|

市场调查报告书

商品编码

1771294

抗病毒药物市场:产业趋势及全球预测 - 依作用机制、适应症、药物标靶、治疗类型和主要地区Antiviral Drugs Market: Industry Trends and Global Forecasts - Distribution by Mechanism of Action, Target Indication, Drug Target, Type of Therapy and Key Geographical Regions |

||||||

全球抗病毒药物市场:概览

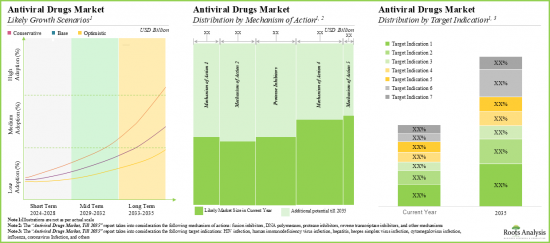

预计到2035年,全球抗病毒药物市场规模将从目前的650亿美元成长至1270亿美元,预测期内的年复合成长率为6.2%。

市场区隔包括根据以下参数对市场规模和市场机会进行分类:

作用机转

- 融合抑制剂

- DNA聚合酶

- 蛋白酶抑制剂

- 逆转录酶抑制剂

- 其他

适应症

- 人类免疫缺乏病毒感染

- 冠状病毒感染

- 肝炎

- 单纯疱疹病毒感染

- 鉅细胞病毒感染

- 流感

- 其他

药物标靶

- 病毒标靶

- 宿主标靶

治疗类型

- 单药治疗

- 合併治疗

主要地区

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和北非

全球抗病毒市场:成长与趋势

众所周知,传染病是全球十大死亡原因之一。事实上,每年有超过4000万人因各种感染而患病。此外,COVID-19 疫情爆发已五年,但病毒仍顽强存在,丝毫没有被彻底根除的迹象。根据The Lancet journal发表的一篇论文,光是2020年,COVID-19 疫情就已造成超过 1,800万人死亡。此外,预计到2030年,主要病毒性疾病之一的人类免疫缺陷病毒(HIV)将在全球造成 650万人死亡。因此,一些製药公司加紧研发,透过开发抗病毒药物来降低感染风险。

抗病毒药物是指一类已证明具有治疗病毒感染潜力的药物,例如人类免疫缺陷病毒感染、鉅细胞病毒(CMV)感染、冠状病毒病(COVID-19)和流感。值得注意的是,美国食品药物管理局(FDA)已批准近 80 种抗病毒药物,针对已知的220 种可导致人类多重感染的病毒中的10 种。此外,目前有多种抗病毒药物接受各种临床试验的评估。由于该领域研究的不断深入以及对有效抗病毒药物需求的不断成长,预计该市场在预测期内将实现稳步成长。

全球抗病毒药物市场:关键洞察

本报告分析了全球抗病毒药物市场的现状,并探讨了该行业的潜在成长机会。主要调查结果包括:

