|

市场调查报告书

商品编码

1699397

被动及互连电子元件市场机会、成长动力、产业趋势分析及 2025-2034 年预测Passive and Interconnecting Electronic Components Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

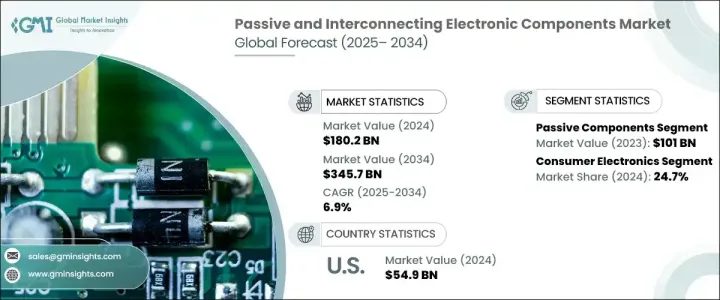

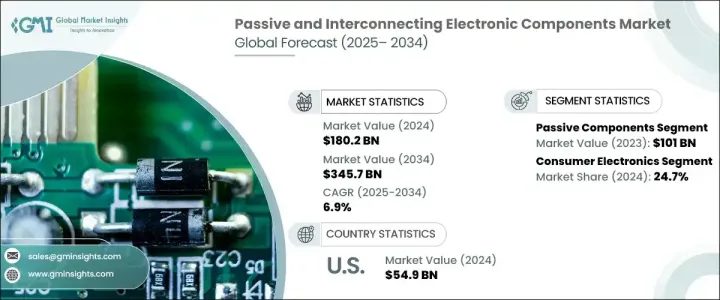

2024 年全球被动和互连电子元件市场规模达到 1802 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.9%。这一增长得益于物联网 (IoT) 的日益普及、汽车电子的快速发展以及多个行业对高性能电子元件不断增长的需求。随着世界联繫日益紧密,各行各业都更加重视能源效率、自动化和无缝连接,从而推动了对可靠电子元件的需求。

物联网整合一直是塑造市场格局的关键因素。随着智慧型装置成为日常生活的重要组成部分,对高品质被动和互连元件的需求持续激增。智慧家庭系统、穿戴式装置、工业自动化和智慧城市都依赖这些电子元件来实现高效的性能和连接性。数据驱动技术、边缘运算和基于云端的应用程式的兴起进一步加速了需求。此外,5G 网路、人工智慧 (AI) 和先进电信基础设施的日益普及也增加了对弹性和高效能电子元件的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1802亿美元 |

| 预测值 | 3457亿美元 |

| 复合年增长率 | 6.9% |

汽车产业也是市场扩张的主要贡献者。现代车辆越来越依赖电子系统,从高级驾驶辅助系统 (ADAS) 和资讯娱乐系统到电动车 (EV) 动力系统和电池管理系统。向电动和自动驾驶汽车的转变对被动和互连组件提出了更高的需求,以确保下一代汽车技术的性能、安全性和寿命。汽车製造商正在整合更多的电子控制单元 (ECU)、感测器和高速连接器,以提高车辆效率、自动化程度和使用者体验。

2023 年,被动元件领域产值达 1,010 亿美元,包括电阻器、电容器、电感器和变压器等基本元件。这些组件不需要外部电源来运行,而是在电路内储存、吸收或耗散能量。它们在消费性电子、工业应用、电信和医疗设备中不可或缺的作用正在推动稳定的需求。随着製造商优先考虑小型化和更高的能源效率,被动元件对于确保现代电子设备的耐用性、性能和可靠性变得至关重要。

2024 年,被动和互连电子元件市场中的消费性电子部分占据了 24.7% 的份额。智慧型手机、笔记型电脑、家用电器和穿戴式装置的日益普及继续推动对高品质电容器、电阻器和连接器的需求。随着电子设备的处理速度越来越快、电池寿命越来越长、设计越来越紧凑,製造商越来越依赖被动和互连组件来保持无缝功能。

