|

市场调查报告书

商品编码

1708144

汽车触控萤幕控制系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Touch Screen Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

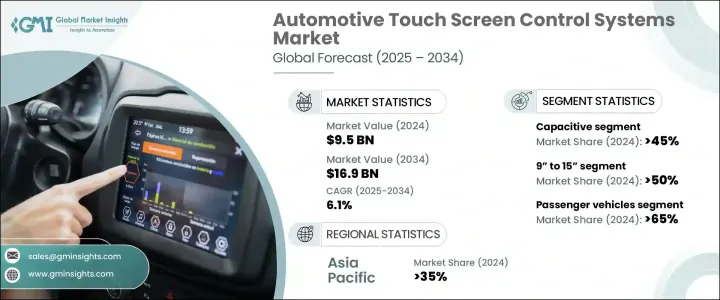

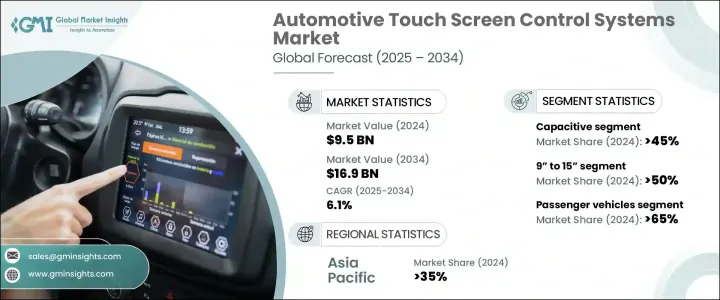

2024 年全球汽车触控萤幕控制系统市场价值为 95 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.1%。市场扩张的动力来自于现代车辆对先进触控介面日益增长的需求,尤其是电动车 (EV) 和连网汽车技术的迅速普及。汽车製造商优先考虑使用者友好、高性能的触控萤幕系统,以增强驾驶体验并简化车辆功能。

随着汽车产业经历数位转型,触控萤幕控制系统已成为下一代汽车的核心部件。电动车的兴起极大地影响了专用触控介面的发展,这些介面可以实现电池监控、再生煞车和节能气候设定。汽车製造商还整合了人工智慧 (AI) 和基于云端的技术来增强触控萤幕功能,实现无缝连接、个人化设定和预测控制。向数位驾驶舱的转变进一步推动了市场成长,製造商专注于透过高解析度触控萤幕提供复杂的资讯娱乐系统、互动式车辆控制和增强的安全功能。消费者对直觉、多功能介面的偏好日益增加,导致对电容式触控萤幕的需求激增,因为电容式触控萤幕具有卓越的反应能力、多点触控功能和清晰的显示品质。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 95亿美元 |

| 预测值 | 169亿美元 |

| 复合年增长率 | 6.1% |

汽车触控萤幕市场根据触控萤幕技术进行细分,其中电容式触控萤幕在 2024 年占据 45% 的主导市场份额。与需要物理压力来记录输入的电阻式触控萤幕不同,电容式触控萤幕可提供流畅无缝的交互,使其成为资讯娱乐系统、导航控制和气候设定的首选。这些先进的触控萤幕不仅提高了使用者的便利性,而且还透过实现光滑、无按钮的仪表板增强了车辆的美观性。

萤幕尺寸是另一个关键的市场细分,9 吋至 15 吋的萤幕尺寸将在 2024 年占据 50% 的市场份额。这一尺寸范围已成为现代车辆的标准,在可用性和可视性之间实现了完美平衡。中型触控萤幕广泛用于车载导航、媒体控制和系统设置,提供沉浸式但非侵入式的介面。汽车製造商正在利用人工智慧驱动的功能、可自订的显示器和语音辅助控制来增强触控萤幕功能,确保高度互动和个人化的用户体验。

2024 年,亚太地区将占据汽车触控萤幕控制系统市场的 35% 份额,中国将成为主要的成长动力。受电动汽车产业蓬勃发展和智慧汽车技术投资不断增加的推动,预计到 2034 年,该国的电动车产业将创收 30 亿美元。随着汽车製造商将先进的数位介面整合到电动车和连网汽车中,对人工智慧大尺寸触控萤幕的推动正在加速采用率。随着竞争加剧,市场参与者专注于创新,结合手势识别、触觉回馈和扩增实境 (AR) 显示等尖端功能,以在不断发展的汽车领域保持领先地位。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商