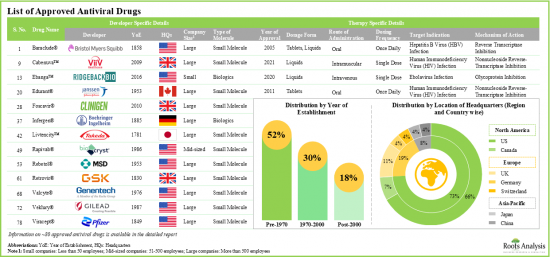

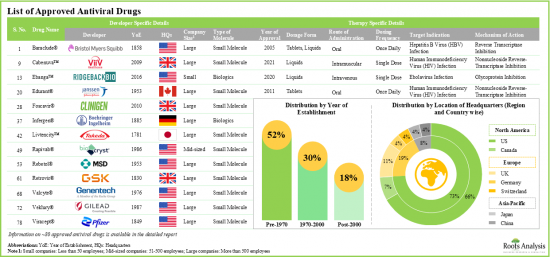

- 迄今为止,已有近80种抗病毒药物获准用于治疗各种传染病,其中近75%为口服药物。

- 约90%的核准抗病毒药物以片剂和液体剂型提供。大多数药物为小分子,设计用于不同的给药方案,以对抗各种感染。

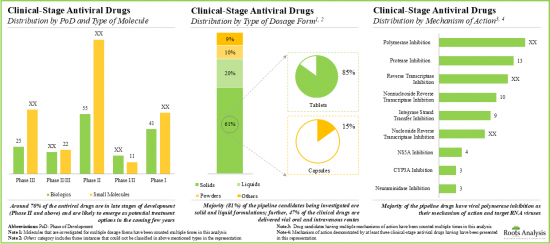

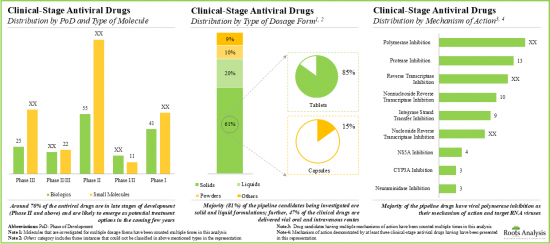

- 目前,约有430种候选药物正处于临床试验的不同阶段,用于治疗多种感染,其中大多数药物分子评估其单药治疗效果。

- 聚合酶抑制和蛋白酶抑制是最常见的作用机制。

- 从合作活动的增加可以看出,利害关係人的兴趣日益浓厚。事实上,与抗病毒药物相关的合作数量在过去两年中达到了最高水准。

- 意识到这一领域的机会,一些投资者在过去四年中已在各轮融资中投资超过 55亿美元。

- 新冠疫情导致製药业对有效抗病毒药物的需求激增。

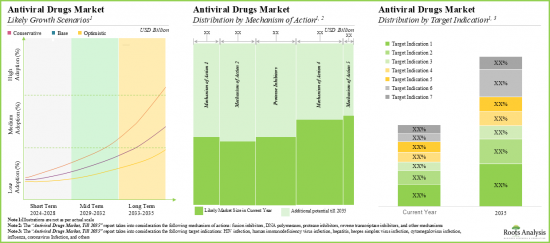

- 抗病毒市场预计将以 6.2%的年复合成长率成长,目前,针对 HIV 感染的药物占据了大部分市场占有率(44%)。

- 抗病毒药物市场相关的机会可能分布在不同类型的药物标靶、治疗方式和主要地理区域。

全球抗病毒药物市场:主要细分市场

依作用机制,市场细分为融合抑制剂、DNA聚合酶抑制剂、蛋白酶抑制剂、逆转录酶抑制剂等。目前,逆转录酶类药物因其在治疗爱滋病毒和C型肝炎方面的有效性,在全球抗病毒药物市场中占据最大占有率。

依适应症,市场细分为人类免疫缺陷病毒感染(HIV)、冠状病毒感染、肝炎、单纯疱疹病毒感染、鉅细胞病毒感染、流感等。目前,人类免疫缺乏病毒感染在全球抗病毒药物市场中所占比例最高。值得注意的是,冠状病毒感染领域的抗病毒药物市场很可能以相对较高的年复合成长率成长。

依药物靶点,市场细分为病毒和宿主。目前,病毒标靶药物在抗病毒药物市场中占最大占有率。然而,由于其具有广泛的宿主潜力,宿主标靶药物市场很可能以相对较高的年复合成长率成长。

依治疗类型,市场细分为单药治疗及合併治疗。目前,单药疗法在抗病毒药物市场中占比最高。此外,值得注意的是,联合疗法市场凭藉其成本效益高、疗效显着等优势,可望实现相对较高的年复合成长率。

依主要地区划分,市场分为北美、欧洲、亚太地区、拉丁美洲以及中东和北非。目前,北美在抗病毒药物市场占据主导地位,占据最大的收入占有率。这得益于该地区蓬勃发展的製药业、不断成长的研究机构以及活跃的传染病研究计画。

全球抗病毒市场参与者

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline(GSK)

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

本报告调查全球抗病毒市场,提供市场概述,以及依作用机制、适应症、药物标靶、治疗类型和地区划分的趋势,和参与市场的公司简介。

目录

第1章 前言

第2章 执行摘要

第3章 导论

- 抗病毒药物概述

- 病毒和病毒性疾病的种类

- 抗病毒药物的作用机制

- 抗病毒药物的特点

- 抗病毒药物的益处

- 抗病毒药物研发面临的挑战

- 抗病毒药物的关键事实与未来展望

第4章 市场格局:已核准的抗病毒药物

- 已核准的抗病毒药物:市场格局

- 已核准的抗病毒药物:研发景观

第5章 市场格局:临床抗病毒药物

- 临床抗病毒药物:市场格局

- 临床抗病毒药物:发展前景

第6章 公司简介

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline(GSK)

- Johnson &Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

第7章 合作伙伴关係与合作

第8章 资金与投资

- 抗病毒药物:资金与投资

第9章 波特五力模型分析

第10章 市场预测与机会分析

- 预测研究方法与关键假设

- 2035年全球抗病毒药物市场

- 抗病毒药物市场:依作用机转

- 抗病毒药物市场:依适应症

- 抗病毒药物市场:依药物标靶

- 抗病毒药物市场:依治疗类型

- 抗病毒药物市场:依地区

第11章 高层洞察

第12章 附录1:表格资料

第13章 附录2:公司与组织清单

GLOBAL ANTIVIRAL DRUGS MARKET: OVERVIEW

As per Roots Analysis, the global antiviral drugs market is estimated to grow from USD 65 billion in the current year to USD 127 billion by 2035, at a CAGR of 6.2% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Mechanism of Action

- Fusion Inhibitors

- DNA Polymerases

- Protease Inhibitors

- Reverse Transcriptase

- Others

Target Indication

- Human Immunodeficiency Virus Infection

- Coronavirus Infection

- Hepatitis

- Herpes Simplex Virus Infection

- Cytomegalovirus Infection

- Influenza

- Others

Drug Target

- Virus Target

- Host Target

Type of Therapy

- Monotherapy

- Combination Therapy

Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North Africa

GLOBAL ANTIVIRAL DRUGS MARKET: GROWTH AND TRENDS

Infectious diseases are known to be one of the top 10 leading causes of deaths, worldwide. In fact, more than 40 million people are affected by various types of infectious diseases annually. Further, it has been five years since the onset of COVID-19 pandemic, and the virus continues to persist with no indication of complete eradication. An article published in The Lancet journal reported that COVID-19 pandemic caused deaths of over 18 million people in 2020 alone. In addition, it has been reported that human immunodeficiency virus (HIV), one of the leading viral diseases is anticipated to be the cause for 6.5 million deaths globally, by 2030. Consequently, several pharmaceutical companies have increased their R&D processes to mitigate the risk of infectious diseases by developing antiviral drugs.