在强劲的技术进步、自动化程度的提高以及对数位基础设施的持续投资的推动下,美国被动和互连电子元件市场规模到 2024 年将达到 549 亿美元。该国在汽车、电信和消费性电子等领域仍处于创新前沿,对电子元件的需求持续存在。随着各行各业越来越多地采用人工智慧、机器人技术和智慧製造,预计未来几年对可靠、高性能被动和互连组件的需求将进一步增加。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 物联网(IoT)的兴起

- 对先进汽车电子产品的需求不断增长

- 消费性电子产业快速扩张

- 再生能源解决方案的普及

- 产业陷阱与挑战

- 原料成本高

- 环境和永续性议题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 被动的

- 电阻器

- 电容器

- 电感器

- 变形金刚

- 其他的

- 互连

- 印刷电路板

- 连接器

- 开关和继电器

- 其他的

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 消费性电子产品

- 智慧型手机和平板电脑

- 笔记型电脑和桌上型电脑

- 电视和家用电器

- 其他的

- 汽车

- 车载资讯娱乐系统

- 安全与安保系统

- 驾驶员辅助系统

- 引擎控制系统

- 其他的

- 卫生保健

- 影像系统

- 病人监护系统

- 治疗设备

- 其他的

- IT和电信

- 电信设备

- 网路装置

- 工业的

- 自动化与机器人

- 发电

- 工业控制系统

- 其他的

- 航太与国防

- 军事通信

- 武器系统

- 飞机安全系统

- 其他的

- 其他的

第七章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Amphenol Corporation

- Fenghua (HK) Electronics Ltd.

- Fujitsu Component Limited

- Hirose Electric Co. Ltd

- Hosiden Corporation

- KYOCERA AVX Components Corporation

- Molex Incorporated

- Murata Manufacturing Co., Ltd.

- Nichicon Corporation

- Panasonic Corporation

- Rohm Co., Ltd.

- Samsung Electro-Mechanics Co., Ltd.

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- TE Connectivity Ltd.

- TT Electronics PLC

- United Chemi-Con

- Vishay Intertechnology, Inc.

- Walsin Technology Corporation

- Yageo Corporation

The Global Passive And Interconnecting Electronic Components Market reached USD 180.2 billion in 2024 and is projected to grow at a CAGR of 6.9% between 2025 and 2034. This growth is fueled by the increasing adoption of the Internet of Things (IoT), rapid advancements in automotive electronics, and rising demand for high-performance electronic components across multiple industries. As the world becomes more connected, industries are placing greater emphasis on energy efficiency, automation, and seamless connectivity, driving the need for reliable electronic components.

IoT integration has been a key factor in shaping the market landscape. With smart devices becoming an essential part of everyday life, the demand for high-quality passive and interconnecting components continues to surge. Smart home systems, wearable devices, industrial automation, and smart cities all rely on these electronic components for efficient performance and connectivity. The rise in data-driven technologies, edge computing, and cloud-based applications has further accelerated demand. Additionally, the increasing penetration of 5G networks, artificial intelligence (AI), and advanced telecommunication infrastructure has amplified the need for resilient and high-efficiency electronic components.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $180.2 Billion |

| Forecast Value | $345.7 Billion |

| CAGR | 6.9% |

The automotive sector is also a major contributor to market expansion. Modern vehicles are increasingly dependent on electronic systems, from advanced driver-assistance systems (ADAS) and infotainment to electric vehicle (EV) powertrains and battery management systems. The shift toward electric and autonomous vehicles has created a higher demand for passive and interconnecting components, ensuring performance, safety, and longevity in next-generation automotive technologies. Automakers are integrating more electronic control units (ECUs), sensors, and high-speed connectors to enhance vehicle efficiency, automation, and user experience.

