|

市场调查报告书

商品编码

1699410

生物标记发现外包服务市场机会、成长动力、产业趋势分析及预测(2025-2034)Biomarker Discovery Outsourcing Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

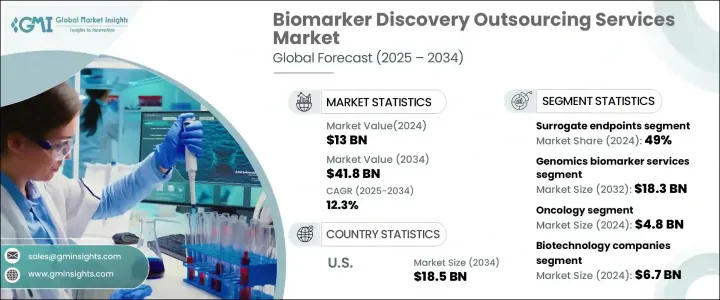

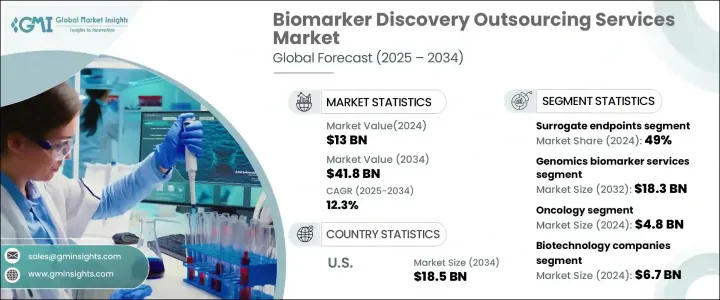

2024 年全球生物标记发现外包服务市场价值为 130 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 12.3%。受慢性病发病率上升、组学技术的快速进步以及製药和生物技术领域研发投资增加的推动,该市场正在经历显着增长。对个人化医疗的日益重视进一步推动了对新型生物标记的需求,这些生物标记能够早期发现、诊断和监测癌症、心血管疾病和糖尿病等慢性疾病。随着全球慢性病盛行率的上升,对生物标记的需求也不断增加,以促进有针对性的治疗策略。

政府倡议的不断增加、製药公司和研究机构之间的合作以及对生物标誌物验证的监管支持正在加速市场扩张。人工智慧 (AI) 和机器学习 (ML) 在生物标记发现中的日益普及也正在改变这个行业,从而更快地识别和验证潜在的生物标记。由于医疗保健支出的增加和先进临床研究中心的建立,新兴经济体正在成为生物标记研究的关键参与者。此外,数位健康解决方案和生物资讯学工具的采用正在增强数据驱动的生物标记发现,从而改善患者的治疗效果并提高药物开发流程的效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 130亿美元 |

| 预测值 | 418亿美元 |

| 复合年增长率 | 12.3% |

市场分为不同的生物标记类型,包括预测性生物标记、预后生物标记、安全生物标记、替代终点等。替代终点在 2024 年占据市场主导地位,占总收入份额的 49%,预计从 2025 年到 2034 年的复合年增长率为 12.1%。替代生物标记在临床试验中发挥着至关重要的作用,使研究人员能够及早评估治疗效果,从而大大加快临床研究进程。它们的广泛应用(尤其是在新兴市场)以及美国 FDA 等机构对肿瘤学和罕见疾病药物审批的强有力监管支持继续推动其市场份额。

生物标记发现外包服务市场进一步按服务类型细分,包括基因组学、蛋白质组学、生物资讯学等。光是基因组生物标记服务领域在 2024 年就创造了 57 亿美元的收入。遗传疾病病例的增加以及与癌症和神经退化性疾病等慢性疾病相关的死亡率的上升,正在推动对基因组生物标记服务的需求。公共和私营部门对基因组学研究的投资不断增加,加速了基因组生物标记的发现和验证,进一步加强了市场。下一代定序 (NGS) 和其他高通量基因组技术的整合正在增强生物标记识别,确保更精确的诊断和个人化的治疗方案。

预计到 2034 年,美国生物标记发现外包服务市场规模将达到 185 亿美元。美国在生物技术领域的领导地位、先进的医疗保健基础设施和完善的监管框架,为其在该领域的主导地位做出了贡献。美国FDA对生物标记验证实施了严格但支持性的监管机制,确保生物标记成功融入诊断和药物开发过程。生物製药公司、学术研究机构和政府机构之间的持续合作正在进一步推动创新和市场扩张。因此,美国仍然处于生物标记发现外包服务的前沿,在整个预测期内引领全球市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 研发投入不断增加