Antiviral drugs refer to the medication class that has shown potential to treat viral infection, including human immunodeficiency virus infection, cytomegalovirus (CMV) infection, Coronavirus infection (COVID-19), influenza, and others. It is worth highlighting here that close to 80 antiviral drugs that can target 10 out of 220 known viruses, resulting in multiple infections in humans, have received approval from the USFDA. Notably, several antiviral drugs are presently being evaluated under different clinical trials. Owing to the increasing research in this field and rising demand for effective antiviral drugs, the market is anticipated to witness steady growth during the forecast period.

GLOBAL ANTIVIRAL DRUGS MARKET: KEY INSIGHTS

The report delves into the current state of global antiviral drugs market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Close to 80 antiviral drugs have been approved, till date, for the treatment of an array of infectious diseases; nearly 75% of these drugs are administered via oral route.

- Around 90% of the approved antiviral drugs are available in tablet and liquid formulations; most of the drugs are small molecules, designed for use against various infectious diseases at different dosing regimens.

- Currently, around 430 drug candidates are being investigated in various phases of clinical trials for the treatment of multiple infectious diseases; majority of the drug molecules are being evaluated as monotherapies.

- More than 40% of the antiviral drug candidates are currently in phase II clinical trials; polymerase inhibition and protease inhibition are the most popular mechanisms of action.

- The growing interest of stakeholders is also evident from the rise in partnership activity; in fact, the maximum number of collaborations related to antiviral drugs were inked in the last two years.

- Several investors, having realized the opportunity within this segment, have invested over USD 5.5 billion across various funding rounds in the past four years.

- The COVID-19 pandemic led to surge in demand for effective antiviral drugs in the pharmaceutical industry; several stakeholders have entered to tap the opportunities within this domain.

- The antiviral drugs market is expected to grow at a CAGR of 6.2%; currently, the majority share of the market (44%) is captured by drugs targeting HIV infections.

- The opportunity associated with the antiviral drugs market is likely to be well distributed across various types of drug targets, therapies, and key geographical regions.

GLOBAL ANTIVIRAL DRUGS MARKET: KEY SEGMENTS

Reverse Transcriptase Segment Occupy the Largest Share of the Antiviral Drugs Market

Based on the mechanism of action, the market is segmented into fusion inhibitors, DNA polymerases, protease inhibitors, reverse transcriptase and others. At present, reverse transcriptase segment holds the maximum share of the global antiviral drugs market owing to its effectiveness in the treatment of HIV and hepatitis C. This trend is likely to remain same in the future.

By Target Indication, Coronavirus Infection is the Fastest Growing Segment of the Global Antiviral Drugs Market During the Forecast Period

Based on the target indication, the market is segmented into human immunodeficiency virus infection (HIV), coronavirus infection, hepatitis, herpes simplex virus infection, cytomegalovirus infection, influenza, and others. Currently, the human immunodeficiency virus segment captures the highest proportion of the global antiviral drugs market. It is worth highlighting that the antiviral drugs market for coronavirus infection segment is likely to grow at a relatively higher CAGR.

Virus Target Segment Occupy the Largest Share of the Antiviral Drugs Market by Drug Target

Based on the drug target, the market is segmented into virus target and host target. At present, the virus target segment holds the maximum share of the antiviral drugs market. However, owing to the potential to indicate a broad-spectrum host, host target segment is likely to grow at a relatively higher CAGR.

By Type of Therapy, the Combination Therapy Segment is the Fastest Growing Segment of the Antiviral Drugs Market During the Forecast Period

Based on the type of therapy, the market is segmented into monotherapy and combination therapy. Currently, monotherapy segment captures the highest proportion of the antiviral drugs market. Further, it is worth highlighting that the combination therapy market is likely to grow at a relatively higher CAGR owing to its benefits like cost-effectiveness and high efficiency.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and North Africa. Currently, North America dominates the antiviral drugs market and accounts for the largest revenue share. This can be attributed to the region's robust pharmaceutical industry and the rising number of research institutions and their active research programs in infectious diseases within the region.

Example Players in the Global Antiviral Drugs Market

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline (GSK)

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

GLOBAL ANTIVIRAL DRUGS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global antiviral drugs market, focusing on key market segments, including [A] mechanism of action, [B] target indication, [C] drug target, [D] type of therapy and [E] key geographical regions.

- Approved Antiviral Drug's Market Landscape: A comprehensive evaluation of commercially available antiviral drugs, considering various parameters, such as [A] year of approval, [B] type of dosage form, [C] type of molecule, [D] type of target virus, [E] route of administration, [F] dosing frequency, [G] mechanism of action and [H] target indication. Additionally, a comprehensive evaluation of antiviral drug developers, based on the parameters, such as [A] year of establishment, [B] company size, [C] geographical location and [D] leading players.

- Clinical Antiviral Drug's Market Landscape: A comprehensive evaluation of clinical-stage antiviral drugs, considering various parameters, such as [A] phase of development, [B] type of molecule, [C] type of dosage form, [C] route of administration, [D] target indication, [E] type of developer, [F] type of therapy, [G] target patient segment, [H] mechanism of action, [I] type of target virus and [J] number of doses. Additionally, a comprehensive evaluation of antiviral companies engaged in the development of clinical-stage antiviral drugs, based on the parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] leading players.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the global antiviral drugs market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] target indication, [E] target virus, [F] most active players (in terms of the number of partnerships signed) and [G] geographical distribution of partnership activity.