The passive components segment generated USD 101 billion in 2023, comprising essential components such as resistors, capacitors, inductors, and transformers. These components do not require external power to operate but instead store, absorb, or dissipate energy within circuits. Their indispensable role in consumer electronics, industrial applications, telecommunications, and medical devices is fueling steady demand. With manufacturers prioritizing miniaturization and higher energy efficiency, passive components have become critical to ensuring durability, performance, and reliability in modern electronic devices.

The consumer electronics segment in the passive and interconnecting electronic components market accounted for a 24.7% share in 2024. The growing proliferation of smartphones, laptops, home appliances, and wearable devices continues to drive demand for high-quality capacitors, resistors, and connectors. As electronic devices evolve with faster processing speeds, enhanced battery life, and compact designs, manufacturers increasingly depend on passive and interconnecting components to maintain seamless functionality.

The U.S. passive and interconnecting electronic components market reached USD 54.9 billion in 2024, driven by strong technological advancements, increasing automation, and continued investment in digital infrastructure. The country remains at the forefront of innovation in sectors like automotive, telecommunications, and consumer electronics, creating a sustained demand for electronic components. With industries increasingly adopting AI, robotics, and smart manufacturing, the need for reliable, high-performance passive and interconnecting components is expected to rise further in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rise of the Internet of Things (IoT)

- 3.6.1.2 Increasing demand for advanced automotive electronics

- 3.6.1.3 Rapid expansion of the consumer electronics industry

- 3.6.1.4 Proliferation of renewable energy solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High raw material costs

- 3.6.2.2 Environmental and sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion & Unit)

- 5.1 Key trends

- 5.2 Passive

- 5.2.1 Resistors

- 5.2.2 Capacitors

- 5.2.3 Inductors

- 5.2.4 Transformers

- 5.2.5 Others

- 5.3 Interconnecting

- 5.3.1 PCB

- 5.3.2 Connectors

- 5.3.3 Switches & relays

- 5.3.4 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Unit)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.2.1 Smartphones & tablets

- 6.2.2 Laptops & desktops

- 6.2.3 Televisions & home appliances

- 6.2.4 Others

- 6.3 Automotive

- 6.3.1 In-vehicle infotainment

- 6.3.2 Safety & security systems

- 6.3.3 Driver assistance systems

- 6.3.4 Engine control systems

- 6.3.5 Others

- 6.4 Healthcare

- 6.4.1 Imaging systems

- 6.4.2 Patient monitoring systems

- 6.4.3 Therapeutic equipment

- 6.4.4 Others

- 6.5 IT & telecom

- 6.5.1 Telecom equipment

- 6.5.2 Networking devices

- 6.6 Industrial

- 6.6.1 Automation & robotics

- 6.6.2 Power generation

- 6.6.3 Industrial control systems

- 6.6.4 Others

- 6.7 Aerospace & defense

- 6.7.1 Military communications

- 6.7.2 Weaponry systems

- 6.7.3 Aircraft safety systems

- 6.7.4 Others

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Unit)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Amphenol Corporation

- 8.2 Fenghua (HK) Electronics Ltd.

- 8.3 Fujitsu Component Limited

- 8.4 Hirose Electric Co. Ltd

- 8.5 Hosiden Corporation

- 8.6 KYOCERA AVX Components Corporation

- 8.7 Molex Incorporated

- 8.8 Murata Manufacturing Co., Ltd.

- 8.9 Nichicon Corporation

- 8.10 Panasonic Corporation

- 8.11 Rohm Co., Ltd.

- 8.12 Samsung Electro-Mechanics Co., Ltd.

- 8.13 Taiyo Yuden Co., Ltd.

- 8.14 TDK Corporation

- 8.15 TE Connectivity Ltd.

- 8.16 TT Electronics PLC

- 8.17 United Chemi-Con

- 8.18 Vishay Intertechnology, Inc.

- 8.19 Walsin Technology Corporation

- 8.20 Yageo Corporation