|

市场调查报告书

商品编码

1699340

抗病毒药物市场机会、成长动力、产业趋势分析及 2025-2034 年预测Antiviral Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

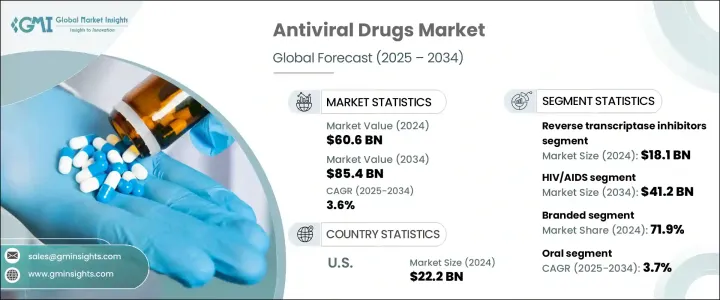

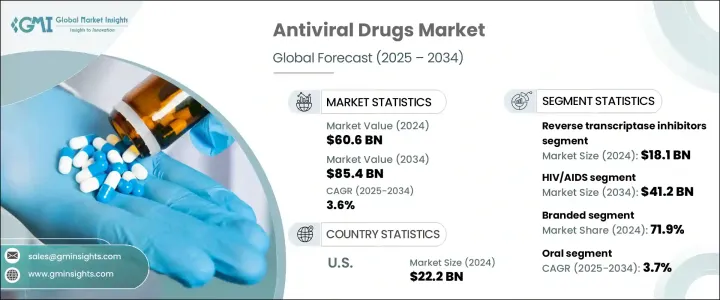

全球抗病毒药物市场预计在 2024 年达到 606 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 3.6%。爱滋病毒/爱滋病、B型肝炎和C肝以及流感等病毒感染病例的增加正在推动对抗病毒药物的需求。意识的增强,加上政府对药品审批和临床研究的资助,正在促进市场的成长。公司正在扩大生产能力以满足不断增长的患者群体,从而提高市场渗透率。

抗病毒药物可以抑制病毒复製,在治疗爱滋病毒/爱滋病、肝炎和流感等感染中发挥至关重要的作用。市场按药物类别细分,其中逆转录酶抑制剂占29.9%的份额,2024年价值181亿美元。这些抑制剂是抗逆转录病毒疗法的关键,核苷和非核苷逆转录酶抑制剂推动了它们的广泛使用。政府支持的爱滋病毒治疗计画及其成本效益提高了采用率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 606亿美元 |

| 预测值 | 854亿美元 |

| 复合年增长率 | 3.6% |

从迹象来看,爱滋病毒/爱滋病领域占据市场主导地位,预计到 2034 年将达到 412 亿美元。感染数量的增加以及抗逆转录病毒疗法的长期必要性正在推动该领域的成长。监管机构正在简化药物开发流程,进一步促进药物扩张。

2024 年,品牌抗病毒药物将占据 71.9% 的市场份额,并经过严格的临床试验以确保其有效性和安全性。由于治疗效果较好,品牌药物仍然是治疗慢性感染的首选。製药公司不断提高可及性,增加市场采用率。

口服抗病毒药物在 2024 年占据领先地位,预计复合年增长率为 3.7%。由于其易于管理且具有非侵入性,因此成为长期治疗的首选。口服药物配方的进步正在提高患者的依从性和治疗效果,进一步增强需求。

按年龄层划分,老年人群体的市场规模在 2024 年为 269 亿美元,预计到 2032 年将达到 375 亿美元。全球人口老化以及对病毒感染的易感性增加推动了需求的成长。老年人抗病毒药物和疫苗的使用增加正在支持市场扩张。

2024 年,医院药局占了 46.7% 的市场份额,预计复合年增长率为 3.3%。医院仍然是严重病毒感染的主要治疗中心,确保药物的方便取得。多种抗病毒製剂的可用性以及危重病例的住院治疗需求正在强化该领域的主导地位。

2024 年美国抗病毒药物市场规模为 222 亿美元,高于 2023 年的 219 亿美元和 2022 年的 215 亿美元。政府措施的增加和感染率的上升正在推动需求成长。以消除病毒性疾病和加强预防力度为重点的政策正在进一步加强市场成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 病毒感染盛行率上升

- 爱滋病毒治疗产品上市数量不断增加

- 研发投入高,拥有成熟的产品线

- 老年人口不断增加

- 产业陷阱与挑战

- 新出现的抗药性

- 开发成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 年至 2034 年

- 主要趋势

- 逆转录酶抑制剂

- DNA聚合酶抑制剂

- 蛋白酶抑制剂

- 神经氨酸酶抑制剂

- 其他药物类别

第六章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 爱滋病毒/爱滋病

- 肝炎

- 冠状病毒感染

- 单纯疱疹病毒(HSV)