- Funding and Investments: An in-depth analysis of the fundings received by players in antiviral drugs market, based on relevant parameters, such as [A] number of funding instances, [B] amount invested, [C] type of funding, [D] most active players, [E] most active investors and [F] geography.

- PORTER'S Five Forces Analysis: A detailed analysis of the five competitive forces prevalent in antiviral drugs market, including [A] threats for new entrants, [B] bargaining power of drug developers, [C] bargaining power of buyers, [D] threats of substitute products and [E] rivalry among existing competitors.

- Company Profiles: In-depth profiles of companies engaged in the development of antiviral drugs, focusing on [A] company overviews, [B] product portfolio and [C] recent developments and an informed future outlook.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Overview of Antiviral Drugs

- 3.2. Types of Viruses and Viral Diseases

- 3.3. Mechanism of Action of Antiviral Drugs

- 3.4. Characteristics of Antiviral Drugs

- 3.5. Advantages of Antiviral Drugs

- 3.6. Challenges Associated with Development of Antiviral Drugs

- 3.7. Key Facts and Future Perspectives of Antiviral Drugs

4. MARKET LANDSCAPE: APPROVED ANTIVIRAL DRUGS

- 4.1. Approved Antiviral Drugs: Overall Market Landscape

- 4.1.1. Analysis by Year of Approval

- 4.1.2. Analysis by Type of Dosage Form

- 4.1.3. Analysis by Type of Molecule

- 4.1.4. Analysis by Type of Target Virus

- 4.1.5. Analysis by Route of Administration

- 4.1.6. Analysis by Dosing Frequency

- 4.1.7. Analysis by Target Indication

- 4.1.8. Analysis by Mechanism of Action

- 4.2. Approved Antiviral Drugs: Developer Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Geography (Region-wise)

- 4.2.4. Analysis by Geography (Country-wise)

- 4.2.5. Most Active Players: Analysis by Number of Approved Drugs

5. MARKET LANDSCAPE: CLINICAL ANTIVIRAL DRUGS

- 5.1. Clinical-stage Antiviral Drugs: Overall Market Landscape

- 5.1.1. Analysis by Phase of Development

- 5.1.2. Analysis by Type of Molecule

- 5.1.3. Analysis by Phase of Development and Type of Molecule

- 5.1.4. Analysis by Type of Dosage Form

- 5.1.5. Analysis by Route of Administration

- 5.1.6. Analysis by Target Indication

- 5.1.7. Analysis by Phase of Development and Target Indication

- 5.1.8. Analysis by Type of Developer

- 5.1.9. Analysis by Type of Therapy

- 5.1.10. Analysis by Target Patient Segment

- 5.1.11. Analysis by Mechanism of Action

- 5.1.12. Analysis by Type of Target Virus

- 5.1.13. Analysis by Number of Doses

- 5.2. Clinical-Stage Antiviral Drugs: Developer Landscape

- 5.2.1. Analysis by Year of Establishment

- 5.2.2. Analysis by Company Size

- 5.2.3. Analysis by Geography (Region-wise)

- 5.2.4. Analysis by Geography (Country-wise)

- 5.2.5. Analysis by Company Size and Location of Headquarters

- 5.2.6. Most Active Players: Analysis by Number of Clinical-Stage Drugs

6. COMPANY PROFILES

- 6.1. AbbVie

- 6.1.1. Company Overview

- 6.1.2. Key Executives

- 6.1.3. Financial Information

- 6.1.4. Product Portfolio

- 6.1.5. Recent Developments and Future Outlook

- 6.2. AstraZeneca

- 6.2.1. Company Overview

- 6.2.2. Key Executives

- 6.2.3. Financial Information

- 6.2.4. Product Portfolio

- 6.2.5. Recent Developments and Future Outlook

- 6.3. Bristol-Myers Squibb

- 6.3.1. Company Overview

- 6.3.2. Key Executives

- 6.3.3. Financial Information

- 6.3.4. Product Portfolio

- 6.3.5. Recent Developments and Future Outlook

- 6.4. Genentech

- 6.4.1. Company Overview

- 6.4.2. Key Executives

- 6.4.3. Product Portfolio

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Gilead Sciences

- 6.5.1. Company Overview

- 6.5.2. Key Executives

- 6.5.3. Financial Information

- 6.5.4. Product Portfolio

- 6.5.5. Recent Developments and Future Outlook

- 6.6. GlaxoSmithKline (GSK)

