|

市场调查报告书

商品编码

1699427

柴油动力房地产发电机市场机会、成长动力、产业趋势分析及 2025-2034 年预测Diesel Powered Real Estate Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

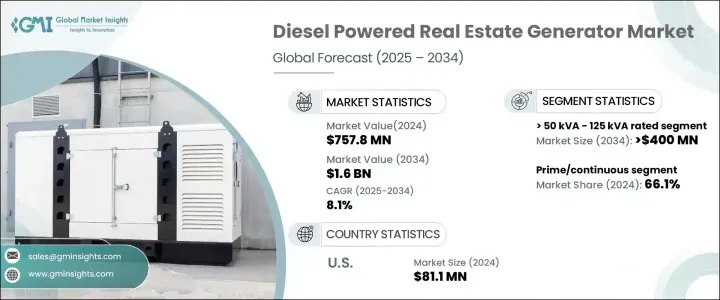

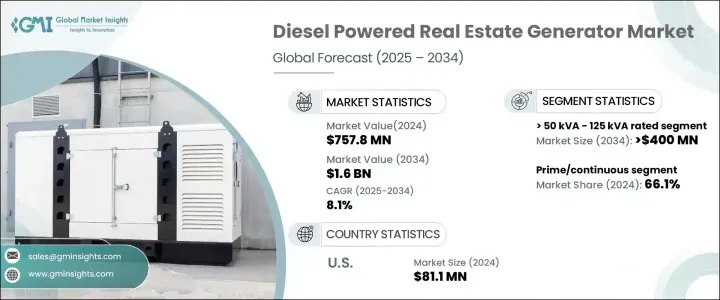

2024 年全球柴油动力房地产发电机市场规模达到 7.578 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 8.1%。随着全球城市化进程的加速,对可靠、稳定的电力解决方案的需求不断增加,市场正经历显着的发展势头。基础设施的快速发展,尤其是在新兴经济体,正在扩大对备用和持续电源的需求。随着房地产项目在住宅和商业领域的扩张,开发商正在投资高效且经济的柴油发电机,以确保不间断的电力供应。极端天气条件导致的停电频率增加、电网老化以及能源消耗增加进一步推动了市场扩张。

技术进步在推动市场成长方面继续发挥关键作用。自动负载管理系统、电子燃油喷射和涡轮增压机制等创新正在提高燃油效率并减少排放。旨在减少碳足迹的监管压力促使製造商开发更清洁、更安静、更节能的柴油发电机。政府和私人利益相关者正在大力投资备用电源解决方案,以减轻与电网故障相关的风险,确保房地产行业的业务连续性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.578亿美元 |

| 预测值 | 16亿美元 |

| 复合年增长率 | 8.1% |

2024 年额定功率 <= 50 kVA 的柴油驱动房地产发电机的价值为 1.2 亿美元。这些小型发电机的需求不断增长,因为它们能够在容易停电或缺乏可靠电网基础设施的地区提供稳定的电力。燃油效率和噪音降低的进步使得这些发电机成为寻求稳定能源解决方案的房主和企业的首选。这些装置结构紧凑、性能卓越,在需要临时或补充电力的城市和半城市发展中越来越受欢迎。

市场分为两个主要应用领域:备用和主要/连续发电。 2024年,主要/连续发电机占据总市场份额的66.1%,这得益于营运效率的提高和燃料节省能力的增强。公共和私人对采用先进喷射技术和智慧电源管理系统的下一代柴油引擎的投资正在提高采用率。随着工业和房地产开发商优先考虑可持续且强大的能源解决方案,对技术先进的柴油发电机的需求持续上升。

2024 年,美国柴油动力房地产发电机市场价值为 8,110 万美元。极端天气条件、电网老化和电力需求激增造成的电力中断日益增多,加剧了对可靠备用电源解决方案的需求。房地产开发商、商业房地产所有者和基础设施规划人员正在转向使用柴油发电机来维持不间断运作并降低与电力故障相关的风险。美国市场仍是能源供应商的焦点,其投资主要集中在提高发电机效率、降低排放和扩大独立于电网的电力解决方案。随着人们对电力可靠性的担忧日益加剧,柴油发电机在房地产应用中的作用变得比以往任何时候都更加重要。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依实力评级

