|

市场调查报告书

商品编码

1708123

癌症生物标记市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cancer Biomarkers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

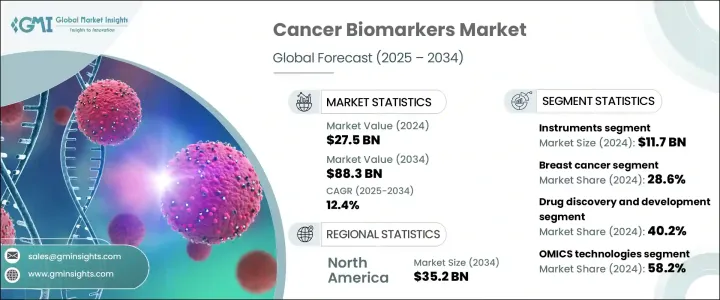

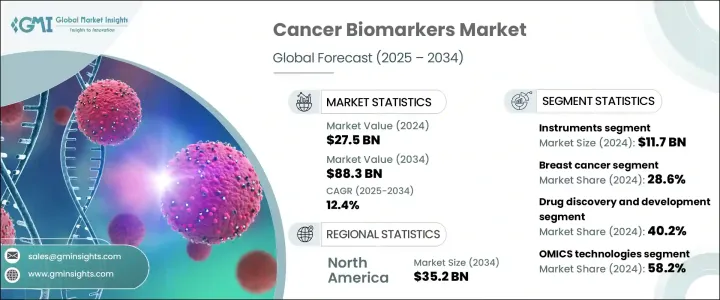

2024 年全球癌症生物标记市场价值为 275 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 12.4%。癌症生物标记包括血液、组织和体液中的蛋白质、基因和各种分子,正成为现代肿瘤学的重要工具。随着全球癌症盛行率持续飙升,这些生物标记正在彻底改变医疗保健专业人员检测、监测和治疗不同形式癌症的方式。它们在早期诊断癌症、评估病情进展和製定个人化治疗方案方面发挥关键作用,最终提高了患者的生存率和生活品质。随着医疗保健系统努力提高诊断准确性,同时减少不必要的治疗,对精准医疗和标靶治疗的日益重视进一步推动了对先进生物标记技术的需求。

分子诊断领域的持续研究和创新也扩大了生物标记的范围,使其在临床试验、药物开发和治疗监测中变得不可或缺。癌症是全球主要死亡原因之一,将生物标记整合到常规临床实践中正在获得发展势头,因为它们在症状出现之前就能够识别癌症,从而实现早期干预并获得更好的结果。此外,液体活检、基因组分析和蛋白质组学的不断改进正在拓宽癌症生物标记的潜在应用,为非侵入性和高度准确的癌症检测解决方案提供新的途径。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 275亿美元 |

| 预测值 | 883亿美元 |

| 复合年增长率 | 12.4% |

癌症生物标记检测市场中的仪器部分在 2024 年创造了 117 亿美元的收入,预计从 2025 年到 2034 年的复合年增长率将达到 12.3%。聚合酶链反应 (PCR) 机器、次世代定序 (NGS) 平台和质谱仪等先进诊断工具处于癌症生物标记研究的前沿。这些仪器在检测与癌症相关的基因突变和分子特征方面具有无与伦比的灵敏度和精确度。它们还支援多路復用,从而可以在单次测试中同时分析多个生物标誌物,显着提高效率和成本效益。这些仪器中尖端技术的整合确保了更快的诊断、更高的可靠性和更广泛的可及性,这使得它们对于不断扩大的癌症生物标记领域至关重要。

市场根据癌症类型进行细分,包括乳癌、摄护腺癌、大肠癌、子宫颈癌、肝癌和肺癌。乳癌领域在 2024 年占据主导地位,占 28.6%,预计到 2034 年将达到 259 亿美元。生物标记对于早期检测乳癌至关重要,CA 15-3 和 CA 27-29 等测试与传统影像方法结合使用时,是提高诊断精确度的重要工具。全球乳癌发生率的持续上升以及人们对早期筛检方法的认识的提高是该领域成长的关键因素。

2023 年,美国癌症生物标记市场价值达 92 亿美元,成为全球领先的区域市场之一。全国癌症发病率的飙升,加上基于生物标记的诊断解决方案的进步,正在推动市场强劲成长。对早期检测和个人化医疗的需求不断增长,使美国成为癌症生物标记研究和创新的重要中心。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 癌症发生率上升

- 个人化医疗的进展

- 诊断工具的技术进步

- 增加研发活动

- 产业陷阱与挑战

- 生物标誌物开发和测试成本高昂

- 缺乏标准化

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 仪器

- 耗材

- 软体

第六章:市场估计与预测:按癌症类型,2021 年至 2034 年

- 主要趋势

- 乳癌

- 摄护腺癌

- 大肠直肠癌

- 子宫颈癌

- 肝癌

- 肺癌

- 其他癌症类型

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 药物发现与开发

- 诊断

- 个人化医疗

- 其他应用

第八章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 组学技术

- 蛋白质体学

- 基因组学

- 其他 OMICS 技术

- 影像技术

- 超音波

- 电脑断层扫描

- 磁振造影

- 正子断层扫描

- 乳房X光检查

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断实验室

- 生物製药公司

- 学术和研究机构

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott Laboratories

- Agilent Technologies

- Bio-Rad Laboratories

- Becton, Dickinson and Company

- BioGenex

- Centogene

- F. Hoffmann-La Roche

- Hologic

- INOVIQ

- Illumina

- Merck & Co.

