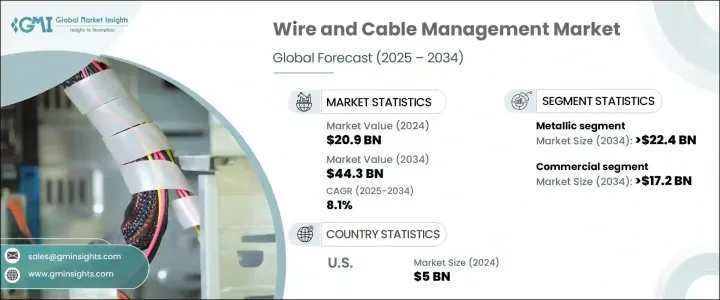

全球电线电缆管理市场规模在 2024 年将达到 209 亿美元,预计 2025 年至 2034 年的复合年增长率为 8.1%。这一扩张是由已开发经济体和新兴经济体对电线电缆的需求不断增长所推动的。快速的城市化和不断扩大的基础设施项目正在推动对高效电网的需求,使得电线和电缆管理成为必不可少的组成部分。电缆和布线系统中先进技术的日益普及进一步加速了对高效能管理解决方案的需求。高效的电力分配、结构化的布线和最小化的电磁干扰 (EMI) 正在成为寻求提高营运效率的行业的首要任务。

商业、住宅和工业建筑的投资促进了对电力基础设施的需求不断增长,从而加强了对电线和电缆管理解决方案的需求。随着各行各业越来越依赖自动化、智慧电网和高速资料传输,对强大布线系统的需求也变得越来越明显。向再生能源的日益转变也对可靠的布线解决方案产生了强烈的需求。先进的电缆对于太阳能、风能和水力发电专案的高效输配电至关重要。此外,资料中心和云端运算的兴起进一步强调了支援无缝资料流的结构化布线系统的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 209亿美元 |

| 预测值 | 443亿美元 |

| 复合年增长率 | 8.1% |

预计到 2034 年,金属线和电缆管理领域的规模将超过 224 亿美元,这得益于对支持长期基础设施发展的耐用材料的偏好日益增长。向再生能源的转变正在促进这一趋势,因为金属部件在苛刻的环境中具有增强的弹性。同样,受建筑活动成长以及智慧家庭和现代电气系统投资增加的推动,到 2034 年,住宅领域的复合年增长率预计将超过 7.7%。新兴经济体的基础设施成长进一步支持了电线电缆管理解决方案的采用。

美国电线电缆管理市场一直持续扩张,2022 年估值为 45 亿美元,2023 年为 47 亿美元,2024 年为 50 亿美元。正在进行大量投资以改善终端行业,特别是在电网、交通和商业基础设施方面。大量资金被分配用于现代化配电系统和改善架空基础设施,包括电线桿、线路和塔。

北美持续重视再生能源,导致对先进电线和电缆管理解决方案的需求增加。正在开发大规模再生电力项目,以满足日益增长的全球能源需求并支持向更清洁能源的转型。随着产业和政府对永续发展计画的投资,高效的布线基础设施仍然是实现长期能源目标的关键因素。

目录

第一章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依资料,2021 年至 2034 年

- 主要趋势

- 金属

- 非金属

第六章:市场规模及预测:依最终用途划分 2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第七章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- Belden

- chatsworth products

- CommScope Holding Company

- Eaton

- Hellermann Tyton

- Hubbell Incorporated

- Legrand

- Niedax India

- Panduit Corporation

- Schneider Electric

- TE Connectivity

- WESCO International

The Global Wire And Cable Management Market, valued at USD 20.9 billion in 2024, is expected to grow at a CAGR of 8.1% from 2025 to 2034. This expansion is driven by increasing demand for wire and cable across developed and emerging economies. Rapid urbanization and expanding infrastructure projects are fueling the need for efficient electrical networks, making wire and cable management an essential component. The rising adoption of advanced technology in cable and wiring systems is further accelerating the demand for high-performance management solutions. Efficient power distribution, structured wiring, and minimized electromagnetic interference (EMI) are becoming priorities for industries looking to enhance operational efficiency.

Investments in commercial, residential, and industrial construction are contributing to the growing need for electrical infrastructure, strengthening the demand for wire and cable management solutions. As industries increasingly rely on automation, smart grids, and high-speed data transfer, the necessity for robust cabling systems is becoming more pronounced. The growing shift toward renewable energy sources is also creating a strong demand for reliable wiring solutions. Advanced cabling is essential for efficient power transmission and distribution in solar, wind, and hydroelectric projects. Additionally, the rise in data centers and cloud computing further underscores the need for structured cabling systems that support seamless data flow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.9 Billion |

| Forecast Value | $44.3 Billion |

| CAGR | 8.1% |

The metallic wire and cable management segment is expected to surpass USD 22.4 billion by 2034, driven by a rising preference for durable materials that support long-term infrastructure development. The shift toward renewable energy is contributing to this trend, as metallic components offer enhanced resilience in demanding environments. Similarly, the residential sector is set to expand at a CAGR exceeding 7.7% through 2034, fueled by growing construction activities and increasing investments in smart homes and modern electrical systems. Infrastructure growth in emerging economies is further supporting the increased adoption of wire and cable management solutions.

The wire and cable management market in the United States has been consistently expanding, with valuations of USD 4.5 billion in 2022, USD 4.7 billion in 2023, and USD 5 billion in 2024. Significant investments are being made to improve end-use industries, particularly in electrical grids, transportation, and commercial infrastructure. Substantial funding allocations are being directed toward modernizing power distribution systems and improving overhead infrastructure, including poles, lines, and towers.

North America continues to emphasize renewable energy, leading to a heightened demand for advanced wire and cable management solutions. Large-scale renewable electricity projects are being developed to meet increasing global energy requirements and support the transition toward cleaner energy sources. As industries and governments invest in sustainability initiatives, efficient cabling infrastructure remains a crucial element in achieving long-term energy goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Material, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Metallic

- 5.3 Non-Metallic

Chapter 6 Market Size and Forecast, By End Use 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Belden

- 8.3 chatsworth products

- 8.4 CommScope Holding Company

- 8.5 Eaton

- 8.6 Hellermann Tyton

- 8.7 Hubbell Incorporated

- 8.8 Legrand

- 8.9 Niedax India

- 8.10 Panduit Corporation

- 8.11 Schneider Electric

- 8.12 TE Connectivity

- 8.13 WESCO International