|

市场调查报告书

商品编码

1699349

面板安装隔离开关市场机会、成长动力、产业趋势分析及 2025-2034 年预测Panel Mounted Disconnect Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

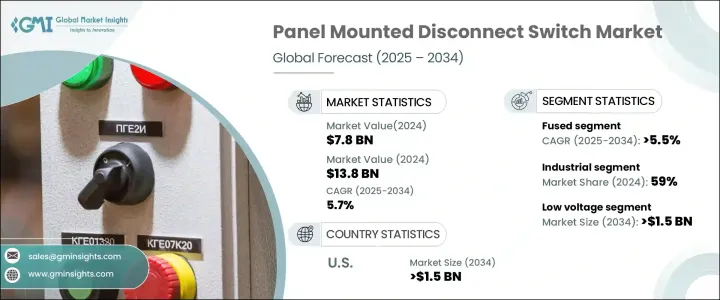

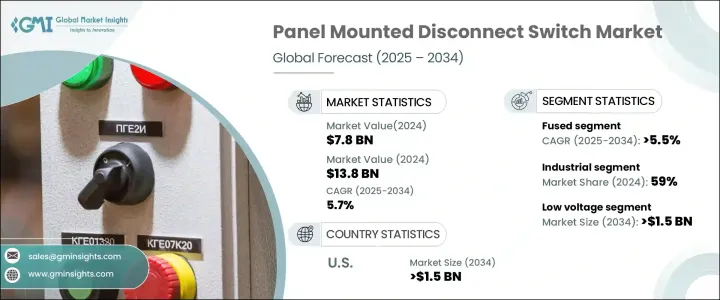

2024 年全球面板安装断路开关市场价值为 78 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.7%。市场受到对可靠电气元件日益增长的需求以及工业和商业领域对安全法规的严格遵守的推动。随着人们对电气安全的日益关注,企业越来越多地采用先进的断路器来增强保护、最大限度地减少停机时间并提高营运效率。工业自动化和智慧基础设施发展的兴起进一步加速了市场成长,为製造商推出了高效能解决方案创造了机会。

面板安装断路开关中物联网和数位技术的整合正在改变市场格局。具有即时性能监控、远端控制功能和预测性维护功能的智慧断路开关正获得显着的发展。这些先进的系统提高了可靠性,降低了营运风险,并帮助企业遵守不断发展的安全标准。此外,对能源效率和永续性的追求促使各行各业投资于下一代电气元件,以优化电力分配并确保无缝运作。工业设施的扩张和电网的现代化,特别是在发展中经济体,是影响市场动态的关键因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 78亿美元 |

| 预测值 | 138亿美元 |

| 复合年增长率 | 5.7% |

熔断面板安装断路开关市场正在经历大幅成长,到 2034 年的复合年增长率将达到 5.5%。这些开关在隔离故障电路、防止连接设备损坏以及维持整体系统稳定性方面发挥关键作用。随着对大型製造工厂和工业自动化的投资不断增加,企业优先采用先进的电气隔离解决方案。使用现代熔断器断路开关升级老化的电气系统的需求正在成为旨在提高安全标准和降低电气故障相关风险的行业的战略倡议。尤其是新兴市场,作为更广泛的基础设施发展计划的一部分,这些交换机正在被迅速采用。

工业部门仍然是主要的应用领域,到 2024 年将占 59% 的份额。製造业、国防和农业等部门正在推动对重型面板安装断路开关的需求。依赖高功率设备的产业,包括纸浆和造纸厂、采矿业以及石油和天然气,需要可靠的电气隔离解决方案来确保不间断运作。工业自动化和基础设施项目投资的增加进一步推动了市场扩张。该公司正专注于部署具有更高耐用性、可承受极端环境条件并符合严格监管框架的断路开关。随着各行各业不断整合数位监控和自动化控制系统,对智慧面板安装断路开关的需求预计将稳定上升。

2024 年,美国面板安装断路开关市场价值为 9.797 亿美元,这得益于具有自动故障检测和诊断功能的智慧电气系统的广泛采用。升级老化的电网仍然是首要任务,这导致对现代安全解决方案的投资增加。美国各地的各个行业都在积极部署下一代断路器,以确保电气安全、提高效率并增强操作控制。数位监控技术的进步,加上严格的安全要求,正在加速该国采用智慧电气解决方案。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 融合