- 主要趋势

- ≤50千伏安

- > 50千伏安 - 125千伏安

- > 125 千伏安 - 200 千伏安

- > 200 千伏安 - 350 千伏安

- > 350千伏安 - 500千伏安

- > 500千伏安

第六章:市场规模与预测:按应用

- 主要趋势

- 支援

- 主/连续

第七章:市场规模及预测:按地区

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第八章:公司简介

- Aggreko

- Atlas Copco

- Caterpillar

- Cooper

- Cummins

- DEUTZ Power Center

- Generac Power Systems

- Greaves Cotton

- HIMOINSA

- JC Bamford Excavators

- Kirloskar

- Mahindra Powerol

- Rehlko

- Rolls-Royce

- YANMAR HOLDINGS

The Global Diesel Powered Real Estate Generator Market reached USD 757.8 million in 2024 and is projected to grow at a CAGR of 8.1% between 2025 and 2034. The market is witnessing significant momentum as urbanization accelerates worldwide, increasing the demand for reliable and stable power solutions. Rapid infrastructure development, especially in emerging economies, is amplifying the need for backup and continuous power sources. With real estate projects expanding in both residential and commercial sectors, developers are investing in efficient and cost-effective diesel generators to ensure uninterrupted power supply. The increasing frequency of power outages due to extreme weather conditions, aging grid networks, and growing energy consumption further fuels market expansion.

Technological advancements continue to play a critical role in driving market growth. Innovations such as automatic load management systems, electronic fuel injection, and turbocharging mechanisms are improving fuel efficiency and reducing emissions. Regulatory pressures aimed at minimizing carbon footprints have pushed manufacturers to develop cleaner, quieter, and more energy-efficient diesel generators. Governments and private stakeholders are heavily investing in backup power solutions to mitigate risks associated with grid failures, ensuring business continuity across real estate sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $757.8 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 8.1% |

Diesel-powered real estate generators with a rating of <= 50 kVA were valued at USD 120 million in 2024. The rising demand for these smaller generators stems from their ability to deliver consistent power in regions prone to outages or lacking reliable grid infrastructure. Advancements in fuel efficiency and noise reduction have made these generators a preferred choice for homeowners and businesses seeking stable energy solutions. Compact and high-performing, these units are gaining traction in urban and semi-urban developments where temporary or supplemental power is essential.

The market is divided into two primary application segments: standby and prime/continuous power generation. In 2024, prime/continuous generators accounted for 66.1% of the total market share, driven by improvements in operational efficiency and enhanced fuel-saving capabilities. Public and private investments in next-generation diesel engines featuring advanced injection technologies and intelligent power management systems are bolstering adoption rates. As industries and real estate developers prioritize sustainable yet powerful energy solutions, the demand for technologically superior diesel generators continues to rise.

The U.S. diesel-powered real estate generator market was valued at USD 81.1 million in 2024. Increasing power disruptions caused by extreme weather conditions, an aging power grid, and surging electricity demand have intensified the need for reliable backup power solutions. Real estate developers, commercial property owners, and infrastructure planners are turning to diesel generators to maintain uninterrupted operations and mitigate risks associated with power failures. The U.S. market remains a focal point for energy providers, with investments directed toward upgrading generator efficiency, lowering emissions, and expanding grid-independent power solutions. As electricity reliability concerns grow, the role of diesel-powered generators in real estate applications is becoming more critical than ever.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 350 kVA

- 5.6 > 350 kVA - 500 kVA

- 5.7 > 500 kVA

Chapter 6 Market Size and Forecast, By Application (USD Million & Units)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Prime/continuous

Chapter 7 Market Size and Forecast, By Region (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Atlas Copco

- 8.3 Caterpillar

- 8.4 Cooper

- 8.5 Cummins

- 8.6 DEUTZ Power Center

- 8.7 Generac Power Systems

- 8.8 Greaves Cotton

- 8.9 HIMOINSA

- 8.10 J C Bamford Excavators

- 8.11 Kirloskar

- 8.12 Mahindra Powerol

- 8.13 Rehlko

- 8.14 Rolls-Royce

- 8.15 YANMAR HOLDINGS