- QIAGEN

- Sino Biological

- Sysmex Corporation

- Thermo Fisher Scientific

The Global Cancer Biomarkers Market was valued at USD 27.5 billion in 2024 and is projected to grow at a CAGR of 12.4% between 2025 and 2034. Cancer biomarkers, which comprise proteins, genes, and various molecules found in blood, tissues, and bodily fluids, are becoming essential tools in modern oncology. As cancer prevalence continues to surge worldwide, these biomarkers are revolutionizing the way healthcare professionals detect, monitor, and treat different forms of cancer. They play a pivotal role in diagnosing cancer at an early stage, evaluating disease progression, and tailoring personalized therapies, ultimately enhancing patient survival rates and quality of life. The growing emphasis on precision medicine and targeted therapies is further driving demand for advanced biomarker technologies, as healthcare systems strive to improve diagnostic accuracy while reducing unnecessary treatments.

Ongoing research and innovation in molecular diagnostics are also expanding the scope of biomarkers, making them indispensable in clinical trials, drug development, and treatment monitoring. With cancer being one of the leading causes of death globally, the integration of biomarkers into routine clinical practice is gaining momentum, as they hold immense promise in identifying cancer even before symptoms arise, thereby enabling early interventions and better outcomes. Moreover, the continuous improvements in liquid biopsy, genomic analysis, and proteomics are broadening the potential applications of cancer biomarkers, offering new avenues for non-invasive and highly accurate cancer detection solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.5 Billion |

| Forecast Value | $88.3 Billion |

| CAGR | 12.4% |

The instruments segment in the cancer biomarker detection market generated USD 11.7 billion in 2024 and is anticipated to grow at a CAGR of 12.3% from 2025 to 2034. Advanced diagnostic tools such as polymerase chain reaction (PCR) machines, next-generation sequencing (NGS) platforms, and mass spectrometers are at the forefront of cancer biomarker research. These instruments offer unmatched sensitivity and precision in detecting genetic mutations and molecular signatures associated with cancer. They also support multiplexing, which allows simultaneous analysis of multiple biomarkers in a single test, significantly improving efficiency and cost-effectiveness. The integration of cutting-edge technologies in these instruments ensures faster diagnosis, enhanced reliability, and broader accessibility, making them critical to the expanding cancer biomarkers landscape.

The market is segmented based on cancer types, including breast, prostate, colorectal, cervical, liver, and lung cancers. The breast cancer segment accounted for a dominant share of 28.6% in 2024 and is forecasted to reach USD 25.9 billion by 2034. Biomarkers are fundamental in detecting breast cancer at an early stage, with tests like CA 15-3 and CA 27-29 serving as important tools to improve diagnostic precision when used alongside traditional imaging methods. The continuously rising incidence of breast cancer globally and increasing awareness about early screening methods are key contributors to the growth of this segment.

The U.S. Cancer Biomarkers Market generated USD 9.2 billion in 2023, positioning itself as one of the leading regional markets worldwide. The surging cancer rates across the country, combined with advancements in biomarker-based diagnostic solutions, are driving robust market growth. Increasing demand for early detection and personalized medicine continues to make the U.S. a significant hub for cancer biomarker research and innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cancer

- 3.2.1.2 Advancements in personalized medicine

- 3.2.1.3 Technological advancements in diagnostic tools

- 3.2.1.4 Increasing research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of biomarker development and testing

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.4 Software

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Breast cancer

- 6.3 Prostate cancer

- 6.4 Colorectal cancer

- 6.5 Cervical cancer

- 6.6 Liver cancer

- 6.7 Lung cancer

- 6.8 Other cancer types

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Drug discovery and development

- 7.3 Diagnostics

- 7.4 Personalized medicine

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 OMICS technologies

- 8.2.1 Proteomics

- 8.2.2 Genomics

- 8.2.3 Other OMICS technologies

- 8.3 Imaging technologies

- 8.3.1 Ultrasound

- 8.3.2 Computed tomography

- 8.3.3 Magnetic resonance imaging

- 8.3.4 Positron emission tomography

- 8.3.5 Mammography

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Biopharmaceutical companies

- 9.5 Academic and research institutions

- 9.6 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 Agilent Technologies

- 11.3 Bio-Rad Laboratories

- 11.4 Becton, Dickinson and Company

- 11.5 BioGenex

- 11.6 Centogene

- 11.7 F. Hoffmann-La Roche

- 11.8 Hologic

- 11.9 INOVIQ

- 11.10 Illumina

- 11.11 Merck & Co.

- 11.12 QIAGEN

- 11.13 Sino Biological

- 11.14 Sysmex Corporation

- 11.15 Thermo Fisher Scientific