- 6.6.1. Company Overview

- 6.6.2. Key Executives

- 6.6.3. Financial Information

- 6.6.4. Product Portfolio

- 6.6.5. Recent Developments and Future Outlook

- 6.7. Johnson & Johnson

- 6.7.1. Company Overview

- 6.7.2. Key Executives

- 6.7.3. Financial Information

- 6.7.4. Product Portfolio

- 6.7.5. Recent Developments and Future Outlook

- 6.8. Merck

- 6.8.1. Company Overview

- 6.8.2. Key Executives

- 6.8.3. Financial Information

- 6.8.4. Product Portfolio

- 6.8.5. Recent Developments and Future Outlook

- 6.9. Novartis

- 6.9.1. Company Overview

- 6.9.2. Key Executives

- 6.9.3. Financial Information

- 6.9.4. Product Portfolio

- 6.9.5. Recent Developments and Future Outlook

- 6.10. Pfizer

- 6.10.1. Company Overview

- 6.10.2. Key Executives

- 6.10.3. Financial Information

- 6.10.4. Product Portfolio

- 6.10.5. Recent Developments and Future Outlook

- 6.11. Roche

- 6.11.1. Company Overview

- 6.11.2. Key Executives

- 6.11.3. Financial Information

- 6.11.4. Product Portfolio

- 6.11.5. Recent Developments and Future Outlook

- 6.12. ViiV Healthcare

- 6.12.1. Company Overview

- 6.12.2. Key Executives

- 6.12.3. Product Portfolio

- 6.12.4. Recent Developments and Future Outlook

7. PARTNERSHIPS AND COLLABORATIONS

- 7.1. Antiviral Drugs: Partnerships and Collaborations

- 7.1.1. Analysis by Year of Partnership

- 7.1.2. Analysis by Type of Partnership

- 7.1.3. Analysis by Year and Type of Partnership

- 7.1.4. Analysis by Target Indication

- 7.1.5. Analysis by Type of Target Virus

- 7.1.6. Analysis by Type of Partner

- 7.1.7. Most Active Players: Analysis by Number of Partnerships

- 7.1.8. Geographical Analysis

- 7.1.8.1. Intercontinental and Intracontinental Deals

- 7.1.8.2. International and Local Deals

8. FUNDING AND INVESTMENTS

- 8.1. Antiviral Drugs: Funding and Investments

- 8.1.1. Analysis by Year of Funding

- 8.1.2. Analysis of Amount Invested by Year

- 8.1.3. Analysis by Type of Funding

- 8.1.4. Analysis of Amount Invested by Type of Funding

- 8.1.5. Analysis by Target Indication

- 8.1.6. Analysis by Type of Target Virus

- 8.1.7. Analysis by Type of Investor

- 8.1.8. Most Active Players: Analysis by Number of Instances

- 8.1.9. Most Active Players: Analysis by Amount Invested

- 8.1.10. Most Active Investors: Analysis by Number of Instances

- 8.1.11. Geographical Analysis

- 8.1.11.1. Analysis of Amount Invested by Region

- 8.1.11.2. Analysis of Amount Invested by Country

9. PORTER'S FIVE FORCES ANALYSIS

- 9.1. Chapter Overview

- 9.2. Methodology and Key Parameters

- 9.3. Porter's Five Forces

- 9.3.1. Threat of New Entrants

- 9.3.2. Bargaining Power of End Users

- 9.3.3. Bargaining Power of Drug Developers

- 9.3.4. Threat of Substitute Products

- 9.3.5. Rivalry Among Existing Competitors

10. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 10.1. Forecast Methodology and Key Assumptions

- 10.2. Global Antiviral Drugs Market, Till 2035

- 10.2.1. Antiviral Drugs Market: Distribution by Mechanism of Action

- 10.2.1.1. Antiviral Drugs Market for Fusion Inhibitors, Till 2035

- 10.2.1.2. Antiviral Drugs Market for DNA Polymerases, Till 2035

- 10.2.1.3. Antiviral Drugs Market for Protease Inhibitors, Till 2035

- 10.2.1.4. Antiviral Drugs Market for Reverse Transcriptase Inhibitors, Till 2035

- 10.2.1.5. Antiviral Drugs Market for Other Mechanisms, Till 2035

- 10.2.2. Antiviral Drugs Market: Distribution by Target Indication

- 10.2.2.1. Antiviral Drugs Market for Human Immunodeficiency Virus Infection, Till 2035

- 10.2.2.2. Antiviral Drugs Market for Hepatitis, Till 2035

- 10.2.2.3. Antiviral Drugs Market for Coronaviruses Infection, Till 2035

- 10.2.2.4. Antiviral Drugs Market for Herpes Simplex Virus Infection, Till 2035

- 10.2.2.5. Antiviral Drugs Market for Cytomegalovirus Infection, Till 2035

- 10.2.2.6. Antiviral Drugs Market for Influenza, Till 2035

- 10.2.2.7. Antiviral Drugs Market for Other Target Indications, Till 2035

- 10.2.3. Antiviral Drugs Market: Distribution by Type of Drug Target

- 10.2.3.1. Antiviral Drugs Market for Virus Target, Till 2035

- 10.2.3.2. Antiviral Drugs Market for Host Target, Till 2035

- 10.2.4. Antiviral Drugs Market: Distribution by Type of Therapy

- 10.2.4.1. Antiviral Drugs Market for Monotherapy, Till 2035

- 10.2.4.2. Antiviral Drugs Market for Combination Therapy, Till 2035

- 10.2.5. Antiviral Drugs Market: Distribution by Geography

- 10.2.5.1. Antiviral Drugs Market in North America, Till 2035

- 10.2.5.2. Antiviral Drugs Market in Europe, Till 2035

- 10.2.5.3. Antiviral Drugs Market in Asia-Pacific, Till 2035

- 10.2.5.4. Antiviral Drugs Market in Latin America, Till 2035

- 10.2.5.5. Antiviral Drugs Market in MENA, Till 2035

- 10.2.5.6. Antiviral Drugs Market in Rest of the World, Till 2035

- 10.2.1. Antiviral Drugs Market: Distribution by Mechanism of Action

11. EXECUTIVE INSIGHTS

- 11.1. Chapter Overview

- 11.2. Company A

- 11.2.1. Company Snapshot

- 11.2.2. Interview Transcript: Chief Commercial Officer

12. APPENDIX 1: TABULATED DATA

13. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 List of Approved Antiviral Drugs