- 非熔合

第六章:市场规模及预测:按电压,2021 年至 2034 年

- 主要趋势

- 低(≤11kV)

- 中(> 11 kV - 33 kV)

- 高(> 33千伏特)

第七章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 商业的

- 工业的

- 公用事业

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 阿曼

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 秘鲁

- 阿根廷

第九章:公司简介

- ABB

- B&J-USA

- c3controls

- Changan Group

- Eaton

- Emerson Electric

- EMSPEC

- General Electric

- Havells India

- Honeywell International

- Littelfuse

- LOVATO ELECTRIC

- MERSEN EP

- Richards Manufacturing

- Rockwell Automation

- Salzer

- Schneider Electric

- Siemens

- SOCOMEC

- WEG

The Global Panel Mounted Disconnect Switch Market was valued at USD 7.8 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. The market is driven by the increasing demand for reliable electrical components and strict adherence to safety regulations across industrial and commercial sectors. With growing concerns over electrical safety, businesses are increasingly adopting advanced disconnect switches to enhance protection, minimize downtime, and improve operational efficiency. The rise in industrial automation and smart infrastructure development is further accelerating market growth, creating opportunities for manufacturers to introduce high-performance solutions.

The integration of IoT and digital technologies in panel mounted disconnect switches is transforming the market landscape. Smart disconnect switches with real-time performance monitoring, remote control capabilities, and predictive maintenance features are gaining significant traction. These advanced systems improve reliability, reduce operational risks, and help businesses comply with evolving safety standards. Additionally, the push for energy efficiency and sustainability is prompting industries to invest in next-generation electrical components that optimize power distribution while ensuring seamless operations. The expansion of industrial facilities and modernization of electrical grids, particularly in developing economies, are key factors influencing market dynamics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 5.7% |

The fused panel mounted disconnect switch segment is experiencing substantial growth, registering a CAGR of 5.5% through 2034. These switches play a critical role in isolating faulty circuits, preventing damage to connected equipment, and maintaining overall system stability. With increasing investments in large-scale manufacturing plants and industrial automation, businesses are prioritizing the adoption of advanced electrical isolation solutions. The need to upgrade aging electrical systems with modern fused disconnect switches is becoming a strategic move for industries aiming to enhance safety standards and mitigate risks associated with electrical failures. Emerging markets, in particular, are witnessing rapid adoption of these switches as part of broader infrastructure development initiatives.

The industrial sector remains the dominant application area, holding a 59% share in 2024. Sectors such as manufacturing, defense, and agriculture are driving demand for heavy-duty panel mounted disconnect switches. Industries that rely on high-power equipment, including pulp and paper mills, mining, and oil and gas, require reliable electrical isolation solutions to ensure uninterrupted operations. Rising investments in industrial automation and infrastructure projects are further fueling market expansion. Companies are focusing on deploying disconnect switches that offer enhanced durability, withstand extreme environmental conditions, and comply with stringent regulatory frameworks. As industries continue to integrate digital monitoring and automated control systems, the demand for smart panel mounted disconnect switches is expected to rise steadily.

The U.S. Panel Mounted Disconnect Switch Market was valued at USD 979.7 million in 2024, driven by the widespread adoption of smart electrical systems with automatic fault detection and diagnostics. The need to upgrade aging electrical networks remains a key priority, leading to increased investments in modern safety solutions. Various industries across the United States are actively deploying next-generation disconnect switches to ensure electrical safety, improve efficiency, and enhance operational control. Advances in digital monitoring technologies, coupled with stringent safety mandates, are accelerating the adoption of intelligent electrical solutions in the country.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fused

- 5.3 Non-fused

Chapter 6 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Low (≤ 11 kV)

- 6.3 Medium (> 11 kV - 33 kV)

- 6.4 High (> 33 kV)

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Oman

- 8.5.5 South Africa

- 8.5.6 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 B&J-USA

- 9.3 c3controls

- 9.4 Changan Group

- 9.5 Eaton

- 9.6 Emerson Electric

- 9.7 EMSPEC

- 9.8 General Electric

- 9.9 Havells India

- 9.10 Honeywell International

- 9.11 Littelfuse

- 9.12 LOVATO ELECTRIC

- 9.13 MERSEN EP

- 9.14 Richards Manufacturing

- 9.15 Rockwell Automation

- 9.16 Salzer

- 9.17 Schneider Electric

- 9.18 Siemens

- 9.19 SOCOMEC

- 9.20 WEG