|

市场调查报告书

商品编码

1708132

保险科技市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Insurtech Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

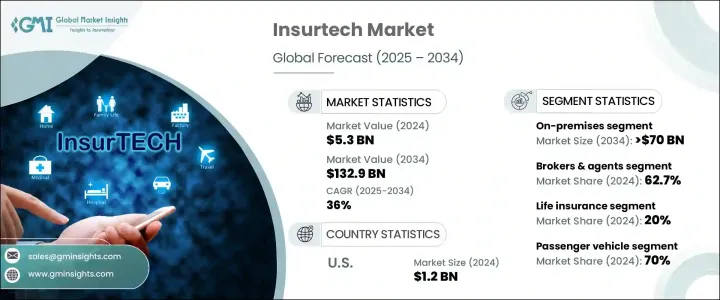

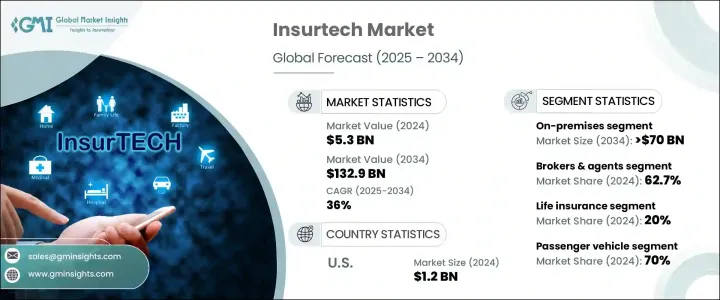

2024 年全球保险科技市场价值为 53 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 36%。这一令人印象深刻的扩张是由人工智慧 (AI) 和机器学习 (ML) 等尖端技术的快速应用所推动的,这些技术正在重新定义保险格局。随着数位转型的加速,保险科技公司正在利用人工智慧驱动的自动化来提高效率、简化索赔处理并改善客户互动。这些进步显着降低了营运成本并改善了诈欺检测,使保险服务更快、更安全、更加以客户为中心。行动应用程式、聊天机器人和高级分析平台的日益普及进一步促进了该行业的发展,为保单持有人提供了无缝的数位体验。

监管支持和不断变化的消费者偏好也影响保险科技市场的发展轨迹。世界各国政府和金融监理机构都认可数位保险解决方案,放宽合规要求,并鼓励传统保险公司和新创企业之间的竞争。消费者越来越被技术驱动的保险模式所吸引,这些模式提供即时索赔追踪、个人化保单建议和快速争议解决。基于使用情况的保险(UBI)、参数保险和嵌入式保险解决方案的需求正在激增,推动了该领域的创新。此外,保险科技公司和老牌保险提供者之间的合作正在促进混合解决方案的发展,确保数位便利性和传统风险评估之间的平衡。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 53亿美元 |

| 预测值 | 1329亿美元 |

| 复合年增长率 | 36% |

市场根据部署模式进行分类,其中内部部署和基于云端的解决方案占据主导地位。内部部署部分占了 60% 的市场份额,预计到 2034 年将创造 700 亿美元的市场价值。这种主导地位很大程度上归功于内部部署基础设施提供的增强的安全性,这对于处理敏感客户和业务资料的行业来说仍然至关重要。金融机构、医疗保健提供者和保险公司优先考虑内部部署解决方案,以确保符合 GDPR、HIPAA 和 PCI-DSS 等监管框架。这些法规要求采取严格的资料保护措施,使得内部部署对于优先考虑资料控制和网路安全的企业来说成为一个有吸引力的选择。

保险科技市场也按分销管道细分,包括经纪人和代理商、直接面向消费者 (D2C) 和其他方式。 2024 年,经纪人和代理商部门占了 62.7% 的市场份额,凸显了人力专业知识在保险交易中仍然具有重要意义。经纪人和代理人在协助客户处理复杂的保单结构、提供客製化建议以及帮助客户进行风险评估方面发挥着至关重要的作用。他们协商客製化保险解决方案的能力使他们比纯数位模式具有竞争优势,特别是在高价值保险类别中。儘管自动化保险平台兴起,但许多消费者仍喜欢个人化咨询,以确保全面的保障和财务安全。

2024 年,北美保险科技市场产值将达到 12 亿美元,美国将成为该领域的主导力量。该国成熟的保险业加上先进的技术基础设施,使其处于全球保险科技创新的前沿。美国的监管环境培育了一个竞争性的生态系统,鼓励采用数位保险并激励新创公司开发创新解决方案。美国高度重视人工智慧驱动的核保、基于区块链的智慧合约以及物联网驱动的风险评估,持续塑造保险科技的未来。这些因素,加上创投和金融机构不断增加的投资,巩固了北美在数位保险革命中的领导地位。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 技术提供者

- 保险提供者

- 经销商

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 用例

- 监管格局

- 衝击力

- 成长动力

- 利用人工智慧、区块链、物联网和云端运算进行数位转型

- 对个人化和灵活的保险解决方案的需求不断增长

- 增加投资和合作关係,推动创新

- 支持数位创新的监管倡议

- 产业陷阱与挑战

- 资料安全和隐私问题

- 与遗留系统整合并满足复杂的监管要求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 健康保险

- 人寿保险

- 财产和意外保险

- 汽车保险

- 专业保险

- 再保险

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 人工智慧 (AI) 与机器学习 (ML)

