|

市场调查报告书

商品编码

1699342

宽频隙半导体市场机会、成长动力、产业趋势分析及2025-2034年预测Wide Bandgap Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

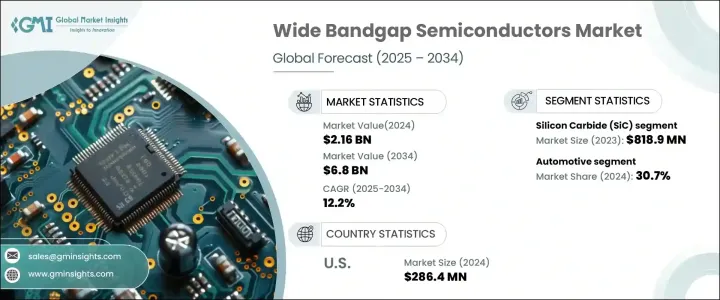

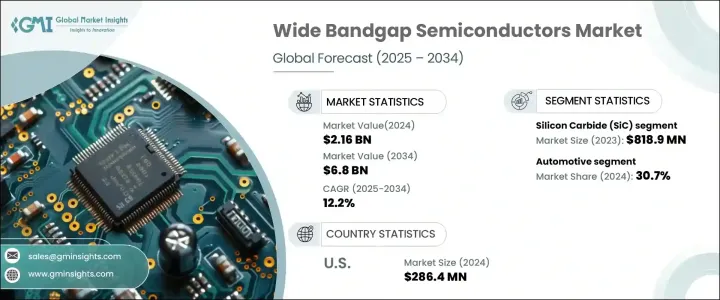

2024 年全球宽频隙半导体市场价值为 21.6 亿美元,预计 2025 年至 2034 年的复合年增长率为 12.2%。这项显着扩张是由各行各业对电力电子技术的日益普及以及全球向电动车的转变所推动的。随着各行各业对能源效率高效能解决方案的需求,对以在高电压和高温下运作的卓越能力而闻名的宽频隙半导体的需求将激增。

再生能源系统的普及、汽车行业电气化的不断增长以及半导体技术的不断进步是推动市场成长的关键因素。政府推动清洁能源的倡议、严格的效率法规以及 5G 基础设施的加速推出也推动了对这些高功率半导体的需求。技术创新不断扩大宽频隙半导体的应用范围,使其成为高耗电产业不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21.6亿美元 |

| 预测值 | 68亿美元 |

| 复合年增长率 | 12.2% |

市场主要按材料类型细分,其中碳化硅(SiC)和氮化镓(GaN)占据行业领先地位。碳化硅因其高热导率、高击穿电压和宽频隙特性等优异特性,在 2023 年创造了 8.189 亿美元的销售额。与传统硅相比,SiC 具有更高的效率,可承受更高的温度和电压水平,因此成为电动车和再生能源应用中电力电子的首选。随着製造商努力开发高性能半导体解决方案,SiC 继续主导高功率和高频应用。另一种重要材料 GaN 因其快速切换能力和能源效率而越来越受到关注,尤其是在射频和微波应用方面。

市场根据最终用途产业进一步细分,包括汽车、电信、消费性电子、能源、航太和国防。受电动车广泛普及的推动,汽车产业到 2024 年将占据 30.7% 的市场。基于 SiC 和 GaN 的电力电子技术提高了电动车的能源效率,减少了功率损耗并实现了更快的开关速度。随着汽车製造商越来越多地将宽频隙半导体整合到车辆系统中,这些组件在实现能源效率目标和延长电池寿命方面发挥关键作用。先进驾驶辅助系统(ADAS) 和快速充电基础设施的需求不断增长,进一步加速了汽车产业对这些高功率半导体的应用。

2024 年美国宽频隙半导体市场价值为 2.864 亿美元,随着美国在半导体製造业地位的加强,预计该市场将经历强劲成长。对能源节约的关注,加上半导体製造技术的不断进步,使美国成为全球市场的重要参与者。在政府支持国内半导体生产的激励措施和不断增加的研发投资下,美国製造商获得了竞争优势。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对节能解决方案的需求不断增加

- 电动车市场的扩张

- 部署5G和先进通信

- 政府支持和投资倡议

- 工业自动化和电气化日益兴起

- 产业陷阱与挑战

- 生产成本高、製造复杂

- 供应链限制和材料可用性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 碳化硅(SiC)

- 氮化镓(GaN)

- 氮化铝(AlN)

- 钻石

- 其他的

第六章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 汽车

- 消费性电子产品

- 电信

- 能源与公用事业

- 航太与国防

- 其他的

第七章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- CISSOID

- Diodes Incorporated

- Fuji Electric Co., Ltd.