- Table 4.2 List of Approved Antiviral Drug Developers

- Table 5.1 List of Clinical-Stage Antiviral Drugs

- Table 5.2 List of Clinical-Stage Antiviral Drug Developers

- Table 6.1 AbbVie: Product Portfolio

- Table 6.2 AbbVie: Recent Developments and Future Outlook

- Table 6.3 AstraZeneca: Product Portfolio

- Table 6.4 AstraZeneca: Recent Developments and Future Outlook

- Table 6.5 Bristol-Myers Squibb: Product Portfolio

- Table 6.6 Bristol-Myers Squibb: Recent Developments and Future Outlook

- Table 6.7 Genentech: Product Portfolio

- Table 6.8 Genentech: Recent Developments and Future Outlook

- Table 6.9 Gilead Sciences: Product Portfolio

- Table 6.10 Gilead Sciences: Recent Developments and Future Outlook

- Table 6.11 GlaxoSmithKline: Product Portfolio

- Table 6.12 GlaxoSmithKline: Recent Developments and Future Outlook

- Table 6.13 Johnson & Johnson: Product Portfolio

- Table 6.14 Johnson & Johnson: Recent Developments and Future Outlook

- Table 6.15 Merck: Product Portfolio

- Table 6.16 Merck: Recent Developments and Future Outlook

- Table 6.17 Novartis: Product Portfolio

- Table 6.18 Novartis: Recent Developments and Future Outlook

- Table 6.19 Pfizer: Product Portfolio

- Table 6.20 Pfizer: Recent Developments and Future Outlook

- Table 6.21 Roche: Product Portfolio

- Table 6.22 Roche: Recent Developments and Future Outlook

- Table 6.23 ViiV Healthcare: Product Portfolio

- Table 6.24 ViiV Healthcare: Recent Developments and Future Outlook

- Table 7.1 Antiviral Drugs: List of Partnerships and Collaborations

- Table 8.1 Antiviral Drugs: List of Funding and Investments

- Table 12.1 Approved Antiviral Drugs: Distribution by Year of Approval

- Table 12.2 Approved Antiviral Drugs: Distribution by Type of Dosage Form

- Table 12.3 Approved Antiviral Drugs: Distribution by Type of Molecule

- Table 12.4 Approved Antiviral Drugs: Distribution by Type of Target Virus

- Table 12.5 Approved Antiviral Drugs: Distribution by Route of Administration

- Table 12.6 Approved Antiviral Drugs: Distribution by Dosing Frequency

- Table 12.7 Approved Antiviral Drugs: Distribution by Target Indication

- Table 12.8 Approved Antiviral Drugs: Distribution by Mechanism of Action

- Table 12.9 Approved Antiviral Drugs Developers: Distribution by Year of Establishment

- Table 12.10 Approved Antiviral Drugs Developers: Distribution by Company Size

- Table 12.11 Approved Antiviral Drugs Developers: Distribution by Geography (Region-wise)

- Table 12.12 Approved Antiviral Drugs Developers: Distribution by Geography (Country-wise)

- Table 12.13 Most Active Players: Distribution by Number of Approved Drugs

- Table 12.14 Clinical Antiviral Drugs: Distribution by Phase of Development

- Table 12.15 Clinical Antiviral Drugs: Distribution by Type of Molecule

- Table 12.16 Clinical Antiviral Drugs: Distribution by Phase of Development and Type of Molecule

- Table 12.17 Clinical Antiviral Drugs: Distribution by Type of Dosage Form

- Table 12.18 Clinical Antiviral Drugs: Distribution by Route of Administration

- Table 12.19 Clinical Antiviral Drugs: Distribution by Target Indication

- Table 12.20 Clinical Antiviral Drugs: Distribution by Phase of Development and Target Indication

- Table 12.21 Clinical Antiviral Drugs: Distribution by Type of Developer

- Table 12.22 Clinical Antiviral Drugs: Distribution by Type of Therapy

- Table 12.23 Clinical Antiviral Drugs: Distribution by Target Patient Segment

- Table 12.24 Clinical Antiviral Drugs: Distribution by Mechanism of Action

- Table 12.25 Clinical Antiviral Drugs: Distribution by Type of Target Virus

- Table 12.26 Clinical Antiviral Drugs: Distribution by Number of Doses

- Table 12.27 Clinical Antiviral Drugs Developers: Distribution by Year of Establishment

- Table 12.28 Clinical Antiviral Drugs Developers: Distribution by Company Size

- Table 12.29 Clinical Antiviral Drugs Developers: Distribution by Geography (Region-wise)

- Table 12.30 Clinical Antiviral Drugs Developers: Distribution by Geography (Country-wise)

- Table 12.31 Clinical Antiviral Drugs Developers: Distribution by Company Size and Location of Headquarters

- Table 12.32 Most Active Players: Distribution by Number of Clinical-stage Drugs

- Table 12.33 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 12.34 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 12.35 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 12.36 Partnerships and Collaborations: Distribution by Target Indication

- Table 12.37 Partnerships and Collaborations: Distribution by Type of Target Virus

- Table 12.38 Partnerships and Collaborations: Distribution by Type of Partner

- Table 12.39 Most Active Players: Distribution by Number of Partnerships

- Table 12.40 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Table 12.41 Partnerships and Collaborations: International and Local Deals

