|

市场调查报告书

商品编码

1699382

湿纸巾市场机会、成长动力、产业趋势分析及 2025-2034 年预测Wet Wipes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

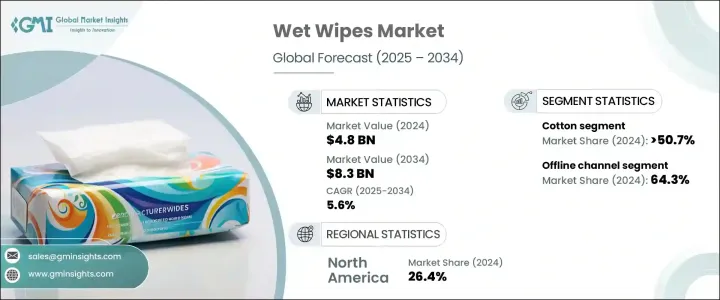

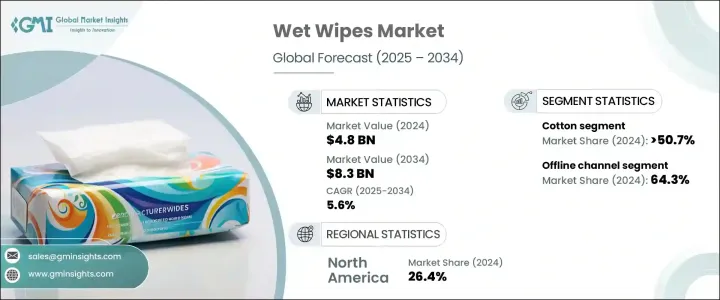

2024 年全球湿纸巾市场价值为 48 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.6%。这一强劲成长是由消费者对个人护理和家庭应用中便利、卫生解决方案的需求不断增长所推动的。随着城市人口的增长和日常生活节奏的加快,湿纸巾已成为无需用水即可保持清洁的首选解决方案。疫情过后,人们对个人卫生的重视持续推动市场扩张,消费者优先考虑能够快速、有效率卫生的产品。此外,人们对护肤、永续性和无化学配方的认识不断提高,正在影响购买决策,导致对环保和可生物降解湿纸巾的需求激增。

随着製造商不断创新以满足消费者对更温和、更永续的选择的偏好,市场正在经历快速转型。各大品牌纷纷推出注入天然萃取物、经皮肤科测试的成分和抗菌特性的湿纸巾,以满足注重健康的消费者的需求。一次性湿纸巾的便利性推动了销售,尤其是适合忙碌生活方式的旅行友善包装。此外,推广环保产品的监管措施正在塑造市场趋势,许多公司专注于可生物降解和无塑胶替代品。製造商和零售商之间的策略合作也推动了竞争性定价和增强的产品可用性,进一步加速了市场渗透。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 48亿美元 |

| 预测值 | 83亿美元 |

| 复合年增长率 | 5.6% |

就产品类型而言,市场分为个人护理湿巾和家用湿纸巾。个人护理领域引领市场,2024 年创造 34 亿美元的收入,预计在预测期内以 5.7% 的复合年增长率成长。日常卫生、护肤和便利性对这些产品的依赖性日益增强,推动了这一成长。婴儿湿纸巾、脸部湿纸巾、女性卫生湿纸巾和身体清洁湿纸巾由于其实用性和无水使用性而需求量不断增加。城市生活方式和繁忙的日程进一步巩固了个人护理湿纸巾作为必需卫生产品的地位。随着消费者寻求有效、可携带的解决方案来保持清洁,这些产品的采用率持续上升。

材料选择在市场动态中起着至关重要的作用,湿巾通常由棉、不织布和机织布製成。 2024 年,棉花部分在预测期内占据 5.8% 的市场。棉花的天然和可生物降解的特性使其成为具有环保意识的消费者的一个有吸引力的选择。它的柔软性和吸收性使其特别适合用于婴儿湿纸巾和脸部湿纸巾,满足了人们对温和、亲肤替代品日益增长的需求。随着对合成材料和有害化学物质的担忧日益加剧,消费者正在积极转向符合他们对永续、无化学物质选择的偏好的棉质湿纸巾。

2024 年,北美占据湿纸巾市场的 26.4%,价值 12.7 亿美元。由于消费者重视个人和家庭护理的卫生,该地区对湿纸巾的需求持续上升。大型零售商透过提供价格具竞争力的自有品牌湿纸巾来促进市场扩张,使广大消费者更容易购买这些产品。此外,监管机构正在鼓励采用更安全、更环保的成分,影响产品配方和行销策略。旅行装多用途湿纸巾的需求在美国和加拿大尤为强劲,在这些国家,随时随地的卫生解决方案已成为生活方式活跃的消费者的必需品。这些因素共同支持了北美湿纸巾市场的持续成长和发展。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 越来越重视卫生

- 便利性和便携性趋势

- 卫生法规和标准

- 酒店业蓬勃发展

- 产业陷阱与挑战

- 监管压力

- 市场饱和与竞争

- 成长动力

- 成长潜力分析

- 消费者购买行为

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品类型,2021 - 2034 年(十亿美元)

- 主要趋势

- 个人护理湿纸巾

- 面巾

- 身体湿纸巾

- 私密湿纸巾

- 婴儿湿纸巾

- 其他的

- 家用湿纸巾

第六章:市场估计与预测:按材料,2021 - 2034 年(十亿美元)

- 主要趋势

- 棉布

- 非织物

- 机织布料

第七章:市场估计与预测:按价格,2021-2034 年(十亿美元)