- Navitas Semiconductor

- Infineon Technologies AG

- Littelfuse, Inc.

- Microsemi Corporation.

- Mitsubishi Electric Corporation

- Nexperia

- Renesas Electronics Corporation

- ROHM Semiconductor

- SEMIKRON

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Electronic Devices & Storage Corporation

- Vishay Intertechnology Inc.

- Wolfspeed, Inc.

The Global Wide Bandgap Semiconductors Market was valued at USD 2.16 billion in 2024 and is projected to grow at a CAGR of 12.2% from 2025 to 2034. This remarkable expansion is fueled by the rising adoption of power electronics across industries and the global transition toward electric vehicles. As industries demand high-performance solutions for energy efficiency, the need for wide bandgap semiconductors, known for their superior ability to operate at high voltages and temperatures, is set to surge.

The proliferation of renewable energy systems, growing electrification in the automotive sector, and increasing advancements in semiconductor technologies are key factors propelling market growth. Government initiatives promoting clean energy, stringent efficiency regulations, and the accelerating rollout of 5G infrastructure are also driving demand for these high-power semiconductors. Technological innovations continue to expand the application scope of wide bandgap semiconductors, making them indispensable for power-hungry industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.16 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 12.2% |

The market is primarily segmented by material type, with Silicon Carbide (SiC) and Gallium Nitride (GaN) leading the industry. SiC generated USD 818.9 million in 2023, owing to its exceptional characteristics such as high thermal conductivity, high breakdown voltage, and wide bandgap properties. Compared to traditional silicon, SiC delivers superior efficiency, withstanding higher temperatures and voltage levels, making it a preferred choice for power electronics in electric vehicles and renewable energy applications. As manufacturers strive to develop high-performance semiconductor solutions, SiC continues to dominate high-power and high-frequency applications. GaN, another prominent material, is gaining traction due to its rapid switching capabilities and energy efficiency, particularly in RF and microwave applications.

The market is further segmented based on end-use industries, including automotive, telecommunications, consumer electronics, energy, aerospace, and defense. The automotive sector accounted for a 30.7% market share in 2024, driven by the widespread adoption of electric vehicles. SiC and GaN-based power electronics enhance energy efficiency in EVs, reducing power losses and enabling faster switching speeds. As automakers increasingly integrate wide bandgap semiconductors into vehicle systems, these components play a pivotal role in meeting energy efficiency goals and achieving longer battery life. The rising demand for advanced driver assistance systems (ADAS) and fast-charging infrastructure further accelerates the adoption of these high-power semiconductors in the automotive industry.

The U.S. wide bandgap semiconductors market was valued at USD 286.4 million in 2024 and is expected to experience robust growth as the country strengthens its position in semiconductor manufacturing. The focus on energy conservation, coupled with ongoing advancements in semiconductor fabrication, positions the U.S. as a key player in the global market. With government-backed incentives for domestic semiconductor production and increasing investments in research and development, U.S. manufacturers gain a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for energy-efficient solutions

- 3.6.1.2 Expansion of electric vehicle market

- 3.6.1.3 Deployment of 5G and advanced communications

- 3.6.1.4 Government support and investment initiatives

- 3.6.1.5 Rising industrial automation and electrification

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs and complex manufacturing

- 3.6.2.2 Supply chain constraints and material availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Silicon Carbide (SiC)

- 5.3 Gallium Nitride (GaN)

- 5.4 Aluminum Nitride (AlN)

- 5.5 Diamond

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End-use Industry, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Consumer electronics

- 6.4 Telecommunications

- 6.5 Energy & utility

- 6.6 Aerospace & defense

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 CISSOID

- 8.2 Diodes Incorporated

- 8.3 Fuji Electric Co., Ltd.

- 8.4 Navitas Semiconductor

- 8.5 Infineon Technologies AG

- 8.6 Littelfuse, Inc.

- 8.7 Microsemi Corporation.

- 8.8 Mitsubishi Electric Corporation

- 8.9 Nexperia

- 8.10 Renesas Electronics Corporation

- 8.11 ROHM Semiconductor

- 8.12 SEMIKRON

- 8.13 STMicroelectronics N.V.

- 8.14 Texas Instruments Inc.

- 8.15 Toshiba Electronic Devices & Storage Corporation

- 8.16 Vishay Intertechnology Inc.

- 8.17 Wolfspeed, Inc.