- 製造商

- 系统整合商

- 技术提供者

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 成本分析

- 监管格局

- 衝击力

- 成长动力

- 车载资讯娱乐需求不断成长

- 电动车和连网汽车的普及率不断上升

- 触控萤幕技术日益进步

- 直觉式触控控制和语音辅助介面的采用率不断上升

- 产业陷阱与挑战

- 耐用性和可靠性问题

- 先进触控萤幕系统成本高昂

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按触控萤幕,2021 年至 2034 年

- 主要趋势

- 电阻式

- 红外线的

- 电容式

- 光学成像

第六章:市场估计与预测:依萤幕尺寸,2021 年至 2034 年

- 主要趋势

- 低于 9 英寸

- 9英寸至15英寸

- 15吋以上

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 资讯娱乐系统

- 导航系统

- 气候控制

- 驾驶员辅助功能

- 车辆诊断

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Analog

- AU Optronics

- Bosch

- Continental

- Denso

- Dingtouch

- Eaton

- Harman

- Infineon

- Kyocera

- LG Display

- Magneti Marelli

- Microchip

- Nippon Seiki

- Pioneer

- Sharp

- Synaptics

- TPK Holding

- Valeo

- Visteon

The Global Automotive Touch Screen Control Systems Market was valued at USD 9.5 billion in 2024 and is projected to grow at a CAGR of 6.1% between 2025 and 2034. The market expansion is driven by the increasing demand for advanced touch interfaces in modern vehicles, particularly with the rapid adoption of electric vehicles (EVs) and connected car technologies. Automakers are prioritizing user-friendly, high-performance touchscreen systems to enhance the driving experience and streamline vehicle functionalities.

As the automotive industry undergoes a digital transformation, touchscreen control systems have become a central component of next-generation vehicles. The rise of EVs has significantly influenced the development of specialized touch interfaces that facilitate battery monitoring, regenerative braking, and energy-efficient climate settings. Automakers are also integrating artificial intelligence (AI) and cloud-based technologies to enhance touchscreen capabilities, allowing for seamless connectivity, personalized settings, and predictive controls. The shift towards digital cockpits is further fueling market growth, with manufacturers focusing on delivering sophisticated infotainment systems, interactive vehicle controls, and enhanced safety features through high-resolution touchscreens. Increasing consumer preference for intuitive, multi-functional interfaces has led to a surge in demand for capacitive touch panels, which offer superior responsiveness, multi-touch capabilities, and crystal-clear display quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $16.9 Billion |

| CAGR | 6.1% |

The automotive touch screen market is segmented based on touch panel technology, with capacitive touch panels holding a dominant 45% market share in 2024. Unlike resistive touch panels, which require physical pressure to register inputs, capacitive touch screens provide a smooth and seamless interaction, making them the preferred choice for infotainment systems, navigation controls, and climate settings. These advanced touchscreens not only improve user convenience but also enhance vehicle aesthetics by enabling sleek, button-free dashboards.

Screen size is another key market segmentation, with the 9" to 15" category accounting for a 50% market share in 2024. This size range has become the standard for modern vehicles, offering the perfect balance between usability and visibility. Mid-sized touchscreens are widely used for in-car navigation, media control, and system settings, providing an immersive yet non-intrusive interface. Automakers are leveraging AI-driven features, customizable displays, and voice-assisted controls to enhance touchscreen functionality, ensuring a highly interactive and personalized user experience.

Asia Pacific accounted for a significant 35% share of the Automotive Touch Screen Control Systems Market in 2024, with China emerging as a major growth driver. The country is expected to generate USD 3 billion by 2034, fueled by its booming electric vehicle sector and increasing investment in smart vehicle technologies. The push for AI-powered, large-format touchscreens is accelerating adoption rates as automakers integrate advanced digital interfaces into EVs and connected vehicles. As competition intensifies, market players are focusing on innovation, incorporating cutting-edge features such as gesture recognition, haptic feedback, and augmented reality (AR) displays to stay ahead in the evolving automotive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Suppliers

- 3.1.2 Manufacturers

- 3.1.3 System Integrators

- 3.1.4 Technology Providers

- 3.1.5 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for in-vehicle infotainment

- 3.9.1.2 Rising adoption of electric and connected vehicles

- 3.9.1.3 Increasing advancements in touchscreen technology

- 3.9.1.4 Rising adoption of intuitive touch controls and voice-assisted interfaces

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Durability and reliability concerns

- 3.9.2.2 High cost of advanced touchscreen systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Touch Panel, 2021 – 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Resistive

- 5.3 Infrared

- 5.4 Capacitive

- 5.5 Optical imaging

Chapter 6 Market Estimates & Forecast, By Screen Size, 2021 – 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Below 9”

- 6.3 9” to 15”

- 6.4 Above 15”

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 – 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Infotainment systems

- 8.3 Navigation systems

- 8.4 Climate control

- 8.5 Driver assistance features

- 8.6 Vehicle diagnostics

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Analog

- 10.2 AU Optronics

- 10.3 Bosch

- 10.4 Continental

- 10.5 Denso

- 10.6 Dingtouch

- 10.7 Eaton

- 10.8 Harman

- 10.9 Infineon

- 10.10 Kyocera

- 10.11 LG Display

- 10.12 Magneti Marelli

- 10.13 Microchip

- 10.14 Nippon Seiki

- 10.15 Pioneer

- 10.16 Sharp

- 10.17 Synaptics

- 10.18 TPK Holding

- 10.19 Valeo

- 10.20 Visteon