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按包装尺寸,2021 - 2034 年(十亿美元)

- 主要趋势

- 最多 50 张湿纸巾

- 50-100张湿纸巾

- 超过 100 张湿纸巾

第九章:市场估计与预测:依最终用途,2021 - 2034 年(十亿美元)

- 主要趋势

- 个人

- 商业的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年(十亿美元)

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市

- 个别商店

- 一元商店

- 其他(专卖店等)

第 11 章:市场估计与预测:按地区,2021 年至 2034 年(十亿美元)

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十二章:公司简介

- Beiersdorf

- Cascades

- Clorox

- Essity

- Estee Lauder

- Johnson & Johnson

- Kimberly-Clark

- Kirkland Signature

- Nice-Pak Products

- PDI

- Procter & Gamble

- Reckitt Benckiser

- Sani Professional

- Seventh Generation

- Unilever

The Global Wet Wipes Market was valued at USD 4.8 billion in 2024 and is projected to expand at a CAGR of 5.6% from 2025 to 2034. This robust growth is fueled by rising consumer demand for convenient, hygienic solutions across personal care and household applications. As urban populations grow and daily routines become increasingly fast-paced, wet wipes have become a go-to solution for maintaining cleanliness without water. The post-pandemic emphasis on personal hygiene continues to drive market expansion, with consumers prioritizing products that offer quick and efficient sanitation. Additionally, heightened awareness of skincare, sustainability, and chemical-free formulations is influencing buying decisions, leading to a surge in demand for eco-friendly and biodegradable wet wipes.

The market is experiencing rapid transformation as manufacturers innovate to meet consumer preferences for gentler, more sustainable options. Brands are introducing wet wipes infused with natural extracts, dermatologically tested ingredients, and antibacterial properties, catering to a health-conscious audience. The convenience of single-use wipes is propelling sales, especially in travel-friendly packaging that appeals to busy lifestyles. Furthermore, regulatory initiatives promoting eco-conscious products are shaping market trends, with many companies focusing on biodegradable and plastic-free alternatives. Strategic collaborations between manufacturers and retailers are also driving competitive pricing and enhanced product availability, further accelerating market penetration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 billion |

| Forecast Value | $8.3 billion |

| CAGR | 5.6% |

In terms of product type, the market is categorized into personal care and household wet wipes. The personal care segment led the market, generating USD 3.4 billion in 2024, and is anticipated to grow at a CAGR of 5.7% over the forecast period. The increasing reliance on these products for daily hygiene, skincare, and convenience fuels this growth. Baby wipes, facial wipes, feminine hygiene wipes, and body cleansing wipes are witnessing heightened demand due to their practicality and waterless application. Urban lifestyles and hectic schedules have further cemented the role of personal care wipes as essential hygiene products. As consumers seek effective, portable solutions to maintain cleanliness, the adoption of these products continues to rise.

Material selection plays a crucial role in market dynamics, with wet wipes commonly made from cotton, non-woven fabrics, and woven fabrics. In 2024, the cotton segment accounted for a 5.8% market share during the forecast period. Cotton's natural and biodegradable properties make it an attractive choice for environmentally conscious consumers. Its softness and absorbency make it particularly suitable for baby wipes and facial wipes, addressing the growing demand for gentle, skin-friendly alternatives. As concerns over synthetic materials and harmful chemicals increase, consumers are actively shifting towards cotton-based wipes that align with their preference for sustainable, chemical-free options.

North America held a 26.4% share of the wet wipes market in 2024, amounting to USD 1.27 billion. The demand for wet wipes continues to rise in this region as consumers emphasize hygiene in both personal and household care. Major retailers are contributing to market expansion by offering competitively priced private-label wet wipes, making them more accessible to a broad consumer base. Additionally, regulatory bodies are encouraging the adoption of safer and eco-friendly ingredients, influencing product formulations and marketing strategies. The demand for travel-sized, multi-use wet wipes is particularly strong in the United States and Canada, where on-the-go hygiene solutions have become a necessity for consumers with dynamic lifestyles. These factors collectively support the continued growth and evolution of the North American wet wipes market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 The growing emphasis on hygiene

- 3.10.1.2 Convenience and portability trends

- 3.10.1.3 Health regulations and standards

- 3.10.1.4 Growing hospitality sector

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Regulatory pressures

- 3.10.2.2 Market saturation and competition

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Personal care wet wipes

- 5.2.1 Face wipes

- 5.2.2 Body wipes

- 5.2.3 Intimate wipes

- 5.2.4 Baby wipes

- 5.2.5 Others

- 5.3 Household wet wipes

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Cotton

- 6.3 Non-woven fabrics

- 6.4 Woven fabrics

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Packaging Size, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Upto 50 wipes

- 8.3 50-100 wipes

- 8.4 More than 100 wipes

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Individual

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Supermarkets

- 10.3.2 Individual stores

- 10.3.3 Dollar stores

- 10.3.4 Others (specialty stores, etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 The U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Beiersdorf

- 12.2 Cascades

- 12.3 Clorox

- 12.4 Essity

- 12.5 Estee Lauder

- 12.6 Johnson & Johnson

- 12.7 Kimberly-Clark

- 12.8 Kirkland Signature

- 12.9 Nice-Pak Products

- 12.10 PDI

- 12.11 Procter & Gamble

- 12.12 Reckitt Benckiser

- 12.13 Sani Professional

- 12.14 Seventh Generation

- 12.15 Unilever