- 更重视个人化医疗和标靶治疗

- 高通量技术的进步

- 蓬勃发展的生物製剂产业

- 产业陷阱与挑战

- 智慧财产权问题

- 资料安全

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 预测性生物标记

- 预后生物标记

- 安全生物标记

- 替代终点

- 其他类型

第六章:市场估计与预测:按服务,2021 年至 2034 年

- 主要趋势

- 基因组学生物标记服务

- 蛋白质体学生物标记服务

- 生物资讯学生物标记服务

- 其他生物标记服务

第七章:市场估计与预测:按治疗领域,2021 年至 2034 年

- 主要趋势

- 肿瘤学

- 心臟病学

- 神经病学

- 自体免疫疾病

- 其他治疗领域

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 製药公司

- 生技公司

- 其他最终用途

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Almac Group Limited

- Biomcare ApS

- Bio-Rad Laboratories

- Crown Bioscience

- Evotec

- Excelra

- Frontage Labs

- ICON

- Integrated DNA Technologies

- Parexel International (MA) Corporation

- RayBiotech

- REPROCELL

- Sino Biological

- Svar Life Science

The Global Biomarker Discovery Outsourcing Services Market was valued at USD 13 billion in 2024 and is projected to expand at a CAGR of 12.3% between 2025 and 2034. The market is witnessing significant growth, driven by the increasing incidence of chronic diseases, rapid advancements in omics technologies, and rising investments in research and development within the pharmaceutical and biotechnology sectors. The growing emphasis on personalized medicine is further fueling demand for novel biomarkers that enable early detection, diagnosis, and monitoring of chronic conditions such as cancer, cardiovascular diseases, and diabetes. With chronic disease prevalence on the rise worldwide, the demand for biomarkers to facilitate targeted treatment strategies continues to increase.

Rising government initiatives, collaborations between pharmaceutical companies and research organizations, and regulatory support for biomarker validation are accelerating market expansion. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in biomarker discovery is also transforming the industry, allowing for faster identification and validation of potential biomarkers. Emerging economies are becoming key players in biomarker research due to rising healthcare expenditures and the establishment of advanced clinical research centers. Additionally, the adoption of digital health solutions and bioinformatics tools is enhancing data-driven biomarker discovery, leading to improved patient outcomes and more efficient drug development processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13 Billion |

| Forecast Value | $41.8 Billion |

| CAGR | 12.3% |

The market is categorized into different biomarker types, including predictive, prognostic, safety biomarkers, surrogate endpoints, and others. Surrogate endpoints dominated the market in 2024, accounting for 49% of the total revenue share, and are expected to grow at a CAGR of 12.1% from 2025 to 2034. Surrogate biomarkers play a crucial role in clinical trials by enabling researchers to assess treatment efficacy early, significantly expediting the clinical study process. Their widespread adoption, particularly in emerging markets, and strong regulatory support from authorities such as the U.S. FDA for drug approvals in oncology and rare diseases continue to drive their market share.

The biomarker discovery outsourcing services market is further segmented by service type, which includes genomics, proteomics, bioinformatics, and others. The genomics biomarker services segment alone generated USD 5.7 billion in 2024. Increasing cases of genetic disorders and the rising mortality rates associated with chronic diseases like cancer and neurodegenerative conditions are fueling the demand for genomic biomarker services. Growing public and private sector investments in genomics research are expediting the discovery and validation of genomic biomarkers, further strengthening the market. The integration of next-generation sequencing (NGS) and other high-throughput genomic technologies is enhancing biomarker identification, ensuring more precise diagnostics and personalized treatment plans.

The U.S. Biomarker Discovery Outsourcing Services Market is expected to reach USD 18.5 billion by 2034. The country's leadership in the biotechnology sector, advanced healthcare infrastructure, and well-established regulatory framework are contributing to its dominance in this space. The U.S. FDA has implemented stringent yet supportive regulatory mechanisms for biomarker validation, ensuring the successful integration of biomarkers into diagnostics and drug development processes. Ongoing partnerships between biopharmaceutical companies, academic research institutions, and government agencies are further propelling innovation and market expansion. As a result, the U.S. remains at the forefront of biomarker discovery outsourcing services, leading the global market throughout the forecast period.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising investments in research and development

- 3.2.1.2 Increasing focus on personalized medicine and targeted therapies

- 3.2.1.3 Advancements in high-throughput technologies

- 3.2.1.4 Booming biologics industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Intellectual property concerns

- 3.2.2.2 Data security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Predictive biomarkers

- 5.3 Prognostic biomarkers

- 5.4 Safety biomarkers

- 5.5 Surrogate endpoints

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Service, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Genomics biomarker services

- 6.3 Proteomics biomarker services

- 6.4 Bioinformatics biomarker services

- 6.5 Other biomarker services

Chapter 7 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oncology

- 7.3 Cardiology

- 7.4 Neurology

- 7.5 Autoimmune diseases

- 7.6 Other therapeutic areas

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Biotechnology companies

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Almac Group Limited

- 10.2 Biomcare ApS

- 10.3 Bio-Rad Laboratories

- 10.4 Crown Bioscience

- 10.5 Evotec

- 10.6 Excelra

- 10.7 Frontage Labs

- 10.8 ICON

- 10.9 Integrated DNA Technologies

- 10.10 Parexel International (MA) Corporation

- 10.11 RayBiotech

- 10.12 REPROCELL

- 10.13 Sino Biological

- 10.14 Svar Life Science