|

市场调查报告书

商品编码

1699284

成人纸尿裤市场机会、成长动力、产业趋势分析及2025-2034年预测Adult Diaper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

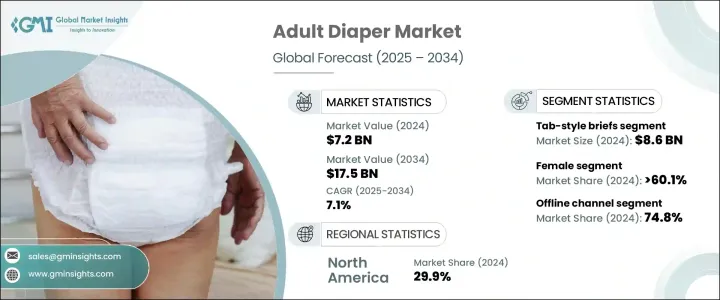

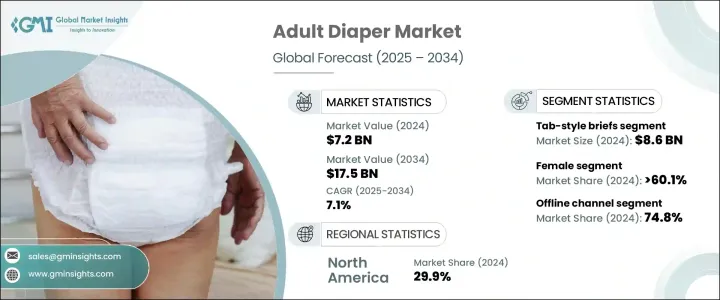

2024 年全球成人纸尿裤市场价值为 72 亿美元,预计 2025 年至 2034 年期间复合年增长率将稳定在 7.1%。老年人口的成长和失禁管理意识的提高推动了这一成长。由于老化、骨盆肌肉无力、荷尔蒙变化和膀胱容量下降等因素,全球尿失禁的盛行率正在激增。因此,对隐蔽、高吸收性和舒适的失禁解决方案的需求持续增长,显着提高用户的生活品质。

随着科技的进步,成人纸尿裤市场也不断发展,推出了超吸收材料、除臭功能和亲肤布料。这些创新既适合活跃人士,也适合卧床不起的人士,使失禁产品更加人性化。成人纸尿裤的接受度越来越高,尤其是在城市地区,这减少了人们对使用成人纸尿裤的耻辱感。各品牌正积极参与行销活动,以提高人们的意识并鼓励公开讨论失禁问题。此外,电子商务可近性的提高使得消费者能够谨慎地购买这些产品,从而进一步推动市场渗透。医疗机构和护理人员在推广失禁解决方案方面也发挥关键作用,因为更好的产品可用性有助于改善老年人护理和卫生管理。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 72亿美元 |

| 预测值 | 175亿美元 |

| 复合年增长率 | 7.1% |

市场按产品类型分类,其中标籤式内裤、套穿式内裤和增强垫为主要部分。 2024 年,Tab 式内裤的收入为 86 亿美元,预计在预测期内的复合年增长率为 7.4%。这些产品因其卓越的吸收性和牢固的贴合性而受到青睐,使其成为中度至重度失禁患者的理想选择。护理人员通常会选择有标籤的内裤,因为它们使用方便,特别是对于行动不便的人。由于具有增强的防漏功能并注重舒适性,这些产品仍然是家庭护理和医疗保健环境中的主要产品。

市场根据消费者人口统计进一步细分,男性和女性使用者表现出不同的需求模式。 2024 年,女性市场占据主导地位,占有 60.1% 的市场份额,预计到 2034 年将以 7.2% 的复合年增长率成长。由于怀孕、更年期、荷尔蒙波动和分娩等因素,女性更容易失禁,这些因素都会导致骨盆底无力。此外,女性预期寿命的延长也增加了与年龄相关的膀胱控制问题的可能性。针对特定性别、提供更合身和更舒适体验的产品的出现继续推动着这一领域的需求。

北美仍然是成人纸尿裤市场的领先地区,占有 29.9% 的份额,到 2024 年将创造 101 亿美元的市场价值。老年人口的增加刺激了对失禁产品的需求,而公众意识的提高和教育活动有助于规范这些产品的使用。政府医疗保健计划和私人保险覆盖失禁解决方案的覆盖范围提高了可及性,进一步支持了市场成长。先进的产品创新专注于超吸收性、亲肤材料,满足了注重谨慎和舒适的活跃用户的需求。各大品牌不断扩大的线上零售业务使得这些产品更容易取得,从而促进了不同消费群体的成长。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 人口老化

- 慢性健康状况增加

- 医疗支出不断上涨

- 产业陷阱与挑战

- 环境问题

- 竞争激烈

- 成长动力

- 成长潜力分析

- 消费者购买行为

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品类型,2021 - 2034 年(十亿美元)

- 主要趋势

- 附扣式内裤

- 套穿式内衣

- 增压垫

第六章:市场估计与预测:按类别,2021 - 2034 年(十亿美元)

- 主要趋势

- 可重复使用的

- 一次性的

第七章:市场估计与预测:按规模,2021 - 2034 年(十亿美元)

- 主要趋势

- 小的

- 中等的

- 大的

- 特大号

第八章:市场估计与预测:按材料,2021 - 2034 年(十亿美元)

- 主要趋势

- 棉布

- 非织物

- 超细纤维

- 其他(绒毛浆、竹子)

第九章:市场估计与预测:依包装数量,2021-2034(十亿美元)

- 主要趋势

- 小包装(1-25)

- 中包(25-100)

- 散装(100个以上)

第 10 章:市场估计与预测:按价格,2021 年至 2034 年(十亿美元)