- Table 12.42 Funding and Investments: Distribution by Year of Funding

- Table 12.43 Funding and Investments: Distribution of Amount Invested by Year

- Table 12.44 Funding and Investments: Distribution of by Type of Fundings

- Table 12.45 Funding and Investments: Distribution of Amount Invested by Type of Funding

- Table 12.46 Funding and Investments: Distribution by Target Indication

- Table 12.47 Funding and Investments: Distribution by Type of Target Virus

- Table 12.48 Funding and Investments: Distribution by Type of Investor

- Table 12.49 Most Active Players: Distribution by Number of Instances

- Table 12.50 Most Active Players: Distribution by Amount Invested

- Table 12.51 Most Active Investors: Distribution by Number of Instances

- Table 12.52 Funding and Investments: Distribution of Amount Invested by Region

- Table 12.53 Funding and Investments: Distribution of Amount Invested by Country

- Table 12.54 Global Antiviral Drugs Market, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.55 Antiviral Drugs Market: Distribution by Mechanism of Action (USD Billion)

- Table 12.56 Antiviral Drugs Market for Fusion Inhibitors, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.57 Antiviral Drugs Market for DNA Polymerases, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.58 Antiviral Drugs Market for Protease Inhibitors, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.59 Antiviral Drugs Market for Reverse Transcriptase Inhibitors, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.60 Antiviral Drugs Market for Other Mechanisms, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.61 Antiviral Drugs Market: Distribution by Target Indication (USD Billion)

- Table 12.62 Antiviral Drugs Market for Human Immunodeficiency Virus Infection, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.63 Antiviral Drugs Market for Hepatitis, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.64 Antiviral Drugs Market for Coronavirus Infection, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.65 Antiviral Drugs Market for Herpes Simplex Virus Infection, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.66 Antiviral Drugs Market for Cytomegalovirus Infection, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.67 Antiviral Drugs Market for Influenza, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.68 Antiviral Drugs Market for Other Target Indications, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.69 Antiviral Drugs Market: Distribution by Type of Drug Target (USD Billion)

- Table 12.70 Antiviral Drugs Market for Virus Target, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.71 Antiviral Drugs Market for Host Target, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.72 Antiviral Drugs Market: Distribution by Type of Therapy (USD Billion)

- Table 12.73 Antiviral Drugs Market for Monotherapy, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.74 Antiviral Drugs Market for Combination Therapy, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.75 Antiviral Drugs Market: Distribution by Geography (USD Billion)

- Table 12.76 Antiviral Drugs Market in North America, Till 2035 (USD Billion)

- Table 12.77 Antiviral Drugs Market in Europe, Till 2035 (USD Billion)

- Table 12.78 Antiviral Drugs Market in Asia-Pacific, Till 2035 (USD Billion)

- Table 12.79 Antiviral Drugs Market in Latin America, Till 2035 (USD Billion)

- Table 12.80 Antiviral Drugs Market in MENA, Till 2035 (USD Billion)

- Table 12.81 Antiviral Drugs Market in Rest of the World, Till 2035 (USD Billion)

List of Figures

- Figure 2.1 Executive Summary: Overall Market Landscape of Approved Antiviral Drugs

- Figure 2.2 Executive Summary: Overall Market Landscape of Clinical-stage Antiviral Drugs

- Figure 2.3 Executive Summary: Partnerships and Collaborations

- Figure 2.4 Executive Summary: Funding and Investments

- Figure 2.5 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Types of Viruses

- Figure 3.2 Mechanism of Action of Antiviral Drugs

- Figure 4.1 Approved Antiviral Drugs: Distribution by Year of Approval

- Figure 4.2 Approved Antiviral Drugs: Distribution by Type of Dosage Form

- Figure 4.3 Approved Antiviral Drugs: Distribution by Type of Molecule

- Figure 4.4 Approved Antiviral Drugs: Distribution by Type of Target Virus

- Figure 4.5 Approved Antiviral Drugs: Distribution by Route of Administration

- Figure 4.6 Approved Antiviral Drugs: Distribution by Dosing Frequency

- Figure 4.7 Approved Antiviral Drugs: Distribution by Target Indication

- Figure 4.8 Approved Antiviral Drugs: Distribution by Mechanism of Action

- Figure 4.9 Approved Antiviral Drugs Developers: Distribution by Year of Establishment

- Figure 4.10 Approved Antiviral Drugs Developers: Distribution by Company Size

- Figure 4.11 Approved Antiviral Drugs Developers: Distribution by Geography (Region-wise)

- Figure 4.12 Approved Antiviral Drugs Developers: Distribution by Geography (Country-wise)

- Figure 4.13 Most Active Players: Distribution by Number of Approved Drugs

- Figure 5.1 Clinical Antiviral Drugs: Distribution by Phase of Development

- Figure 5.2 Clinical Antiviral Drugs: Distribution by Type of Molecule

- Figure 5.3 Clinical Antiviral Drugs: Distribution by Phase of Development and Type of Molecule

- Figure 5.4 Clinical Antiviral Drugs: Distribution by Type of Dosage Form

- Figure 5.5 Clinical Antiviral Drugs: Distribution by Route of Administration

- Figure 5.6 Clinical Antiviral Drugs: Distribution by Target Indication

- Figure 5.7 Clinical Antiviral Drugs: Distribution by Phase of Development and Target Indication