- 巨量资料与分析

- 区块链

- 物联网 (IoT)

- 远端资讯处理

- 云端运算

第七章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接面向消费者(D2C)

- 经纪人和代理人

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Alan

- BIMA

- Bolttech

- Bright Health Group

- Clover Health

- Coalition

- Cover Genius

- Duck Creek Technologies

- GoHealth

- Hippo Insurance

- Lemonade

- Metromile

- Next Insurance

- Oscar Health

- PolicyBazaar

- Root Insurance

- Shift Technology

- Trov

- Wefox

- ZhongAn Insurance

The Global Insurtech Market was valued at USD 5.3 billion in 2024 and is projected to grow at a CAGR of 36% between 2025 and 2034. This impressive expansion is fueled by the rapid adoption of cutting-edge technologies like artificial intelligence (AI) and machine learning (ML), which are redefining the insurance landscape. As digital transformation accelerates, Insurtech firms are leveraging AI-driven automation to enhance efficiency, streamline claim processing, and improve customer interactions. These advancements significantly reduce operational costs and improve fraud detection, making insurance services faster, more secure, and more customer-centric. The growing penetration of mobile applications, chatbots, and advanced analytics platforms further contributes to the sector's development, offering policyholders seamless digital experiences.

Regulatory support and evolving consumer preferences also shape the Insurtech market's trajectory. Governments and financial regulators worldwide endorse digital insurance solutions, easing compliance requirements, and encouraging competition among traditional insurers and startups. Consumers are increasingly drawn to tech-driven insurance models that provide real-time claim tracking, personalized policy recommendations, and swift dispute resolutions. The demand for usage-based insurance (UBI), parametric insurance, and embedded insurance solutions is surging, driving innovation in the sector. Additionally, partnerships between Insurtech firms and established insurance providers are fostering the development of hybrid solutions, ensuring a balance between digital convenience and traditional risk assessment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $132.9 Billion |

| CAGR | 36% |

The market is categorized based on deployment models, with on-premises and cloud-based solutions leading the segment. The on-premises segment held a 60% market share and is forecasted to generate USD 70 billion by 2034. This dominance is largely due to the enhanced security offered by on-premises infrastructure, which remains critical for industries handling sensitive customer and business data. Financial institutions, healthcare providers, and insurance companies prioritize on-premises solutions to ensure compliance with regulatory frameworks like GDPR, HIPAA, and PCI-DSS. These regulations necessitate stringent data protection measures, making on-premises deployment an attractive choice for enterprises prioritizing data control and cybersecurity.

The Insurtech market is also segmented by distribution channels, which include brokers & agents, Direct-to-Consumer (D2C), and other methods. The brokers & agents segment held a 62.7% market share in 2024, underscoring the continued relevance of human expertise in insurance transactions. Brokers and agents play a vital role in assisting clients with complex policy structures, providing tailored advice, and helping customers navigate risk assessments. Their ability to negotiate customized coverage solutions offers a competitive edge over digital-only models, particularly in high-value insurance categories. Despite the rise of automated insurance platforms, many consumers still prefer personalized consultation to ensure comprehensive coverage and financial security.

North America Insurtech market generated USD 1.2 billion in 2024, with the United States emerging as a dominant force in the sector. The country's well-established insurance industry, coupled with its advanced technological infrastructure, positions it at the forefront of global Insurtech innovation. The U.S. regulatory environment fosters a competitive ecosystem that encourages digital insurance adoption and incentivizes startups to develop innovative solutions. With a strong emphasis on AI-driven underwriting, blockchain-based smart contracts, and IoT-powered risk assessments, the U.S. continues to shape the future of Insurtech. These factors, combined with increasing investments from venture capitalists and financial institutions, solidify North America's leadership in the digital insurance revolution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Technology providers

- 3.1.1.2 Insurance providers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Use cases

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Digital transformation using AI, blockchain, IoT, and cloud computing

- 3.6.1.2 Growing demand for personalized and flexible insurance solutions

- 3.6.1.3 Increased investments and partnerships fuelling innovation

- 3.6.1.4 Regulatory initiatives supporting digital innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Data security and privacy concerns

- 3.6.2.2 Integration with legacy systems and navigating complex regulatory requirements

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Health insurance

- 5.3 Life insurance

- 5.4 Property & casualty (P&C) insurance

- 5.5 Auto insurance

- 5.6 Specialty insurance

- 5.7 Reinsurance

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Artificial intelligence (AI) & machine learning (ML)

- 6.3 Big data & analytics

- 6.4 Blockchain

- 6.5 Internet of things (IoT)

- 6.6 Telematics

- 6.7 Cloud computing

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-Premises

- 7.3 Cloud-Based

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Direct-to-Consumer (D2C)

- 8.3 Brokers & agents

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alan

- 10.2 BIMA

- 10.3 Bolttech

- 10.4 Bright Health Group

- 10.5 Clover Health

- 10.6 Coalition

- 10.7 Cover Genius

- 10.8 Duck Creek Technologies

- 10.9 GoHealth

- 10.10 Hippo Insurance

- 10.11 Lemonade

- 10.12 Metromile

- 10.13 Next Insurance

- 10.14 Oscar Health

- 10.15 PolicyBazaar

- 10.16 Root Insurance

- 10.17 Shift Technology

- 10.18 Trov

- 10.19 Wefox

- 10.20 ZhongAn Insurance