- 主要趋势

- 低的

- 中等的

- 高的

第 11 章:市场估计与预测:按消费者群体划分,2021 年至 2034 年(十亿美元)

- 主要趋势

- 男性

- 女性

第 12 章:市场估计与预测:按配销通路,2021 年至 2034 年(十亿美元)

- 主要趋势

- 线上通路

- 电子商务

- 公司网站

- 线下通路

- 专卖店

- 大型零售商店

- 其他(个体店、百货店)

第 13 章:市场估计与预测:按地区,2021 年至 2034 年(十亿美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 14 章:公司简介

- Attends Healthcare Products

- BetterDry

- DSG International

- Essity

- First Quality Enterprises

- Hengan International

- Kao

- Kimberly-Clark

- Majors Medical Service

- Meddcare

- Procter & Gamble

- Svenska Cellulosa

- Tranquility Products

- Tykables

- Unicharm

The Global Adult Diaper Market was valued at USD 7.2 billion in 2024 and is projected to reflect a steady CAGR of 7.1% from 2025 to 2034. The growth is fueled by a rising elderly population and increasing awareness regarding incontinence management. The prevalence of incontinence is surging worldwide due to factors such as aging, weakened pelvic muscles, hormonal changes, and declining bladder capacity. As a result, the demand for discreet, highly absorbent, and comfortable incontinence solutions continues to grow, significantly improving users' quality of life.

The adult diaper market has evolved with technological advancements, introducing ultra-absorbent materials, odor control features, and skin-friendly fabrics. These innovations cater to both active and bedridden individuals, making incontinence products more user-friendly. Greater acceptance of adult diapers, particularly in urban areas, has reduced the stigma surrounding their use. Brands are actively engaging in marketing campaigns to raise awareness and encourage open discussions about incontinence. Additionally, improvements in e-commerce accessibility have enabled consumers to purchase these products discreetly, driving market penetration further. Healthcare institutions and caregivers are also playing a critical role in promoting incontinence solutions, as better product availability supports improved elderly care and hygiene management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $17.5 Billion |

| CAGR | 7.1% |

The market is categorized by product type, with tab-style briefs, pull-on underwear, and booster pads as key segments. Tab-style briefs generated USD 8.6 billion in revenue in 2024 and are expected to grow at a CAGR of 7.4% over the forecast period. These products are preferred for their superior absorbency and secure fit, making them ideal for individuals with moderate to severe incontinence. Caregivers often opt for tab-style briefs due to their ease of use, particularly for those with limited mobility. With enhanced leakage protection and a focus on comfort, these products remain a staple in homecare and healthcare settings.

The market is further segmented based on consumer demographics, with male and female users exhibiting distinct demand patterns. The female segment dominated with a 60.1% market share in 2024 and is expected to grow at a CAGR of 7.2% through 2034. Women experience incontinence more frequently due to factors such as pregnancy, menopause, hormonal fluctuations, and childbirth, all contributing to pelvic floor weakness. Additionally, a longer life expectancy among women increases the likelihood of age-related bladder control concerns. The availability of gender-specific products offering a more tailored fit and improved comfort continues to drive demand within this segment.

North America remains a leading region in the adult diaper market, holding a 29.9% share and generating USD 10.1 billion in 2024. The rising elderly population has fueled demand for incontinence products, while public awareness initiatives and education campaigns have helped normalize their use. Government healthcare programs and private insurance coverage for incontinence solutions have enhanced accessibility, further supporting market growth. Advanced product innovations focusing on ultra-absorbent, skin-friendly materials are addressing the needs of active users who prioritize discretion and comfort. The expanding online retail presence of major brands has made these products more accessible, reinforcing growth across diverse consumer demographics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Aging population

- 3.10.1.2 Increase in chronic health conditions

- 3.10.1.3 Rising healthcare expenditure

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Environmental concerns

- 3.10.2.2 High competition

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Tab-Style briefs

- 5.3 Pull-On underwear

- 5.4 Booster pads

Chapter 6 Market Estimates & Forecast, By Category, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Reusable

- 6.3 Disposable

Chapter 7 Market Estimates & Forecast, By Size, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Small

- 7.3 Medium

- 7.4 Large

- 7.5 Extra large

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Cotton

- 8.3 Non-woven fabric

- 8.4 Microfiber

- 8.5 Others (Fluff pulp, Bamboo)

Chapter 9 Market Estimates & Forecast, By Packaging Quantity, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Small pack (1-25)

- 9.3 Mid pack (25- 100)

- 9.4 Bulk pack (More than 100)

Chapter 10 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates & Forecast, By Consumer Group, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 Male

- 11.3 Female

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 12.1 Key trends

- 12.2 Online channels

- 12.2.1 E-commerce

- 12.2.2 Company websites

- 12.3 Offline channels

- 12.3.1 Specialty Stores

- 12.3.2 Mega retails stores

- 12.3.3 Others (Individual stores, Departmental stores)

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 UK

- 13.3.2 Germany

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Russia

- 13.3.7 Nordics

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.4.6 Southeast Asia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 UAE

- 13.6.2 South Africa

- 13.6.3 Saudi Arabia

Chapter 14 Company Profiles

- 14.1 Attends Healthcare Products

- 14.2 BetterDry

- 14.3 DSG International

- 14.4 Essity

- 14.5 First Quality Enterprises

- 14.6 Hengan International

- 14.7 Kao

- 14.8 Kimberly-Clark

- 14.9 Majors Medical Service

- 14.10 Meddcare

- 14.11 Procter & Gamble

- 14.12 Svenska Cellulosa

- 14.13 Tranquility Products

- 14.14 Tykables

- 14.15 Unicharm