- Figure 5.8 Clinical Antiviral Drugs: Distribution by Type of Developer

- Figure 5.9 Clinical Antiviral Drugs: Distribution by Type of Therapy

- Figure 5.10 Clinical Antiviral Drugs: Distribution by Target Patient Segment

- Figure 5.11 Clinical Antiviral Drugs: Distribution by Mechanism of Action

- Figure 5.12 Clinical Antiviral Drugs: Distribution by Type of Target Virus

- Figure 5.13 Clinical Antiviral Drugs: Distribution by Number of Doses

- Figure 5.14 Clinical Antiviral Drugs Developers: Distribution by Year of Establishment

- Figure 5.15 Clinical Antiviral Drugs Developers: Distribution by Company Size

- Figure 5.16 Clinical Antiviral Drugs Developers: Distribution by Geography (Region-wise)

- Figure 5.17 Clinical Antiviral Drugs Developers: Distribution by Geography (Country-wise)

- Figure 5.18 Clinical Antiviral Drugs Developers: Distribution by Company Size and Location of Headquarters

- Figure 5.19 Most Active Players: Distribution by Number of Clinical-Stage Drugs

- Figure 7.1 Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 7.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 7.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 7.4 Partnerships and Collaborations: Distribution by Target Indication

- Figure 7.5 Partnerships and Collaborations: Distribution by Type of Target Virus

- Figure 7.6 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 7.7 Most Active Players: Distribution by Number of Partnerships

- Figure 7.8 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Figure 7.9 Partnerships and Collaborations: International and Local Deals

- Figure 8.1 Funding and Investments: Distribution by Year of Funding

- Figure 8.2 Funding and Investments: Distribution of Amount Invested by Year

- Figure 8.3 Funding and Investments: Distribution by Type of Funding

- Figure 8.4 Funding and Investments: Distribution of Amount Invested by Type of Funding

- Figure 8.5 Funding and Investments: Distribution by Target Indication

- Figure 8.6 Funding and Investments: Distribution by Type of Target Virus

- Figure 8.7 Funding and Investments: Distribution by Type of Investor

- Figure 8.8 Most Active Players: Distribution by Number of Instances

- Figure 8.9 Most Active Players: Distribution by Amount Invested

- Figure 8.10 Most Active Investors: Distribution by Number of Instances

- Figure 8.11 Funding and Investments: Distribution of Amount Invested by Region

- Figure 8.12 Funding and Investments: Distribution of Amount Invested by Country

- Figure 9.1 Antiviral Drugs: Porter's Five Forces Analysis

- Figure 10.1 Global Antiviral Drugs Market, Till 2035 (USD Billion)

- Figure 10.2 Antiviral Drugs Market: Distribution by Mechanism of Action (USD Billion)

- Figure 10.3 Antiviral Drugs Market for Fusion Inhibitors, Till 2035 (USD Billion)

- Figure 10.4 Antiviral Drugs Market for DNA Polymerases, Till 2035 (USD Billion)

- Figure 10.5 Antiviral Drugs Market for Protease Inhibitors, Till 2035 (USD Billion)

- Figure 10.6 Antiviral Drugs Market for Reverse Transcriptase Inhibitors, Till 2035 (USD Billion)

- Figure 10.7 Antiviral Drugs Market for Other Mechanisms, Till 2035 (USD Billion)

- Figure 10.8 Antiviral Drugs Market: Distribution by Target Indication (USD Billion)

- Figure 10.9 Antiviral Drugs Market for Human Immunodeficiency Virus Infection, Till 2035 (USD Billion)

- Figure 10.10 Antiviral Drugs Market for Hepatitis, Till 2035 (USD Billion)

- Figure 10.11 Antiviral Drugs Market for Coronavirus Infection, Till 2035 (USD Billion)

- Figure 10.12 Antiviral Drugs Market for Herpes Simplex Virus Infection, Till 2035 (USD Billion)

- Figure 10.13 Antiviral Drugs Market for Cytomegalovirus Infection, Till 2035 (USD Billion)

- Figure 10.14 Antiviral Drugs Market for Influenza, Till 2035 (USD Billion)

- Figure 10.15 Antiviral Drugs Market for Other Target Indications, Till 2035 (USD Billion)

- Figure 10.16 Antiviral Drugs Market: Distribution by Type of Drug Target (USD Billion)

- Figure 10.17 Antiviral Drugs Market for Virus Target, Till 2035 (USD Billion)

- Figure 10.18 Antiviral Drugs Market for Host Target, Till 2035 (USD Billion)

- Figure 10.19 Antiviral Drugs Market: Distribution by Type of Therapy (USD Billion)

- Figure 10.20 Antiviral Drugs Market for Monotherapy, Till 2035 (USD Billion)

- Figure 10.21 Antiviral Drugs Market for Combination Therapy, Till 2035 (USD Billion)

- Figure 10.22 Antiviral Drugs Market: Distribution by Geography (USD Billion)

- Figure 10.23 Antiviral Drugs Market in North America, Till 2035 (USD Billion)

- Figure 10.24 Antiviral Drugs Market in Europe, Till 2035 (USD Billion)

- Figure 10.25 Antiviral Drugs Market in Asia-Pacific, Till 2035 (USD Billion)

- Figure 10.26 Antiviral Drugs Market in Latin America, Till 2035 (USD Billion)

- Figure 10.27 Antiviral Drugs Market in MENA, Till 2035 (USD Billion)

- Figure 10.28 Antiviral Drugs Market in Rest of the World, Till 2035 (USD Billion)