- 流感

- 其他适应症

第七章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 品牌

- 通用的

第八章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 肠外

- 外用

- 其他给药途径

第九章:市场估计与预测:按年龄组,2021 年至 2034 年

- 主要趋势

- 老年

- 成人

- 儿科

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- AbbVie

- Aurobindo Pharma Limited

- Bristol-Myers Squibb

- Cipla

- Dr. Reddy's Laboratories

- Gilead Sciences

- GlaxoSmithKline

- Janssen Pharmaceutical (Johnson & Johnson)

- Merck

- Mylan

- Pfizer

- Sun Pharmaceutical Industries

The Global Antiviral Drugs Market, estimated at USD 60.6 billion in 2024, is set to grow at a CAGR of 3.6% from 2025 to 2034. Increasing cases of viral infections, including HIV/AIDS, hepatitis B and C, and influenza, are driving demand for antiviral medications. Greater awareness, combined with government funding for drug approvals and clinical research, is fostering market growth. Companies are expanding manufacturing capacities to cater to a rising patient base, contributing to increased market penetration.

Antiviral drugs inhibit viral replication, playing a crucial role in treating infections such as HIV/AIDS, hepatitis, and influenza. The market is segmented by drug class, with reverse transcriptase inhibitors holding 29.9% of the share at USD 18.1 billion in 2024. These inhibitors are key in antiretroviral therapy, with nucleoside and non-nucleoside reverse transcriptase inhibitors driving their widespread use. Government-backed HIV treatment programs and their cost-effectiveness enhance adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $60.6 Billion |

| Forecast Value | $85.4 Billion |

| CAGR | 3.6% |

By indication, the HIV/AIDS segment dominates the market and is expected to reach USD 41.2 billion by 2034. A rising number of infections, along with antiretroviral therapy's long-term necessity, is fueling segment growth. Regulatory bodies are streamlining drug development, further boosting expansion.

Branded antiviral drugs accounted for 71.9% of the market in 2024, supported by rigorous clinical trials ensuring efficacy and safety. Branded drugs remain preferred for treating chronic infections due to better therapeutic outcomes. Pharmaceutical companies continue to enhance accessibility, increasing market adoption.

Oral antiviral drugs led in 2024 and are projected to grow at a 3.7% CAGR. Their ease of administration and non-invasive nature make them a preferred choice for long-term treatment. Advances in oral drug formulations are improving patient adherence and treatment effectiveness, further strengthening demand.

By age group, the geriatric segment, valued at USD 26.9 billion in 2024, is expected to reach USD 37.5 billion by 2032. An aging global population with a higher susceptibility to viral infections is driving demand. Increased use of antiviral medications and vaccines among older adults is supporting market expansion.

Hospital pharmacies captured 46.7% of the market share in 2024 and are anticipated to grow at a 3.3% CAGR. Hospitals remain the primary treatment centers for severe viral infections, ensuring easy drug accessibility. The availability of diverse antiviral formulations and the need for hospitalization in critical cases are reinforcing segment dominance.

The U.S. antiviral drugs market stood at USD 22.2 billion in 2024, up from USD 21.9 billion in 2023 and USD 21.5 billion in 2022. Growing government initiatives and rising infection rates are driving demand. Policies focused on eliminating viral diseases and intensifying prevention efforts are further strengthening market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of viral infections

- 3.2.1.2 Increasing number of product launches for HIV treatment

- 3.2.1.3 High investment in R&D activities and presence of pipeline products

- 3.2.1.4 Increasing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Emerging drug resistance

- 3.2.2.2 High development cost

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reverse transcriptase inhibitors

- 5.3 DNA polymerase inhibitors

- 5.4 Protease inhibitors

- 5.5 Neuraminidase inhibitors

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 HIV/AIDS

- 6.3 Hepatitis

- 6.4 Coronavirus infection

- 6.5 Herpes simplex virus (HSV)

- 6.6 Influenza

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Topical

- 8.5 Other routes of administration

Chapter 9 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Geriatric

- 9.3 Adult

- 9.4 Pediatric

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Aurobindo Pharma Limited

- 12.3 Bristol-Myers Squibb

- 12.4 Cipla

- 12.5 Dr. Reddy's Laboratories

- 12.6 Gilead Sciences

- 12.7 GlaxoSmithKline

- 12.8 Janssen Pharmaceutical (Johnson & Johnson)

- 12.9 Merck

- 12.10 Mylan

- 12.11 Pfizer

- 12.12 Sun Pharmaceutical Industries